2015: A Turning Point for Bioplastic Building-Block Investments

The fall in crude oil prices made last year a challenging one for renewable chemicals producers

Previous Article Next Article

By Doris de Guzman

Tecnon OrbiChem, Croydon, UK

2015: A Turning Point for Bioplastic Building-Block Investments

The fall in crude oil prices made last year a challenging one for renewable chemicals producers

Previous Article Next Article

By Doris de Guzman

Tecnon OrbiChem, Croydon, UK

2015: A Turning Point for Bioplastic Building-Block Investments

The fall in crude oil prices made last year a challenging one for renewable chemicals producers

Previous Article Next Article

By Doris de Guzman

Tecnon OrbiChem, Croydon, UK

In 2015, Avantium signed an agreement with Mitsui & Co. to commercialize the bio-based chemicals FDCA and PEF in Asia (photo courtesy of Avantium).

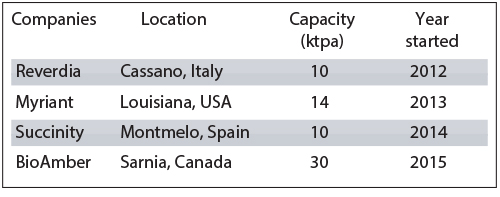

Four Major Bio-Succinic Acid Producers Worldwide

The developments in the past decade for emerging bioplastics have been spectacular from a technological point of view, but as the fall of crude oil prices lingered in 2015, the bioplastic market struggled to compete with lower-priced petrochemical-based plastics in the commodity space, which made the year a turning point for several renewable chemicals projects. Some companies halted plans for further investments. Others re-strategized plans to focus towards more specialty or niche markets, while some did not make it past “the valley of death.”

Bio-Polyolefins

Braskem remains the sole producer of sugarcane-based polyethylene (PE) with it 200-ktpa (kilotons per annum) capacity in Rio do Sul, Brazil. What has helped Braskem, despite the low crude oil prices, is the steady low price of sugar feedstock. Global prices for sugar have been depressed because of oversupply, while ethanol prices have also been down because of lower gasoline prices.

However, depressed petro-based PE prices have slowed down enthusiasm for higher-priced bio-PE materials, especially when attracting new customers. Dow Chemical (soon to be part of the merged DowDuPont company) reportedly has shelved its plans for its own 350-ktpa bio-PE Brazil joint venture with Mitsui since late 2012 because of cheaper shale gas-based ethylene in the USA. Mitsui has recently sold Dow its entire share in their 50/50 ethanol joint venture, Santa Vitoria Acucar e Alcool Ltda. (SVAA). Mitsui reasoned out that it does not foresee the situation on bio-PE investments improving in the near future, and that the project pipeline of other bio-based chemicals integrated to SVAA requires substantial R&D.

Bio-PE has been selling at a premium of 30-50%, compared to conventional PE. Braskem also shelved its sugarcane-based polypropylene (PP) plans, stating unimproved cost economic factors for scale-up.

There’s also increasing competition in the bio-PE space, especially in Europe, with the entrance of SABIC’s renewable polyolefins using bio-based naphtha produced from the hydrocracking of waste fats and oils. SABIC is also said to be producing bio-PP from this feedstock. It’s believed that Neste Oil produces this bio-naphtha (although SABIC declined to confirm this).

Bio-naphtha could be an increasing feedstock alternative to produce renewable polyolefins, as several companies worldwide have taken interests or even increased their capacity for commercial hydrotreated fats and oils production, mainly to manufacture renewable diesel with bio-naphtha as byproduct.

Bio-Polyacrylates

The R&D for bio-based acrylic acid has seen the most dramatic change in 2015, with the sell-out of Colorado-based OPX Biotechnologies (OPXBIO) and BASF backing out of its collaboration with Novozymes and Cargill. OPXBIO has been developing bio-based acrylic acid in partnership with Dow Chemical, but it parted ways in September 2014. In April 2015, OPXBIO sold its proprietary fermentation-based processes and systems to Cargill and has since then closed its operations after the transition.

There are not many companies developing bio-based acrylic acid as well as bio-based methacrylates. Arkema and Nippon Shokubai have also been looking to produce bio-acrylic acid from glycerine, but there had been no news of further advancements in their projects after reported success at the pilot scale. Archer Daniels Midland also has a pilot plant that can produce acrylic acid using glycerine, but the company has not announced any plans to further commercialize its technology.

Novomer is pursuing a different route to acrylic acid by using their proprietary catalysts to produce propiolactone from ethylene oxide and carbon monoxide. Polypropiolactone can then be converted to glacial acrylic acid via pyrolysis. The ethylene oxide can either be bio-based or petro-based depending on its current economics. Novomer has yet to announce scale-up to commercialize this technology.

In the production of bio-based methyl methacrylate (MMA), France-based Global Bioenergies has been working with Arkema on the development of bio-based methacrylic acid using glucose-based isobutene feedstock. Novomer has a 10-ktpa pilot plant in Pomacle, France, that focuses on producing oxidation-grade isobutene batches for use in bio-methacrylic acid production. This pilot project is expected to end in October 2016.

Evonik, through its Creavis business unit, is also working on bio-based MMA using a fermentation process that can convert syngas to pure 2-hydroxyisobutyric acid (2-HIBA). Evonik has partnered with LanzaTech for its gas fermentation expertise. This project is still at an early stage of development.

