Thermoplastic Composites Take Off in Aircraft Interiors

Extending the important role that composites already play in aircraft, reinforced thermoplastics slowly move into parts & panels

Previous Article Next Article

By Peggy Malnati

Thermoplastic Composites Take Off in Aircraft Interiors

Extending the important role that composites already play in aircraft, reinforced thermoplastics slowly move into parts & panels

Previous Article Next Article

By Peggy Malnati

Thermoplastic Composites Take Off in Aircraft Interiors

Extending the important role that composites already play in aircraft, reinforced thermoplastics slowly move into parts & panels

Previous Article Next Article

By Peggy Malnati

A thermoplastic trim strip at the top of an overhead storage bin inside the Boeing 737 jet (image courtesy of Ed Turner/The Boeing Co.).

A thermoplastic trim strip at the top of an overhead storage bin inside the Boeing 737 jet (image courtesy of Ed Turner/The Boeing Co.).

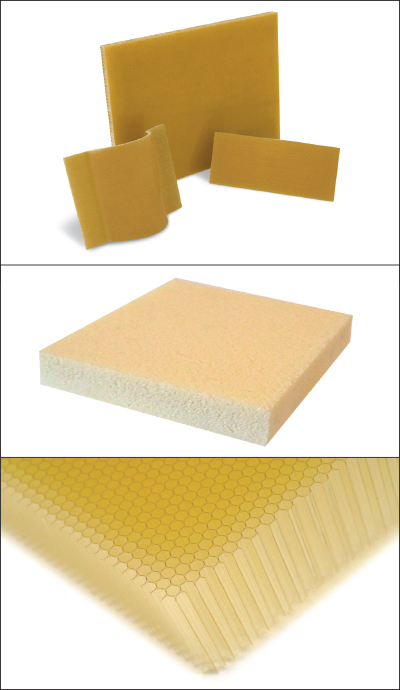

PEI is used in sandwich composites on cabin interiors as the matrix of laminate skins, and also for foam or honeycomb cores (images courtesy of SABIC).

Closed-cell TegraCore PPSU foam provides excellent resistance to fire, impact, and chemicals for applications ranging from ducting to panels on aircraft interiors (images courtesy of Solvay).

Closed-cell TegraCore PPSU foam provides excellent resistance to fire, impact, and chemicals for applications ranging from ducting to panels on aircraft interiors (images courtesy of Solvay).

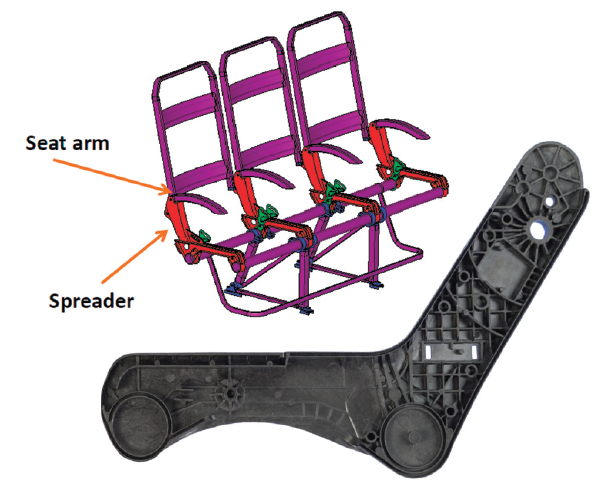

Injection molded carbon fiber-reinforced PES reduced weight 30% compared with aluminum, at cost parity for seat spreaders (shown here) and arm rests (images courtesy of Plasticomp).

Since the very beginnings, composites have played an important role in aircraft construction. Although the Boeing 787 DreamlinerandAirbus A380 wide-bodied jets have grabbed much-deserved attention in recent years for their pioneering use of structural thermoset composites in airframe construction, aircraft interiors remain a significant segment for all composites—with opportunities for thermoplastic composite (TPC) technologies.

