ASEAN Region Offers Thin-Wall Packaging Opportunities

Singapore conference outlines trends & challenges in Southeast Asia

Previous Article Next Article

By Conor Carlin

Sales & Marketing Manager, CMT Materials Inc.

ASEAN Region Offers Thin-Wall Packaging Opportunities

Singapore conference outlines trends & challenges in Southeast Asia

Previous Article Next Article

By Conor Carlin

Sales & Marketing Manager, CMT Materials Inc.

ASEAN Region Offers Thin-Wall Packaging Opportunities

Singapore conference outlines trends & challenges in Southeast Asia

Previous Article Next Article

By Conor Carlin

Sales & Marketing Manager, CMT Materials Inc.

Clear polypropylene cups like these are just one common example of popular thin-wall plastics packaging. Courtesy of Milliken Chemical

Clear polypropylene cups like these are just one common example of popular thin-wall plastics packaging. Courtesy of Milliken Chemical

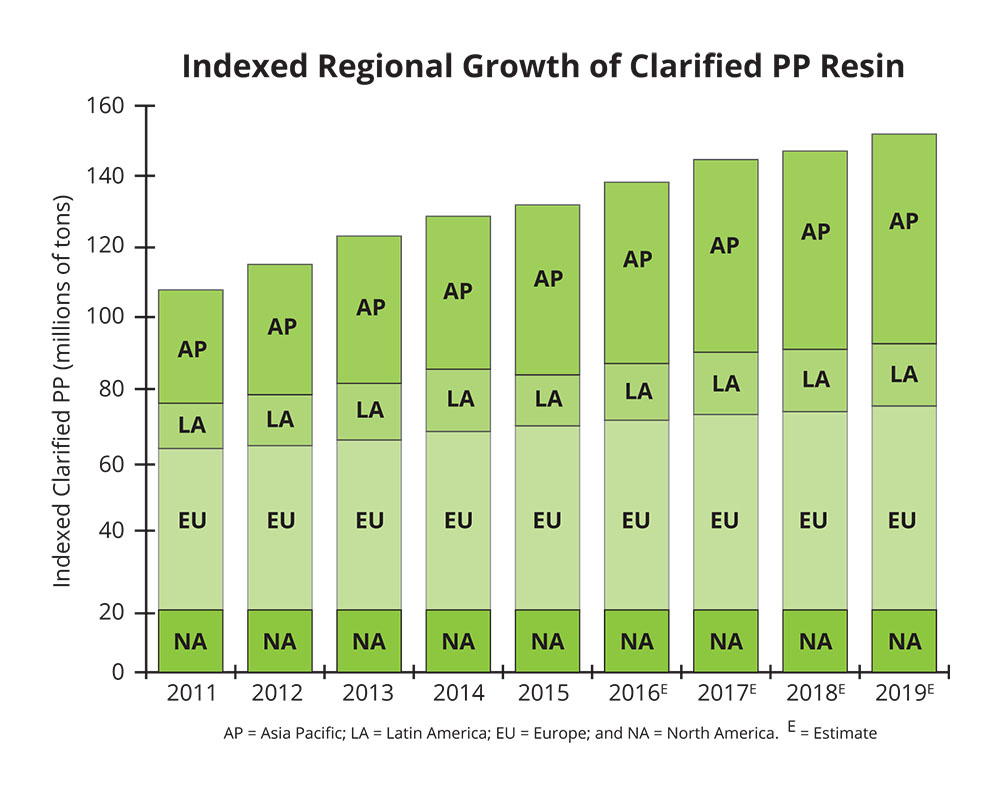

Clarified polypropylene is an attractive market, growing at a 5-6% rate globally. Dynamic growth in emerging markets. Courtesy of Milliken Chemical

