Additives Annual 2015: New Standards & Synergies

Let your imagination roam when considering what additives & colorants can bring to an application

Previous Article Next Article

By Michael Tolinski

Ever-multiplying plastics packaging requirements and other applications draw out new options in additives, like Dover Chemical’s Doverphos LGP-11 alternative thermal stabilizer for PE, discussed in this article (photo courtesy of Dover Chemical).

Additives are supporting more diverse product requirements—and the performance of other additives as well. Not only has the variety of stabilizers, colorants, and functional fillers and reinforcements increased, but the kinds of plastic properties made possible by these additives have expanded.

As additives become more diverse over time, it’s less likely that any single “best” chemistry or form can serve multiple applications. Why the diversity? There are many reasons, such as:

- end-use application demands have been getting more specific, extreme, and unusual;

- processors are wanting to use less resin in products—and are seeking faster cycle times—and they look to additives for help in these efforts; and

- more processors are looking for “greener” material alternatives.

Meanwhile, in trying to maximize the properties of conventional thermoplastics, polymer chemists may be running up against the natural limits of what can be enhanced in the molecular chain itself. For these polymers, additives can stretch properties to the next level.

“Future-Proof” Stabilization

In search of “greener” pastures, some additives suppliers are looking to serve customers’ interests in moving away from traditional chemistries that have fallen under the scrutiny of regulators.

For instance, Dover Chemical Corp. is the leading supplier of the common thermal stabilizer tris(4-nonyl-phenyl) phosphite (TNPP). But there’s nothing complicated about the reasoning behind the company’s release of an alternative to TNPP—Doverphos® LGP-11. “We’re essentially just providing our existing customer base with a [non-TNPP] option,” says Matt Fender, business manager, Polymer Additives.

Unlike TNPP and other stabilizers, LGP-11 is not produced from alkylphenols, explains Dover Chemical R&D director Mick Jakupca. “Most antioxidants are composed of or contain alkylphenols. Alkylphenols, as a general class of chemicals, are a focus of both consumer and regulatory organizations. Doverphos LGP-11 was engineered to offer the global plastics market a viable long-term alkylphenol-free alternative chemistry.”

The stabilizer is also “future-proof,” adds Jakupca, given that it has forward-looking characteristics in its composition: unlike traditional phosphite heat stabilizers, it’s polymeric, so it shows very low migration through the bulk polymer. This helps reduce or eliminate plateout and blooming of the antioxidant in blown- and cast-film applications, “which has been an industry-wide problem for decades,” Jakupca says. Plus testing shows it offers superior color hold.

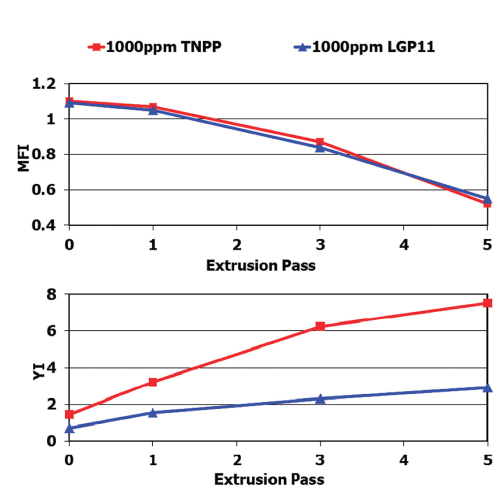

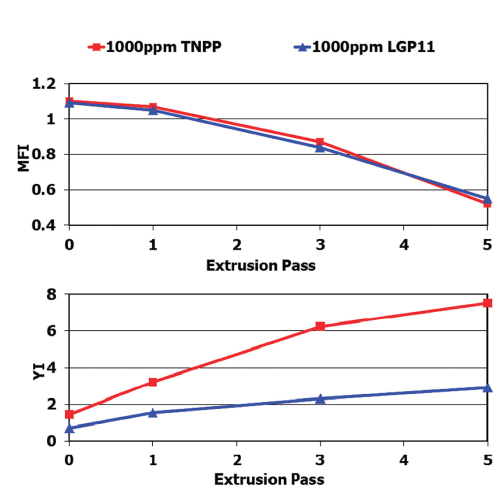

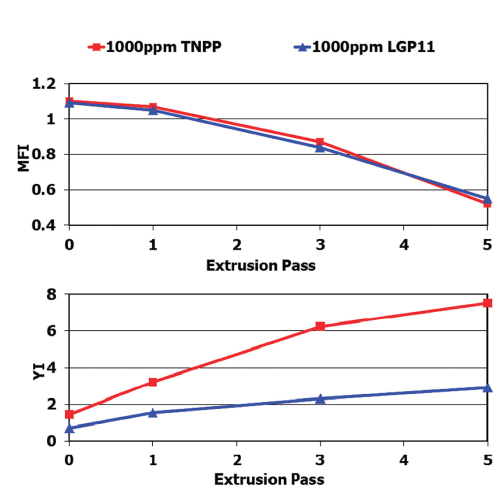

Over multiple extrusion passes, the melt flow index (MFI) performance of Dover Chemical’s LGP-11 thermal stabilizer in LLDPE compares well with that of an LLDPE with TNPP (top). Meanwhile, the color hold of the LGP-11 formulation, indicated by yellowness index (YI), is superior (bottom). (Note: In this testing, extrusion was at 245°C, and each formulation contained 600 ppm of primary antioxidant; the graphs were provided by Dover Chemical.)