While composite parts used inside the cabin don’t need the structural performance of airframe components, still they have their own set of demanding requirements, including stiffness and strength at low weight, dimensional stability, durable aesthetics, chemical resistance to cleaning solvents, and stringent flame, smoke, and toxicity (FST) values.

Reportedly, thousands of kilograms of carbon fiber-reinforced thermoset composites already are used for cabin interiors on every commercial jet, along with neat and reinforced high-performance engineering thermoplastics. Common composites applications there include floor, ceiling, door, and sidewall panels; overhead storage bins; window surrounds; ducting and bracketry; galley and lavatory components; passenger-service units; and bulkheads/ partitions.

The very nature of the demanding FST requirements for interior parts necessitates use of high-temperature, inherently flame-retardant thermoplastics. These include polyetherimide (PEI), polyphenylene sulfide (PPS), polyethersulfone (PES), polyphenylsulfone (PPSU), polyetheretherketone (PEEK), and polyetherketoneketone (PEKK), plus polycarbonate (PC) and polyamide (PA or nylon). Owing to their relatively high stiffness, these materials are often used unreinforced in injection-molded or thermoformed covers, window shades, glazing, lighting, and signage.

With the introduction of thermoplastic tapes, thermoplastic prepreg, and long-fiber thermoplastics (LFT) impregnated with these high-temperature resins and reinforced with continuous or discontinuous carbon fiber, TPCs have slowly begun expanding in this segment. They’re initially replacing aluminum and titanium fasteners and smaller structural elements for seating and carts, as well as cores for sandwich-panel structures, eventually displacing some thermoset composites. Now there are even TPC applications on plane exteriors and in fasteners for the airframe itself. Why the change?

The Case for TPCs

Versus aerospace-grade thermoset composites, high-performance TPCs generally provide higher toughness (impact strength), lower mass, and better surfaces out of the press (reducing finishing costs/time). And most provide excellent thermal stability at elevated temperatures.

TPCs mold faster, so they provide opportunities to lower part costs, since they arrive at the fabricator pre-polymerized and don’t require extra time to build chain length and cross-link density as thermosets do. Also, they don’t require refrigeration prior to use and have extremely long shelf-life at room temperature, so there’s no concern about performance of material that’s been stored half a year or longer, as can be the case with thermosets.

Depending on part requirements, scrap and off-spec TPC parts can be remelted and reformed, allowing recycling opportunities—whether in aircraft or other industries—helping reduce material costs and avoid the expense of landfilling offal.

Automated processes like compression and injection molding are capable of high-to-very-high levels of part complexity at medium-to-high production speeds. This means designers can consolidate numerous subassemblies. This lowers tooling costs and boosts quality by reducing stack-tolerance issues, all while reducing inventory and assembly steps and hence cost and mass. It also helps offset the generally higher raw-material costs for these thermoplastic polymers.

Furthermore, opportunities to join parts via welding techniques (instead of or in combination with mechanical fasteners or structural adhesives) presents additional ways to trim costs and production speeds.

“Airframe manufacturers are operating at historically high production rates, yet are being asked by customers to reduce the cost of planes,” notes Jim Griffing, technical fellow, 777X Materials & Processes, The Boeing Co., and SPE past president. “This is driving the industry to look for faster processing times, reduced tooling costs, and lower raw-material costs while still meeting regulatory requirements, as well as aesthetics, durability, and safety standards.”

Griffing notes that weight and cost remain important for materials selection, as do appearance and durability. “We’re also seeing more aggressive cleaning agents being used in some regions, so must choose materials accordingly. And recent trends for whiter, brighter colors on aircraft interiors have proven difficult to attain while meeting fire-worthiness, solvent-resistance, and mechanical-property requirements.”

Challenging Market Conditions

Despite a solid value proposition, TPC adoption in aircraft interiors remains slow, and present market conditions aren’t helping. “Given the current value of fuel, which is expected to stay low for at least another year, new composite interior applications are a tough sell,” notes Chris Red, principal, Composites Forecasts and Consulting, LLC.

