Plastic Additives Sector Continues to Grow & Evolve

Various performance needs — from fire safety to sustainability — driving innovation

Previous Article Next Article

By Geoff Giordano

With European Commission approval this year, Perstorp’s Akestra thermoplastic copolyester can now be used for all hot or cold food applications. Courtesy of Perstorp

Continuing a pattern of steady growth, the global plastics additives sector saw a slew of product innovations, increased manufacturing capacity and significant operational transitions over the past year.

The market for plastics additives worldwide was valued at $50.6 billion for 2016, up from $48.2 billion in 2015, according to the January 2016 report “Global Markets for Plastics Additives” by BCC Research of Wellesley, Mass. The analyst for the publisher of technology market research reports estimates the market’s value will grow to $64.6 billion by 2021 — a compound annual growth rate of 5%.

The planned blockbuster merger of Dow Chemical Co. and DuPont, announced Dec. 11, 2015, set the stage for this eventful period. The union, if approved, would result in DowDuPont then separating into three independent, publicly traded companies. One of those new businesses, a material science company, would absorb DuPont’s polymer additives and modifiers portfolio. The merger, undergoing intensive regulatory scrutiny, was on track to conclude by year’s end, DuPont CEO Ed Breen said in July a week after shareholders voted to approve the plan.

A sampling of headlines from the newsletter “Additives for Polymers” gives a sense of the robust developments of the past year:

- “Merck extends Miraval Cosmic effect pigment range” with new Cosmic Bronze decorative pigment (January)

- “Metabolix unveils further PHA grades as additives for PVC and PLA; moves corporate HQ” (March)

- “Cabot targets food contact applications with new universal masterbatch grades” (May)

- “Clariant targets packaging films, printed circuit boards and EPS applications with additive introductions at Chinaplas 2016” (June)

- “Chemours starts commercial operations at new TiO2 line in Mexico” and “A Schulman expands in China with new colour masterbatch facility” (July)

Key Trends

Among key trends in the industry is the increasing popularity of bioplastics and biodegradable plastics, and “smart additives are being developed to improve the quality of these plastics,” says Srinivasa Rajaram, the analyst who created BCC’s report. “Most of these are in the development stage and in the near future these products will become more dominant.”

Fire safety is another concern of additives makers. “Previous standards were primarily based on the risk of fire related to a spark or short circuit within the equipment but may be updated to include external ignition from a candle or other source,” Rajaram explains. “If these provisions are enacted, many additional plastic components used in electronics, such as speakers and keyboards, could require higher levels of flame-resistant performance.”

He also notes that “food-approved slip agents have been developed to decrease surface friction and mold-release force in polystyrene processing, which also improves packing and de-nesting of molded parts, and reduces scratches and scuffs.”

Driving efforts in the automotive realm are consumers seeking more functionality and comfort and improved interior aesthetics, notes Dr. Volker Bach, head of BASF’s Global Competence Center for Plastic Additives. Manufacturers are focusing on “unique cabin designs constructed with advanced materials and evermore stringent materials specifications.” Additives are combined with lightweight thermoplastic olefins (TPOs) to maintain physical properties when exposed to sunlight radiation or long-term heat. “Such additives must provide stability without negatively impacting secondary properties like stickiness, emissions and odor.”

As the plastics industry has evolved toward more environmentally friendly and sustainable solutions, Bach continues, “greater attention is being paid to the volatile emissions from plastic molded articles. The automotive industry, in particular, has been raising the standards for final article emissions requirements to enhance vehicle interior air quality.”

Adds Roberto Todesco, Switzerland-based consultant and long-time chair of SPE’s Additives and Color Europe Division, “improvement of the antifog properties of food packaging films and greenhouse films and a demand for real permanent antistats for automotive interiors” are and will continue to be key drivers of additives advances.

Meanwhile, PolyOne Corp. focused on “expanding our application base for anti-microbial, laser marking and low retention additive technology,” explains Larry Kuzniar, senior manager of technology development for color and additives. “This has been made possible by innovative manufacturing processes to improve the delivery, distribution and performance of our additive systems.”

In the medical space, Kuzniar says, “there is a strong focus on hospital cleaning programs designed to battle hospital-acquired infections (HAIs). Our WithStand Antimicrobial additive technology helps reduce the growth of microbes in non-acute care settings where minor lapses in cleaning protocol can lead to life-threatening HAIs. Our additive technology has proven performance in six medical-grade polymers — ABS, PP, PC, PEEK, silicone and TPU — with efficacy (Log 7 reductions) against four known antibiotic-resistant organisms.”

Laser marking for tubing and jacketed wire and cable is another significant application area for PolyOne. “We’ve been collaborating with the latest laser marking equipment manufacturers to assist them with polymer formulations,” he says. “We’ve achieved fantastic results with our OnCap Lasermarking Additive with benefits including: high-quality and high-contrast coated wire and multi-core cable marks and permanent alphanumeric character, graphic or barcode information that does not fade.”

Kuzniar also notes that “customers are leveraging our breakthrough Low Retention Additive for surface-energy modification in olefin resins. Hydrophilic (higher surface energy) vs. hydrophobic (lower surface energy) represent the functional performance of the solution. We are modifying the surface tension, only without sacrificing the bulk physical property characteristics.”

Industry Snapshots

A survey of some key additives purveyors illustrates a range of new performance-enhancing additives. Among the notable developments:

Addivant: Announced a multimillion-dollar tripling of capacity for its Weston 705 additive at its Morgantown, W.Va., plant, and launched the liquid antioxidant Lowinox Fast XL for wire and cable applications. Weston 705 — a nonylphenol-free liquid phosphite antioxidant for PE films and rigid packaging — also earned food-contact approval in China and Canada. Lowinox Fast XL is formulated to produce medium- and high-voltage crosslinked PE cables, balancing scorch protection and crosslinking speed.

At October’s K show in Düsseldorf, Addivant also revealed new:

- Stabilization solutions for polyurethane foam to enable compliance with new car interior emission standards

- Royaltuf nylon impact modifiers for car interiors and engine compartments

- Ultranox 800 series and other solutions that enhance the production efficiency of polypropylene (PP) converters.

BASF: Revealed that about one third of the overall sales of its performance chemicals division — which totaled €4.121 million, or about $4.63 million, in 2015 — are related to the chemicals and plastics industry, according to BASF Factbook 2016. The companylaunched three new products:

- Tinuvin 880, a novel light stabilizer molecule designed to comply with the most demanding automotive industry requirements for PP and TPO parts. It enables outstanding stabilization performance against UV degradation, even at low concentrations, with no resulting stickiness on part surfaces. It comes in a dust-free form for easy storage, handling and dosing, as well as improved productivity for compounders and master batchers. As a 100% active additive, formulators can tailor solutions to optimize the cost/performance ratio.

- Irgastab PUR 70, designed to meet stringent emissions requirements for foamed articles in automotive interior applications, is a premium-grade anti-scorch package for such uses as seating. Its extremely low volatility prevents degradation of polyol and polyurethane (PU) foams.

- Tinuvin XT 55, a stabilizer solution for PE-LLD monofilaments producers that provides durability without water carry over, which can negatively affect monofilaments and tape production lines.

Clariant: Unveiled Mevopur-LQ, a series of color and additive solutions that combines the benefits of its Mevopur line with its Hi Former liquid-vehicle technology. The first concentrates, developed for silicone elastomers, include a transparent amber color for polyethylene terephthalate (PET) materials for pharmaceutical packaging, as well as concentrates for liquid silicone resin.

Croda: Developed a series of anti-scratch additives to reduce scratch width and visibility with superior stability that reduces surface blooming. These additives, ideal for use in automotive interiors, include Incroslip SL and Incromold K for PP impact copolymer and Incroslip G for PP homopolymer applications. The company also announced plans to expand amide capacity at its facility in Hull, England, to meet demand for slip additives.