The stabilizer suits companies that are looking to avoid nonylphenol-based materials. But “TNPP de-selection is not a legal issue,” emphasizes Jakupca. He cites the risk assessment on TNPP in the 1990s submitted to the U.S. FDA, which permits its use in food-contact applications.

In July, Dover confirmed that LGP-11 received FDA clearance as a thermal stabilizer in single- and repeated-use linear low density polyethylene (LLDPE) and high density polyethylene (HDPE) articles in contact with all food types, under “Conditions of Use” “A” through “H,” at loading levels in the polymer up to 2000 ppm. The company says LGP-11 is suitable not only for these most common applications in which TNPP is used, but also in high-impact polystyrene (HIPS), styrene-butadiene rubbers, urethanes, and PVC.

Fender says that his company and most of its customers “strongly believe this new platform of ‘Liquid Green Chemistry,’ which contains no alkylphenols, is a paradigm leap forward for the future of antioxidant systems for all polymers globally.”

Heat Management for “Cool Plastics”

Apart from the thermal stabilizers that protect the polymer from the heat of processing, other additives—specifically in this case, pigments—are being modified to manage the heat of the glaring sun in the final part application. At ANTEC® Orlando in March, Dietmar Mäder from Eckart GmbH presented findings related to the company’s EnergySafe solar-reflecting pigments for outdoor plastics applications (see also p. 48 of the January 2015 Plastics Engineering).

Mäder’s findings focused on how the company’s solar reflective effect pigments (SREPs), used in plastics, absorb solar radiation, especially in the near-infrared (NIR) range. The typical pigments, especially dark ones, absorb a great deal of NIR energy, heating up the material in heavily exposed applications, like roofing in building and construction. So solar energy-reflecting pigments are of interest.

BASF was among a number of pigment suppliers this year which released new series of products for plastics. This company photo shows a coffeemaker casing colored with a Lumina® Royal effect pigment, a series of products “characterized by their high brilliance, purity, and chromaticity,” says BASF.

In the paper, Mäder quantifies the amount of radiation reflected by the SREPs in polyolefin samples (PP molded plaques and LDPE blown films). Each sample’s “total solar reflectance” (TSR) was determined over the 280 to 2500 nm wavelength range. “TSR is a measure of the amount of incident solar energy reflected from a surface,” he notes, and is expressed as a proportion or percentage. A pigment with a relatively high TSR is generally considered an NIR reflective or “cool” color pigment. “Pigments with a high solar reflectance allow building surfaces to minimize absorption of solar energy by reflecting some of the incident solar radiation.”

Spectrometers and ASTM test methods were used to determine the TSRs for seven colors. As expected, the TSRs for black and brown SREP samples showed the lowest TSRs (from under 20% up to near 30%), and the white and light-colored pigments had the highest (40-60%). The “cool” pigments also showed less heat buildup in the plastic over time of exposure.

Mäder concludes that “these novel pigments provide high TSR efficiency, as well as outstanding outdoor durability (i.e., highest light fastness and weather stability).” The SREPs can used with any resin systems, he adds.

Visual Effects & Fillers

Adding style and brand identity to plastic products are new series of colorants which more and more often offer not just bright colors, but complex, almost textural surface patterns and combinations of colors.

One example is Ampacet’s FusionFx, four color palettes “that use proprietary technology to produce [a] random flow of color effects.” The effects enable designers to create molded parts that show the “raw beauty found in nature’s imperfections,” the company adds.

“FusionFx ensures that finished products are consistent, but never look exactly alike,” says Linda Carroll, color insight manager at Ampacet. The random, abstract surface patterns created offer the look of camouflage, rock, cork, or multi-color confetti, with each of these four “palettes” having six variations.

“Our proprietary masterbatch process produces randomized flow of color effects during the injection molding process, for what we call ‘consistent inconsistencies’,” says the company’s Doug Brownfield, adding that this enables “mass customization.”

Meanwhile, surface aesthetics and color quality can be influenced by additives that are more commonly used for mechanical property enhancement, such as the mineral filler talc. Imerys Talc has introduced Jetfine® 3CW talc, a North America-sourced alternative to its 3CA talc. The company says the talcs have a fine delaminated particle size distribution (about 1.3 microns, median) in a dispersible, easy-to-feed pelletized form, lending stiffness and low-temperature impact toughness to applications like automotive TPO panels and trim. And both the 3CW and 3CA talc have a 91 Y brightness level.

Ampacet’s FuisonFx series of effects colorants provide “consistent inconsistencies”—variable color patterns—in plastic products; this is the company’s “Carnival” palette from the series.

The company has also released a North America-sourced “bright white” talc, JetWhite® 7C, with a brightness of 92 Y. It’s recommended for enhancing stiffness, heat deflection temperature, dimensional stability, and impact strength in engineered polypropylene and TPOs.

“From micro-crystalline talc with low brightness, to very bright white, Imerys can help our customers meet nearly any challenge, economic or technical,” says North American Polymers market manager Chris Scarazzo.

Incorporating Minerals and Glass

Given the heavy use of fillers in plastics (like mineral flame retardants), more attention is being paid to how to better disperse and incorporate mineral particles in the resin. Here processing additives and coupling agents are becoming more effective aids.