The value of fuel savings seems to be a “no-brainer” at $3 USD/gallon, but market acceptance and adoption haven’t reflected this. With fuel costs now one-third what they were two years ago, the motivation to displace legacy components with lighter composites just isn’t there. Red adds that one reason is the component lifecycle differences between interiors (2-8 years) and airframe structures (20-30 years). Unless TPC parts offer initial cost parity plus fuel savings, it’s unlikely they’ll be approved until crude oil prices return to $80+/barrel, except for drop-in solutions that improve functionality (e.g., in-flight infotainment or increased seating density without compromising passenger comfort).

“With airlines looking at historically low financing costs, combined with unprecedented profitability due to the rapid decline in fuel costs, the motivation is to retire old aircraft while long-term fleet replacement costs remain attractive. Of course, if fuel prices return to where they were a few years ago, the incentive for change will return.”

What follows are some interesting applications and materials that are available when market conditions improve.

Foam Cores and Composite Skins

PEI (Ultem resin from SABIC) is used for both rigid foam cores and unidirectional carbon fiber-reinforced skins (like Cetex laminates from TenCate Advanced Composites) for numerous panel structures on aircraft interiors. Compared with aramid honeycomb, PEI foam provides full FST and U.S. Federal Aviation Administration (FAA) heat-release compliance, lower moisture absorption, better energy absorption, low dielectric loss, and easier manufacturing.

And compared with thermoset prepreg, PEI laminates reduce labor-intensive hand layup, weigh up to 30% less, and are available pre-colored in hues ranging from near-white to black. This eliminates the need to paint storage bins, flooring, and galley carts or, when paint is required, eliminates the need for primer.

Tubus Bauer GmbH also partnered with TenCate and SABIC to produce lightweight PEI honeycomb panels to replace aluminum and thermoset honeycomb. The PEI-intensive sandwich reportedly meets more stringent FST standards, eliminates secondary operations, and allows the entire panel to be thermoformed.

Meanwhile, Solvay just announced that its closed-cell TegraCore PPSU foam has obtained qualification from Airbus SAS for use in applications ranging from ducting to sandwich-panel components requiring excellent resistance to fire, impact, and chemicals. It’s already used for cabin components on Airbus’ flagship A350 XWB wide-body jets and floor panels on the Solar Impulse 2 long-range experimental solar-powered aircraft. Its approval shows Solvay can produce the material repeatably in an aerospace-compliant process with excellent quality control, and paves the way for its use on other Airbus aircraft.

TegraCore foam is based on super-tough Radel PPSU, which reportedly offers excellent FST values and resists water uptake, aggressive chemicals, and temperatures ranging from -40 to 204°C. Plus it’s exceptionally damage tolerant, thanks to a polymer structure that prevents uncontrolled crack propagation after impact.

In solid form, PPSU has been used for structural and decorative aircraft-interior components for over 25 years. (TegraCore is part of Solvay’s new and evolving Tegralite family of semi-finished thermoplastic lightweighting materials launched last year targeting the aerospace industry.)

TPCs in Seating

TPCs were the focus of a development project for aircraft seating involving BASF Corp., Plasticomp, Inc., and an unnamed seat supplier. The program compared performance of PES, PEI, and PEEK in pelletized LFT grades reinforced with 30-wt% chopped carbon fiber for injection molded seat spreaders and arm rests on wide-body jets. The eight-month accelerated development program involved material selection and testing, tooling and part design, and CAE analysis, as well as prototype molding. The goal was to reduce component mass 30% or more vs. incumbent aluminum.

BASF’s FST-compliant Ultrason E 3010 PES reportedly was selected for improved fiber/matrix adhesion, yielding parts with high strength/weight ratios. Not only was the mass-reduction target met with similar mechanical performance, but this was accomplished roughly at cost parity on a systems basis—despite little opportunity to modify the legacy aluminum design, other than parts consolidation and minor changes to facilitate molding.

Although the parts aren’t yet commercial, they’ve passed demanding 16G kinetic testing and achieved FAR 25.853 approval. Additional programs with other seat suppliers are reportedly underway.