Eurotec: Introduced a new flame-retardant, Tecomid NT40 GD40 BK009 XA61, for automotive applications.

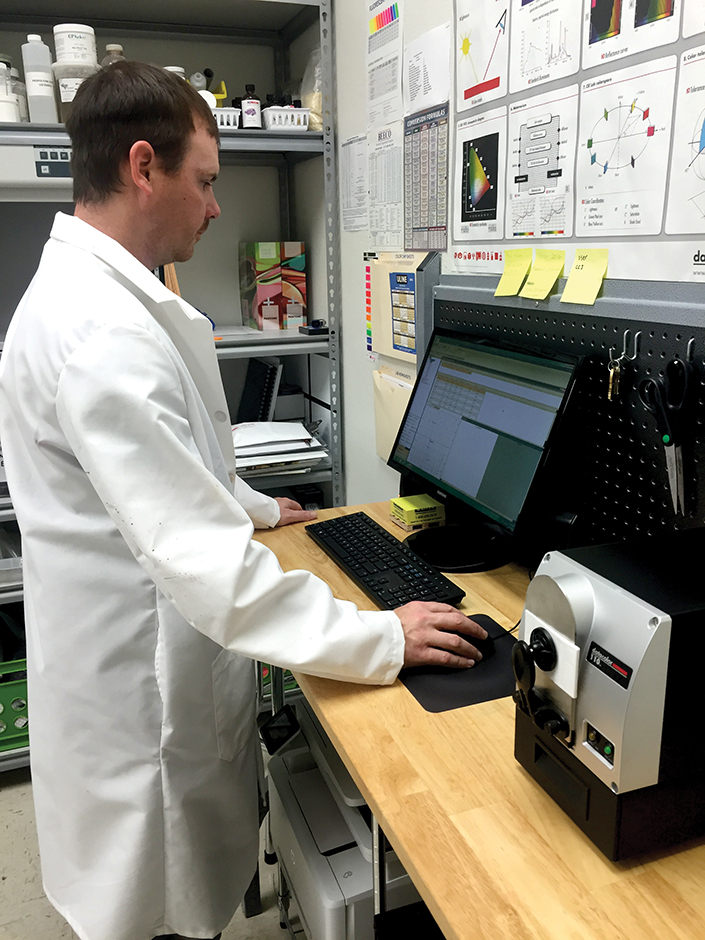

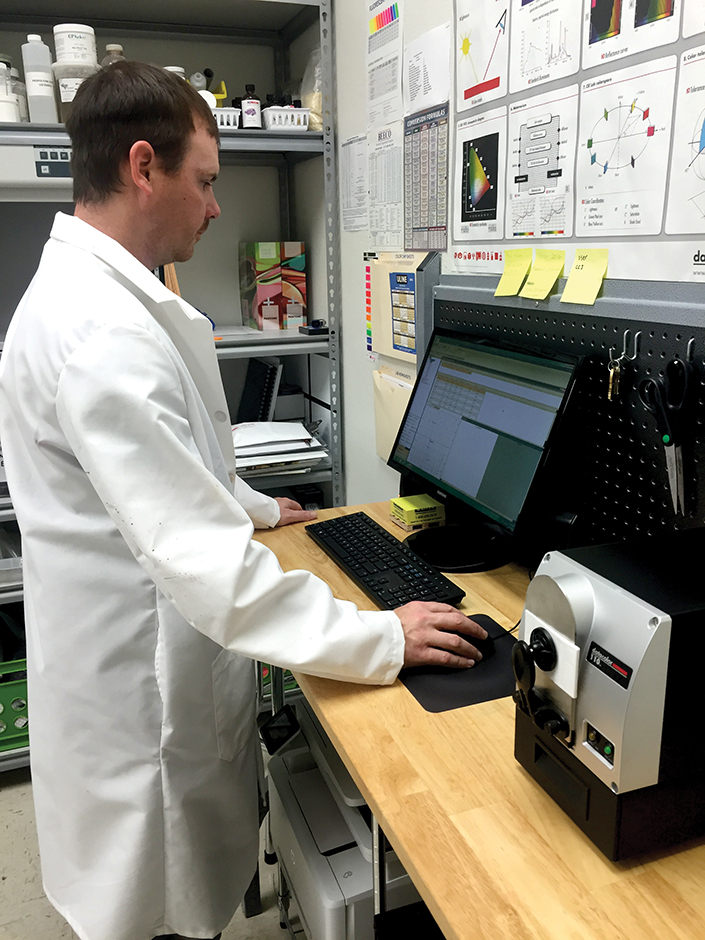

Left: Matt Dillard, color technician at iD LiquiD Systems, examines some samples. Right is the company’s new facility for iD Additives in Flint, Texas. Courtesy of iD Additives

iD Additives: Released a new, high-temperature foaming agent to work with engineering resins in lightweighting parts and opened iD LiquiD Systems, a division for producing liquid colorants and additives in Flint, Texas.

iD High Temperature Foam features under 2% LDR and is non-hydroscopic, requiring no material drying; it improves material flow and dimensional stability for cosmetic and non-cosmetic applications. The new agent, intended mainly for injection molding or sheet extrusion, also works with filled or unfilled nylon, PC/ABS, PC and other materials. It allows for low-pressure molding and faster molding cycles.

The company’s new liquid color operation will distribute specialty products to North American customers including: color foam, which combines liquid colorant and foaming agent; and delivery systems including metering pumps, mixers and pre-mixers, bucket tumblers and agitators, pump carts, tote delivery systems, adapters, plates and injection nozzles.

Lanxess: Announced the planned takeover of additives maker Chemtura on Sept. 26. The deal, valued at about $2.7 billion, will nearly triple the size of Lanxess’ additives business by bringing in Chemtura’s brominated flame retardants and urethanes and organometallics businesses. The acquisition is expected to be completed in mid-2017.

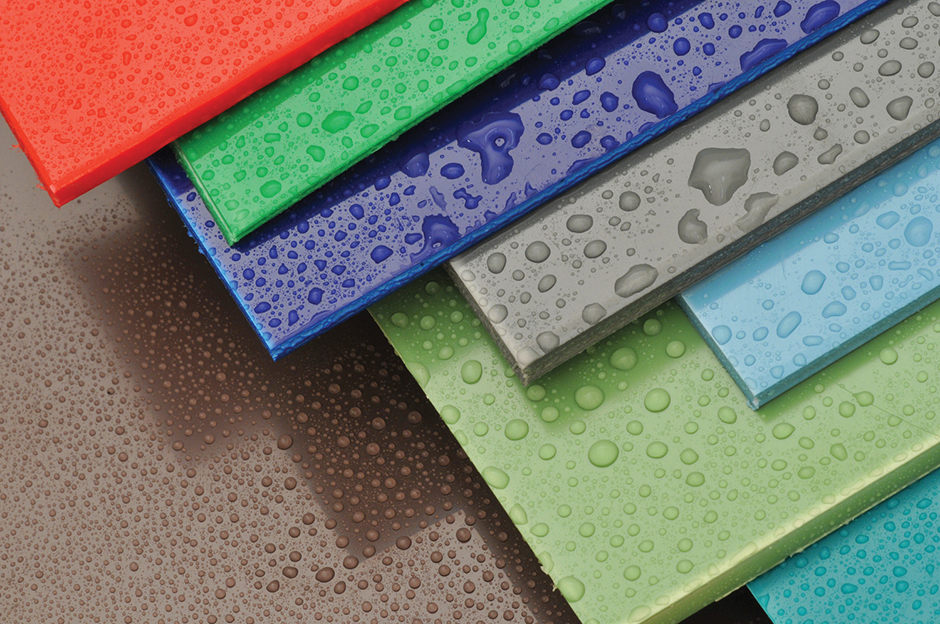

The two above images show examples of food packaging manufactured using UltraClear PP resin incorporating Milliken’s Millad NX 8000 clarifier, which offers glass-clear transparency and additional benefits such as easy sealability, and impact and heat resistance. Courtesy of Milliken

Milliken & Co.: Launched a new version of Millad NX 8000 clarifiers, called 8000E, specifically for extrusion blow molding, “which gives PP similar optical properties as PET at higher output EBM machines,” says Sami T.K. Palanisami, commercial manager plastic additives for Europe, the Middle East and Africa. The firm also has developed NX UltraClear products for sheet extrusion and thermoforming applications for PET replacement.

