China’s Plastics Processing Industry Adapts to a New Era

High-tech innovation is now the name of the game in China

Previous Article Next Article

By Qian Guijing

China Plastics Processing Industry Association, Beijing, China

China’s Plastics Processing Industry Adapts to a New Era

High-tech innovation is now the name of the game in China

Previous Article Next Article

By Qian Guijing

China Plastics Processing Industry Association, Beijing, China

China’s Plastics Processing Industry Adapts to a New Era

High-tech innovation is now the name of the game in China

Previous Article Next Article

By Qian Guijing

China Plastics Processing Industry Association, Beijing, China

“China’s plastics processing industry… is now a modern manufacturing industry which utilizes new materials, new crafts, new technologies, and new equipment.”

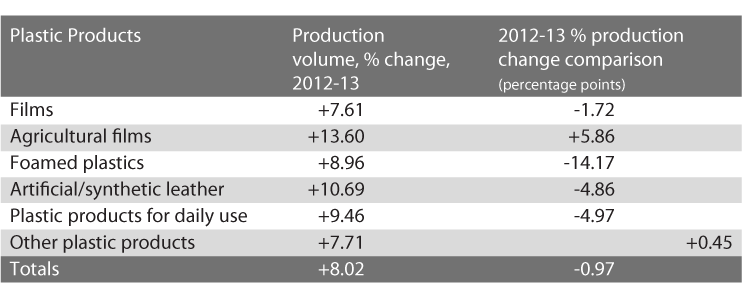

Table 1: 2013 China Plastic Products Production (Source: National Bureau of Statistics of China)

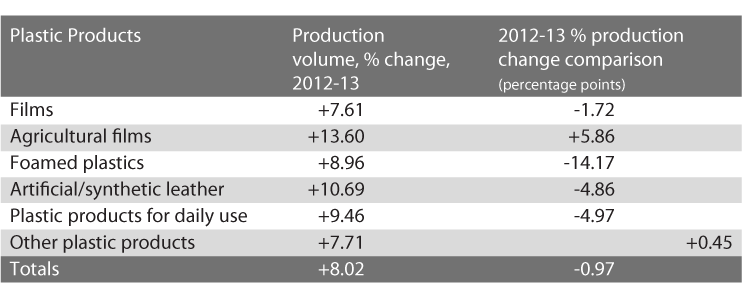

Table 1: 2013 China Plastic Products Production (Source: National Bureau of Statistics of China)

