A “Banner Year” for M&A

Merger & acquisition activity in the plastics and packaging industries was driven to new heights in 2015

Previous Article Next Article

By Rick Weil Mesirow Financial, Chicago, Illinois, USA

A “Banner Year” for M&A

Merger & acquisition activity in the plastics and packaging industries was driven to new heights in 2015

Previous Article Next Article

By Rick Weil Mesirow Financial, Chicago, Illinois, USA

A “Banner Year” for M&A

Merger & acquisition activity in the plastics and packaging industries was driven to new heights in 2015

Previous Article Next Article

By Rick Weil Mesirow Financial, Chicago, Illinois, USA

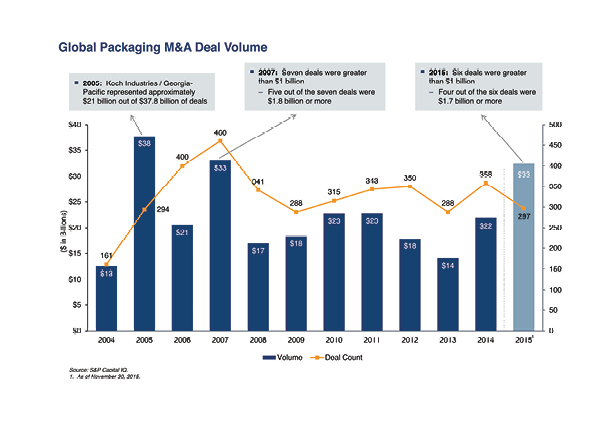

Figure 1.

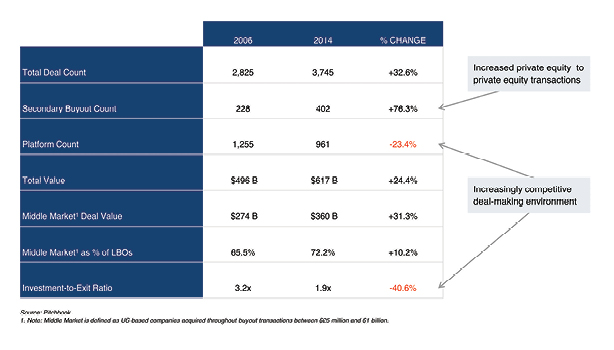

Table 1: Comparing Key Private Equity Metrics Between 2006 and 2014

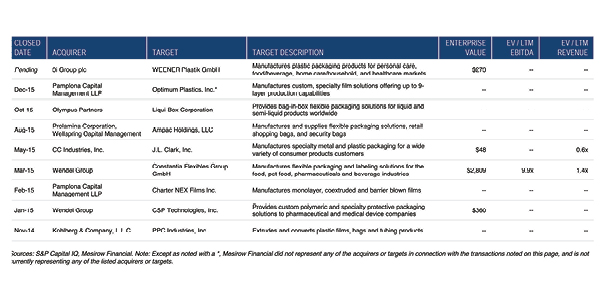

Table 2: Selected Private Equity Packaging M&A Activity

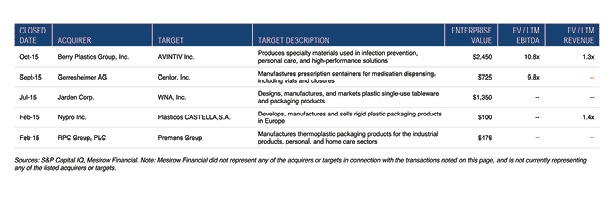

Table 3: Selected Strategic Packaging M&A Activity

Note: This article is based on the author’s presentation at SPE’s FlexPackCon 2015.

The year 2015 was a banner year for mergers and acquisitions (M&A) in the plastics and packaging sectors and related segments. Global M&A has been driven to record heights, in part, as the return of the “mega-deal” boosted global deal values. Private equity firms have taken an active and leading role in reshaping areas of the packaging and plastics markets. In today’s market, however, private equity firms are feeling pressure from increasingly competitive corporate acquirers and high valuation levels or target companies. Strategic acquirers also remain active due to their significant cash reserves, internal and external pressure to grow earnings, and limited organic growth options, among other factors.

In a business environment where costs have already been reduced over the last several years and companies are struggling to achieve growth, M&A can provide a viable pathway for expansion. The changing economic environment has compelled some leading companies to diversify their product portfolios, expand their sales channels and geographic reach, in many cases through acquisitions.

