Global Machinery Trends 2016

This “roundtable” of industry players shows both agreement and diversity of views about where primary plastics machinery markets are headed, region by region

Previous Article Next Article

Arburg produces Allrounder injection molding machines exclusively at its central production location in Lossburg, Germany (photo courtesy of Arburg).

Despite their size and complexity, primary plastics conversion machines seem to move relatively easily across national borders in the global machinery trade. With so many heavily populated regions of the world both producing and using plastic products at an increasing rate, Plastics Engineering asked three international executives about the state of the global machinery market.

The expert comments below are from:

- Satoshi Takami, VP and area sales manager for Japan Steel Works America, Inc.;

- Mario Maggiani, general manager of Assocomaplast, the Italian trade association for plastics and rubber processing machinery and mold manufacturers; and

- Helmut Heinson, managing director, Arburg.

Market Trends & Policy Effects

Plastics Engineering:Briefly, what are some current global trends in primary plastics machinery sales? Which regions are currently most active in importing/exporting machines? And what’s affecting these trends?

Heinson: Barring a few exceptions, Europe is a stable and growing market. One positive example in Western Europe is the UK. Here, growth rates are good because production is being brought back into the country. Our [Arburg’s] activities in Central and Eastern Europe are also progressing well. Germany—our most important market—is stable at a high level.

In the USA—our most important foreign market—the situation has been very positive for some time now. The Asian market is growing and offers great potential. Here, we have successfully expanded our activities in recent years, and we will continue to intensify these in the future.

Maggiani: From the point of view of equipment types, the largest volumes of imported injection molding machines, flexographic printing machines, and molds … were recorded for Germany, the country that confirms its role as principal supplier of technology for Italy. Germany—historically also the most important destination market for Italian exports in this sector—confirms its position from this point of view as well.

Takami: [Recent trends are] I would say localization, and division into high-end and non-high-end markets. No matter whether developed or developing countries—countries with high population, high consumption of plastics, and highly advanced industrial machinery are likely to have local injection molding [machine] manufacturers.

Another primary plastics machinery is compounding extruders. Nowadays, in addition to traditional companies from Germany, Italy, Austria, and Japan, new companies from the USA, Brazil, China, Korea, Taiwan, Thailand, and India are increasing their presence. [M]ulti-million dollar machinery such as polyolefin extruders and film/sheet and blow molding machines tend to be sourced from European, U.S., or Japanese companies who have a long history in the industry.

PE:Concerning certain tariffs and related government trade supports in various countries, how are these hurting/helping machine makers, or hurting/helping plastics processors? And overall, is there a net benefit, or only costs, to the global plastics engineering sector from these kinds of government interventions?

Maggiani: The topic is surely complicated and can hardly be debated in a few words. In principle (without discussing the cases of each single country) governments undertake these kinds of actions to protect local manufacturers of plastics and rubber machinery and ancillaries. Though this strategy may be successful in the short and medium term, I believe it is absolutely wrong in the long term.

Globalization cannot be stopped. Moreover, banning high-tech machinery—which cannot be manufactured on site—damages local processors.

Takami: It is very much depending on how a plastics business is rooted in one country and is competing with other foreign countries or not. Under such circumstances, governments may protect and encourage such business, which is understandable.

Such governmental trade supports have significant roles and benefits to develop the plastics industry both locally and globally.

Emerging Markets, “Hot” Machines

PE:What are some important emerging plastics machinery-making countries and markets? In five years, which of these countries do you think will be major producers of plastics primary machines, and why so much growth there?

Takami: The most common answers could be China, Korea, and India. China has [had a] slight slowdown in its economy, but still has more than double the growth rate [of the] global average. India is similar also. Korea is now a worldwide supplier for automobiles and electrical appliances.

Anyhow, we need to pay attention to what are the drivers: low-cost labor, high-end or non-high-end targets, leading technical development innovation or low-cost innovation. Germany and Japan will remain as leading suppliers for the industry for the next five to ten years, thanks to long accumulated technical know-how and innovative research and development.