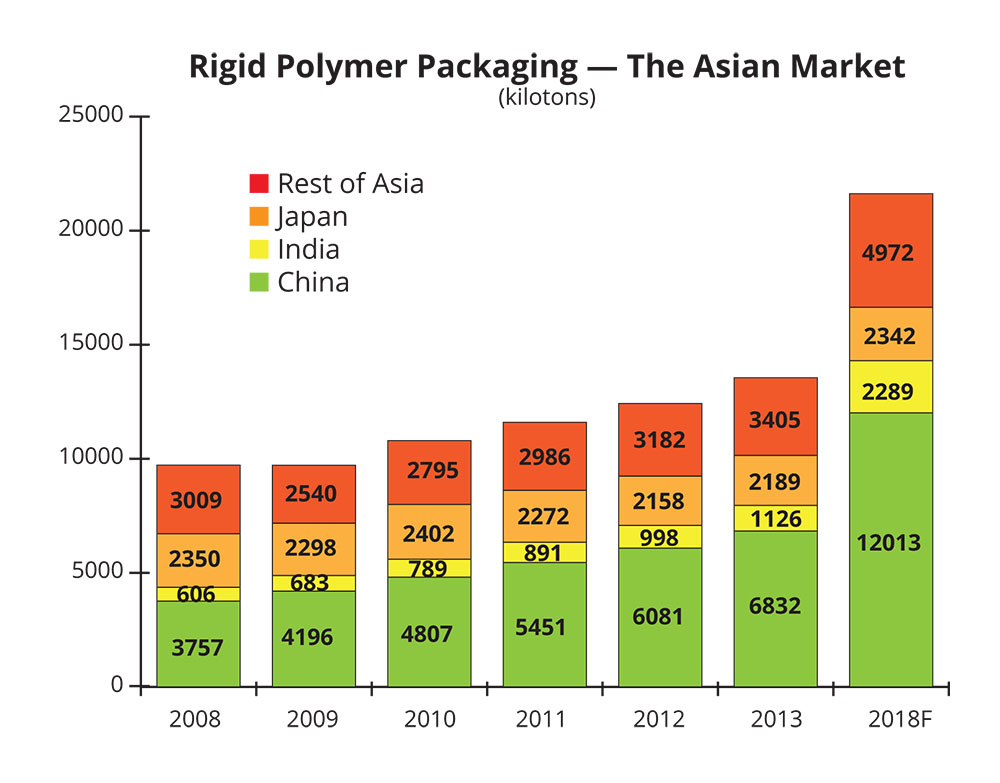

Strong growth in consumer demand is expected over the next few years, especially in India. Courtesy of Borouge Pte Ltd.

An example of unintended legislative consequences — a PS lid is mismatched with a paper cup. Courtesy of Kiefel

An assortment of clear plastic PP packaging. Courtesy of Milliken Chemical

An assortment of clear plastic PP packaging. Courtesy of Milliken Chemical

Bosch Sprang 60-cavity tool with HYTAC FLX plug assists for PP water cup production. Courtesy of Bosch Sprang

Demographic shifts, inter-material replacement, and ambient vs. chilled packaging were among the “megatrends” that surfaced at a recent Thin Wall Packaging conference in Singapore. In addition, presenters there also addressed several interesting trends in the region, such as the continued importance of polypropylene thermoformed water cups in Indonesia, PP replacing expanded polystyrene in Malaysia, and how the importance of 7-11 stores has influenced packaged goods in Thailand.

Just under 100 attendees from 25 countries -- primarily from Europe and Asia -- attended this first such event in Southeast Asia by the UK-based Applied Market Information Ltd.

Content focused on the 10-member Association of South East Asia Nations (ASEAN) region, with its population of roughly 670 million people, which ranks higher than NAFTA and EU-28 as a trading bloc. While growth rates in the ASEAN nations are higher than most Western countries, purchasing power remains significantly lower on aggregate. And though the term “Southeast Asia” was used throughout the event, several presenters drew distinctions among individual countries, as the region cannot be considered monolithic.

Representatives from machinery maker Brückner Group/Kiefel offered a nuanced view of the regional market by delving into specific trends in individual countries. The Philippines, for example, with more than 100 million people, is more Westernized than other countries in the region. After being hit with a typhoon in 2009 that resulted in severe flooding, the country’s drains were clogged and PS cups were identified as a major contributor. The central government decided that only paper cups should be used in the future, thinking they would degrade more easily, despite studies showing that waste increased with paper use. This led to a mismatch in tolerances between PS lids and new paper cups. The unintended consequence is now that many take-out drinks are sold with a piece of tape securing the lid to the cup.

Malaysia & Indonesia Trends

Manufacturers in Malaysia produce more than 2 billion lunch boxes each year. Originally made from expanded polystyrene foam, a new directive now mandates a switch to polypropylene. Though EPS offers lightweight parts with good insulation, it cracks easily and, perhaps more importantly, it has proven to be very difficult to recover as part of any recycling program.

Demand for water in Indonesia is “unlimited,” according to several presenters and statistics would appear to reinforce that claim. With a 1.4% year-over-year increase in population, more than half of all drinking water in the country is served via thermoformed PP cups, making Indonesia a key market for thermoforming. Several European OEMs continue to reap the benefits of this demand with dozens of machines and multiple turnkey systems being delivered in recent years.