Process additives from Struktol Company of America reportedly are targeted for thermoplastic compounds containing greater than 50% mineral fillers and exceptionally high loadings of flame retardants. (They also aid is dispersing difficult-to-disperse pigments and natural fibers, says the company.) The Struktol® TR 451 product reduces viscosity and improves mold release, with Struktol citing studies that show that adding TR 451 to PP allows for higher loadings of calcium carbonate without sacrificing processing or performance. Compounders may even be able to use less-expensive untreated fillers when using TR 451, the company suggests.

The product can be modified or combined with other process additives to offer more flow or lubricity or metal release. These “combination products” include Struktol TR 251 and 255, which include both surfactants and lubricants that work better than ethylene bis-stearamide or other single-component lubricants, in terms of color concentrate dispersion, gloss, flow, surface quality, and other properties, the company adds.

Coupling agents based on maleic anhydride (MA) are common tools for bonding the surface of glass fiber and other fibers to non-polar resins like PP. BYK Additives & Instruments recently developed the coupling agent Scona TPPP 9212, which is said to have very high (1.8%) MA content. The MA groups react with surface chemical groups on the glass-fiber size treatment, “thereby producing a very stable structure,” the company says. The relatively high MA content means improved mechanical properties, even at low dosages.

The coupling agent is made with BYK’s solid-phase MA grafting process, a “gentle manufacturing process” that requires relatively low temperatures leading to a reduced number of cleavage products, compared to melt grafting. The process reportedly also removes volatile components, resulting in low VOCs when manufacturing PP/glass-fiber compounds.

Other additives are designed to toughen glass fiber-reinforced engineering materials like polybutylene terephthalate and polyamide grades. An ANTEC 2015 paper from Polymer Dynamix, LLC summarized the impact-modifying abilities of an organosilicon-based additive called Flexil™.

The company co-authors explain that Flexil’s toughening mechanism “is slightly different than traditional plasticizers and tougheners.” It “increases the spacing in between the polymer chains,” but it lacks the inherent solubility of a plasticizer, so it doesn’t affect the glass transition temperature of the polymer. “Flexil acts similar to a hinge on a door or a joint in the body,” providing a point of movement without disrupting or interfering with the polymer chain, and resulting in a polymer that has greater flexibility and impact strength.

Testing with the modifier at 5-15% loadings showed it decreased modulus while increasing impact resistance significantly, compared with unmodified glass-filled PBT and PA. The authors also looked at elongation, which is usually much reduced by glass fibers. “This is one of the main drawbacks of glass reinforced polymer composites; fortunately Flexil helps to improve the elongation of the compound,” they add, doubling or tripling it.

Cost-Cutting Copolymer

Another development in modifying engineering resins discussed at ANTEC 2015 focused on lowering costs. A paper by co-authors from Vertellus Specialties Inc. discussed the company’s ZeMac® E60 ethylene-maleic anhydride copolymer. When compounded with BASF Ultramid® nylons, the copolymer increases properties of the material, thus allowing more low-cost recycled nylon to be used in place of the virgin grade to get virgin-like properties.

The copolymer creates a chain-extension reaction with the polyamide, even at low 1-2% loadings, the authors explain. “The end-group amines of nylon react with multiple groups in [the] 1:1 alternating ethylene-maleic anhydride (EMAh) copolymer chain,” creating a highly branched structure (one “that looks more like a centipede than an earthworm,” they add).

The modified nylon shows a non-Newtonian shear thinning rheology, allowing good injection molding and lower cycle times—while opening up more atypical applications for nylons in sheet, pipe, and profile extrusion, as well as foaming, blow molding, and thermoforming, they note.

The modified nylons also show improved tensile strength, elongation, elastic modulus, flexural strength and modulus, and impact strength, compared to the virgin nylon grade. The authors report similar improvements in the mechanicals of recycled nylon “sourced from fishnets, carpet scrap, and other post-industrial and post-consumer streams,” as long as it has reasonable purity.

Imerys’s Jetfine 3CW “high brightness” talc in light-colored automotive body panels helps the panel material maintain a balance of stiffness and cold impact performance (photo courtesy of Imerys).

However, in the initial introduction of these modifiers, they found that their “primary driver is not increased performance but rather reducing the cost of the compound.” One way of cost-cutting is to replace 20-25% of the virgin nylon with cheaper recycled nylon, and adding ZeMac to maintain properties which would otherwise drop off.

A cost model offered by the company can show how much net raw materials and processing costs can be saved, but roughly a “cost savings of 5 to 15% can be achieved by replacing or increasing the amount of recycled nylon in the compound and adding [the EMAh] at low levels.” The copolymer has sustainable benefits as well, they add: “Hopefully this work will help to reduce the amount of scrap nylon that today goes into landfills or is used for low-performance applications.”

Note: The ANTEC Orlando 2015 papers mentioned in this article can be obtained by phoning SPE customer service at U.S. 203-775-0471.

Mike Tolinski’s revised and expanded second edition of his first book, Additives for Polyolefins, was released in spring 2015; go to www.additivesforplastics.com to view its table of contents.