Heinson: The important manufacturers in these market segments are based in Germany, Austria, Italy, the USA, Brazil (a small part), China, Japan, Taiwan, and Korea. There are no “emerging plastics machinery-making countries” as such, as manufacturers from these key countries have been in the market for decades. Essentially, this situation will not change and no significant shifts are to be expected.

Maggiani: As far as plastics and rubber machinery destination markets are concerned, … we can notice a split in the Americas: the North (driven by the USA) is going through a growth period; on the contrary, the South is in deadlock (if not in recession), worsened by the Brazilian crisis hitting the leading country of the area.

Depending on each country, Europe is giving some hints of recovery (sometimes strong, sometimes weak). Being a mature market, we cannot expect any sudden growth. The Russian situation is still complicated; Russia is for sure an important market, but it is limited by economic sanctions….

As for Asia, we have great expectations for the re-opening of the Iranian market. India is also recovering, though local processors are very sensitive on prices. Though Chinese growth is slowing down, the local demand of high-tech items is always strong.

Finally, Africa is the big challenge of our century; we are all following with great attention the evolution of Sub-Saharan countries. South Africa and the northern [African] countries overlooking the Mediterranean Sea are quite known, while Nigeria, Kenya, Angola, and Mozambique are of great interest for us.

PE:In terms of sales growth, what types of primary machines are the “hottest” globally? Will the popularity of more complex machines (like all-electric molding machines) shift overall sales trends towards countries that produce them—or will less-complex machines remain popular globally?

Maggiani: Drawing a global trend is not so easy. Consider the application fields: Automotive is recovering (most of all in Europe, where the economic crisis had strongly hit this industry). Thumb-up for packaging.… Building and construction is still suffering in Europe and, in particular, in Italy.

As for high-tech and low-profile machines, in the end the customer makes his choice. I’m going to tell an illustrative story, in my opinion: A few years ago, I met a North African entrepreneur who, though working in the food industry, decided to start investing money in the production of plastic cutlery for the local market. I asked him why he had bought machines from Far East instead of Europe, and he answered that he was not interested in quality nor in production capacity, but he bought three machines from the Far East for the price of a European one.…

That businessman contacted me last year and told me that a big automobile [plant] opened near his plant. They were looking for quality suppliers for automotive components … and he had to turn to Italian machinery manufacturers.

Heinson: The share for complex machines and systems with a high level of automation continues to grow. Nevertheless, high-quality standard machines continue to play an important role. As [Arburg’s] portfolio covers this entire spectrum—from standard machines through to sophisticated, customized turnkey solutions—we are very well positioned for the future.

Takami: If we talk about “growth” itself, the hottest primary machines will be 3-D printers, so-called “game-changers” as the technology is advanced and cost is optimized. If we talk about primary machines for mass production, global economic growth, and increased substitution from metal, paper, and wood to plastic—injection molding machinery will remain [the] hottest.

In Search of Global Standards

PE:And what about local primary plastics machine standards/requirements in individual countries/regions? In what ways do energy-efficiency and quality standards in one country affect the processor’s options in sourcing machines from other, low-cost countries?

Takami: Since each country has their standards and safety regulations/certifications, compliance is mandatory for sales to each country. We are fully aware of the current standards and keep an eye on any possible changes to be introduced. Suppliers from low-cost countries, who export machines to global market, should be aware of such compliance. However, quality control criteria and choice of raw materials are areas where each supplier is able to differentiate technical and quality capability from others.

Heinson: At Arburg, there are no differences with regard to the various countries and regions, as we produce our Allrounder injection molding machines exclusively at our central production location in Lossburg, Germany. We have a vertical integration of around 60% and manufacture all the important key components in-house. One example is our Selogica machine control system, with which all Allrounders operate and which can be fully integrated into our robotic systems and further peripherals. … Thanks to our centralized production, all Allrounders, regardless of their final place of use, are built to the same high quality standard.

The topic of energy efficiency also plays an important role. However, we already go a step further: energy efficiency is only one aspect of our topic of production efficiency. Our objective is to ensure that our customers can produce their plastic products in optimum quality at the lowest possible unit costs.