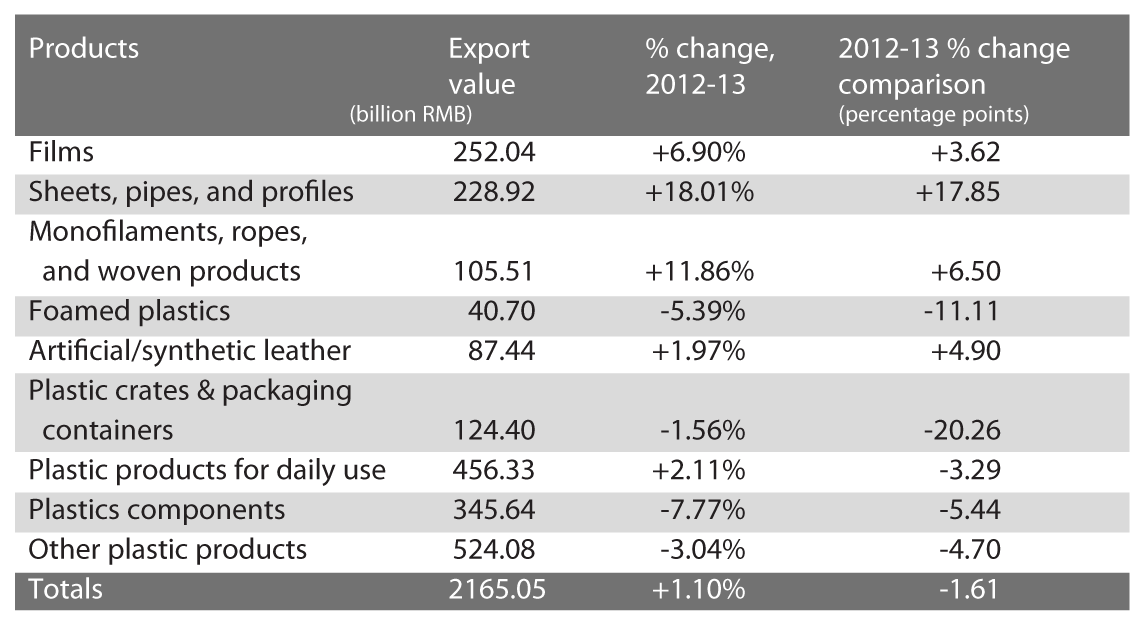

Table 2: 2013 China Plastic Products Export Value (Source: National Bureau of Statistics of China)

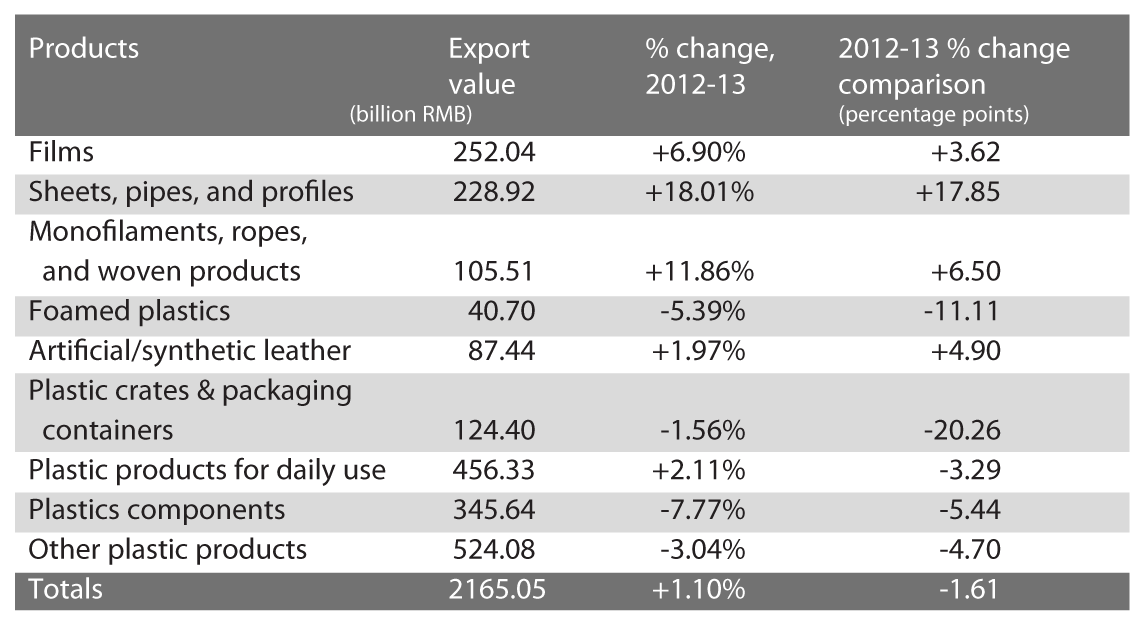

Table 2: 2013 China Plastic Products Export Value (Source: National Bureau of Statistics of China)

Since China joined the World Trade Organization more than a decade ago, China’s plastics processing industry has made great progress. It is now a modern manufacturing industry which utilizes new materials, new crafts, new technologies, and new equipment. After playing catch-up, with exponential growth, the industry is shifting from focusing on quantity to focusing on quality. Taking the chance to improve quality and efficiency will lead to a better future for the plastics processing industry.

Developments in 2013: Steady but Slower Growth

Supported by a series of macro-economic policies, the plastics processing industry in China overcame a number of adversities in 2013, such as declines in exports, RMB appreciation, and rising materials and labor costs. Gaining pace in industrial transformation and upgrading, the industry recovered gradually with double-digit growth in major operating income and gross profit.

According to the National Bureau of Statistics of China (NBSC), a total of 13,699 enterprises above a designated size produced 61,886.6 kilotons of plastics products in 2013. The total volume increased 8.02% year on year, but growth was 0.97 percentage points lower than in 2012 (8.99%).

Major operating income from these enterprises amounted to RMB 1.867 trillion, up 14.26% year on year, and was 2.47 percentage points better than the growth rate in 2012. Gross profit hit RMB 112.318 billion, grew 16.45% year on year and was 0.51 percentage points higher than in 2012.

