Customer-Management Survey:

Existing Business Is Top Priority for Publishers

Boosting retention and revenue are on the front burner. [sponsored content]

Customer-Management Survey:

Existing Business Is Top Priority for Publishers

Boosting retention and revenue are on the front burner. [sponsored content]

Customer-Management Survey:

Existing Business Is Top Priority for Publishers

Boosting retention and revenue are on the front burner. [sponsored content]

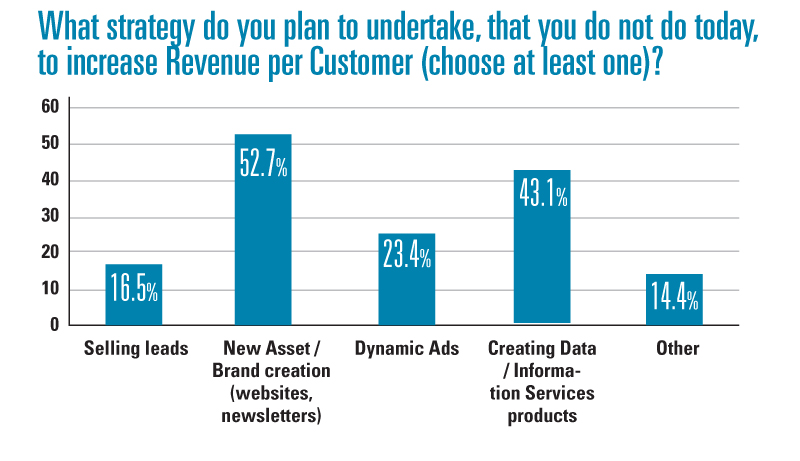

As advertising continues to be challenged, publishers are turning to their subscribers and customers for new revenue opportunities. In doing so, lifetime value models change and acquisition costs become more acute. Even so, publishers are only now discovering that there are many nuances to increasing per-customer revenue.

To help shed some light on this process, FOLIO: partnered with Hallmark Data to conduct a short survey to see how closely publishers are actually monitoring their margins, costs and values associated with each customer.

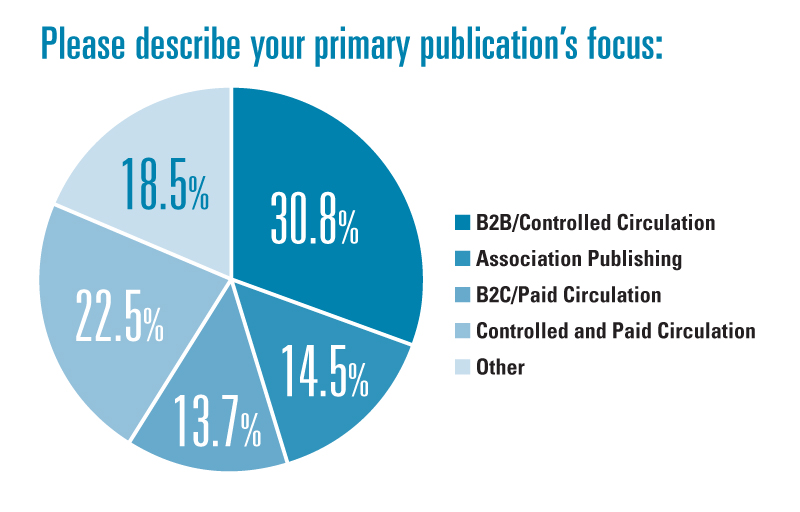

An online survey conducted in November collected responses from 184 publishing executives. Most respondents were spread across executive management, editorial, marketing and audience development functions.