Meanwhile, Milliken continued optimizing its ClearShield and Milliguard products. “Recent reports have indicated that UV stabilization in PET bottles is an interesting alternative to protect the content of PET packaging,” Palanisami notes. “With ClearShield, Milliken offers an alternative way to provide UV protection to formulations without reworking the composition.” The company has developed a special UV-absorbing additive for PET packaging that has a wider range of UV protection than other products, he says. “It has proven efficacy in protecting sensitive ingredients such as vitamins and dyes. The additive is crystal clear, which retains the high transparency of PET without unwanted shading.”

Milliguard AOX-1 polymer-bound antioxidant for polyurethane won an innovation award from the European Association of Flexible Polyurethane Foam Blocks Manufacturers. The additive “gives the automotive industry a unique solution for compliance with toughening indoor air quality standards for vehicles,” Palanisami says. “As VOC (volatile organic compounds) and FOG (windscreen fogging) regulations tighten around the world, Milliken continues to lead compliance efforts with high-performance products that enhance sustainability, health and safety. We continue to develop different grades to meet the needs of the market.”

Perstorp: Won food-contact approval by the European Commission for its Akestra thermoplastic copolyester. Akestra, which imparts transparent, glass-like aesthetics with greater heat resistance than PET, can now be used for all hot or cold food applications. Akestra can be used in place of polystyrene in thin-wall packaging; polycarbonate in more durable items; and glass, according to Product Manager David Engberg. It had already won approval for food-contact uses in the U.S. and Japan.

