Plastics in the Driver’s Seat

OEMs and Tier 1 suppliers are advancing the design of automotive seating with enhanced materials and constructions

Previous Article Next Article

By Pat Toensmeier

Plastics in the Driver’s Seat

OEMs and Tier 1 suppliers are advancing the design of automotive seating with enhanced materials and constructions

Previous Article Next Article

By Pat Toensmeier

Plastics in the Driver’s Seat

OEMs and Tier 1 suppliers are advancing the design of automotive seating with enhanced materials and constructions

Previous Article Next Article

By Pat Toensmeier

The Lexus LF-NX hybrid SUV concept vehicle has an ergonomic, driver-focused cabin in which the seating is both attractive and designed to open up space (photo courtesy of Lexus).

The Lexus LF-NX hybrid SUV concept vehicle has an ergonomic, driver-focused cabin in which the seating is both attractive and designed to open up space (photo courtesy of Lexus).

Industry standard jounce and squirm tests qualify the durability of seating (photo courtesy of Jeffrey Sauger/Chevrolet).

Industry standard jounce and squirm tests qualify the durability of seating (photo courtesy of Jeffrey Sauger/Chevrolet).

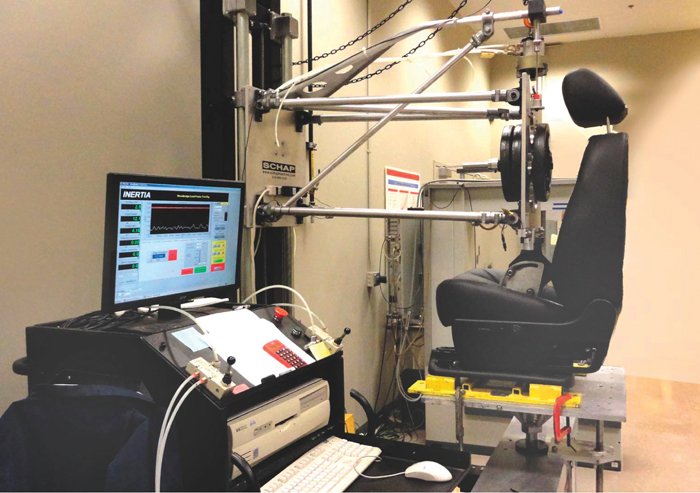

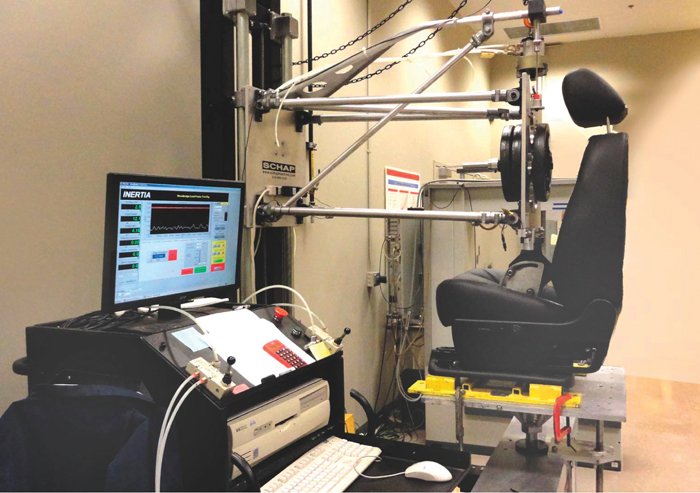

Woodbridge tests its VibControl foam to ensure it keeps vibrations well below levels of human sensitivity (photo courtesy of Woodbridge Group).

Woodbridge tests its VibControl foam to ensure it keeps vibrations well below levels of human sensitivity (photo courtesy of Woodbridge Group).

The Gen 3 Synergy Seat from Johnson Controls is an exercise in reducing the weight and complexity of luxury seating (photo courtesy of Johnson Controls).

The Gen 3 Synergy Seat from Johnson Controls is an exercise in reducing the weight and complexity of luxury seating (photo courtesy of Johnson Controls).

Boshoku Automotive Europe uses SynFlow, a hot-runner control system from Synventive, to eliminate appearance problems in a molded Audi backrest; the photo shows a clean part due to controlled melt flow (photo courtesy of Synventive Molding Solutions).