Better Access to Data Needed

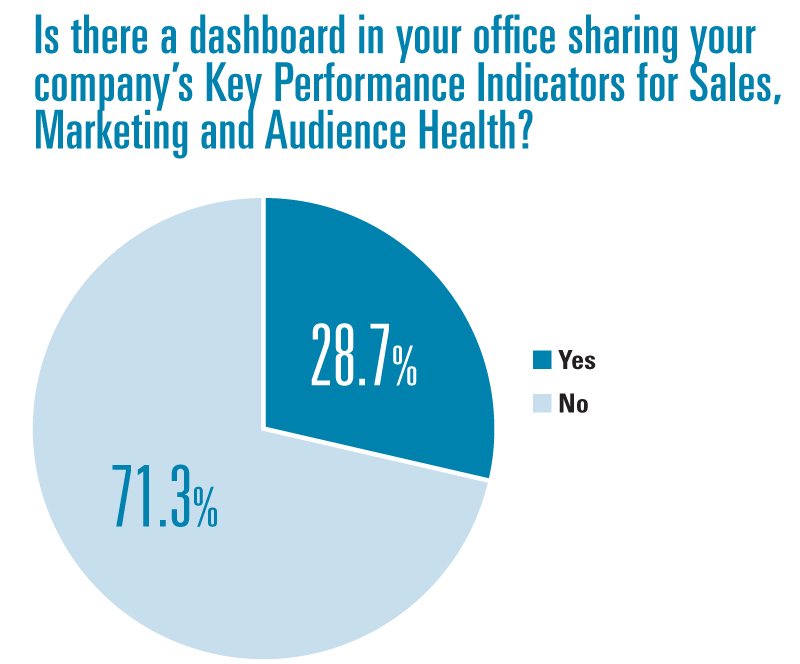

In this age of data-driven business, survey results show that publishers and marketers likely need better insight into their metrics. A perennial pain point among publishers that collect large amounts of data on their customers is turning that information into actionable material. Almost three-quarters of respondents say they don’t have a dashboard that shares KPIs for sales, marketing and audience data.

“Audience health, sales results, retention rates and ongoing campaign management are critical to how a publisher operates on a daily basis, but those items don’t seem to be as visible as they could be,” says Joshua Sukenic, senior vice president, sales and growth strategy at EBSCO’s Hallmark Data Systems.

Other top-line results indicate publishers are more focused on retention efforts and driving more revenue from existing customers than finding new ones.

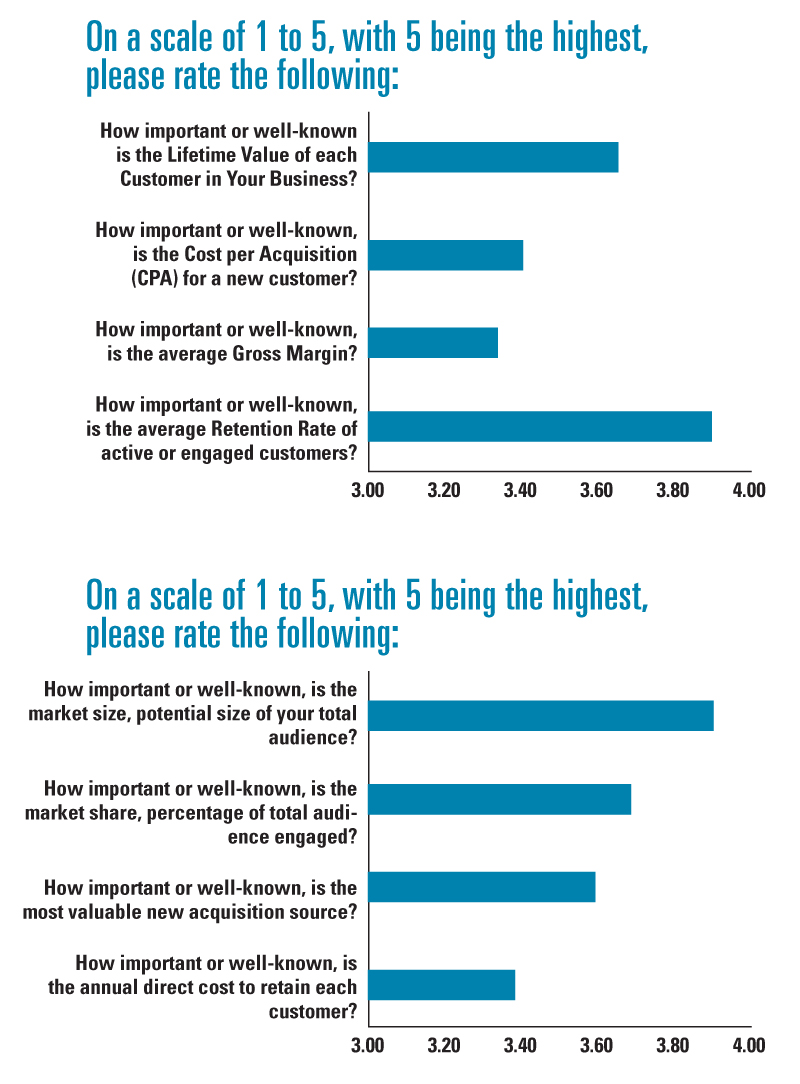

In measuring the importance of certain key performance indicators, respondents gave the highest rating (a 3.95 average) on a 1-to-5 scale to the importance of retention rate of “active and engaged customers.” Just behind, with a 3.68 average, was increasing customer lifetime value.