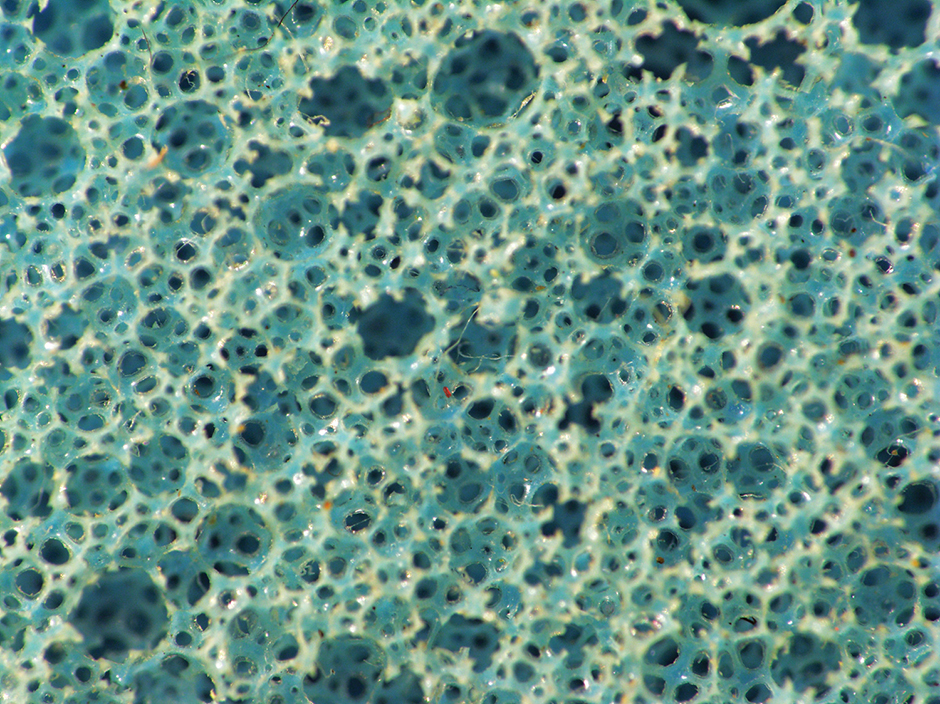

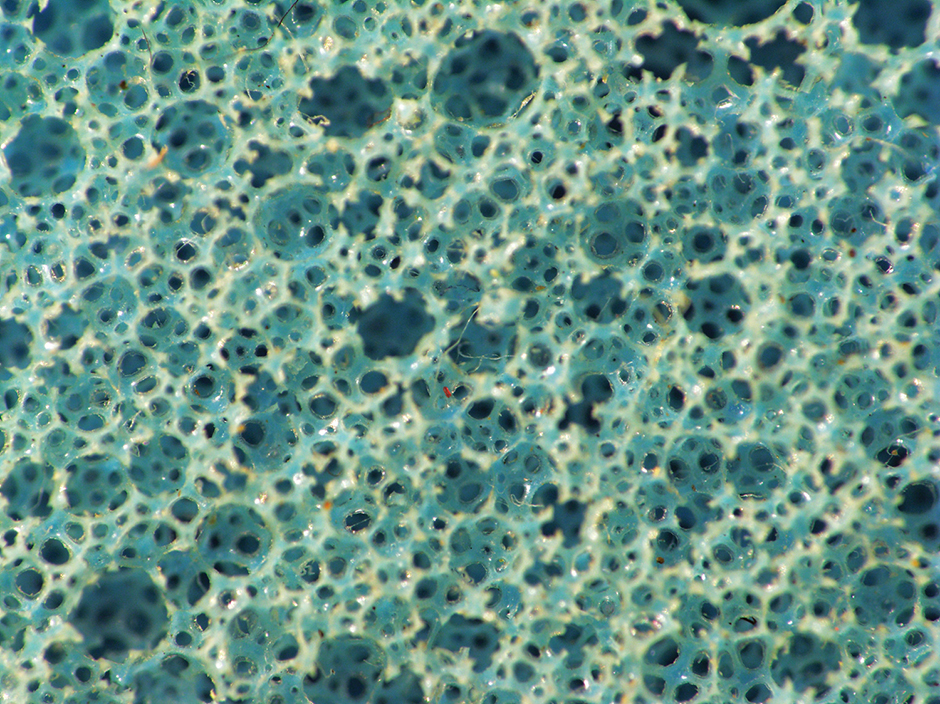

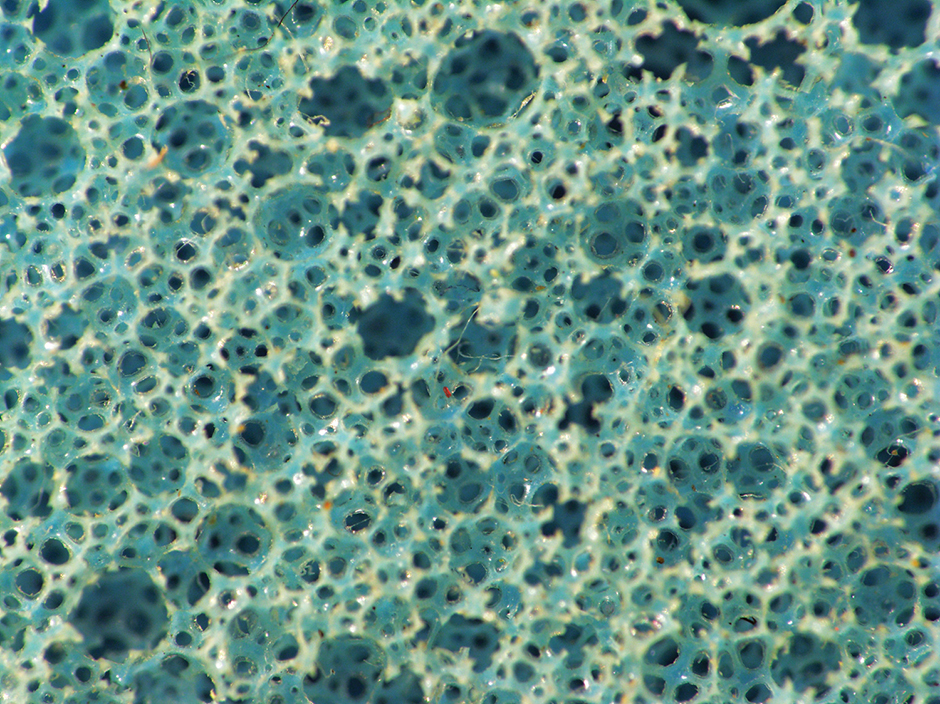

A foamed plastic cell structure produced with Riverdale Global’s new +Foam agents. Courtesy of Riverdale Global

Riverdale Global: Introduced a range of stand-alone liquid modifiers in the GlobalPlus Sealed Additives line, including:

- Antimicrobial agents for polyolefins and engineering thermoplastics that provide more protection at lower doses than pellet masterbatches. +Clean antimicrobials “are inorganic, silver-based formulations that prevent discoloration, odors and product degradation caused by the growth of bacteria, mold and yeast,” Riverdale says. Optimized for color retention indoors or out, they can be used at letdown ratios of 0.2 to 0.5%, saving money on additive costs by dispersing more readily.

- Blowing agents that disperse more uniformly and provide more controlled foaming action with polyolefins, polystyrene, ABS, PPO and other polymers. The new +Foam series offers an exothermic azodicarbonamide blowing agent, an endothermic variety and a version with both — all used at letdown ratios of 0.5 percent to 1.5%.

- Nucleating agents and clarifiers that reduce molding cycles and costs for polyolefins. +Speed agents come in four grades, three effective at load rates from 0.1 to 0.5% and a fourth that serves as a nucleating and clarifying agent for PP at letdowns of 0.2 to 1%. NUC-138 is a PP nucleator that enables molten polymer to harden at higher temperatures. NUC-139 is a nucleator and acid neutralizer that reduces molding cycles for high-density polyethylene (HDPE) by reorienting polymer crystals to optimize shrinkage. NUC-140 increases crystallization temperatures and optimizes shrinkage properties for PP and HDPE. And NUC-141 adds clarifying properties for PP by increasing polymer crystallization at lower temperatures in the melt phase.

Songwon: Created SongXtend 1301 to protect polymeric flame retardants in extruded polystyrene (XPS) automotive applications and Songxtend 2124 stabilizer to improve the long-term thermal stability (LTTS) of glass fiber-reinforced PP at 150°C for more than 1,000 hours. The new stabilizer allows for thinner and lighter molded automotive parts with similar mechanical properties as unfilled parts.

Teknor’s TekTuff colorant also has been shown to improve the strength of extruded polyolefin sheets by 33%. Courtesy of Teknor Apex

Teknor Apex: Colorants that improve counterfeiting detection and impact strength. DeTek color concentrates include markers or taggants to ensure the authenticity and safety of products using a variety of thermoplastics. Detectable with special equipment, the taggants are difficult to copy, the company says. Meanwhile, TekTuff has been shown to improve the impact resistance of extruded polyolefin sheet by 33% and molded drinking cups by 45%. Both products can be added at standard letdown ratios.

Comparison of polyolefin strength with and without Teknor’s TekTuff color concentrate. Courtesy of Teknor Apex

Tolsa Group: Launched a new range of high-performance, flame-retardant ADINS clay, which delivers reduced smoke production in PVC and rubber polymer systems.

A Look Ahead

In the coming year, major drivers for additives innovation include enhanced performance requirements for plastics, increasing regulatory requirements with regard to environmental and consumer safety, and productivity improvements, says BASF’s Bach. With technical competency centers in Switzerland, Italy, the United States and China, “we are addressing the application needs of our customers in their local markets.”

On the radar of SPE division chair Todesco is the “development of HALS (hindered amine light stabilizers)/co-stabilizer combinations to enhance HALS performance in polyolefins (and) antistats and antifogs for non-polyolefinic materials (such as) polyester and polyamide-based articles.”

At Songwon, CEO Maurizio Butti notes that the company is focusing on automotive applications: “We have a quite big range of LTTS (solutions) meeting different needs of the automotive industry; the goal is to reduce TVOC, VOC and FOG. With the drive to replace HBCD (hexabromocyclododecane) in XPS applications with new polymeric flame retardants, there was the need to stabilize the polymeric flame retardant during processing. Together with SABO, our partner for hindered amine light stabilizers, we focus on automotive applications to provide better light stability and more attractive cost.”

For iD Additives, “expanding into liquid colors made sense for our company,” says President Nick Sotos about the firm’s new production facility. “We see it as a real growth area” in which the company has made “great strides towards creating products our customers want and need.”

PolyOne, meanwhile, intends to “expand our additive platform for purging operations and leverage state-of-the-art manufacturing processes to further optimize our additive performance,” Kuzniar asserts.

Plastic Additives Sector Continues to Grow & Evolve

Various performance needs — from fire safety to sustainability — driving innovation

Previous Article Next Article

By Geoff Giordano

With European Commission approval this year, Perstorp’s Akestra thermoplastic copolyester can now be used for all hot or cold food applications. Courtesy of Perstorp

Continuing a pattern of steady growth, the global plastics additives sector saw a slew of product innovations, increased manufacturing capacity and significant operational transitions over the past year.

The market for plastics additives worldwide was valued at $50.6 billion for 2016, up from $48.2 billion in 2015, according to the January 2016 report “Global Markets for Plastics Additives” by BCC Research of Wellesley, Mass. The analyst for the publisher of technology market research reports estimates the market’s value will grow to $64.6 billion by 2021 — a compound annual growth rate of 5%.

The planned blockbuster merger of Dow Chemical Co. and DuPont, announced Dec. 11, 2015, set the stage for this eventful period. The union, if approved, would result in DowDuPont then separating into three independent, publicly traded companies. One of those new businesses, a material science company, would absorb DuPont’s polymer additives and modifiers portfolio. The merger, undergoing intensive regulatory scrutiny, was on track to conclude by year’s end, DuPont CEO Ed Breen said in July a week after shareholders voted to approve the plan.

A sampling of headlines from the newsletter “Additives for Polymers” gives a sense of the robust developments of the past year:

- “Merck extends Miraval Cosmic effect pigment range” with new Cosmic Bronze decorative pigment (January)

- “Metabolix unveils further PHA grades as additives for PVC and PLA; moves corporate HQ” (March)

- “Cabot targets food contact applications with new universal masterbatch grades” (May)

- “Clariant targets packaging films, printed circuit boards and EPS applications with additive introductions at Chinaplas 2016” (June)

- “Chemours starts commercial operations at new TiO2 line in Mexico” and “A Schulman expands in China with new colour masterbatch facility” (July)

Key Trends

Among key trends in the industry is the increasing popularity of bioplastics and biodegradable plastics, and “smart additives are being developed to improve the quality of these plastics,” says Srinivasa Rajaram, the analyst who created BCC’s report. “Most of these are in the development stage and in the near future these products will become more dominant.”