Boshoku Automotive Europe uses SynFlow, a hot-runner control system from Synventive, to eliminate appearance problems in a molded Audi backrest; the photo shows a clean part due to controlled melt flow (photo courtesy of Synventive Molding Solutions).

Seating is one of the last things consumers consider when buying a car, light truck, or sport utility vehicle. Vehicle styling, color, performance, options, fuel efficiency… certainly. But seating? Unless it’s too small or uncomfortable, or both, no one puts seating high on a list of priorities when shopping for a ride.

Nevertheless, automotive seating and related components (such as headrests, armrests, and consoles) are at the center of a surge in design and engineering that’s yielding sophisticated construction concepts and advances in materials and formulations.

Designers, for example, increasingly use multiple foam densities in seat construction to achieve various properties, from improvements in comfort and support to vibration damping, smaller seat mass, and, in some cases, lower weight. Ongoing efforts also focus on replacing the metal parts of seating frames with composites and engineered plastics to both reduce weight and improve styling—and this is influenced by the design flexibility of plastics.

At the same time, seating contributes to efforts by automakers to significantly reduce interior emissions of volatile organic compounds (VOCs) and meet growing sustainability requirements of global OEMs and Tier 1 suppliers. Flexible foam suppliers are developing formulations and even precursors for these requirements.

The result of all this is an evolving area of automotive innovation, led by enhancements to the flexible TDI (toluene diisocyanate) and MDI (methylene diphenyl diisocyanate) polyurethane foams used in virtually all seating. There might not be blockbuster developments produced every model year, but the foams are vital to the comfort, safety, fuel economy, and aesthetics of vehicles.

At stake for auto OEMs and Tier 1 suppliers is a huge global market with diverse styling requirements. Seating must not only meet the expectations of performance among automakers, which are mostly expressed as comfort and utility, but be accepted in multiple market niches, from economy vehicles to luxury platforms, conventional gasoline-powered cars, and hybrids and all-electrics. Lexus, for one, has developed a concept vehicle, the LF-NX hybrid SUV with off-road capabilities, for the “premium compact crossover” market, which doubtless appeals to younger buyers.

Custom capabilities are requirements as well, as automakers seek to differentiate their brands from those of competitors. And in major markets like North America, Europe, Asia, and Japan, demographics such as aging populations, youth-centric societies, or a fast-growing middle class, help determine seat design, engineering and pricing.

PUR Innovation

Much of seating development comes down to innovations in established materials and processing techniques, notably of foam structures for seating, which are almost made entirely

of polyurethane (PUR) and critical to a seat’s construction and performance.

PUR technology is “very mature in seating and tends to be commoditized,” notes Ana Wagner, global strategic marketing manager at Dow Automotive Systems. The company, however, has recently worked with development partner Faurecia Automotive Seating to commercialize a catalyst-free PUR chemistry that could rank as a rare groundbreaking innovation for foam seating.

The material, SPECFLEX Activ, represents years of work by Dow (one paper on the topic was presented in 2001 at a meeting of the Alliance for the Polyurethanes Industry). The material is formulated to substantially reduce amine-based VOCs in vehicles by eliminating the use of amine catalysts in PUR foam.

Most PUR foam uses amine catalysts to promote gelling and blowing reactions between polyols and water and the isocyanate side of formulations. Wagner says Dow Automotive eliminated the need for amine catalysts by developing an additive family of reactive (autocatalytic) polyols that provides balanced catalytic activity in processing.

Among the factors behind this development are growing efforts by regulatory authorities to minimize exposure to amine emissions, not only for vehicle occupants but also workers in foam plants. Much of this effort originated overseas. The Japanese Automobile Manufacturers Association adopted VOC rules a while ago, as did the German automobile industry, or VDA (Verband der Automobilindustrie), whose Odor VDA 270 rule covers amine emissions.

Wagner says that prior to the commercialization of SPECFLEX Activ, most PUR foams “barely passed” emission tests at German automotive OEMs. Now foams made with the Dow material “pass or exceed [VDA] emission requirements,” she says.

The material has added benefits in its ability to improve foam processing and upgrade the mechanical and aging properties of foam products, regardless of their firmness and density. Importantly, because local regulations governing vehicles tend to migrate with the vehicles made in one region, demand for the product could extend beyond Germany and Europe. North American OEMs and Tier 1 suppliers are already testing the material, Wagner reports, since emission rules will affect the models they export and could eventually be part of U.S. regulations.