Maggiani: In my opinion we have to face two topics: the first one is related to safety requirements (European CEN or international ISO regulations); the second one is strictly technical (for example, energy saving)….

Assocomaplast, together with other European associations, has always been working on safety regulations for safer machines in our industry. Today we are moving from a European to an international level, involving the United States, China, India, Brazil,….

[W]ithin our European association, Euromap, we decided to fix some standards on energy saving for injection molding and thermoforming machines, extruders, etc. Since there was not a common policy, we trusted it could have been of interest to all of us (manufacturers and processors) to define an unambiguous way to measure energy saving and fix some consumption categories, as it occurs with home appliances today [like with refrigerators] … If we really want to save energy, we must be clear and frank, without playing with numbers.

Note: Read more about recent plastics machinery trends in the USA on p. 49, in the “Inside SPI” section of this issue of PE.

Mike Tolinski’s revised and expanded second edition of his first book, Additives for Polyolefins, was released in spring 2015; go to www.additivesforplastics.com to view its table of contents.

Global Machinery Trends 2016

This “roundtable” of industry players shows both agreement and diversity of views about where primary plastics machinery markets are headed, region by region

Previous Article Next Article

Arburg produces Allrounder injection molding machines exclusively at its central production location in Lossburg, Germany (photo courtesy of Arburg).

Despite their size and complexity, primary plastics conversion machines seem to move relatively easily across national borders in the global machinery trade. With so many heavily populated regions of the world both producing and using plastic products at an increasing rate, Plastics Engineering asked three international executives about the state of the global machinery market.

The expert comments below are from:

- Satoshi Takami, VP and area sales manager for Japan Steel Works America, Inc.;

- Mario Maggiani, general manager of Assocomaplast, the Italian trade association for plastics and rubber processing machinery and mold manufacturers; and

- Helmut Heinson, managing director, Arburg.

Market Trends & Policy Effects

Plastics Engineering:Briefly, what are some current global trends in primary plastics machinery sales? Which regions are currently most active in importing/exporting machines? And what’s affecting these trends?

Heinson: Barring a few exceptions, Europe is a stable and growing market. One positive example in Western Europe is the UK. Here, growth rates are good because production is being brought back into the country. Our [Arburg’s] activities in Central and Eastern Europe are also progressing well. Germany—our most important market—is stable at a high level.

In the USA—our most important foreign market—the situation has been very positive for some time now. The Asian market is growing and offers great potential. Here, we have successfully expanded our activities in recent years, and we will continue to intensify these in the future.

Maggiani: From the point of view of equipment types, the largest volumes of imported injection molding machines, flexographic printing machines, and molds … were recorded for Germany, the country that confirms its role as principal supplier of technology for Italy. Germany—historically also the most important destination market for Italian exports in this sector—confirms its position from this point of view as well.

Takami: [Recent trends are] I would say localization, and division into high-end and non-high-end markets. No matter whether developed or developing countries—countries with high population, high consumption of plastics, and highly advanced industrial machinery are likely to have local injection molding [machine] manufacturers.

Another primary plastics machinery is compounding extruders. Nowadays, in addition to traditional companies from Germany, Italy, Austria, and Japan, new companies from the USA, Brazil, China, Korea, Taiwan, Thailand, and India are increasing their presence. [M]ulti-million dollar machinery such as polyolefin extruders and film/sheet and blow molding machines tend to be sourced from European, U.S., or Japanese companies who have a long history in the industry.

PE:Concerning certain tariffs and related government trade supports in various countries, how are these hurting/helping machine makers, or hurting/helping plastics processors? And overall, is there a net benefit, or only costs, to the global plastics engineering sector from these kinds of government interventions?

Maggiani: The topic is surely complicated and can hardly be debated in a few words. In principle (without discussing the cases of each single country) governments undertake these kinds of actions to protect local manufacturers of plastics and rubber machinery and ancillaries. Though this strategy may be successful in the short and medium term, I believe it is absolutely wrong in the long term.

Globalization cannot be stopped. Moreover, banning high-tech machinery—which cannot be manufactured on site—damages local processors.