Additives Annual 2015: New Standards & Synergies

Let your imagination roam when considering what additives & colorants can bring to an application

Previous Article Next Article

By Michael Tolinski

Ever-multiplying plastics packaging requirements and other applications draw out new options in additives, like Dover Chemical’s Doverphos LGP-11 alternative thermal stabilizer for PE, discussed in this article (photo courtesy of Dover Chemical).

Additives are supporting more diverse product requirements—and the performance of other additives as well. Not only has the variety of stabilizers, colorants, and functional fillers and reinforcements increased, but the kinds of plastic properties made possible by these additives have expanded.

As additives become more diverse over time, it’s less likely that any single “best” chemistry or form can serve multiple applications. Why the diversity? There are many reasons, such as:

- end-use application demands have been getting more specific, extreme, and unusual;

- processors are wanting to use less resin in products—and are seeking faster cycle times—and they look to additives for help in these efforts; and

- more processors are looking for “greener” material alternatives.

Meanwhile, in trying to maximize the properties of conventional thermoplastics, polymer chemists may be running up against the natural limits of what can be enhanced in the molecular chain itself. For these polymers, additives can stretch properties to the next level.

“Future-Proof” Stabilization

In search of “greener” pastures, some additives suppliers are looking to serve customers’ interests in moving away from traditional chemistries that have fallen under the scrutiny of regulators.

For instance, Dover Chemical Corp. is the leading supplier of the common thermal stabilizer tris(4-nonyl-phenyl) phosphite (TNPP). But there’s nothing complicated about the reasoning behind the company’s release of an alternative to TNPP—Doverphos® LGP-11. “We’re essentially just providing our existing customer base with a [non-TNPP] option,” says Matt Fender, business manager, Polymer Additives.

Unlike TNPP and other stabilizers, LGP-11 is not produced from alkylphenols, explains Dover Chemical R&D director Mick Jakupca. “Most antioxidants are composed of or contain alkylphenols. Alkylphenols, as a general class of chemicals, are a focus of both consumer and regulatory organizations. Doverphos LGP-11 was engineered to offer the global plastics market a viable long-term alkylphenol-free alternative chemistry.”

The stabilizer is also “future-proof,” adds Jakupca, given that it has forward-looking characteristics in its composition: unlike traditional phosphite heat stabilizers, it’s polymeric, so it shows very low migration through the bulk polymer. This helps reduce or eliminate plateout and blooming of the antioxidant in blown- and cast-film applications, “which has been an industry-wide problem for decades,” Jakupca says. Plus testing shows it offers superior color hold.

Over multiple extrusion passes, the melt flow index (MFI) performance of Dover Chemical’s LGP-11 thermal stabilizer in LLDPE compares well with that of an LLDPE with TNPP (top). Meanwhile, the color hold of the LGP-11 formulation, indicated by yellowness index (YI), is superior (bottom). (Note: In this testing, extrusion was at 245°C, and each formulation contained 600 ppm of primary antioxidant; the graphs were provided by Dover Chemical.)

The stabilizer suits companies that are looking to avoid nonylphenol-based materials. But “TNPP de-selection is not a legal issue,” emphasizes Jakupca. He cites the risk assessment on TNPP in the 1990s submitted to the U.S. FDA, which permits its use in food-contact applications.

In July, Dover confirmed that LGP-11 received FDA clearance as a thermal stabilizer in single- and repeated-use linear low density polyethylene (LLDPE) and high density polyethylene (HDPE) articles in contact with all food types, under “Conditions of Use” “A” through “H,” at loading levels in the polymer up to 2000 ppm. The company says LGP-11 is suitable not only for these most common applications in which TNPP is used, but also in high-impact polystyrene (HIPS), styrene-butadiene rubbers, urethanes, and PVC.

Fender says that his company and most of its customers “strongly believe this new platform of ‘Liquid Green Chemistry,’ which contains no alkylphenols, is a paradigm leap forward for the future of antioxidant systems for all polymers globally.”

Heat Management for “Cool Plastics”

Apart from the thermal stabilizers that protect the polymer from the heat of processing, other additives—specifically in this case, pigments—are being modified to manage the heat of the glaring sun in the final part application. At ANTEC® Orlando in March, Dietmar Mäder from Eckart GmbH presented findings related to the company’s EnergySafe solar-reflecting pigments for outdoor plastics applications (see also p. 48 of the January 2015 Plastics Engineering).

Mäder’s findings focused on how the company’s solar reflective effect pigments (SREPs), used in plastics, absorb solar radiation, especially in the near-infrared (NIR) range. The typical pigments, especially dark ones, absorb a great deal of NIR energy, heating up the material in heavily exposed applications, like roofing in building and construction. So solar energy-reflecting pigments are of interest.

BASF was among a number of pigment suppliers this year which released new series of products for plastics. This company photo shows a coffeemaker casing colored with a Lumina® Royal effect pigment, a series of products “characterized by their high brilliance, purity, and chromaticity,” says BASF.

In the paper, Mäder quantifies the amount of radiation reflected by the SREPs in polyolefin samples (PP molded plaques and LDPE blown films). Each sample’s “total solar reflectance” (TSR) was determined over the 280 to 2500 nm wavelength range. “TSR is a measure of the amount of incident solar energy reflected from a surface,” he notes, and is expressed as a proportion or percentage. A pigment with a relatively high TSR is generally considered an NIR reflective or “cool” color pigment. “Pigments with a high solar reflectance allow building surfaces to minimize absorption of solar energy by reflecting some of the incident solar radiation.”