Fire safety is another concern of additives makers. “Previous standards were primarily based on the risk of fire related to a spark or short circuit within the equipment but may be updated to include external ignition from a candle or other source,” Rajaram explains. “If these provisions are enacted, many additional plastic components used in electronics, such as speakers and keyboards, could require higher levels of flame-resistant performance.”

He also notes that “food-approved slip agents have been developed to decrease surface friction and mold-release force in polystyrene processing, which also improves packing and de-nesting of molded parts, and reduces scratches and scuffs.”

Driving efforts in the automotive realm are consumers seeking more functionality and comfort and improved interior aesthetics, notes Dr. Volker Bach, head of BASF’s Global Competence Center for Plastic Additives. Manufacturers are focusing on “unique cabin designs constructed with advanced materials and evermore stringent materials specifications.” Additives are combined with lightweight thermoplastic olefins (TPOs) to maintain physical properties when exposed to sunlight radiation or long-term heat. “Such additives must provide stability without negatively impacting secondary properties like stickiness, emissions and odor.”

As the plastics industry has evolved toward more environmentally friendly and sustainable solutions, Bach continues, “greater attention is being paid to the volatile emissions from plastic molded articles. The automotive industry, in particular, has been raising the standards for final article emissions requirements to enhance vehicle interior air quality.”

Adds Roberto Todesco, Switzerland-based consultant and long-time chair of SPE’s Additives and Color Europe Division, “improvement of the antifog properties of food packaging films and greenhouse films and a demand for real permanent antistats for automotive interiors” are and will continue to be key drivers of additives advances.

Meanwhile, PolyOne Corp. focused on “expanding our application base for anti-microbial, laser marking and low retention additive technology,” explains Larry Kuzniar, senior manager of technology development for color and additives. “This has been made possible by innovative manufacturing processes to improve the delivery, distribution and performance of our additive systems.”

In the medical space, Kuzniar says, “there is a strong focus on hospital cleaning programs designed to battle hospital-acquired infections (HAIs). Our WithStand Antimicrobial additive technology helps reduce the growth of microbes in non-acute care settings where minor lapses in cleaning protocol can lead to life-threatening HAIs. Our additive technology has proven performance in six medical-grade polymers — ABS, PP, PC, PEEK, silicone and TPU — with efficacy (Log 7 reductions) against four known antibiotic-resistant organisms.”

Laser marking for tubing and jacketed wire and cable is another significant application area for PolyOne. “We’ve been collaborating with the latest laser marking equipment manufacturers to assist them with polymer formulations,” he says. “We’ve achieved fantastic results with our OnCap Lasermarking Additive with benefits including: high-quality and high-contrast coated wire and multi-core cable marks and permanent alphanumeric character, graphic or barcode information that does not fade.”

Kuzniar also notes that “customers are leveraging our breakthrough Low Retention Additive for surface-energy modification in olefin resins. Hydrophilic (higher surface energy) vs. hydrophobic (lower surface energy) represent the functional performance of the solution. We are modifying the surface tension, only without sacrificing the bulk physical property characteristics.”

Industry Snapshots

A survey of some key additives purveyors illustrates a range of new performance-enhancing additives. Among the notable developments:

Addivant: Announced a multimillion-dollar tripling of capacity for its Weston 705 additive at its Morgantown, W.Va., plant, and launched the liquid antioxidant Lowinox Fast XL for wire and cable applications. Weston 705 — a nonylphenol-free liquid phosphite antioxidant for PE films and rigid packaging — also earned food-contact approval in China and Canada. Lowinox Fast XL is formulated to produce medium- and high-voltage crosslinked PE cables, balancing scorch protection and crosslinking speed.

At October’s K show in Düsseldorf, Addivant also revealed new:

- Stabilization solutions for polyurethane foam to enable compliance with new car interior emission standards

- Royaltuf nylon impact modifiers for car interiors and engine compartments

- Ultranox 800 series and other solutions that enhance the production efficiency of polypropylene (PP) converters.

BASF: Revealed that about one third of the overall sales of its performance chemicals division — which totaled €4.121 million, or about $4.63 million, in 2015 — are related to the chemicals and plastics industry, according to BASF Factbook 2016. The companylaunched three new products:

- Tinuvin 880, a novel light stabilizer molecule designed to comply with the most demanding automotive industry requirements for PP and TPO parts. It enables outstanding stabilization performance against UV degradation, even at low concentrations, with no resulting stickiness on part surfaces. It comes in a dust-free form for easy storage, handling and dosing, as well as improved productivity for compounders and master batchers. As a 100% active additive, formulators can tailor solutions to optimize the cost/performance ratio.

- Irgastab PUR 70, designed to meet stringent emissions requirements for foamed articles in automotive interior applications, is a premium-grade anti-scorch package for such uses as seating. Its extremely low volatility prevents degradation of polyol and polyurethane (PU) foams.

- Tinuvin XT 55, a stabilizer solution for PE-LLD monofilaments producers that provides durability without water carry over, which can negatively affect monofilaments and tape production lines.

Clariant: Unveiled Mevopur-LQ, a series of color and additive solutions that combines the benefits of its Mevopur line with its Hi Former liquid-vehicle technology. The first concentrates, developed for silicone elastomers, include a transparent amber color for polyethylene terephthalate (PET) materials for pharmaceutical packaging, as well as concentrates for liquid silicone resin.

Croda: Developed a series of anti-scratch additives to reduce scratch width and visibility with superior stability that reduces surface blooming. These additives, ideal for use in automotive interiors, include Incroslip SL and Incromold K for PP impact copolymer and Incroslip G for PP homopolymer applications. The company also announced plans to expand amide capacity at its facility in Hull, England, to meet demand for slip additives.

Eurotec: Introduced a new flame-retardant, Tecomid NT40 GD40 BK009 XA61, for automotive applications.

Top: Matt Dillard, color technician at iD LiquiD Systems, examines some samples. Bottom: The company’s new facility for iD Additives in Flint, Texas. Courtesy of iD Additives

iD Additives: Released a new, high-temperature foaming agent to work with engineering resins in lightweighting parts and opened iD LiquiD Systems, a division for producing liquid colorants and additives in Flint, Texas.

iD High Temperature Foam features under 2% LDR and is non-hydroscopic, requiring no material drying; it improves material flow and dimensional stability for cosmetic and non-cosmetic applications. The new agent, intended mainly for injection molding or sheet extrusion, also works with filled or unfilled nylon, PC/ABS, PC and other materials. It allows for low-pressure molding and faster molding cycles.

The company’s new liquid color operation will distribute specialty products to North American customers including: color foam, which combines liquid colorant and foaming agent; and delivery systems including metering pumps, mixers and pre-mixers, bucket tumblers and agitators, pump carts, tote delivery systems, adapters, plates and injection nozzles.

Lanxess: Announced the planned takeover of additives maker Chemtura on Sept. 26. The deal, valued at about $2.7 billion, will nearly triple the size of Lanxess’ additives business by bringing in Chemtura’s brominated flame retardants and urethanes and organometallics businesses. The acquisition is expected to be completed in mid-2017.