Faurecia plans to supply seats foamed with SPECFLEX Activ for undisclosed European vehicles by the end of the year. Wagner believes that the chemistry could be used in models from North American OEMs by the end of 2015.

Recycled Foam

Sustainable automotive parts have long been a developmental requirement of OEMs. Many models incorporate components with natural fiber reinforcements and, of course, recycled plastics. PUR foams, as well, use sustainable materials. BASF, for example, is supplying a castor oil-based foam that not only reduces the petrochemical content of automotive parts, but provides performance benefits as well.

Called Elastoflex Bio, the material, developed at the company’s facility in Wyandotte, Michigan, initially appeared in instrument panels (IPs) in the Ford Focus and Taurus models, in North America in 2012. Since then, BASF has been “aggressively marketing the product and technology, features and benefits” for use in headsets, armrests, and center consoles, says Jeff Hagar, interior market segment manager for performance materials.

“We are cascading this technology into other areas [beyond IPs],” he adds. “We have the chemistry developed and look to monetize it in the future.”

Hagar declined to discuss potential customers for Elastoflex Bio beyond Ford, but puts the timeline for other applications at one to two years. He believes it will find acceptance for two reasons: “It represents a commitment to the environment, and there are no tradeoffs in processing, performance, or finished goods.”

Elastoflex Bio, which is listed in patent literature as an MDI-based foam solution, has a 12 wt% castor oil content, Hagar says. The chemistry behind it involves adding castor oil to the polyol side of the formulation between the A and B components, along with an isocyanate prepolymer, polymeric compounds with isocyanate reactive groups, optional chain extenders and/or crosslinking agents, and additives, to form a reactive mixture.

BASF has released figures that show the material has achieved 36% greater tensile strength in IP foam than the undisclosed material it replaced. This means that the foam will maintain its shape better over time and use. Tear strength also increased by 5% with Elastoflex Bio, and elongation—a measure of stretch under temperature or impact—was reduced by 12%. BASF further reports that with a 43% reduction in cure time, the productivity of foam fabrication increases, while improvements in processing (notably flow) minimize scrap.

Hagar notes another benefit of castor oil: It doesn’t affect food supplies. Because some bio-based materials are derived from food sources (think ethanol and corn), there have been occasional concerns about regional shortfalls in supply and spikes in prices that affect consumers. Ford is among the OEMs that have used foam seating with soy in the formulation. The Elastoflex Bio foam uses castor oil sourced from tropical regions such as India where it’s abundant and readily available for harvest.

More Room in Lighter Cars

Another trend affecting materials development and seating construction is the push by OEMs to increase cabin space in vehicles. Much of this activity centers on small cars, especially sub-compacts, where space is at a premium. But it also applies to electric and hybrid vehicles, most versions of which tend to be small or, as with all-electrics, laid out around the ample battery compartment.

“There are requirements for low-profile seats,” Hagar remarks. Every inch or even half-inch of mass that can be removed from a seat opens up cabin space.

This also contributes to a reduction in vehicle weight. Although most lightweighting benefits in seats come from replacing metal components with engineered plastics or composites, foam offers a large mass of material whose weight can in some cases be reduced to help meet fuel efficiency rules like the U.S. government’s CAFE (Corporate Average Fuel Economy) standards.

“Seat providers are exploring all means of maintaining or improving seat performance while making a demonstrable contribution to reach CAFE goals,” affirms Bob Walker, a spokesman for PUR materials supplier Bayer MaterialScience. “Automotive seating is required to satisfy a number of performance requirements with respect to occupant comfort and well-being, passenger safety, and overall cockpit functionality. These performance requirements are now complemented by the holistic desire to reduce the mass of the vehicle in response to CAFE standards.”

“Jounce and Squirm”-Tested Comfort

Foam adds weight, but mostly to achieve performance in a crucial area: passenger comfort. This not only includes how a seat feels when someone sits in it, but related concerns such as vibration damping during vehicle operation. Without the ability to neutralize automotive vibrations, long journeys would cause fatigue and could induce nausea in occupants.

So techniques are being developed that reduce seating weight and thickness without affecting properties. One such involves the use of multiple foams in a seat to meet comfort and stability needs while achieving lower-profile assemblies. Some seat makers take this concept further and place different foam densities within individual sections of a seating pad to meet performance needs.

The Woodbridge Group, a major global seat maker based in Mississauga, Ontario, Canada, announced last September the development of GreenLite PUR formulations for the production of extreme low-mass, TDI-based, high-resiliency foams. The materials are designed to provide significant advantages in dynamic comfort, weight and cost.

