Regional Rotomolders Ride the Storm

By Peter J. Mooney

Figure 1: Trends in aggregate sales of a large sample of regional (N.A.) plastics processors, 2001-2011 (source: PCRS, “The State of the North American Plastics Processing Business: Review and Outlook,” August 2013).

Figure 1: Trends in aggregate sales of a large sample of regional (N.A.) plastics processors, 2001-2011 (source: PCRS, “The State of the North American Plastics Processing Business: Review and Outlook,” August 2013).

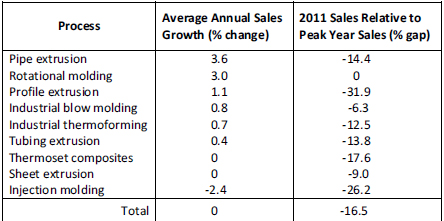

Table 1: Pattern of Sales Growth among Regional Structural Part Processors, 2000-2011

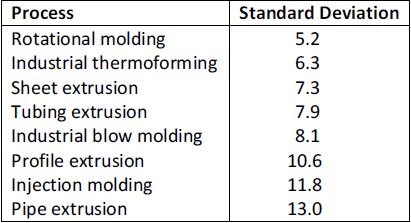

Table 2: Volatility of Annual Sales Growth among Structural Part Plastics Processors, 2000-2011

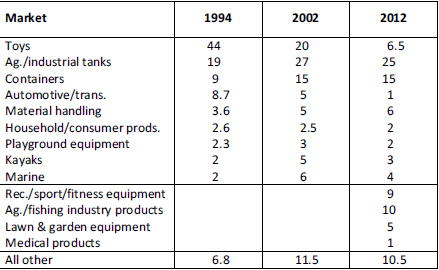

Table 3: Evolution of Leading Markets for Regional Rotomolders, 1994-2012 (% Shares)

Companies in the North American plastics processing business experienced extremely challenging market conditions over the course of the first decade of the new millennium, and those conditions have only marginally improved right up to the present. The U.S. economy, which accounts for 84% of regional GDP, sustained a mini-recession at the start of the decade and then endured the Great Recession towards the end of the decade. The latter was global in scope, so the Canadian and Mexican economies were also pulled down into this maelstrom.

How did the various plastics processing businesses fare during this difficult period, and what lies ahead? A new report from Plastics Custom Research Services (PCRS) addresses this issue. One of the interesting findings is that the rotomolders in this region came through the period 2000-2011 in much better shape than many other regional plastics processors.

Figure 1 portrays the trend of sales of a large sample (540) of U.S., Canadian, and Mexican plastics processors. We observe a minor sales setback (-0.3%) in 2002 and the strong recovery out to 2005.

Sales growth decelerated in 2006, and then came three years of steadily worsening conditions. The aggregate sales of these companies rebounded in 2010 and 2011. The average annual growth of sales registered by these plastics processors over the whole twelve-year period was 2.0%. In real (volume) terms there was probably no growth at all.

To drill deeper and study the trend of sales among the various regional plastics processing groups we need first of all to distinguish between two broad-based groups of plastics processors: namely, those producing structural parts and final products (e.g., automotive components) and those producing non-structural parts and final products (e.g., packaging). The latter group registered 3.7% average annual sales growth over the period 2000-2011. Meanwhile the average annual growth of regional structural plastics processors, taken as a group, was zero. In effect, this group of plastics processors endured a lost decade in sales terms. In real terms they ended up in 2011 with a volume of output lower than at the start of the new millennium.

The “New Normal” for Structural Part Molders

So how did the rotomolders fare in these “new normal” conditions in the regional structural plastic part processing business?

Table 1 presents data on the trend in the value of output of regional plastics processors competing in the regional structural plastic part market space. We observe that regional pipe extruders registered the highest average annual sales growth, at 3.6%. Yet, in terms of recovering from the Great Recession, their 2011 sales were 14.4% lower than their peak sales year of 2006. It will take three more years of roughly 5% sales growth to regain their 2006 peak sales—eight years in all.