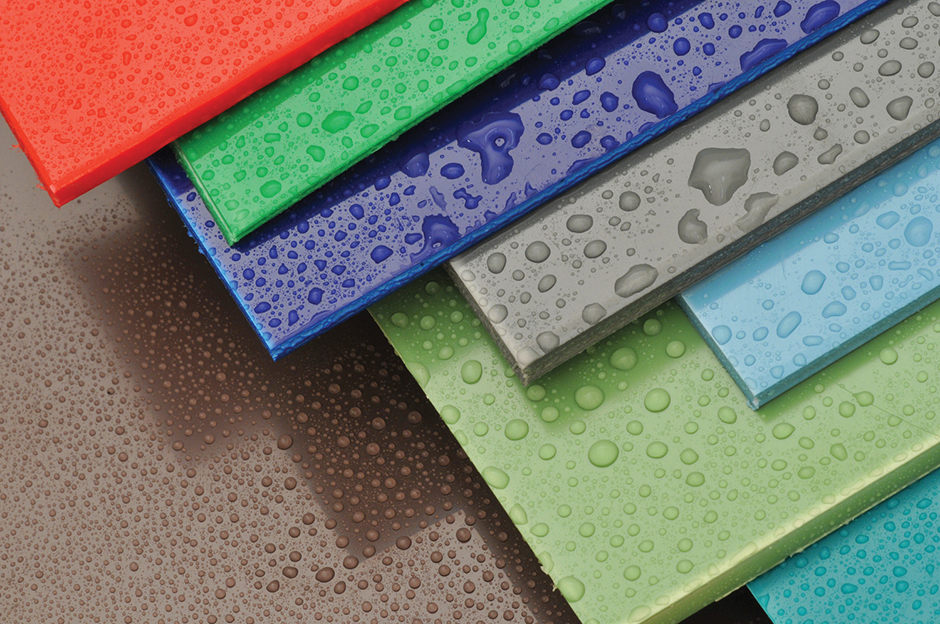

The two above images show examples of food packaging manufactured using UltraClear PP resin incorporating Milliken’s Millad NX 8000 clarifier, which offers glass-clear transparency and additional benefits such as easy sealability, and impact and heat resistance. Courtesy of Milliken

Milliken & Co.: Launched a new version of Millad NX 8000 clarifiers, called 8000E, specifically for extrusion blow molding, “which gives PP similar optical properties as PET at higher output EBM machines,” says Sami T.K. Palanisami, commercial manager plastic additives for Europe, the Middle East and Africa. The firm also has developed NX UltraClear products for sheet extrusion and thermoforming applications for PET replacement.

Meanwhile, Milliken continued optimizing its ClearShield and Milliguard products. “Recent reports have indicated that UV stabilization in PET bottles is an interesting alternative to protect the content of PET packaging,” Palanisami notes. “With ClearShield, Milliken offers an alternative way to provide UV protection to formulations without reworking the composition.” The company has developed a special UV-absorbing additive for PET packaging that has a wider range of UV protection than other products, he says. “It has proven efficacy in protecting sensitive ingredients such as vitamins and dyes. The additive is crystal clear, which retains the high transparency of PET without unwanted shading.”

Milliguard AOX-1 polymer-bound antioxidant for polyurethane won an innovation award from the European Association of Flexible Polyurethane Foam Blocks Manufacturers. The additive “gives the automotive industry a unique solution for compliance with toughening indoor air quality standards for vehicles,” Palanisami says. “As VOC (volatile organic compounds) and FOG (windscreen fogging) regulations tighten around the world, Milliken continues to lead compliance efforts with high-performance products that enhance sustainability, health and safety. We continue to develop different grades to meet the needs of the market.”

Perstorp: Won food-contact approval by the European Commission for its Akestra thermoplastic copolyester. Akestra, which imparts transparent, glass-like aesthetics with greater heat resistance than PET, can now be used for all hot or cold food applications. Akestra can be used in place of polystyrene in thin-wall packaging; polycarbonate in more durable items; and glass, according to Product Manager David Engberg. It had already won approval for food-contact uses in the U.S. and Japan.

A foamed plastic cell structure produced with Riverdale Global’s new +Foam agents. Courtesy of Riverdale Global

Riverdale Global: Introduced a range of stand-alone liquid modifiers in the GlobalPlus Sealed Additives line, including:

- Antimicrobial agents for polyolefins and engineering thermoplastics that provide more protection at lower doses than pellet masterbatches. +Clean antimicrobials “are inorganic, silver-based formulations that prevent discoloration, odors and product degradation caused by the growth of bacteria, mold and yeast,” Riverdale says. Optimized for color retention indoors or out, they can be used at letdown ratios of 0.2 to 0.5%, saving money on additive costs by dispersing more readily.

- Blowing agents that disperse more uniformly and provide more controlled foaming action with polyolefins, polystyrene, ABS, PPO and other polymers. The new +Foam series offers an exothermic azodicarbonamide blowing agent, an endothermic variety and a version with both — all used at letdown ratios of 0.5 percent to 1.5%.

- Nucleating agents and clarifiers that reduce molding cycles and costs for polyolefins. +Speed agents come in four grades, three effective at load rates from 0.1 to 0.5% and a fourth that serves as a nucleating and clarifying agent for PP at letdowns of 0.2 to 1%. NUC-138 is a PP nucleator that enables molten polymer to harden at higher temperatures. NUC-139 is a nucleator and acid neutralizer that reduces molding cycles for high-density polyethylene (HDPE) by reorienting polymer crystals to optimize shrinkage. NUC-140 increases crystallization temperatures and optimizes shrinkage properties for PP and HDPE. And NUC-141 adds clarifying properties for PP by increasing polymer crystallization at lower temperatures in the melt phase.

Songwon: Created SongXtend 1301 to protect polymeric flame retardants in extruded polystyrene (XPS) automotive applications and Songxtend 2124 stabilizer to improve the long-term thermal stability (LTTS) of glass fiber-reinforced PP at 150°C for more than 1,000 hours. The new stabilizer allows for thinner and lighter molded automotive parts with similar mechanical properties as unfilled parts.

Teknor’s TekTuff colorant also has been shown to improve the strength of extruded polyolefin sheets by 33%. Courtesy of Teknor Apex

Teknor Apex: Colorants that improve counterfeiting detection and impact strength. DeTek color concentrates include markers or taggants to ensure the authenticity and safety of products using a variety of thermoplastics. Detectable with special equipment, the taggants are difficult to copy, the company says. Meanwhile, TekTuff has been shown to improve the impact resistance of extruded polyolefin sheet by 33% and molded drinking cups by 45%. Both products can be added at standard letdown ratios.

Comparison of polyolefin strength with and without Teknor’s TekTuff color concentrate. Courtesy of Teknor Apex

Tolsa Group: Launched a new range of high-performance, flame-retardant ADINS clay, which delivers reduced smoke production in PVC and rubber polymer systems.

A Look Ahead

In the coming year, major drivers for additives innovation include enhanced performance requirements for plastics, increasing regulatory requirements with regard to environmental and consumer safety, and productivity improvements, says BASF’s Bach. With technical competency centers in Switzerland, Italy, the United States and China, “we are addressing the application needs of our customers in their local markets.”

On the radar of SPE division chair Todesco is the “development of HALS (hindered amine light stabilizers)/co-stabilizer combinations to enhance HALS performance in polyolefins (and) antistats and antifogs for non-polyolefinic materials (such as) polyester and polyamide-based articles.”

At Songwon, CEO Maurizio Butti notes that the company is focusing on automotive applications: “We have a quite big range of LTTS (solutions) meeting different needs of the automotive industry; the goal is to reduce TVOC, VOC and FOG. With the drive to replace HBCD (hexabromocyclododecane) in XPS applications with new polymeric flame retardants, there was the need to stabilize the polymeric flame retardant during processing. Together with SABO, our partner for hindered amine light stabilizers, we focus on automotive applications to provide better light stability and more attractive cost.”

For iD Additives, “expanding into liquid colors made sense for our company,” says President Nick Sotos about the firm’s new production facility. “We see it as a real growth area” in which the company has made “great strides towards creating products our customers want and need.”

PolyOne, meanwhile, intends to “expand our additive platform for purging operations and leverage state-of-the-art manufacturing processes to further optimize our additive performance,” Kuzniar asserts.