The majority of PP cups are formed on tilt-bed, trim-in-place systems, which offer highly accurate and concentric cutting. The tooling for these machines continues to evolve with companies such as Bosch Sprang and Marbach enabling faster cycle times through improved cooling and high-pressure forming. New high-volume, dual-circuit pressure forming valves allow air to flow in and out of the mold cavities for faster speeds and a significant reduction in air consumption and, by extension, operating costs. Downstream automation is increasingly being adopted for rim rolling, sleeving, bagging and final case-packing operations.

Energy & Labor Concerns

The Philippines, with an average energy cost of $0.135/kwh, has the highest electric rates in the region, which drives the need for energy-efficient equipment. Humidity levels in Indonesia, where factory temperatures can rise to 45°C (113°F), contribute to an increased demand on the electricity infrastructure where voltage fluctuations can create risks for equipment and workers. Labor costs continue to rise in several countries. The Malaysian government stopped the practice of hiring foreign workers, which has led to increased investments in faster, more energy-efficient systems. Kiefel described how the increased demand for turnkey solutions and more automation in the region was a factor in its decision to acquire toolmaker Bosch Sprang and automation specialist Mould & Matic this year.

PP Gains at the Expense of PS

There is no doubt that polypropylene continues to be an important material in thin-wall packaging, both as a replacement for existing polymers such as PET and PS, and other materials such as glass, tin and paper. Versatile, low density, and easy to recycle with a relatively low environmental footprint (in terms of water and energy inputs), along with a higher energy recovery rate, PP scores well across the value chain in terms of sustainability. Speakers from Milliken Chemical (China) and Borouge (Singapore) extolled the virtues of polyolefins while presenting impressive facts on rates of growth in India, China and ASEAN markets. Beyond food and dairy packaging, PP is finding greater adoption in other sectors such industrial paints and lubricants, where it is replacing traditional tin and steel containers.

Borouge presented a case study illustrating how the addition of their Borstar Nucleation Technology (BNT) to injection-grade propylene was a factor in one company’s decision to switch from EPS to PP for a noodle cup. BNT increases the crystallization rate, is isotropic and enhances stiffness, which increases the potential for downgauging. Milliken Chemical also highlighted how thin-wall injection molded parts made with its nucleated PP are replacing PS takeaway containers in both China and Japan. Milliken also pointed out that, because Japan taxes plastic parts by weight, the lower density of PP means more parts can be produced from the same amount of material, reducing the tax liability for converters.

In food packaging, wherever there is PP film, EVOH almost certainly follows. Representatives from Kuraray presented data illustrating how multilayer films with EVOH layers improve shelf life by effectively reducing oxygen transmission rates (OTR). According to the company, 1mm of EVAL (Kuraray’s trade name for EVOH) has the same gas barrier as a 10-meter-thick wall of LDPE. EVOH can be applied in different grades for different applications, from fuel tanks to extrusion coating to shrink films. Silgan Food Containers described how it incorporated EVOH into its 7-layer PP film that is formed in the melt phase of their proprietary rotary thermoforming process. Because the EVOH is less than 5% of the sheet, it does not affect the recycling stream, which allows the company to take advantage of the #5 recycling symbol.

PET & Recycling Concerns

Representatives from Austria-based extrusion technology firm SML discussed how the physical properties of PET sheet influence discrete processes for thin-wall packaging. Because PET is hygroscopic and must be dried prior to extrusion, factory conditions play a critical role in whether or not a converter will be able to offer value-added services such as lamination. SML see a trend toward bigger cups in several ASEAN markets, which requires a stronger, thicker sheet. Thinner sheet, by comparison, increases the probability of roll deflection and can lead to non-uniform sheet thickness. For the moment, recycling rates remain low in Asia despite increases in plastics production. According to several panel members, the development of thin-wall packaging will be accelerated though better recycling infrastructure and closer cooperation along the supply chain.

The Thai Packaging Association offered some updates on standards development, though with 10 countries trying to find harmonization across markets in different stages of maturity, it is clear that more remains to be done. There are nine working groups in the food packaging sector alone. The ASEAN Consultative Committee on Standards & Quality (ACCSQ) is using FDA, CE and JETRO regulations for guidance. And though PE/PET lamination is not prevalent in SE Asia, the regulatory environment is in its early stages so there are no defined limits for post-consumer content in PET.

Convergence of Megatrends

One anecdote from the panel discussion neatly encapsulated the convergence of several trends -- both packaging and demographic -- in SE Asia. In Thailand, 7-11 stores have become more of a meeting place than a simple convenience store. People will often work in stores with cell phones or laptops, which increases the likelihood that they will purchase and eat something while there. Space is a premium in these small shops with refrigerators eating up valuable real estate and expensive energy. Because barrier films increase the shelf life of foods, many of these store owners are putting more ambient-temperature items on the shelves while reducing the inventory of chilled foods.