Mitsubishi Rayon, through its subsidiary Lucite International, has been developing several bio-based MMA routes either by using available building blocks such as bio-acetone, bio-ethylene, bio-methanol, etc. as feedstock in its existing production processes, or using a novel one-step fermentation route to produce bio-MMA. The bio-MMA project is reportedly ongoing as the company addresses many technological challenges in designing complex new biochemical routes.

Itaconic acid is seen as a highly interesting chemical building block due to its resemblance to maleic acid, a compound commonly used in acrylates and resins. Companies involved in developing itaconic acid include France-based Leaf Technologies and U.S.-based Itaconix.

Bio-Polyesters

Bio-based diols such as ethylene glycol and 1,3 propanediol (PDO), as well as diacids such as succinic acid, are the poster children of successfully commercialized renewable chemical building blocks for use in the production of bio-based polyesters such as bio-PET, bio-PBS (polybutylene succinate) and bio-PTT (polytrimethylene terephthalate).

2015 was the year when the bio-based succinic acid market has proven itself resilient amidst the low crude oil pricing environment. BioAmber was able to start the biggest bio-succinic acid production facility worldwide with its 30-ktpa plant in Sarnia, Ontario, Canada, which started in August last year. Its take-or-pay agreements with Vinmar and PTTMCC Biochem represent 50% of the Sarnia capacity’s annual sales projected for 2016 and 2017. PTTMCC has already started its new 20 ktpa bio-based PBS plant in Thailand last year. (PBS, a biodegradable polyester made from succinic acid and 1,4 butanediol, resembles polypropylene in terms of mechanical properties.)

For 1,3 PDO, DuPont has enjoyed the success of its Susterra® molecule especially in the production of its Sorona® PTT, which is made from 1,3 PDO and terephthalic acid. PDO is also being offered as an alternative to petroleum-based glycols. The DuPont Tate & Lyle joint venture produces the glucose-based PDO at its 64 ktpa facility in Loudon, Tennessee. It’s uncertain what will be the future of the joint venture with the recent merger of Dow Chemical and DuPont.

There were reports of China-based Zhangjiagang Glory Industrial having a 65-ktpa plant that can produce glycerol-based PDO and 2,3 BDO, but industry sources have noted that Glory Industrial uses almost all of its PDO for captive use in the production of PTT. An unconfirmed report also noted Suzhou Shenghong Group planning a glycerol-based PDO and PTT project, but industry sources suggested this is still at the trial stage.

The bio-PET market, meanwhile, had a hard time last year with pressures from much lower crude oil pricing. While proponents of bio-PET, especially Coca-Cola, valiantly try to grow this market, demand for new business growth remains slow, and premium pricing for bio-based MEG (mono-ethylene glycol) and bio-PET has further moved up in the past few months. India Glycols and Greencol Taiwan Corporation are currently the only two known producers of sugarcane-based MEG.

Italy-based M&G Chemicals has been planning on a bio-ethanol and bio-MEG project in China, but there were reports of difficulties in financing the project. India-based JBF Industries dropped its bio-MEG project in Brazil in late 2013, but Coca-Cola said it’s still working with the company for another possible bio-MEG project. JBF has been looking at a potential bio-MEG facility in South Carolina, USA.

The bright spot in the bio-PET market is the advancement in the development of bio-based purified terephthalic acid (PTA)/paraxylene and 1,5 furandicarboxylic acid (FDCA), which is an alternative to PTA. Anellotech will soon start operations at its demo facility in New York for the production of bio-based xylenes and toluenes via thermal catalytic conversion of biomass. The company expects to announce this month a partnership related to the development of bio-PET using its bio-based aromatics technology. Other companies developing bio-aromatics include Virent and Vertimass.

The Netherlands-based company Avantium has been planning its first commercial FDCA facility in Europe, about which details will soon be announced in the first quarter of 2016. The company had announced a signed agreement where Japan-based Mitsui & Co. will have the right to purchase a sizeable volume of the bio-based molecule from the planned commercial facility.

Mitsui and Avantium will also collaborate in the development and roll-out of polyethylene furanoate (PEF) in thin films in Asia, and PEF bottles in Japan. PEF is being developed as an alternative to PET, and is made from FDCA and MEG. The companies are hoping to launch PEF and other FDCA-based applications into the Japanese market well in time for the Tokyo Olympics in 2020.

Avantium has been producing FDCA samples since 2012 at its 40 tons/year pilot plant in Geleen, Netherlands. Avantium’s technology involves a proprietary two-step chemical, catalytic process to produce FDCA from sugars called the “YXY” process.

Note: The facts gathered above are based on the author’s own research and contacts with the industry, and any views expressed above are the author’s; see more of her reporting or connect with her at greenchemicalsblog.com.

About the author… Dorisde Guzman is senior consultant, Bio-Materials, for Tecnon OrbiChem and creator and author of the “Green Chemicals Blog.” She joined the UK-based Tecnon OrbiChem in March 2013, covering bio-based chemical feedstocks for the company’s “Bio-Materials Chemical Business Focus” newsletter published every month. Tecnon OrbiChem has served the global petrochemical intermediates, chlor-alkali, synthetic fibers, and resin industries as an independent market consultancy for 40 years. Guzman has been covering the business of green chemistry for more than 15 years.