Takami: It is very much depending on how a plastics business is rooted in one country and is competing with other foreign countries or not. Under such circumstances, governments may protect and encourage such business, which is understandable.

Such governmental trade supports have significant roles and benefits to develop the plastics industry both locally and globally.

Emerging Markets, “Hot” Machines

PE:What are some important emerging plastics machinery-making countries and markets? In five years, which of these countries do you think will be major producers of plastics primary machines, and why so much growth there?

Takami: The most common answers could be China, Korea, and India. China has [had a] slight slowdown in its economy, but still has more than double the growth rate [of the] global average. India is similar also. Korea is now a worldwide supplier for automobiles and electrical appliances.

Anyhow, we need to pay attention to what are the drivers: low-cost labor, high-end or non-high-end targets, leading technical development innovation or low-cost innovation. Germany and Japan will remain as leading suppliers for the industry for the next five to ten years, thanks to long accumulated technical know-how and innovative research and development.

Heinson: The important manufacturers in these market segments are based in Germany, Austria, Italy, the USA, Brazil (a small part), China, Japan, Taiwan, and Korea. There are no “emerging plastics machinery-making countries” as such, as manufacturers from these key countries have been in the market for decades. Essentially, this situation will not change and no significant shifts are to be expected.

Maggiani: As far as plastics and rubber machinery destination markets are concerned, … we can notice a split in the Americas: the North (driven by the USA) is going through a growth period; on the contrary, the South is in deadlock (if not in recession), worsened by the Brazilian crisis hitting the leading country of the area.

Depending on each country, Europe is giving some hints of recovery (sometimes strong, sometimes weak). Being a mature market, we cannot expect any sudden growth. The Russian situation is still complicated; Russia is for sure an important market, but it is limited by economic sanctions….

As for Asia, we have great expectations for the re-opening of the Iranian market. India is also recovering, though local processors are very sensitive on prices. Though Chinese growth is slowing down, the local demand of high-tech items is always strong.

Finally, Africa is the big challenge of our century; we are all following with great attention the evolution of Sub-Saharan countries. South Africa and the northern [African] countries overlooking the Mediterranean Sea are quite known, while Nigeria, Kenya, Angola, and Mozambique are of great interest for us.

PE:In terms of sales growth, what types of primary machines are the “hottest” globally? Will the popularity of more complex machines (like all-electric molding machines) shift overall sales trends towards countries that produce them—or will less-complex machines remain popular globally?

Maggiani: Drawing a global trend is not so easy. Consider the application fields: Automotive is recovering (most of all in Europe, where the economic crisis had strongly hit this industry). Thumb-up for packaging.… Building and construction is still suffering in Europe and, in particular, in Italy.

As for high-tech and low-profile machines, in the end the customer makes his choice. I’m going to tell an illustrative story, in my opinion: A few years ago, I met a North African entrepreneur who, though working in the food industry, decided to start investing money in the production of plastic cutlery for the local market. I asked him why he had bought machines from Far East instead of Europe, and he answered that he was not interested in quality nor in production capacity, but he bought three machines from the Far East for the price of a European one.…

That businessman contacted me last year and told me that a big automobile [plant] opened near his plant. They were looking for quality suppliers for automotive components … and he had to turn to Italian machinery manufacturers.

Heinson: The share for complex machines and systems with a high level of automation continues to grow. Nevertheless, high-quality standard machines continue to play an important role. As [Arburg’s] portfolio covers this entire spectrum—from standard machines through to sophisticated, customized turnkey solutions—we are very well positioned for the future.

Takami: If we talk about “growth” itself, the hottest primary machines will be 3-D printers, so-called “game-changers” as the technology is advanced and cost is optimized. If we talk about primary machines for mass production, global economic growth, and increased substitution from metal, paper, and wood to plastic—injection molding machinery will remain [the] hottest.

In Search of Global Standards

PE:And what about local primary plastics machine standards/requirements in individual countries/regions? In what ways do energy-efficiency and quality standards in one country affect the processor’s options in sourcing machines from other, low-cost countries?