Other groups of structural part processors fared much worse. Injection molders, many of which were battered and forced into bankruptcy by the collapse of the automotive industry, occupy the bottom of this table. Over the whole twelve-year period covered, the average annual change in their annual sales was -2.4%, and by 2011 their aggregate sales were 26.2% below their peak sales year of 2004. They would need five years of roughly 5% sales growth to regain their 2004 sales peak—eleven years in all.

Of all these groups of regional structural plastic part processors, rotomolders arguably fared best over the course of these tumultuous twelve years. They managed to achieve 3.0% average annual sales growth, and by 2011 their sales marginally exceeded their peak sales attained in 2008. In addition, over this twelve-year period, the regional rotomolders experienced the least volatile year-to-year sales pattern. This is confirmed in Table 2 below, setting out the standard deviations of year-to-year changes in the value of output of the various structural plastic part processing groups over the period 2000-2011. The rotomolders’ standard deviation was the lowest, at 5.2. By contrast, the pipe extruders, which registered the highest average annual growth rate over this period, experienced the greatest year-to-year sales volatility.

Regional Rotomolders Respond

What explains this strong, steady sales performance by the regional rotomolders over this difficult period? A bit of background on the process and its practitioners is warranted.

For the regional rotational molding business in 1995, the major market was toys, accounting for over 40% of total sales. Little Tikes was the largest rotomolder in the region—indeed in the world—and its annual value of output of rotomolded toys constituted an extraordinary 25% of the whole regional business. Yet Chinese toy manufacturers were taking over the global market. The rotomolders, injection molders, and all other plastics processors in North America involved in the toy market saw their sales steadily shrink. They had to replace lost toy sales by penetrating other markets, and that meant competing against thermoset composite processors, metal fabricators, blow molders, and other thermoplastic structural part processors. It also meant innovating and developing whole new applications for unmet needs.

Over the second half of the 1990s, and into the first decade of the new millennium, rotomolders broadened their customer base. They had a secure position in the agricultural and industrial tank business; steel tanks were vulnerable to corrosion, and no other plastics processing method can produce a large (e.g., 10,000-20,000 gallon [38,000-76,000 L]), seamless tank as cost-effectively. The marine industry was buoyant, and rotomolding was ideal for the production of light-weight boat parts replacing fiberglass, dock flotation units, and fuel tanks. And whereas the thermoformers had replaced almost all the aluminum canoes, rotomolded sit-in and sit-on kayaks were displacing thermoformed canoes at outdoor gear retail stores, camps, and lakeside resorts.

In Table 3 we portray the evolution of markets for regional rotomolders from the mid-1990s to the present. Several important features stand out in these data. First of all, the rotomolders’ reliance on the toy market declined sharply, although it still contributes 6-7% of annual sales. Secondly, the market shares of agricultural/industry tanks and containers have stabilized at around 25% and 15%, respectively. Thirdly, rotomolders have managed to penetrate growth markets reflective of changing demographics in the region (e.g., medical and fitness equipment).

This strategy of expanding market diversity contributed greatly to the relative stability of rotomolders’ annual sales, which we alluded to earlier. It served to set them apart from other structural plastic part processors. Injection molders depended heavily on the automotive industry; when that industry crashed, seven of the top ten automotive part injection molders were forced to file for bankruptcy. Profile extruders depended heavily on the housing industry; when that industry crashed, they found it hard to replace lost sales due to the limited design flexibility inherent in their process.

Rotomolders also confronted reduced demand and challenging environmental regulations in one of their major markets—namely, the marine industry. Yet they succeeded in promoting the cost/performance advantages of their process with designers in new markets, such as medical equipment, and expanding existing markets, such as containers and material-handling products in the agricultural, fishing, and livestock industries.