Spectrometers and ASTM test methods were used to determine the TSRs for seven colors. As expected, the TSRs for black and brown SREP samples showed the lowest TSRs (from under 20% up to near 30%), and the white and light-colored pigments had the highest (40-60%). The “cool” pigments also showed less heat buildup in the plastic over time of exposure.

Mäder concludes that “these novel pigments provide high TSR efficiency, as well as outstanding outdoor durability (i.e., highest light fastness and weather stability).” The SREPs can used with any resin systems, he adds.

Visual Effects & Fillers

Adding style and brand identity to plastic products are new series of colorants which more and more often offer not just bright colors, but complex, almost textural surface patterns and combinations of colors.

One example is Ampacet’s FusionFx, four color palettes “that use proprietary technology to produce [a] random flow of color effects.” The effects enable designers to create molded parts that show the “raw beauty found in nature’s imperfections,” the company adds.

“FusionFx ensures that finished products are consistent, but never look exactly alike,” says Linda Carroll, color insight manager at Ampacet. The random, abstract surface patterns created offer the look of camouflage, rock, cork, or multi-color confetti, with each of these four “palettes” having six variations.

“Our proprietary masterbatch process produces randomized flow of color effects during the injection molding process, for what we call ‘consistent inconsistencies’,” says the company’s Doug Brownfield, adding that this enables “mass customization.”

Meanwhile, surface aesthetics and color quality can be influenced by additives that are more commonly used for mechanical property enhancement, such as the mineral filler talc. Imerys Talc has introduced Jetfine® 3CW talc, a North America-sourced alternative to its 3CA talc. The company says the talcs have a fine delaminated particle size distribution (about 1.3 microns, median) in a dispersible, easy-to-feed pelletized form, lending stiffness and low-temperature impact toughness to applications like automotive TPO panels and trim. And both the 3CW and 3CA talc have a 91 Y brightness level.

Ampacet’s FuisonFx series of effects colorants provide “consistent inconsistencies”—variable color patterns—in plastic products; this is the company’s “Carnival” palette from the series.

The company has also released a North America-sourced “bright white” talc, JetWhite® 7C, with a brightness of 92 Y. It’s recommended for enhancing stiffness, heat deflection temperature, dimensional stability, and impact strength in engineered polypropylene and TPOs.

“From micro-crystalline talc with low brightness, to very bright white, Imerys can help our customers meet nearly any challenge, economic or technical,” says North American Polymers market manager Chris Scarazzo.

Incorporating Minerals and Glass

Given the heavy use of fillers in plastics (like mineral flame retardants), more attention is being paid to how to better disperse and incorporate mineral particles in the resin. Here processing additives and coupling agents are becoming more effective aids.

Process additives from Struktol Company of America reportedly are targeted for thermoplastic compounds containing greater than 50% mineral fillers and exceptionally high loadings of flame retardants. (They also aid is dispersing difficult-to-disperse pigments and natural fibers, says the company.) The Struktol® TR 451 product reduces viscosity and improves mold release, with Struktol citing studies that show that adding TR 451 to PP allows for higher loadings of calcium carbonate without sacrificing processing or performance. Compounders may even be able to use less-expensive untreated fillers when using TR 451, the company suggests.

The product can be modified or combined with other process additives to offer more flow or lubricity or metal release. These “combination products” include Struktol TR 251 and 255, which include both surfactants and lubricants that work better than ethylene bis-stearamide or other single-component lubricants, in terms of color concentrate dispersion, gloss, flow, surface quality, and other properties, the company adds.

Coupling agents based on maleic anhydride (MA) are common tools for bonding the surface of glass fiber and other fibers to non-polar resins like PP. BYK Additives & Instruments recently developed the coupling agent Scona TPPP 9212, which is said to have very high (1.8%) MA content. The MA groups react with surface chemical groups on the glass-fiber size treatment, “thereby producing a very stable structure,” the company says. The relatively high MA content means improved mechanical properties, even at low dosages.

The coupling agent is made with BYK’s solid-phase MA grafting process, a “gentle manufacturing process” that requires relatively low temperatures leading to a reduced number of cleavage products, compared to melt grafting. The process reportedly also removes volatile components, resulting in low VOCs when manufacturing PP/glass-fiber compounds.

Other additives are designed to toughen glass fiber-reinforced engineering materials like polybutylene terephthalate and polyamide grades. An ANTEC 2015 paper from Polymer Dynamix, LLC summarized the impact-modifying abilities of an organosilicon-based additive called Flexil™.

The company co-authors explain that Flexil’s toughening mechanism “is slightly different than traditional plasticizers and tougheners.” It “increases the spacing in between the polymer chains,” but it lacks the inherent solubility of a plasticizer, so it doesn’t affect the glass transition temperature of the polymer. “Flexil acts similar to a hinge on a door or a joint in the body,” providing a point of movement without disrupting or interfering with the polymer chain, and resulting in a polymer that has greater flexibility and impact strength.

Testing with the modifier at 5-15% loadings showed it decreased modulus while increasing impact resistance significantly, compared with unmodified glass-filled PBT and PA. The authors also looked at elongation, which is usually much reduced by glass fibers. “This is one of the main drawbacks of glass reinforced polymer composites; fortunately Flexil helps to improve the elongation of the compound,” they add, doubling or tripling it.

