Welcome to 2016! Global Considerations for Success in the Chemicals Value Chain

Low oil prices, over time, should “sow the seeds” for improved economic conditions and petrochemical demand.

Previous Article Next Article

Welcome to 2016! Global Considerations for Success in the Chemicals Value Chain

Low oil prices, over time, should “sow the seeds” for improved economic conditions and petrochemical demand.

Previous Article Next Article

Welcome to 2016! Global Considerations for Success in the Chemicals Value Chain

Low oil prices, over time, should “sow the seeds” for improved economic conditions and petrochemical demand.

Previous Article Next Article

By year end, 2015 had proved to be a truly roller-coaster year for the global petrochemicals industry. The first half of the year was characterized by global inventory tightness, restocking on the back of recovering crude oil prices, and very healthy producer margins in some regions and sectors. The second half of the year brought a rapid global stock market decline and new concerns over global demand, while WTI (Texas light sweet crude oil) fell to around $40, with continued oversupply suggesting low prices for the next few years.

Since crude oil acts as the primary driver for feedstocks and serves as the marginal production cost- and price-setter for many chemicals, plastics, and fibers, a decline in crude oil prices typically leads to lower product prices. As derivative prices followed the decline in crude, many plastics processors around the world finally saw some price relief—but not without significant volatility and, at times, regional supply shortages as global supply/demand adjusted to the new market dynamics.

Drawing from a wide range of presentations by IHS experts and industry leaders at the recent Global Plastics Summit, this month’s Resin Market Focus will take a step back from specific resin analysis to cover a sampling of the key global considerations for 2016 and beyond.

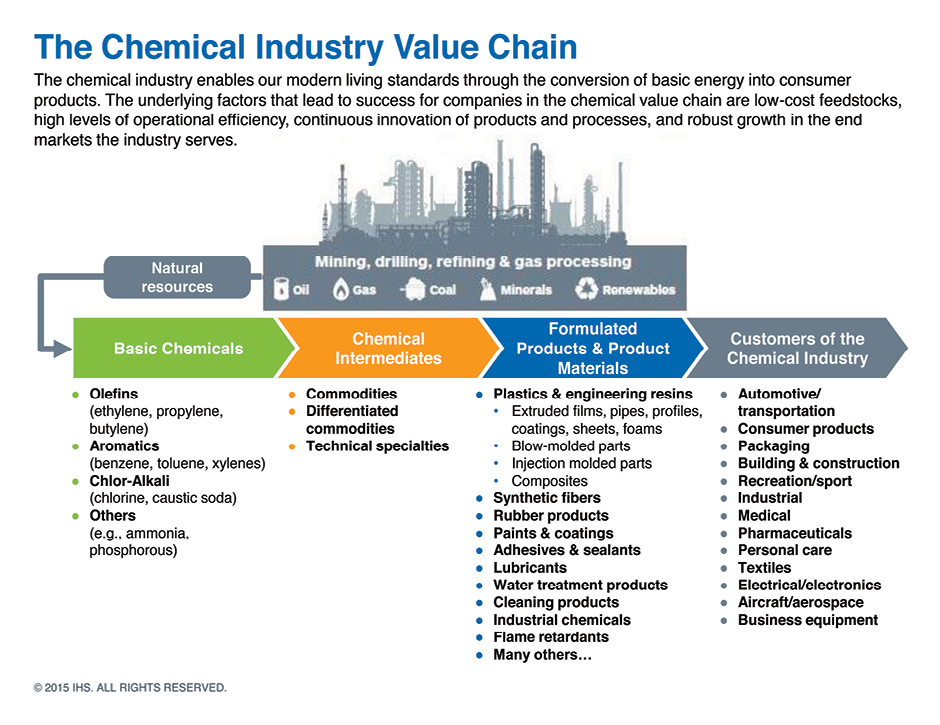

When Energy Markets Move, Chemical Markets Respond

Change in energy markets creates nearly instant responses in chemical prices. Falling energy prices often translate into a buyer expectation of “lower prices tomorrow.” This anticipation creates a collective pause in demand, generating inventory and price reductions, as well as market-share battles.