Global deal-values in 2015 have already topped the record books, reaching $4.2 trillion as of late Novemberand surpassing the all-time annual record of $4.1 trillion set in 2007. U.S.-targeted M&A activity, which accounts for nearly half of global M&A volume, has had a record-setting year as well. As of mid-November, M&A targeting American companies stood at $2.03 trillion, a 55% increase from the $1.3 trillion announced through the same period last year. The gains have been driven by a surge of “mega-deals” (mergers and acquisitions that are greater than $5 billion in value) which account for 47% of all activity—the highest proportion since 1999.

As can be seen in Figure 1, M&A activity in the plastics and packaging sectors remains robust. $32.5 billion in deals were announced globally through November; this is up 179% from $11.6 billion for the same period last year. This also includes a number of mega-deals, such as Rock-Tenn Company’s $10.9 billion merger with MeadWestvaco Corp. (now known as WestRock Company) and Ball Corp.’s acquisition of Rexam plc for $8.7 billion.

Record Levels of “Dry Powder”

In today’s competitive M&A market, private equity firms have, in many cases, been forced to pay higher purchase prices in order to “put money to work.” These firms are sitting on record levels of “dry powder” (committed but un-invested capital), as pension funds, endowments, and sovereign wealth funds increase their allocations to private equity.

Pension funds in particular are benefiting from the superior returns that private equity consistently provides to their funds. Private equity delivered a 12.3% annualized return to the median public pension over the last ten years, more than any other asset class. By comparison, the median public pension received a 7.5% annualized return on its total fund during the same period. However, given recent market volatility and an increasingly competitive deal-making environment, private equity firms may face increased difficulty in achieving appropriate returns in the coming years.

With these high levels of dry powder and high expectations for above-average returns, private equity firms are feeling the pressure to invest. This pressure, combined with a limited supply of attractively priced targets in the marketplace, has prompted private equity firms to turn to other financial sponsors to find possible transactions. As such, secondary buyouts, or private equity-to-private equity transactions, have increased 76.3% from 2006 to 2014 (see Table 1).

Additionally, we’ve seen a decline in the private equity investment-to-exit ratio from 3.2x to 1.9x over the same period. As multiples continue to climb, private equity firms have been exiting portfolio companies in record volumes in an effort to lock in solid returns. However, as exit activity and secondary buyout count remain elevated, these firms may face a decreased number of opportunities for portfolio company value maximization, limiting future return potential.

Private equity firms have maintained a very healthy interest in the plastics and packaging industries largely because these sectors are viewed as lower risk and less cyclical than other sectors of the economy. The use of leverage in a highly cyclical environment, such as the capital goods industry for example, can be risky. However, given that packaging is driven by the food, beverage, and personal care industries, the cash flows are much more reliable and consequently more suitable to a private equity capital structure.

Some recent notable private equity investments in plastics and packaging are shown in Table 2.

Strategic Acquisitions

There has also been a notable trend of strategic companies outside of the plastics and packaging sectors (such as Quad/Graphics Inc., Transcontinental Inc., and R.R. Donnelley) making acquisitions of plastics and packaging companies. They’re doing this to diversify and expand their product portfolios away from secularly challenged markets like commercial printing.

For example, Transcontinental Inc. has completed acquisitions of Capri Packaging Inc., a supplier of printed flexible plastic packaging products, and Ultra Flex Packaging Corp., a printer, laminator, and converter of flexible packaging. There are also a number of active strategic acquirers within the plastics and packaging sectors that have been expanding through M&A. Table 3 highlights notable strategic deals.

There are plenty of reasons to expect packaging M&A to remain active into 2016. M&A continues to be a viable strategy for packaging executives as a result of tepid organic growth coupled with a favorable financing environment and large cash reserves. Private equity firms should also remain busy in the packaging and plastics space as they seek to deploy their growing levels of available capital. With both strategic acquirers and financial sponsors on the trail for acquisitions, packaging M&A activity is likely to remain elevated in 2016.

About the author… Rick Weil is a managing director in Mesirow Financial’s Investment Banking Group. He’s responsible for leading deal teams on middle-market M&A transactions and developing the firm’s relationships with plastics, packaging, and specialty printing clients. Since joining the firm in 2000, he’s been involved in over 100 M&A transactions in the rigid and flexible packaging, labels, folding cartons, specialty printing, tissue, and corrugated packaging sectors. Connect with Rick at +1 312-595-6131 or raweil@mesirowfinancial.com.