Cost-Cutting Copolymer

Another development in modifying engineering resins discussed at ANTEC 2015 focused on lowering costs. A paper by co-authors from Vertellus Specialties Inc. discussed the company’s ZeMac® E60 ethylene-maleic anhydride copolymer. When compounded with BASF Ultramid® nylons, the copolymer increases properties of the material, thus allowing more low-cost recycled nylon to be used in place of the virgin grade to get virgin-like properties.

The copolymer creates a chain-extension reaction with the polyamide, even at low 1-2% loadings, the authors explain. “The end-group amines of nylon react with multiple groups in [the] 1:1 alternating ethylene-maleic anhydride (EMAh) copolymer chain,” creating a highly branched structure (one “that looks more like a centipede than an earthworm,” they add).

The modified nylon shows a non-Newtonian shear thinning rheology, allowing good injection molding and lower cycle times—while opening up more atypical applications for nylons in sheet, pipe, and profile extrusion, as well as foaming, blow molding, and thermoforming, they note.

The modified nylons also show improved tensile strength, elongation, elastic modulus, flexural strength and modulus, and impact strength, compared to the virgin nylon grade. The authors report similar improvements in the mechanicals of recycled nylon “sourced from fishnets, carpet scrap, and other post-industrial and post-consumer streams,” as long as it has reasonable purity.

Imerys’s Jetfine 3CW “high brightness” talc in light-colored automotive body panels helps the panel material maintain a balance of stiffness and cold impact performance (photo courtesy of Imerys).

However, in the initial introduction of these modifiers, they found that their “primary driver is not increased performance but rather reducing the cost of the compound.” One way of cost-cutting is to replace 20-25% of the virgin nylon with cheaper recycled nylon, and adding ZeMac to maintain properties which would otherwise drop off.

A cost model offered by the company can show how much net raw materials and processing costs can be saved, but roughly a “cost savings of 5 to 15% can be achieved by replacing or increasing the amount of recycled nylon in the compound and adding [the EMAh] at low levels.” The copolymer has sustainable benefits as well, they add: “Hopefully this work will help to reduce the amount of scrap nylon that today goes into landfills or is used for low-performance applications.”

Note: The ANTEC Orlando 2015 papers mentioned in this article can be obtained by phoning SPE customer service at U.S. 203-775-0471.

Mike Tolinski’s revised and expanded second edition of his first book, Additives for Polyolefins, was released in spring 2015; go to www.additivesforplastics.com to view its table of contents.

Additives Annual 2015: New Standards & Synergies

Let your imagination roam when considering what additives & colorants can bring to an application

Previous Article Next Article

By Michael Tolinski

Ever-multiplying plastics packaging requirements and other applications draw out new options in additives, like Dover Chemical’s Doverphos LGP-11 alternative thermal stabilizer for PE, discussed in this article (photo courtesy of Dover Chemical).

Additives are supporting more diverse product requirements—and the performance of other additives as well. Not only has the variety of stabilizers, colorants, and functional fillers and reinforcements increased, but the kinds of plastic properties made possible by these additives have expanded.

As additives become more diverse over time, it’s less likely that any single “best” chemistry or form can serve multiple applications. Why the diversity? There are many reasons, such as:

- end-use application demands have been getting more specific, extreme, and unusual;

- processors are wanting to use less resin in products—and are seeking faster cycle times—and they look to additives for help in these efforts; and

- more processors are looking for “greener” material alternatives.

Meanwhile, in trying to maximize the properties of conventional thermoplastics, polymer chemists may be running up against the natural limits of what can be enhanced in the molecular chain itself. For these polymers, additives can stretch properties to the next level.

“Future-Proof” Stabilization

In search of “greener” pastures, some additives suppliers are looking to serve customers’ interests in moving away from traditional chemistries that have fallen under the scrutiny of regulators.

For instance, Dover Chemical Corp. is the leading supplier of the common thermal stabilizer tris(4-nonyl-phenyl) phosphite (TNPP). But there’s nothing complicated about the reasoning behind the company’s release of an alternative to TNPP—Doverphos® LGP-11. “We’re essentially just providing our existing customer base with a [non-TNPP] option,” says Matt Fender, business manager, Polymer Additives.

Unlike TNPP and other stabilizers, LGP-11 is not produced from alkylphenols, explains Dover Chemical R&D director Mick Jakupca. “Most antioxidants are composed of or contain alkylphenols. Alkylphenols, as a general class of chemicals, are a focus of both consumer and regulatory organizations. Doverphos LGP-11 was engineered to offer the global plastics market a viable long-term alkylphenol-free alternative chemistry.”

The stabilizer is also “future-proof,” adds Jakupca, given that it has forward-looking characteristics in its composition: unlike traditional phosphite heat stabilizers, it’s polymeric, so it shows very low migration through the bulk polymer. This helps reduce or eliminate plateout and blooming of the antioxidant in blown- and cast-film applications, “which has been an industry-wide problem for decades,” Jakupca says. Plus testing shows it offers superior color hold.