When analyzing and characterizing the most important KPIs of acquisition and retention sources on the same 1-to-5 scale, the top-two rated responses included “market share, percentage of total audience engaged” (3.73 average) and “most valuable new acquisition source” (3.60 average).

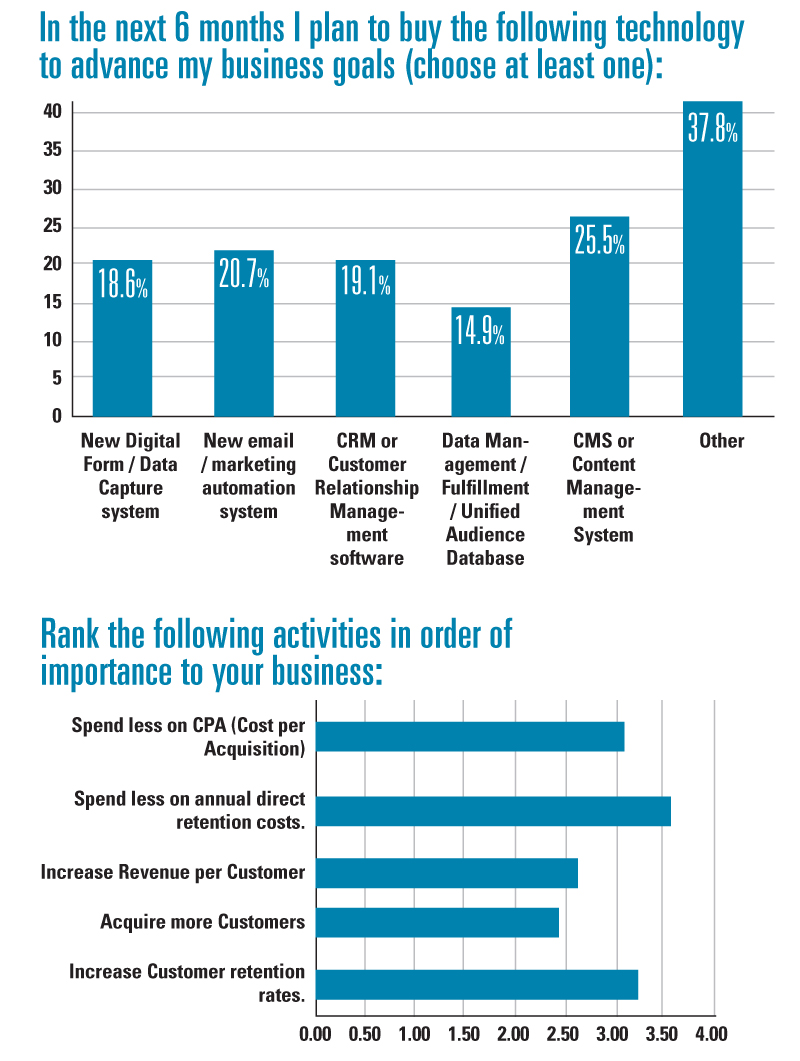

Interestingly, when asked to rank specific activities in order of business importance, respondents seek to spend less on annual direct retention costs (3.56 average rating), but also want to increase customer retention rates (3.26 average). Cost control is top of mind for respondents, who next indicated that they wanted to decrease cost per acquisition (3.08 average).

Ranked last in business importance, with a 2.42 average on a 1-to-5 scale, is “acquire more customers.”

One explanation of this may be a focus on making existing customers even more loyal. With the ever-increasing choices customers have for finding the information they need, publishers are enhancing their content and products to make sure they remain the content provider of choice, says Sukenic.

“I think publishers need to invest more in this concept, perhaps by measuring a net promoter score or creating metrics around share of voice. However, publishers tend to know who their target market is and their market share. Therefore, they focus on making the customers the have die-hard fans and promoters, as opposed to seeking new customers who might not be in their wheelhouse.” ![]()