By sectors, only agricultural film and artificial/synthetic leather witnessed double-digit growth, at 13.6% and 10.69% respectively. Only the agricultural film sector and the category “other plastics products” exhibited a growth rate higher than 2012, and were 5.86 and 0.45 percentage points better, respectively. All the other sectors exhibited a lower growth compared with 2012; in particular, foamed plastics were down by 14.17 percentage points.

Regionally speaking, output of plastic products mainly comes from these provinces: Zhejiang, Guangdong, Shandong, Henan, Liaoning, Jiangsu, Hubei, Sichuan, Fujian and Anhui. Zhejiang and Guangdong ranked first and second, accounting for 15.20% and 13.87% of the total respectively. They also achieved year on year growth of 5.60% and 4.80%, respectively.

In terms of growth rate, Henan, Hubei, Sichuan, Fujian and Liaoning outperformed the average of China’s plastics industry. Henan and Sichuan in particular grew by 29.30% and 20.18% year on year, respectively, indicating that plastics manufacturing is developing rapidly in the central region of China. Meanwhile, Zhejiang and Guangdong recorded 5.60% and 4.8% growth, respectively.

In addition to global economic uncertainty, there are structural problems that remain to be solved by China’s plastic processing industry, such as severe overcapacity, lack of innovation, low technology level, irrational product structure, insufficient R&D input, low intensification, lack of balance in regional development, and disorderly competition in the market. The missions of restructuring, saving energy, and reducing emissions are far from successful.

The “Prevention of Air Pollution in Major Regions in the 12th Five Year” scheme enacted by the Ministry of Environmental Protection, the National Development and Reform Commission, and the Ministry of Finance in December 2012, as well as the “Action Plan for Air Pollution Prevention” enacted by the State Council in September 2013, have further affected the plastics color printing, flexible packaging, and artificial and synthetic leather sectors.

Local governments have set stringent targets on the industry in order to eliminate pollution. Failing to meet these targets will lead to severe punishments that might drive companies out of business eventually. Production has been suspended by companies in certain regions as a result.

From a macro point of view though, the plastics processing industry maintained steady development in 2013.

International Demand Shows Signs of Recovery

For the full year 2013, export values of plastics products in China totaled RMB 216.5 billion, up 1.1% year on year, according to China Customs statistics. A slight decline, which is 1.61 percentage points lower than that in 2012, indicated a recovery in the export market.

By sectors, plastic sheet, pipes, and profiles and monofilaments, ropes, and woven products recorded the biggest growth, up 18.01% and 11.86% year on year respectively. Foamed plastics, plastics crates and packaging containers, plastics components, and other plastics products exhibited a decline. In particular, plastics crates and containers, as well as foamed plastics, were down by 20.26% and 11.11%, respectively.

Opportunities in the Future

Relevant data has shown that China’s plastic processing industry slowed down. Due to a weak global economy, worldwide demands have been stagnant. As a result, the Chinese economy was under huge pressure for a slowdown, and subsequently exports declined. Not only exports of plastics products slipped, being an important packaging material for exported goods, plastics also faced a downturn as indirect exports.

Meanwhile, the slowdown of China’s economy led to softened demand for plastics products, further affecting the performance of the plastics processing industry, which is facing three structural difficulties: (1.) irrational market structure with too many medium- to low-end products; (2.) structural and periodical production surplus; and (3.) lack of innovation ability. Here are some recommendations to deal with these problems.

1. Get a full picture of the slowdown, adapt to it, and focus on transformation, restructuring, and upgrading

Upon strategic changes, the Chinese economy enters a period of medium-paced development following years of rapid growth. The adjustment also applies to the plastic processing industry. After an accelerated development during the 11th Five Year Plan and 12th Five Year Plan, the industry is gearing towards high quality and the high-end markets.

From shortage to saturation and even production surplus, there is little room for capacity growth. One of the major reasons behind China’s much faster development compared with other countries is that there were existing technologies and systems for China to learn from and expand on.

As the catching-up comes to an end, ordinary technology and machines cannot satisfy the requirements of the plastic processing industry now. At the top of the pyramid, technological competition is fierce, and it is unlikely that the world leaders would sell their innovations to China. Technological advancement unavoidably slowed down, which is why China has to intensify efforts in R&D.