Takami: Since each country has their standards and safety regulations/certifications, compliance is mandatory for sales to each country. We are fully aware of the current standards and keep an eye on any possible changes to be introduced. Suppliers from low-cost countries, who export machines to global market, should be aware of such compliance. However, quality control criteria and choice of raw materials are areas where each supplier is able to differentiate technical and quality capability from others.

Heinson: At Arburg, there are no differences with regard to the various countries and regions, as we produce our Allrounder injection molding machines exclusively at our central production location in Lossburg, Germany. We have a vertical integration of around 60% and manufacture all the important key components in-house. One example is our Selogica machine control system, with which all Allrounders operate and which can be fully integrated into our robotic systems and further peripherals. … Thanks to our centralized production, all Allrounders, regardless of their final place of use, are built to the same high quality standard.

The topic of energy efficiency also plays an important role. However, we already go a step further: energy efficiency is only one aspect of our topic of production efficiency. Our objective is to ensure that our customers can produce their plastic products in optimum quality at the lowest possible unit costs.

Maggiani: In my opinion we have to face two topics: the first one is related to safety requirements (European CEN or international ISO regulations); the second one is strictly technical (for example, energy saving)….

Assocomaplast, together with other European associations, has always been working on safety regulations for safer machines in our industry. Today we are moving from a European to an international level, involving the United States, China, India, Brazil,….

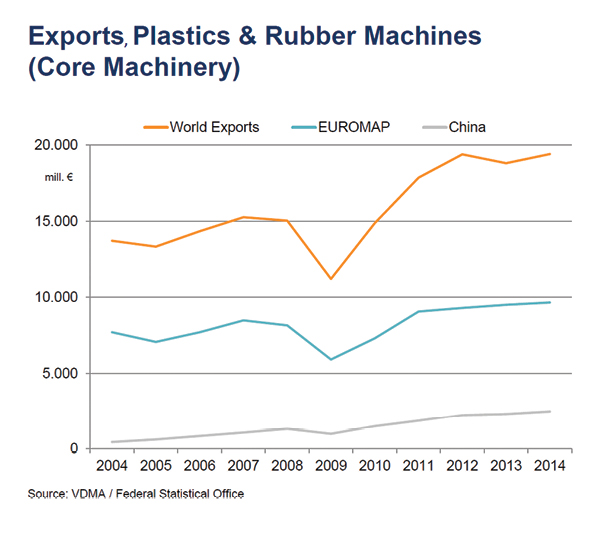

[W]ithin our European association, Euromap, we decided to fix some standards on energy saving for injection molding and thermoforming machines, extruders, etc. Since there was not a common policy, we trusted it could have been of interest to all of us (manufacturers and processors) to define an unambiguous way to measure energy saving and fix some consumption categories, as it occurs with home appliances today [like with refrigerators] … If we really want to save energy, we must be clear and frank, without playing with numbers.

Note: Read more about recent plastics machinery trends in the USA on p. 49, in the “Inside SPI” section of this issue of PE.

Mike Tolinski’s revised and expanded second edition of his first book, Additives for Polyolefins, was released in spring 2015; go to www.additivesforplastics.com to view its table of contents.

Global Machinery Trends 2016

This “roundtable” of industry players shows both agreement and diversity of views about where primary plastics machinery markets are headed, region by region

Previous Article Next Article

Arburg produces Allrounder injection molding machines exclusively at its central production location in Lossburg, Germany (photo courtesy of Arburg).

Despite their size and complexity, primary plastics conversion machines seem to move relatively easily across national borders in the global machinery trade. With so many heavily populated regions of the world both producing and using plastic products at an increasing rate, Plastics Engineering asked three international executives about the state of the global machinery market.

The expert comments below are from:

- Satoshi Takami, VP and area sales manager for Japan Steel Works America, Inc.;

- Mario Maggiani, general manager of Assocomaplast, the Italian trade association for plastics and rubber processing machinery and mold manufacturers; and

- Helmut Heinson, managing director, Arburg.

Market Trends & Policy Effects

Plastics Engineering:Briefly, what are some current global trends in primary plastics machinery sales? Which regions are currently most active in importing/exporting machines? And what’s affecting these trends?