Lower crude oil prices and resulting margin declines are encouraging some chemical companies to delay and further assess investments that were dependent upon a significant oil-to-gas (or oil-to-coal) differential. Producers are reevaluating their investment returns and testing the robustness of their competitiveness assumptions. The combination of these factors can lead to tight markets in the future.

Impact of Base Chemicals

Base chemicals link primary energy sources to chemical intermediates, derivatives, and finished products. While finished-product demand drives demand for these base chemicals, supply sources are largely dictated by three key factors:

- Energy and feedstock costs: The differential between oil- and gas-based feedstock prices in the highly competitive markets of the Americas, Asia, Europe, and the Middle East divides cost-advantaged from cost-disadvantaged chemical producers. Because as much as 75% of the cost of producing petrochemicals is related to hydrocarbon values, companies with a cost disadvantage may choose to invest in lower-cost raw materials (such as a conversion to ethane cracking in the U.S. market) or attempt to relieve competitive cost pressures through product differentiation.

- Proximity to demand growth: Demand can drive or stifle the need for new investment. Today, assets that derive margin from a wide gas-to-oil differential—such as those in North America and the Middle East—are experiencing margin declines. In energy environments where the supply curve is lower and flatter, proximity to demand growth can provide a strong competitive advantage, in which companies leverage freight and logistics costs as a barrier to protect or grow market share.

- Technology advantage: Technology serves as a clear, important differential variable for both commodity (low-cost) and non-commodity sectors. For example, the use of on-purpose propylene technology (propane dehydrogenation, or PDH) in North America today allows propylene producers to take advantage of excess propane supply in the region. This allows them to provide low-cost propylene, as opposed to naphtha co-product propylene from a steam cracker. Producers with sustainable technological advantage typically enjoy better performance in terms of volume, profits, and lower margin volatility over the chemical cycle.

Regional Trade is Critical to Success

From 2010 to 2020, five countries—China, India, Saudi Arabia, South Korea, and the United States—account for 75% of base chemical capacity growth. With such a concentration of base chemical capacity, regional trade will continue to grow in importance as an element throughout the chemicals value chain.

Low-cost countries such as the USA and Saudi Arabia will export increasing volumes of both basic chemicals and derivatives. Adoptions of on-purpose technologies such as PDH will also change trade patterns. Significant investment in ships, ports, and infrastructure is needed to support increasing trade volumes.

2016 and Beyond

All is not gloom and doom, but we would only be fooling ourselves if we were to believe that 2016 is going to be a banner year. Global GDP growth has been stuck in a tight range of 2.5-2.8% for the last four years, and there is good reason to expect that 2016 will provide us with more of the same.

While more advanced economies such the United States and Western Europe are expected to continue to recover slowly, several emerging markets are facing increasing economic headwinds, which are being exacerbated by plunging commodity prices. China’s economy continues to decelerate, and the best we can hope for is an annual GDP growth rate for the coming years of somewhere between 6% and 7%.

Given the current oversupply of crude oil, IHS Energy is forecasting crude oil prices well below $100 per barrel (Brent basis) for the next two to three years. With lower crude, there is a transfer of value between oil producers and downstream beneficiaries such as industry, governments,

and consumers. The chemical industry is one of the key beneficiaries of that value transfer. Macroeconomic demand-related effects can expand wealth transfer to the greater global population.

In addition, any stimulus to GDP created by a drop in crude oil prices results in an overall benefit to the chemical industry through an increase in overall demand for durable and non-durable goods. In addition, the lower prices of petrochemicals relative to other competing materials—such as glass, paper, and metals—accelerate substitution demand.

Thus, while the near-term outlook remains subdued and varies by region and value chain, low oil prices are expected to positively impact the industry over time—sowing the seeds for better economic conditions and improved global petrochemical demand.

Robin Waters is director, Plastics Planning and Analysis, for IHS Chemical and can be reached at robin.waters@ihs.com.

Resin Market Focus, by IHS Chemical, provides ongoing insights into key industry topics and trends for major plastics and engineering resins, covering all major regions. IHS Chemical provides extensive industry insight, analytics, and data for over 300 chemical markets worldwide, including the global plastics, polymers, and engineering resin markets. Learn more or inquire about IHS content at U.S.

877-825-8188 or AmericasTQ@ihs.com.