At present, China is the second largest economy in the world, and its per capita income reaches U.S. $6,000. It is now a crucial time for China to avoid being stuck in what economists called the middle income trap. The fast-growing period has gone and the industry should be prepared for an economic slowdown. Instead, the emphasis should be put on industrial restructuring and upgrading, transforming itself from a volume-oriented industry to quality- and profit-oriented.

2. Dealing with overcapacity is an important task for the plastics processing industry

The imbalance of demand and supply is closely related to product competitiveness, quality, and market scope. For a newly developed fast-growing manufacturing industry, overcapacity should not be occurring in plastics processing.

However, structural or periodical surplus does exist in certain segments, particularly in low-end woven plastics as well as window and door profiles. Overcapacity also appears in the plastics pipe market, with general PVC-U pipes being the main culprit; there is also excess supply in BOPP and BOPET films.

Overcapacity leads to vicious price competition and market chaos, damaging the industry’s image and a company’s profit, while hindering the healthy development of the industry. It is clear that an unreasonable proportion of low-end products appear in the market due to repetitive construction of similar, low-level facilities.

Meanwhile, periodical surplus is usually caused by irrational investment in new capacity that outweighs the current demand, although most of this production is leading in quality.

Overcapacity is the result of market competition, an inevitable industrial behavior causing excess supply in the transition from an expanding market to a mature one. Economic history shows that the domestic demand will slip as the task of industrialization completes. When per capita GDP of China reaches 11,000 international dollars (around U.S. $7,500), key industrial products will achieve production peaks.

Based on this theory and the current per-capita GDP of China, steel, cement, real estate construction, and automobile production will reach their respective absolute productivity and peak growth by 2015 and beyond. This proves that there is a certain pattern in overcapacity which is closely associated with the stage of economic development.

China’s plastics processing industry, though an advanced manufacturing sector, cannot avoid such problems. It’s necessary to take actions against overcapacity, first of all, by surpressing excess supply from the source by raising entry threshold in terms of technology, environment, energy and resource utilization. Besides, the industry needs to phase out outdated production capacity, transform and upgrade itself, and explore overseas demand.

3. Be aware of the significant changes in opportunities and challenges in the plastics processing industry to aid its transformation

As a rising manufacturing sector, plastic processing is presented with rare opportunities along with severe challenges. The industry should make use of its competitive edge to improve quality and efficiency.

Increasing production costs is posing a huge problem. Besides shortages of resources and energy and stringent environment standards, coupled with economic adjustment, are hints that a high-cost era is fast approaching. It is a must to speed up transformation to absorb cost pressure and avoid being trapped in a low profit margin.

Previous growth that relies on high output, high power consumption, and low costs is no longer sustainable. Plastics processing should be transformed from exhaustion of resources to a key factors-intensive approach, and from expansion of production scale to innovation of technology. Only through technological advancements and upgrade of quality can new competitive advantages be fostered.

The utilization of resources, energy, and capital, as well as input/output ratios and labor productivity, have to be substantially improved. In addition, capital-intensive production should take center stage, investing in talent to enhance the quality of the whole industry chain.

The plastics market promises great prospects. Despite difficulties that arise during a transitional period, the plastic processing industry is poised for a steady and healthy development when it becomes truly technology-driven.

Optimism in 2014

The USA is recovering steadily; EU nations are poised for mild growth; emerging economies remain stable; while African countries show strong performance. All these situations indicate a better market environment in 2014.

The Chinese economy is going through an adjustment period, with some unresolved deep-lying controversies and issues after decades of high growth. Meanwhile, a lack of momentum in the economy makes it difficult to reduce excess supply. Overcapacity remains a stumbling block for China’s plastic processing industry.

After the National People’s Congress and the Chinese People’s Political Consultative Conference sessions in 2014, China is expected to speed up its economic reform. A new drive for urbanization and other means to absorb excess capacity in the plastics processing industry will create a favorable environment for future growth. The industry will maintain a steady upward trend in 2014.

About the author:

Qian Guijing is the president of the China Plastics Processing Industry Association.

Note:

The original version of this article was published in China Plastic & Rubber Journal (www.adsalecprj.com).