The European Polymers Market: How Will it Fare?

Low oil prices and supply shortages put a damper on medium-term growth patterns

Previous Article Next Article

From China Plastic & Rubber Journal

The European Polymers Market: How Will it Fare?

Low oil prices and supply shortages put a damper on medium-term growth patterns

Previous Article Next Article

From China Plastic & Rubber Journal

The European Polymers Market: How Will it Fare?

Low oil prices and supply shortages put a damper on medium-term growth patterns

Previous Article Next Article

From China Plastic & Rubber Journal

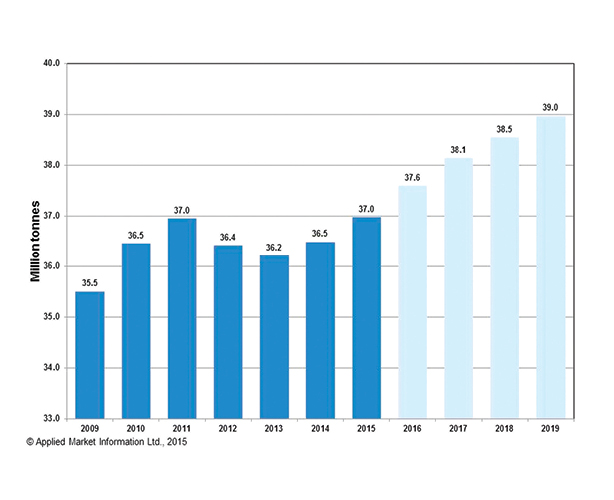

Expected consumption of polymers in Europe 2009-2019 (graph courtesy of AMI).

For years, the European polymers sector offered few surprises as stagnation struck after the global economic crisis. The situation is not helped by the recent plunge of crude oil prices. Several market reports suggest the scenario is unlikely to change significantly in the medium term.

Alliance for Polymers to Fight Material Shortages

Due to the sudden shortage and continuing price increases of raw materials, production lines across Europe are forced to stop at the plastics converting level. EuPC, the EU-level trade association representing European plastics converters, has set up the Alliance for Polymers for Europe in order to bring all forces together to fight this unjustified situation.

“It seems that after months of low oil prices, the petrochemical industry appears to be clawing back margins in the polymer value chain by stopping some crackers in Europe, one after the other. This situation is very serious, risking future customers for raw material producers and raising several antitrust concerns,” stated Michael Kundel, president of EuPC.

The Alliance for Polymers for Europe will provide detailed information on the current polymer market and help assist raw material users through its network of national plastics associations, as well as assist companies in requesting suspension of certain EU import duties to relieve the current shortages in polymer markets.

The Alliance will also initiate a study on the aging of polymer sites in Europe, together with industry and independent experts, so as to provide more transparency on the future development of polymer production sites in Europe. It will also discuss potential legal assistance for companies that have no other option but to seek legal action against their polymer suppliers, due to erroneous force majeure declarations.

Revenues Expected to Rise

At Fakuma 2015, market research institute Ceresana released a new market study about the European plastics market. The report is Ceresana’s first to give a detailed overview of all significant plastics in Europe, from standard products, such as PE, PP, or PVC, to engineering plastics, such as ABS, or fluoropolymers and bioplastics.

“In total, the European plastics market reached a volume of more than 53 million tons in 2014,” said Oliver Kutsch, CEO of Ceresana. “Over the next eight years, we expect revenues to rise further at an average rate of 2.9% per annum. In 2022, they will amount to about €104 billion.” (These figures do not include fibers, paints, and adhesives.)

Having a market share of almost 24%, Germany is the largest manufacturer of plastics in Europe. Belgium ranks second, followed by France, Russia, the Netherlands, and Spain.

The most important application areas for plastics in 2014 were flexible packaging, rigid packaging, and the construction industry. Those three areas are currently representing about 70% of the total demand for plastics in Europe.

Flexible packaging, such as packaging films, bags, and sacks, as well as shrink and stretch films, are mainly used for food packaging, but also as secondary and tertiary packaging, for example, for transportation. These application areas are dominated by LDPE and LLDPE, which account for almost 53%, followed by PP and HDPE.

Packaging Organizations Call for New Investment

As the weight reduction of materials is reaching its limits, more and more plastic bags are used in the area of beverages as an alternative to rigid packaging. However, the industry is hampered by a lack of investment in the European polymer sector.

The four largest national organizations representing the plastics packaging industry in Europe, Elipso (France), IK (Germany), and BPF and PAFA (UK), have called on polymer producers to invest more in European facilities. The four organizations said that unless the supply of raw materials is secure, then it cannot be said there’s a truly sustainable plastics packaging industry, which has traditionally accounted for more than one-third of Europe’s polymer consumption.

It is understood that polymer producers are increasingly likely to invest in the faster-growing markets of Asia and the Americas. Consequently there’s unlikely to be significant investment forthcoming to support the European marketplace.

Fragile Growth Ahead

Meanwhile, a new Applied Market Information (AMI) report shows that polymer demand in Europe is slowly returning to growth, after nearly three years of fairly flat market conditions. The European polymer markets are forecasted to grow by 1.3% this year, building on a recovery of less than 1% for 2014, according to AMI’s 2015 European Plastics Industry Report. However, even this modest gain is under risk from the region’s tight supply for many materials and rapidly rising prices.

As a result, the European plastics industry in 2015 finds itself in another period of upheaval and change as it looks to pull itself out of the stagnation caused first by the Great Recession in 2008-2009 and then by the Eurozone crisis of 2012-2013, said AMI.

In the two years since AMI published its last review in 2013, demand has barely shifted from just over 36 million tons, and the volume of polymers consumed in 2014 was still some 10% below that used in 2007 before the Great Recession hit.

While at a top-line level the trend looks pretty static, patterns of demand have been variable by polymer, by application, and by country, and the report shows who have been the winners and losers over the past five years, according to AMI. As has been the trend for several years, demand was stronger in Central and Eastern Europe, compared with Western Europe.

Overall, Western Europe showed very little volume growth, while Central and Eastern Europe saw increased demand of 2.7%. Most of the countries in the East now have a polymer demand well ahead of where they were in 2007, while, with the exception of Germany, nearly every country in Western Europe has a market demand still 10% or more below their 2007 volume.

At the half-way point of 2015, demand was better than it had been for some time, but the industry was grappling with issues around rapidly rising prices and tight supply which may dampen the improving outlook, reported AMI.

Given the cautious outlook for the European economy, polymer demand in Europe is expected by AMI to average a growth of just over 1% per year, for the five-year period 2014-2019. Given this, European thermoplastic demand in 2019 will still be below the 2007 market peak.

Note: The original version of this article first appeared in China Plastic & Rubber Journal.