Heinson: Barring a few exceptions, Europe is a stable and growing market. One positive example in Western Europe is the UK. Here, growth rates are good because production is being brought back into the country. Our [Arburg’s] activities in Central and Eastern Europe are also progressing well. Germany—our most important market—is stable at a high level.

In the USA—our most important foreign market—the situation has been very positive for some time now. The Asian market is growing and offers great potential. Here, we have successfully expanded our activities in recent years, and we will continue to intensify these in the future.

Maggiani: From the point of view of equipment types, the largest volumes of imported injection molding machines, flexographic printing machines, and molds … were recorded for Germany, the country that confirms its role as principal supplier of technology for Italy. Germany—historically also the most important destination market for Italian exports in this sector—confirms its position from this point of view as well.

Takami: [Recent trends are] I would say localization, and division into high-end and non-high-end markets. No matter whether developed or developing countries—countries with high population, high consumption of plastics, and highly advanced industrial machinery are likely to have local injection molding [machine] manufacturers.

Another primary plastics machinery is compounding extruders. Nowadays, in addition to traditional companies from Germany, Italy, Austria, and Japan, new companies from the USA, Brazil, China, Korea, Taiwan, Thailand, and India are increasing their presence. [M]ulti-million dollar machinery such as polyolefin extruders and film/sheet and blow molding machines tend to be sourced from European, U.S., or Japanese companies who have a long history in the industry.

PE:Concerning certain tariffs and related government trade supports in various countries, how are these hurting/helping machine makers, or hurting/helping plastics processors? And overall, is there a net benefit, or only costs, to the global plastics engineering sector from these kinds of government interventions?

Maggiani: The topic is surely complicated and can hardly be debated in a few words. In principle (without discussing the cases of each single country) governments undertake these kinds of actions to protect local manufacturers of plastics and rubber machinery and ancillaries. Though this strategy may be successful in the short and medium term, I believe it is absolutely wrong in the long term.

Globalization cannot be stopped. Moreover, banning high-tech machinery—which cannot be manufactured on site—damages local processors.

Takami: It is very much depending on how a plastics business is rooted in one country and is competing with other foreign countries or not. Under such circumstances, governments may protect and encourage such business, which is understandable.

Such governmental trade supports have significant roles and benefits to develop the plastics industry both locally and globally.

Emerging Markets, “Hot” Machines

PE:What are some important emerging plastics machinery-making countries and markets? In five years, which of these countries do you think will be major producers of plastics primary machines, and why so much growth there?

Takami: The most common answers could be China, Korea, and India. China has [had a] slight slowdown in its economy, but still has more than double the growth rate [of the] global average. India is similar also. Korea is now a worldwide supplier for automobiles and electrical appliances.

Anyhow, we need to pay attention to what are the drivers: low-cost labor, high-end or non-high-end targets, leading technical development innovation or low-cost innovation. Germany and Japan will remain as leading suppliers for the industry for the next five to ten years, thanks to long accumulated technical know-how and innovative research and development.

Heinson: The important manufacturers in these market segments are based in Germany, Austria, Italy, the USA, Brazil (a small part), China, Japan, Taiwan, and Korea. There are no “emerging plastics machinery-making countries” as such, as manufacturers from these key countries have been in the market for decades. Essentially, this situation will not change and no significant shifts are to be expected.

Maggiani: As far as plastics and rubber machinery destination markets are concerned, … we can notice a split in the Americas: the North (driven by the USA) is going through a growth period; on the contrary, the South is in deadlock (if not in recession), worsened by the Brazilian crisis hitting the leading country of the area.

Depending on each country, Europe is giving some hints of recovery (sometimes strong, sometimes weak). Being a mature market, we cannot expect any sudden growth. The Russian situation is still complicated; Russia is for sure an important market, but it is limited by economic sanctions….

As for Asia, we have great expectations for the re-opening of the Iranian market. India is also recovering, though local processors are very sensitive on prices. Though Chinese growth is slowing down, the local demand of high-tech items is always strong.

