Guess What? Magazine M&A Is Back. Here’s Why.

Acquisitions are getting done for very different reasons now than during the M&A heyday.

BY BILL MICKEY

Guess What? Magazine M&A Is Back. Here’s Why.

Acquisitions are getting done for very different reasons now than during the M&A heyday.

BY BILL MICKEY

Guess What? Magazine M&A Is Back. Here’s Why.

Acquisitions are getting done for very different reasons now than during the M&A heyday.

BY BILL MICKEY

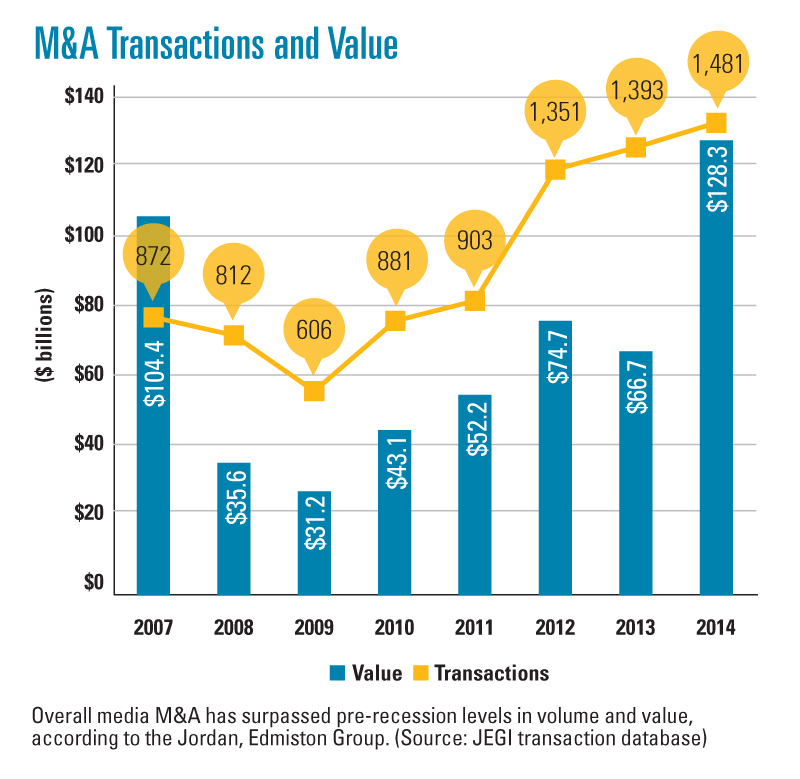

Last year was such a good year in media M&A, industry watchers are talking about a return to pre-recession levels. Those, many fondly remember, were pretty high levels. Nevertheless, the M&A tracked since then has grown to include more media categories, such as marketing, information and technology. M&A specific to magazine media has bounced back too, but the majority of the activity is focused elsewhere these days. Further, business models have changed even since the recession and the M&A market for magazine companies reflects that. Recaps are common and buyers and sellers are often motivated to take action for different reasons than they use to.

Even so, there have been plenty of magazine-media deals, multiples are on the rise and many companies have moved further into diversified asset mixes that have become more amenable to deal-making. That is, print has been sufficiently offset by events, digital and other revenue lines.

But first, let’s review just how active M&A was in 2006 (the last of the go-go years before 2007 was slammed part-way through by the credit crunch). According to the Jordan, Edmiston Group, 2006 had 42 B2B magazine deals valued at about $6 billion. There were 45 consumer magazine deals valued at $1.8 billion and 52 event transactions valued at $875 million.

In 2014, there were 38 B2B media deals valued at $3.1 billion; 31 consumer magazine deals valued at $1.6 billion; and 53 event transactions valued at $1.1 billion.

B2B, despite comparable volume, has not quite regained pre-recession stature, but there have been some significant deals made in the last couple years that show there’s still major interest in that category. UBM bought Advanstar for $972 million. Wasserstein bought ALM back for about $417 million, which put its EBITDA multiple at about 8x. ALM itself has since gone on an acquisition tear, recently picking up Summit Professional Networks.

Overall M&A across the media categories JEGI tracks may have caught up to, and even surpassed, pre-recession levels (872 transactions valued at $104 billion in 2007 versus 1,481 transactions valued at $128 billion), but the magazine media corner of the world is not quite there yet.