Plastic Additives Sector Continues to Grow & Evolve

Various performance needs — from fire safety to sustainability — driving innovation

Previous Article Next Article

By Geoff Giordano

With European Commission approval this year, Perstorp’s Akestra thermoplastic copolyester can now be used for all hot or cold food applications. Courtesy of Perstorp

Continuing a pattern of steady growth, the global plastics additives sector saw a slew of product innovations, increased manufacturing capacity and significant operational transitions over the past year.

The market for plastics additives worldwide was valued at $50.6 billion for 2016, up from $48.2 billion in 2015, according to the January 2016 report “Global Markets for Plastics Additives” by BCC Research of Wellesley, Mass. The analyst for the publisher of technology market research reports estimates the market’s value will grow to $64.6 billion by 2021 — a compound annual growth rate of 5%.

The planned blockbuster merger of Dow Chemical Co. and DuPont, announced Dec. 11, 2015, set the stage for this eventful period. The union, if approved, would result in DowDuPont then separating into three independent, publicly traded companies. One of those new businesses, a material science company, would absorb DuPont’s polymer additives and modifiers portfolio. The merger, undergoing intensive regulatory scrutiny, was on track to conclude by year’s end, DuPont CEO Ed Breen said in July a week after shareholders voted to approve the plan.

A sampling of headlines from the newsletter “Additives for Polymers” gives a sense of the robust developments of the past year:

- “Merck extends Miraval Cosmic effect pigment range” with new Cosmic Bronze decorative pigment (January)

- “Metabolix unveils further PHA grades as additives for PVC and PLA; moves corporate HQ” (March)

- “Cabot targets food contact applications with new universal masterbatch grades” (May)

- “Clariant targets packaging films, printed circuit boards and EPS applications with additive introductions at Chinaplas 2016” (June)

- “Chemours starts commercial operations at new TiO2 line in Mexico” and “A Schulman expands in China with new colour masterbatch facility” (July)

Key Trends

Among key trends in the industry is the increasing popularity of bioplastics and biodegradable plastics, and “smart additives are being developed to improve the quality of these plastics,” says Srinivasa Rajaram, the analyst who created BCC’s report. “Most of these are in the development stage and in the near future these products will become more dominant.”

Fire safety is another concern of additives makers. “Previous standards were primarily based on the risk of fire related to a spark or short circuit within the equipment but may be updated to include external ignition from a candle or other source,” Rajaram explains. “If these provisions are enacted, many additional plastic components used in electronics, such as speakers and keyboards, could require higher levels of flame-resistant performance.”

He also notes that “food-approved slip agents have been developed to decrease surface friction and mold-release force in polystyrene processing, which also improves packing and de-nesting of molded parts, and reduces scratches and scuffs.”

Driving efforts in the automotive realm are consumers seeking more functionality and comfort and improved interior aesthetics, notes Dr. Volker Bach, head of BASF’s Global Competence Center for Plastic Additives. Manufacturers are focusing on “unique cabin designs constructed with advanced materials and evermore stringent materials specifications.” Additives are combined with lightweight thermoplastic olefins (TPOs) to maintain physical properties when exposed to sunlight radiation or long-term heat. “Such additives must provide stability without negatively impacting secondary properties like stickiness, emissions and odor.”

As the plastics industry has evolved toward more environmentally friendly and sustainable solutions, Bach continues, “greater attention is being paid to the volatile emissions from plastic molded articles. The automotive industry, in particular, has been raising the standards for final article emissions requirements to enhance vehicle interior air quality.”

Adds Roberto Todesco, Switzerland-based consultant and long-time chair of SPE’s Additives and Color Europe Division, “improvement of the antifog properties of food packaging films and greenhouse films and a demand for real permanent antistats for automotive interiors” are and will continue to be key drivers of additives advances.

Meanwhile, PolyOne Corp. focused on “expanding our application base for anti-microbial, laser marking and low retention additive technology,” explains Larry Kuzniar, senior manager of technology development for color and additives. “This has been made possible by innovative manufacturing processes to improve the delivery, distribution and performance of our additive systems.”

In the medical space, Kuzniar says, “there is a strong focus on hospital cleaning programs designed to battle hospital-acquired infections (HAIs). Our WithStand Antimicrobial additive technology helps reduce the growth of microbes in non-acute care settings where minor lapses in cleaning protocol can lead to life-threatening HAIs. Our additive technology has proven performance in six medical-grade polymers — ABS, PP, PC, PEEK, silicone and TPU — with efficacy (Log 7 reductions) against four known antibiotic-resistant organisms.”

Laser marking for tubing and jacketed wire and cable is another significant application area for PolyOne. “We’ve been collaborating with the latest laser marking equipment manufacturers to assist them with polymer formulations,” he says. “We’ve achieved fantastic results with our OnCap Lasermarking Additive with benefits including: high-quality and high-contrast coated wire and multi-core cable marks and permanent alphanumeric character, graphic or barcode information that does not fade.”

Kuzniar also notes that “customers are leveraging our breakthrough Low Retention Additive for surface-energy modification in olefin resins. Hydrophilic (higher surface energy) vs. hydrophobic (lower surface energy) represent the functional performance of the solution. We are modifying the surface tension, only without sacrificing the bulk physical property characteristics.”

Industry Snapshots

A survey of some key additives purveyors illustrates a range of new performance-enhancing additives. Among the notable developments:

Addivant: Announced a multimillion-dollar tripling of capacity for its Weston 705 additive at its Morgantown, W.Va., plant, and launched the liquid antioxidant Lowinox Fast XL for wire and cable applications. Weston 705 — a nonylphenol-free liquid phosphite antioxidant for PE films and rigid packaging — also earned food-contact approval in China and Canada. Lowinox Fast XL is formulated to produce medium- and high-voltage crosslinked PE cables, balancing scorch protection and crosslinking speed.

At October’s K show in Düsseldorf, Addivant also revealed new:

- Stabilization solutions for polyurethane foam to enable compliance with new car interior emission standards

- Royaltuf nylon impact modifiers for car interiors and engine compartments

- Ultranox 800 series and other solutions that enhance the production efficiency of polypropylene (PP) converters.

BASF: Revealed that about one third of the overall sales of its performance chemicals division — which totaled €4.121 million, or about $4.63 million, in 2015 — are related to the chemicals and plastics industry, according to BASF Factbook 2016. The companylaunched three new products:

- Tinuvin 880, a novel light stabilizer molecule designed to comply with the most demanding automotive industry requirements for PP and TPO parts. It enables outstanding stabilization performance against UV degradation, even at low concentrations, with no resulting stickiness on part surfaces. It comes in a dust-free form for easy storage, handling and dosing, as well as improved productivity for compounders and master batchers. As a 100% active additive, formulators can tailor solutions to optimize the cost/performance ratio.

- Irgastab PUR 70, designed to meet stringent emissions requirements for foamed articles in automotive interior applications, is a premium-grade anti-scorch package for such uses as seating. Its extremely low volatility prevents degradation of polyol and polyurethane (PU) foams.

- Tinuvin XT 55, a stabilizer solution for PE-LLD monofilaments producers that provides durability without water carry over, which can negatively affect monofilaments and tape production lines.

Clariant: Unveiled Mevopur-LQ, a series of color and additive solutions that combines the benefits of its Mevopur line with its Hi Former liquid-vehicle technology. The first concentrates, developed for silicone elastomers, include a transparent amber color for polyethylene terephthalate (PET) materials for pharmaceutical packaging, as well as concentrates for liquid silicone resin.

Croda: Developed a series of anti-scratch additives to reduce scratch width and visibility with superior stability that reduces surface blooming. These additives, ideal for use in automotive interiors, include Incroslip SL and Incromold K for PP impact copolymer and Incroslip G for PP homopolymer applications. The company also announced plans to expand amide capacity at its facility in Hull, England, to meet demand for slip additives.