Finally, Africa is the big challenge of our century; we are all following with great attention the evolution of Sub-Saharan countries. South Africa and the northern [African] countries overlooking the Mediterranean Sea are quite known, while Nigeria, Kenya, Angola, and Mozambique are of great interest for us.

PE:In terms of sales growth, what types of primary machines are the “hottest” globally? Will the popularity of more complex machines (like all-electric molding machines) shift overall sales trends towards countries that produce them—or will less-complex machines remain popular globally?

Maggiani: Drawing a global trend is not so easy. Consider the application fields: Automotive is recovering (most of all in Europe, where the economic crisis had strongly hit this industry). Thumb-up for packaging.… Building and construction is still suffering in Europe and, in particular, in Italy.

As for high-tech and low-profile machines, in the end the customer makes his choice. I’m going to tell an illustrative story, in my opinion: A few years ago, I met a North African entrepreneur who, though working in the food industry, decided to start investing money in the production of plastic cutlery for the local market. I asked him why he had bought machines from Far East instead of Europe, and he answered that he was not interested in quality nor in production capacity, but he bought three machines from the Far East for the price of a European one.…

That businessman contacted me last year and told me that a big automobile [plant] opened near his plant. They were looking for quality suppliers for automotive components … and he had to turn to Italian machinery manufacturers.

Heinson: The share for complex machines and systems with a high level of automation continues to grow. Nevertheless, high-quality standard machines continue to play an important role. As [Arburg’s] portfolio covers this entire spectrum—from standard machines through to sophisticated, customized turnkey solutions—we are very well positioned for the future.

Takami: If we talk about “growth” itself, the hottest primary machines will be 3-D printers, so-called “game-changers” as the technology is advanced and cost is optimized. If we talk about primary machines for mass production, global economic growth, and increased substitution from metal, paper, and wood to plastic—injection molding machinery will remain [the] hottest.

In Search of Global Standards

PE:And what about local primary plastics machine standards/requirements in individual countries/regions? In what ways do energy-efficiency and quality standards in one country affect the processor’s options in sourcing machines from other, low-cost countries?

Takami: Since each country has their standards and safety regulations/certifications, compliance is mandatory for sales to each country. We are fully aware of the current standards and keep an eye on any possible changes to be introduced. Suppliers from low-cost countries, who export machines to global market, should be aware of such compliance. However, quality control criteria and choice of raw materials are areas where each supplier is able to differentiate technical and quality capability from others.

Heinson: At Arburg, there are no differences with regard to the various countries and regions, as we produce our Allrounder injection molding machines exclusively at our central production location in Lossburg, Germany. We have a vertical integration of around 60% and manufacture all the important key components in-house. One example is our Selogica machine control system, with which all Allrounders operate and which can be fully integrated into our robotic systems and further peripherals. … Thanks to our centralized production, all Allrounders, regardless of their final place of use, are built to the same high quality standard.

The topic of energy efficiency also plays an important role. However, we already go a step further: energy efficiency is only one aspect of our topic of production efficiency. Our objective is to ensure that our customers can produce their plastic products in optimum quality at the lowest possible unit costs.

Maggiani: In my opinion we have to face two topics: the first one is related to safety requirements (European CEN or international ISO regulations); the second one is strictly technical (for example, energy saving)….

Assocomaplast, together with other European associations, has always been working on safety regulations for safer machines in our industry. Today we are moving from a European to an international level, involving the United States, China, India, Brazil,….

[W]ithin our European association, Euromap, we decided to fix some standards on energy saving for injection molding and thermoforming machines, extruders, etc. Since there was not a common policy, we trusted it could have been of interest to all of us (manufacturers and processors) to define an unambiguous way to measure energy saving and fix some consumption categories, as it occurs with home appliances today [like with refrigerators] … If we really want to save energy, we must be clear and frank, without playing with numbers.

Note: Read more about recent plastics machinery trends in the USA on p. 49, in the “Inside SPI” section of this issue of PE.

Mike Tolinski’s revised and expanded second edition of his first book, Additives for Polyolefins, was released in spring 2015; go to www.additivesforplastics.com to view its table of contents.