Over multiple extrusion passes, the melt flow index (MFI) performance of Dover Chemical’s LGP-11 thermal stabilizer in LLDPE compares well with that of an LLDPE with TNPP (top). Meanwhile, the color hold of the LGP-11 formulation, indicated by yellowness index (YI), is superior (bottom). (Note: In this testing, extrusion was at 245°C, and each formulation contained 600 ppm of primary antioxidant; the graphs were provided by Dover Chemical.)

The stabilizer suits companies that are looking to avoid nonylphenol-based materials. But “TNPP de-selection is not a legal issue,” emphasizes Jakupca. He cites the risk assessment on TNPP in the 1990s submitted to the U.S. FDA, which permits its use in food-contact applications.

In July, Dover confirmed that LGP-11 received FDA clearance as a thermal stabilizer in single- and repeated-use linear low density polyethylene (LLDPE) and high density polyethylene (HDPE) articles in contact with all food types, under “Conditions of Use” “A” through “H,” at loading levels in the polymer up to 2000 ppm. The company says LGP-11 is suitable not only for these most common applications in which TNPP is used, but also in high-impact polystyrene (HIPS), styrene-butadiene rubbers, urethanes, and PVC.

Fender says that his company and most of its customers “strongly believe this new platform of ‘Liquid Green Chemistry,’ which contains no alkylphenols, is a paradigm leap forward for the future of antioxidant systems for all polymers globally.”

Heat Management for “Cool Plastics”

Apart from the thermal stabilizers that protect the polymer from the heat of processing, other additives—specifically in this case, pigments—are being modified to manage the heat of the glaring sun in the final part application. At ANTEC® Orlando in March, Dietmar Mäder from Eckart GmbH presented findings related to the company’s EnergySafe solar-reflecting pigments for outdoor plastics applications (see also p. 48 of the January 2015 Plastics Engineering).

Mäder’s findings focused on how the company’s solar reflective effect pigments (SREPs), used in plastics, absorb solar radiation, especially in the near-infrared (NIR) range. The typical pigments, especially dark ones, absorb a great deal of NIR energy, heating up the material in heavily exposed applications, like roofing in building and construction. So solar energy-reflecting pigments are of interest.

BASF was among a number of pigment suppliers this year which released new series of products for plastics. This company photo shows a coffeemaker casing colored with a Lumina® Royal effect pigment, a series of products “characterized by their high brilliance, purity, and chromaticity,” says BASF.

In the paper, Mäder quantifies the amount of radiation reflected by the SREPs in polyolefin samples (PP molded plaques and LDPE blown films). Each sample’s “total solar reflectance” (TSR) was determined over the 280 to 2500 nm wavelength range. “TSR is a measure of the amount of incident solar energy reflected from a surface,” he notes, and is expressed as a proportion or percentage. A pigment with a relatively high TSR is generally considered an NIR reflective or “cool” color pigment. “Pigments with a high solar reflectance allow building surfaces to minimize absorption of solar energy by reflecting some of the incident solar radiation.”

Spectrometers and ASTM test methods were used to determine the TSRs for seven colors. As expected, the TSRs for black and brown SREP samples showed the lowest TSRs (from under 20% up to near 30%), and the white and light-colored pigments had the highest (40-60%). The “cool” pigments also showed less heat buildup in the plastic over time of exposure.

Mäder concludes that “these novel pigments provide high TSR efficiency, as well as outstanding outdoor durability (i.e., highest light fastness and weather stability).” The SREPs can used with any resin systems, he adds.

Visual Effects & Fillers

Adding style and brand identity to plastic products are new series of colorants which more and more often offer not just bright colors, but complex, almost textural surface patterns and combinations of colors.

One example is Ampacet’s FusionFx, four color palettes “that use proprietary technology to produce [a] random flow of color effects.” The effects enable designers to create molded parts that show the “raw beauty found in nature’s imperfections,” the company adds.

“FusionFx ensures that finished products are consistent, but never look exactly alike,” says Linda Carroll, color insight manager at Ampacet. The random, abstract surface patterns created offer the look of camouflage, rock, cork, or multi-color confetti, with each of these four “palettes” having six variations.

“Our proprietary masterbatch process produces randomized flow of color effects during the injection molding process, for what we call ‘consistent inconsistencies’,” says the company’s Doug Brownfield, adding that this enables “mass customization.”

Meanwhile, surface aesthetics and color quality can be influenced by additives that are more commonly used for mechanical property enhancement, such as the mineral filler talc. Imerys Talc has introduced Jetfine® 3CW talc, a North America-sourced alternative to its 3CA talc. The company says the talcs have a fine delaminated particle size distribution (about 1.3 microns, median) in a dispersible, easy-to-feed pelletized form, lending stiffness and low-temperature impact toughness to applications like automotive TPO panels and trim. And both the 3CW and 3CA talc have a 91 Y brightness level.

Ampacet’s FuisonFx series of effects colorants provide “consistent inconsistencies”—variable color patterns—in plastic products; this is the company’s “Carnival” palette from the series.

The company has also released a North America-sourced “bright white” talc, JetWhite® 7C, with a brightness of 92 Y. It’s recommended for enhancing stiffness, heat deflection temperature, dimensional stability, and impact strength in engineered polypropylene and TPOs.

“From micro-crystalline talc with low brightness, to very bright white, Imerys can help our customers meet nearly any challenge, economic or technical,” says North American Polymers market manager Chris Scarazzo.