Many regional rotomolders have also broadened their customer bases by diversifying their plastics processing capabilities. The leading diversification routes have been injection molding and thermoforming. And since rotomolders risk losing accounts to blow molders when the volume of production ramps up, many of these companies have added a blow molding capability.

Conclusion

There were several other factors contributing to the fact that regional rotomolders were able to maintain moderate, yet steady growth in the value of their output over the recent past and recover more quickly from the Great Recession, while other regional structural plastic part processors suffered serious sales setbacks.

Part of the rationale relates to globalization. The emergence of China as “the workshop of the world” resulted in massive outsourcing of many structural plastic parts and final products formerly manufactured in North America. Regional injection molders were impacted the most, since China has vast comparative advantages in not only abundant, low-cost labor, but also inexpensive injection molding machinery and molds. If part design complexity is low and part volume requirements are high, regional OEMs had to at least consider the option of importing those parts from China.

Rotomolders lost some business to China (e.g., toys), yet they confront much less outsourcing and import competition, since the typical rotomolded part is large and either hollow or semi-hollow (that is, non-nestable), rendering long-distance shipping uneconomical. Moreover, the typical rotomolded part program is low volume, which provides another barrier to sourcing from foreign competitors.

Globalization has benefited regional rotomolders in another way. Insofar as globalization puts pressure on regional OEMs to remain competitive in domestic and foreign markets, this mandates producing or purchasing the lowest-cost plastic parts meeting the customer’s performance and quality requirements. Over time this focus on cost reduction has yielded a steady replacement of over-engineered parts by ones that simply meet performance specifications.

A good example of this force at work is the control panels or helm-stands on mid-sized boats. Originally these parts were fabricated out of aluminum. The boat companies eventually switched to fiberglass for greater design freedom. They then switched to thermoformed helm-stands, which met the performance specifications and saved on weight. And in recent years several boat companies have switched to rotomolded helm-stands. In this application, and many others, rotomolded polyethylene powder is a lower-cost alternative to thermoformed sheet, and it provides equivalent or superior durability.

In the end, much of the market success achieved by regional rotomolders during the challenging conditions experienced from 2000 right up to the present stems from the nature of the process and the character of the processors. Unlike injection molding, there are few economies of scale to be gained in expanding rotomolding operations past a certain point. So most regional rotomolders are single-site, moderate-scale operations. And whereas a few rotomolders rely exclusively on a single product (e.g., kayaks and agricultural/industrial tanks), the typical rotomolder deliberately cultivates a highly diversified customer base.

Consequently, in order to survive and thrive, rotomolders—many still owned and operated by the company founder—have to be entrepreneurial and nimble, constantly adjusting to the eternal ebb and flow of structural part markets, constantly looking for opportunities to convert parts made from traditional materials and alternative plastics processing methods to their evolving menu of materials and their uniquely versatile production method. This characteristic of entrepreneurship will continue to be the key to growing the regional rotomolding business going forward.

Reference Reports

- “An Analysis of the North American Rotational Molding Business,” PCRS, May 1995.

- “New Market Dynamics in Rotomolding,” PCRS, January 2003.

- “The Future of North American Rotational Molding,” PCRS, January 2012.

- “The State of the North American Plastics Processing Business: Review and Outlook,” PCRS, August 2013.

About the author: Dr. Peter J. Mooney is principal of Plastics Custom Research Services (PCRS), of Advance, North Carolina, USA. He researches and publishes multi-client plastics industry reports and conducts custom research programs. PCRS’s latest (August 2013) report, “The State of the North American Plastics Processing Business: Review and Outlook,” is available via www.plasres.com.

About the author: Dr. Peter J. Mooney is principal of Plastics Custom Research Services (PCRS), of Advance, North Carolina, USA. He researches and publishes multi-client plastics industry reports and conducts custom research programs. PCRS’s latest (August 2013) report, “The State of the North American Plastics Processing Business: Review and Outlook,” is available via www.plasres.com.