Plastics Additives: Asia Driving Demand Growth and Increased Competition

Previous Article Next Article

Plastics Additives: Asia Driving Demand Growth and Increased Competition

Previous Article Next Article

Plastics Additives: Asia Driving Demand Growth and Increased Competition

Previous Article Next Article

The global plastics additives market amounted to 5.6 million metric tons in 2014, with a value of $20 billion, following a strong recovery from the 2008-2009 economic downturn that affected most of the major end-use markets. The recovery has been driven by the growing demand from end-use industries, especially those in Asia. The Asian contribution to global plastics additives demand has risen from 30% in 2008 to 52% in 2014, according to our analysis at IHS Chemical.

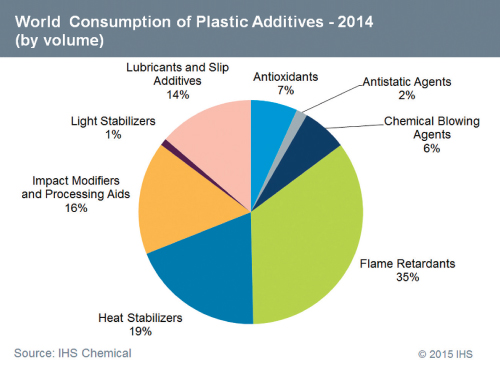

Plastics additives’ functional classes include antioxidants, antistatic agents, chemical blowing agents, flame retardants, heat stabilizers, impact modifiers/processing aids, light stabilizers, and lubricants/slip additives (see pie chart).

Overview: Consumption & Markets

Although the growth in plastics additive consumption parallels the growth of plastic resins, some plastics additive consumption rates are growing more rapidly than others. Demand for plastics additives is strongly dependent on demand for plastics; however, it is obviously influenced by demand requirements from plastics end-use consumer segments such as automotive, electronics, office machinery, packaging, and construction—and by changes in regulations. Plastics end-use industries such as automotive, electronics, and construction often demand high-performance, safe, and/or eco-friendly plastics additives, reflecting the high-quality requirements for advanced plastics applications with environmental safety.

Asian plastics additives markets are the largest, consuming 52% of global volumes, followed by North America at 18%, Western Europe at 17%, and the rest of the world at 13%. The Chinese market leads both the Asian region and also the world in terms of plastics additives demand, accounting for 31% of the world’s plastics additives market. Japan follows with just five percent of the market, followed by India and South Korea, both at four percent, respectively.

Global Growth

The Chinese and Indian plastics additives markets are expected to continue to expand at an accelerated rate during the forecast period, in part due to a shift in plastics manufacturing to these two countries of many end-user manufacturing plants from North America, Europe, Japan, South Korea, and Taiwan.

While North American and Western European consumption of plastics additives has shown growth, it is generally slow growth of just one percent to two percent since 2011. And for most of the eight categories studied, these growth rates will largely continue for Western Europe and will be slightly greater in North America, with a few exceptions. IHS expects impact modifiers and processing aids, chemical blowing agents, and heat stabilizers to experience the highest growth in North America, at between three and five percent growth through 2018. None of the categories studied will grow in Europe by more than three percent, with flame retardants and heat stabilizers showing the most growth.

In terms of growth in the Chinese market, overall demand for plastics additives through 2018 is expected to grow by approximately five to six percent, with light stabilizers leading in terms of demand growth at nearly nine to ten percent expected growth. Antioxidants and lubricants and slip additives will follow, each growing at approximately six to seven percent, during the forecast period.

Looking Farther Ahead

Many key issues affect the plastics additives market, including fluctuations in feedstock prices; changes in environmental, safety, and health regulations; increasing global competition; and the growth of China and other developing countries such as India and others in Asia. During the next four years, market competition will intensify among manufacturers in China and other developing countries.

Therefore, plastics additives manufacturers will face an increasingly difficult business environment. Since 2008, the shifting regulatory environment, combined with organizational changes driven by alliances, mergers, acquisitions, and divestitures, has significantly altered the competitive landscape for the plastics additives industry. We at IHS Chemical expect those trends to continue during the next several years, as some companies seek to strengthen their market share while others choose to exit the business and focus on other, more strategic assets.

The author, Henry Chinn, is principal analyst for IHS Chemical and can be reached at Henry.Chinn@ihs.com.

Resin Market Focus, by IHS Chemical, provides ongoing insights into key industry topics and trends for major plastics and engineering resins, covering all major regions. IHS Chemical provides extensive industry insight, analytics, and data for over 300 chemical markets worldwide, including the global plastics, polymers, and engineering resin markets. Learn more or inquire about IHS content at U.S. 877-825-8188 or AmericasTQ@ihs.com.