Incorporating Minerals and Glass

Given the heavy use of fillers in plastics (like mineral flame retardants), more attention is being paid to how to better disperse and incorporate mineral particles in the resin. Here processing additives and coupling agents are becoming more effective aids.

Process additives from Struktol Company of America reportedly are targeted for thermoplastic compounds containing greater than 50% mineral fillers and exceptionally high loadings of flame retardants. (They also aid is dispersing difficult-to-disperse pigments and natural fibers, says the company.) The Struktol® TR 451 product reduces viscosity and improves mold release, with Struktol citing studies that show that adding TR 451 to PP allows for higher loadings of calcium carbonate without sacrificing processing or performance. Compounders may even be able to use less-expensive untreated fillers when using TR 451, the company suggests.

The product can be modified or combined with other process additives to offer more flow or lubricity or metal release. These “combination products” include Struktol TR 251 and 255, which include both surfactants and lubricants that work better than ethylene bis-stearamide or other single-component lubricants, in terms of color concentrate dispersion, gloss, flow, surface quality, and other properties, the company adds.

Coupling agents based on maleic anhydride (MA) are common tools for bonding the surface of glass fiber and other fibers to non-polar resins like PP. BYK Additives & Instruments recently developed the coupling agent Scona TPPP 9212, which is said to have very high (1.8%) MA content. The MA groups react with surface chemical groups on the glass-fiber size treatment, “thereby producing a very stable structure,” the company says. The relatively high MA content means improved mechanical properties, even at low dosages.

The coupling agent is made with BYK’s solid-phase MA grafting process, a “gentle manufacturing process” that requires relatively low temperatures leading to a reduced number of cleavage products, compared to melt grafting. The process reportedly also removes volatile components, resulting in low VOCs when manufacturing PP/glass-fiber compounds.

Other additives are designed to toughen glass fiber-reinforced engineering materials like polybutylene terephthalate and polyamide grades. An ANTEC 2015 paper from Polymer Dynamix, LLC summarized the impact-modifying abilities of an organosilicon-based additive called Flexil™.

The company co-authors explain that Flexil’s toughening mechanism “is slightly different than traditional plasticizers and tougheners.” It “increases the spacing in between the polymer chains,” but it lacks the inherent solubility of a plasticizer, so it doesn’t affect the glass transition temperature of the polymer. “Flexil acts similar to a hinge on a door or a joint in the body,” providing a point of movement without disrupting or interfering with the polymer chain, and resulting in a polymer that has greater flexibility and impact strength.

Testing with the modifier at 5-15% loadings showed it decreased modulus while increasing impact resistance significantly, compared with unmodified glass-filled PBT and PA. The authors also looked at elongation, which is usually much reduced by glass fibers. “This is one of the main drawbacks of glass reinforced polymer composites; fortunately Flexil helps to improve the elongation of the compound,” they add, doubling or tripling it.

Cost-Cutting Copolymer

Another development in modifying engineering resins discussed at ANTEC 2015 focused on lowering costs. A paper by co-authors from Vertellus Specialties Inc. discussed the company’s ZeMac® E60 ethylene-maleic anhydride copolymer. When compounded with BASF Ultramid® nylons, the copolymer increases properties of the material, thus allowing more low-cost recycled nylon to be used in place of the virgin grade to get virgin-like properties.

The copolymer creates a chain-extension reaction with the polyamide, even at low 1-2% loadings, the authors explain. “The end-group amines of nylon react with multiple groups in [the] 1:1 alternating ethylene-maleic anhydride (EMAh) copolymer chain,” creating a highly branched structure (one “that looks more like a centipede than an earthworm,” they add).

The modified nylon shows a non-Newtonian shear thinning rheology, allowing good injection molding and lower cycle times—while opening up more atypical applications for nylons in sheet, pipe, and profile extrusion, as well as foaming, blow molding, and thermoforming, they note.

The modified nylons also show improved tensile strength, elongation, elastic modulus, flexural strength and modulus, and impact strength, compared to the virgin nylon grade. The authors report similar improvements in the mechanicals of recycled nylon “sourced from fishnets, carpet scrap, and other post-industrial and post-consumer streams,” as long as it has reasonable purity.

Imerys’s Jetfine 3CW “high brightness” talc in light-colored automotive body panels helps the panel material maintain a balance of stiffness and cold impact performance (photo courtesy of Imerys).

However, in the initial introduction of these modifiers, they found that their “primary driver is not increased performance but rather reducing the cost of the compound.” One way of cost-cutting is to replace 20-25% of the virgin nylon with cheaper recycled nylon, and adding ZeMac to maintain properties which would otherwise drop off.

A cost model offered by the company can show how much net raw materials and processing costs can be saved, but roughly a “cost savings of 5 to 15% can be achieved by replacing or increasing the amount of recycled nylon in the compound and adding [the EMAh] at low levels.” The copolymer has sustainable benefits as well, they add: “Hopefully this work will help to reduce the amount of scrap nylon that today goes into landfills or is used for low-performance applications.”

Note: The ANTEC Orlando 2015 papers mentioned in this article can be obtained by phoning SPE customer service at U.S. 203-775-0471.

Mike Tolinski’s revised and expanded second edition of his first book, Additives for Polyolefins, was released in spring 2015; go to www.additivesforplastics.com to view its table of contents.