Meanwhile, financial buyers are getting back in the game, says Berkery Noyes managing director Mary Jo Zandy. “According to the data in our full year media report, the number of deals backed by financial sponsors increased 35 percent from 2013 to 2014. Nonetheless, strategic buyers should continue to dominate the media landscape as they look for tuck-in acquisitions.”

And print isn’t so much the ugly duckling the market thinks it is. “We experienced the best year ever in 2014 regarding publication sales with five sizeable transactions encompassing 36 publications and 18 digital properties (along with 25 trade shows),” says Nick Curci, president of boutique M&A brokerage firm, Corporate Solutions. “This is the first time in our 20-year history that we sold more publications than trade shows.”

So, given current market dynamics, what’s driving the deals?

Banks Are Flush

“The good news is there seems to be a robust recovery in M&A generally,” says Tom Kemp, CEO of Northstar Travel Media, which itself was acquired by Wicks Group in 2012, a stand-out deal at the time. When that transaction was getting done, Kemp remarked at the time that one of his chief concerns was financing. “A lot of the lenders still have a lot of distressed properties in these markets,” he told FOLIO:.

Now, however, the debt markets are much more favorable. “Bankers are flush with cheap capital. They cleaned up their balance sheets, wrote down things that weren’t performing and they’re ready to put money to work again,” he says.

Covenant-lite loans are even making a comeback. “It’s almost like 2007 all over again,” says Kemp.

As the debt markets recover, banks are better able to unload some of the business they had to take over through bankruptcies. “The ‘non-natural’ equity owners—hedge funds and banks—that took over in debt-for-equity deals and hung in there now have an opportunity to recapitalize the business,” he says.

The Shamrock Capital acquisition of Questex in September 2014 is an example. “They were able to sell successfully and they have a more natural equity partner now,” says Kemp.

Another development has been interest in deals for companies at the lower end of the capital structure—as long as the margins are strong, adds Curci. While the market isn’t wide open yet, banks that only looked at deals in the $20 million EBITDA range are now more likely to consider deals with companies in the $5 million range.

Efficient, But Not Growing

In another sense, the lean times were trial by fire. Those that have emerged alive have learned to operate their companies extremely efficiently. Even so, growth, not just survival, is a priority.

But in order to raise capital, smaller companies may still find some pressure to use that capital in certain ways. “A lot of people have something good, but to grow they either need more capital or to sell to a bigger company,” says John Lerner, CEO of Breaking Media, which just purchased healthcare media company MedCity Media. “On the buyer side, it’s the same equation—looking for like-minded people. People who got the model down and through the tough times became very efficient.”

And if you’re a smaller company that’s raising capital, your lenders might be more comfortable if you use that money to acquire, not launch. “Companies with deep pockets would much rather launch, but those tend to be much larger companies. You see that in the raises that have happened,” Lerner adds. “For smaller companies, it’s a much cleaner and easier presentation to raise money and buy with it than raise it and launch something from scratch.”

Those companies that became efficient to survive are, in a sense, hamstrung by that efficiency. To grow, it might make better sense to acquire another company that’s already created the model you want. “Everyone wants to have events, a better tech platform and stronger sales teams,” says Lerner. “And if you’re a standalone, even if you’re doing well, [launching is] a significant investment.”

Exploit Consolidation

Meredith Corp. has been acquisitive in the last several years, but while it has purchased both traditional and non-traditional media properties, it’s stalking the market with another strategy. “The way we think about it is are there other types of relationships we can strike with potential partners other than straight up acquisitions?” says John Zieser, chief development officer and general counsel.

Some publishers may want to divest, but there are others that want to take a half-step and enter into an outsourced services deal. Meredith did that with Martha Stewart Living, taking over the business side of the brand, leaving MSLO with editorial and creative control.

“It’s not an acquisition by any definition,” says Zieser. “We are very open minded and we are going to be talking to industry partners we can collaborate with.”

Who might those partners be? Market categories that have seven or eight titles these days are ripe for consolidation. “As you continue to see consolidation, there will be more pressure on the publishers that are not number-one or two to seek solutions. And that’s where we come in. Perhaps not as an outright acquisition, but with a strategic partnership.”

Zieser says Meredith brings with it a very tight cost structure and massive scale in the women’s market—the Shape acquisition from AMI, for example, when merged with Meredith title Fitness, will create a 2.5 million rate base giant. “We know exactly what our costs are going to be when we bring volume on board,” he says. “That’s a strong first step towards a strategic relationship with potential partners.” ![]()