Eurotec: Introduced a new flame-retardant, Tecomid NT40 GD40 BK009 XA61, for automotive applications.

Top: Matt Dillard, color technician at iD LiquiD Systems, examines some samples. Bottom: The company’s new facility for iD Additives in Flint, Texas. Courtesy of iD Additives

iD Additives: Released a new, high-temperature foaming agent to work with engineering resins in lightweighting parts and opened iD LiquiD Systems, a division for producing liquid colorants and additives in Flint, Texas.

iD High Temperature Foam features under 2% LDR and is non-hydroscopic, requiring no material drying; it improves material flow and dimensional stability for cosmetic and non-cosmetic applications. The new agent, intended mainly for injection molding or sheet extrusion, also works with filled or unfilled nylon, PC/ABS, PC and other materials. It allows for low-pressure molding and faster molding cycles.

The company’s new liquid color operation will distribute specialty products to North American customers including: color foam, which combines liquid colorant and foaming agent; and delivery systems including metering pumps, mixers and pre-mixers, bucket tumblers and agitators, pump carts, tote delivery systems, adapters, plates and injection nozzles.

Lanxess: Announced the planned takeover of additives maker Chemtura on Sept. 26. The deal, valued at about $2.7 billion, will nearly triple the size of Lanxess’ additives business by bringing in Chemtura’s brominated flame retardants and urethanes and organometallics businesses. The acquisition is expected to be completed in mid-2017.

The two above images show examples of food packaging manufactured using UltraClear PP resin incorporating Milliken’s Millad NX 8000 clarifier, which offers glass-clear transparency and additional benefits such as easy sealability, and impact and heat resistance. Courtesy of Milliken

Milliken & Co.: Launched a new version of Millad NX 8000 clarifiers, called 8000E, specifically for extrusion blow molding, “which gives PP similar optical properties as PET at higher output EBM machines,” says Sami T.K. Palanisami, commercial manager plastic additives for Europe, the Middle East and Africa. The firm also has developed NX UltraClear products for sheet extrusion and thermoforming applications for PET replacement.

Meanwhile, Milliken continued optimizing its ClearShield and Milliguard products. “Recent reports have indicated that UV stabilization in PET bottles is an interesting alternative to protect the content of PET packaging,” Palanisami notes. “With ClearShield, Milliken offers an alternative way to provide UV protection to formulations without reworking the composition.” The company has developed a special UV-absorbing additive for PET packaging that has a wider range of UV protection than other products, he says. “It has proven efficacy in protecting sensitive ingredients such as vitamins and dyes. The additive is crystal clear, which retains the high transparency of PET without unwanted shading.”

Milliguard AOX-1 polymer-bound antioxidant for polyurethane won an innovation award from the European Association of Flexible Polyurethane Foam Blocks Manufacturers. The additive “gives the automotive industry a unique solution for compliance with toughening indoor air quality standards for vehicles,” Palanisami says. “As VOC (volatile organic compounds) and FOG (windscreen fogging) regulations tighten around the world, Milliken continues to lead compliance efforts with high-performance products that enhance sustainability, health and safety. We continue to develop different grades to meet the needs of the market.”

Perstorp: Won food-contact approval by the European Commission for its Akestra thermoplastic copolyester. Akestra, which imparts transparent, glass-like aesthetics with greater heat resistance than PET, can now be used for all hot or cold food applications. Akestra can be used in place of polystyrene in thin-wall packaging; polycarbonate in more durable items; and glass, according to Product Manager David Engberg. It had already won approval for food-contact uses in the U.S. and Japan.

A foamed plastic cell structure produced with Riverdale Global’s new +Foam agents. Courtesy of Riverdale Global

Riverdale Global: Introduced a range of stand-alone liquid modifiers in the GlobalPlus Sealed Additives line, including:

- Antimicrobial agents for polyolefins and engineering thermoplastics that provide more protection at lower doses than pellet masterbatches. +Clean antimicrobials “are inorganic, silver-based formulations that prevent discoloration, odors and product degradation caused by the growth of bacteria, mold and yeast,” Riverdale says. Optimized for color retention indoors or out, they can be used at letdown ratios of 0.2 to 0.5%, saving money on additive costs by dispersing more readily.

- Blowing agents that disperse more uniformly and provide more controlled foaming action with polyolefins, polystyrene, ABS, PPO and other polymers. The new +Foam series offers an exothermic azodicarbonamide blowing agent, an endothermic variety and a version with both — all used at letdown ratios of 0.5 percent to 1.5%.

- Nucleating agents and clarifiers that reduce molding cycles and costs for polyolefins. +Speed agents come in four grades, three effective at load rates from 0.1 to 0.5% and a fourth that serves as a nucleating and clarifying agent for PP at letdowns of 0.2 to 1%. NUC-138 is a PP nucleator that enables molten polymer to harden at higher temperatures. NUC-139 is a nucleator and acid neutralizer that reduces molding cycles for high-density polyethylene (HDPE) by reorienting polymer crystals to optimize shrinkage. NUC-140 increases crystallization temperatures and optimizes shrinkage properties for PP and HDPE. And NUC-141 adds clarifying properties for PP by increasing polymer crystallization at lower temperatures in the melt phase.

Songwon: Created SongXtend 1301 to protect polymeric flame retardants in extruded polystyrene (XPS) automotive applications and Songxtend 2124 stabilizer to improve the long-term thermal stability (LTTS) of glass fiber-reinforced PP at 150°C for more than 1,000 hours. The new stabilizer allows for thinner and lighter molded automotive parts with similar mechanical properties as unfilled parts.

Teknor’s TekTuff colorant also has been shown to improve the strength of extruded polyolefin sheets by 33%. Courtesy of Teknor Apex

Teknor Apex: Colorants that improve counterfeiting detection and impact strength. DeTek color concentrates include markers or taggants to ensure the authenticity and safety of products using a variety of thermoplastics. Detectable with special equipment, the taggants are difficult to copy, the company says. Meanwhile, TekTuff has been shown to improve the impact resistance of extruded polyolefin sheet by 33% and molded drinking cups by 45%. Both products can be added at standard letdown ratios.

Comparison of polyolefin strength with and without Teknor’s TekTuff color concentrate. Courtesy of Teknor Apex

Tolsa Group: Launched a new range of high-performance, flame-retardant ADINS clay, which delivers reduced smoke production in PVC and rubber polymer systems.

A Look Ahead

In the coming year, major drivers for additives innovation include enhanced performance requirements for plastics, increasing regulatory requirements with regard to environmental and consumer safety, and productivity improvements, says BASF’s Bach. With technical competency centers in Switzerland, Italy, the United States and China, “we are addressing the application needs of our customers in their local markets.”

On the radar of SPE division chair Todesco is the “development of HALS (hindered amine light stabilizers)/co-stabilizer combinations to enhance HALS performance in polyolefins (and) antistats and antifogs for non-polyolefinic materials (such as) polyester and polyamide-based articles.”

At Songwon, CEO Maurizio Butti notes that the company is focusing on automotive applications: “We have a quite big range of LTTS (solutions) meeting different needs of the automotive industry; the goal is to reduce TVOC, VOC and FOG. With the drive to replace HBCD (hexabromocyclododecane) in XPS applications with new polymeric flame retardants, there was the need to stabilize the polymeric flame retardant during processing. Together with SABO, our partner for hindered amine light stabilizers, we focus on automotive applications to provide better light stability and more attractive cost.”

For iD Additives, “expanding into liquid colors made sense for our company,” says President Nick Sotos about the firm’s new production facility. “We see it as a real growth area” in which the company has made “great strides towards creating products our customers want and need.”

PolyOne, meanwhile, intends to “expand our additive platform for purging operations and leverage state-of-the-art manufacturing processes to further optimize our additive performance,” Kuzniar asserts.