Printpack India also discussed how this shift to high-barrier, high-clarity containers, both thermoformed and injection molded, signaled a move away from glass containers despite the premium factor associated with glass and its lower cost. In one study, the newer plastic formats did not cannibalize existing glass containers, but rather led to an expansion of the market into new segments such as schools and offices where safety concerns are more pronounced. Beyond hot soups and noodle dishes, additional trends toward minimally processed foods mean that convenience stores have more SKUs to display. And though the topic was discussed in only a teasing fashion, the impact of online delivery services for food could affect the requirements for packaging and transport. Will consumers still expect a high level of decoration (IML or otherwise) on items that they have only previously seen online?

Innovation vs. Technology

Moderator Jon Nash of AMI posited that plastic consumption increases after $5,000- $10,000 of per capita income, and plateaus at $30,000. These figures are based on AMI’s global market research in thin-wall packaging. Given the relative sizes of purchasing power in the various ASEAN countries, coupled with demographic trends favoring urban migration and the associated increase in convenience eating, the stage is set for increased growth in most countries throughout the region.

So what are the critical success factors for specific end-use applications? On the theme of inter-material replacement, the panel moderator asked about the drivers behind brands’ decision to select barrier plastic packaging. Two main responses emerged: the first was about adding value to the product, particularly in terms of functionality (think squeezable ketchup bottles instead of tapping the “57” logo on a glass version); the second was to extend shelf life, for both long transportation cycles and in-home usage.

In a “design-led journey” for packaging, a speaker from qDesign, an Australian multidisciplinary design firm, described how human-centered design thinking can influence packaging in new ways. The case in point was a redesign of Gourmet Garden’s fresh herbs that are packaged in a tube. The original intent was to avoid spoilage of fresh herbs that many consumers would buy, use once, then store in the fridge until they wilted. Diving deeper into the consumer experience, the designers discovered that using herbs imparted a sense of culinary élan and transformed the average household cook into a Michelin-starred chef, if only for a few seconds. This insight led to a complete change in package format for dried herbs, moving from a tube to a ‘system’ of interlocking tubs with large openings for fingers to easily grab and sprinkle cilantro, basil, coriander and ginger. Proving that innovative packaging leads to an increase in purchases, Gourmet Garden reported a 60% jump in category sales after the new design was introduced. The story served as an important reminder that innovation will often trump technology in terms of understanding market needs. Eye-catching technology will draw a crowd into a trade show booth, but solving customer problems through innovation and supply-chain collaboration ultimately drives sales.

One Size Does Not Fit All

While large Asian converters are importing (mainly) European technology for packaging needs, global trends are not exactly uniform, though it could be said that technology platforms and possibly material developments are converging. North American and European countries feature high rates of supermarket penetration, associated transportation chains, and aging populations that demand more and more from packaged goods.

Other regions, including ASEAN, do not have such high ratios of supermarkets to people, with smaller convenience stores and street vendors providing food to increasingly young and urban consumers. And though the region itself is large, there are several discrete trends among the countries that offer opportunities for innovative thinking. As the data suggest, increasing growth rates and rising disposable incomes will continue to drive consumption of plastic packaging across Southeast Asia.

ABOUT THE AUTHOR

Conor Carlin is the Boston-based sales and marketing manager for CMT Materials Inc., a company specializing in lightweight composite materials for applications in plastics, packaging, aerospace and buoyancy markets. He began his plastics industry career in 1998 with Sencorp Inc., a leading maker of thermoforming and packaging equipment. He has served on the SPE Thermoforming Division’s board of directors for eight years, as SPE membership chair, and in 2007 took over as managing editor of division’s flagship publication, Thermoforming Quarterly. Since 2014, Carlin also has served as secretary of the SPE Foundation Board, a non-profit which funds programs and projects that support polymer-related education worldwide.

Conor Carlin is the Boston-based sales and marketing manager for CMT Materials Inc., a company specializing in lightweight composite materials for applications in plastics, packaging, aerospace and buoyancy markets. He began his plastics industry career in 1998 with Sencorp Inc., a leading maker of thermoforming and packaging equipment. He has served on the SPE Thermoforming Division’s board of directors for eight years, as SPE membership chair, and in 2007 took over as managing editor of division’s flagship publication, Thermoforming Quarterly. Since 2014, Carlin also has served as secretary of the SPE Foundation Board, a non-profit which funds programs and projects that support polymer-related education worldwide.