With the system “Woodbridge can independently control the density and firmness of up to four seating pad sections,” says the company’s Ed Cauchi.

Based on data developed from industry standard jounce and squirm tests, a driver’s seat, for example, can have a pair of bolsters on either side with a hard firmness rating of 41 N, a soft rear section of 22 N, a low-mid firmness rating of 26 N in the center, and a high-mid firmness rating of 30 N at the front end.

By distributing mass/density zones throughout the seat and back, Woodbridge claims significant weight and cost savings in seat fabrication. In one example, the company estimates driver-side seat-weight savings of 24% and cost savings of 5%. For the passenger seat weight, savings of 36% were achieved, along with a 7% cost reduction.

Woodbridge achieves multiple mass/density zones in pads with a proprietary robotic pouring technique called Stream Architecture, an established process that the company continually upgrades. The process programs a seat’s “DNA spec,” as Cauchi calls it, based on what an OEM or Tier 1 wants in look, feel, and comfort. Partitions are placed in molds on a carousel to separate formulations. When a mold indexes beneath a robotic pouring head, each section is filled with the formulation necessary to meet its mass/density specification.

The processing system can also be set up to insert-mold rigid PUR or expanded polypropylene foam frame components in the cushions, which helps further reduce seat weight.

Cauchi credits the company’s foam formulations to a large staff of chemical engineers. None of the PUR mixtures used for multiple mass/density foaming are derived from off-the-shelf solutions.

One critical area of development is the company’s VibControl vibration management foam. This tailors PUR to effectively manage vehicle vibrations by lowering attenuation and resonance peaks and keeping vibrational transmissibility well below the level of human sensitivity. Generally, vibrations that generate more than 6 Hz of internal organ resonance will induce nausea.

VibControl foam achieves the right balance of damping and seating comfort. It analyzes a vehicle’s unique harmonic signature and develops a damping target that is met with a combination of foam properties.

“Vibration management is a big problem in the 11th hour of automotive development,” Cauchi remarks.

Driving fatigue, in fact, “is your body dealing with micro-vibrations generated by cars,” says Tom Gould, director of design, research, and craftsmanship at Johnson Controls. Gould affirms the importance of developing foam structures that absorb these vibrations, and adds that if this can be done “with thinner foam versions, that’s great” in terms of the potential for weight and cost savings.

Synergized Materials

Johnson Controls is making significant strides in the development of world-class seating systems. The global organization, based in Milwaukee, Wisconsin, USA, has developed a number of techniques for reducing the size and weight of seating systems. “We are always rethinking how to put seats together,” Gould says.

Areas in which the company experiments includes replacing all-metal seating frames with steel and aluminum hybrids combined with composites. “As joining technologies improve, this assembly [concept] will work better,” he comments.

“Because we are working to thin-down plastics as much as possible, we look at fiber-filled materials such as glass-reinforced polyamides (PA) and polypropylene (PP),” says Ed Harrison, subject matter technical expert for polyethylene at Johnson Controls. Grades here include PA 6 and 66, with 13 to 33% reinforcement levels. The company is familiar with reinforced PAs and with PP, and sees potential in applying them as metal replacements, possibly with new fabrication techniques, to improve seating design.

Many of the company’s latest design concepts were presented last year at auto shows in the USA and Germany in the Gen 3 Synergy Seat, a concept designed to highlight Johnson Controls’ ability to reduce the weight and complexity of luxury seating while improving comfort and safety.

Features of the fully powered Synergy Seat include: the use of eco-friendly materials, including a “breathable,” moisture-wicking fabric; a fiber-reinforced composite back frame with low mass and improved packaging efficiency; the company’s VariTec horizontal layering cushion with dual layers of multiple-hardness PUR foams consolidated in one structure for short-term and long-term comfort; and a powered four-way passive head restraint with fore-and-aft locking and an up-down height adjuster.

The composite back frame is notable, Gould says, because it’s an exposed feature, and one with aesthetics. “It lets us get a little thinner with the seat, and dial-in what the structure can achieve. Steel remains a staple of seating design but has limits to its shape. With plastics you can achieve a lot of variations,” he remarks.

“Incremental” Process Advancements

The equipment used in fabricating seating systems, whether foam-molding lines, injection molding machines and molds, compression molding systems, or other hardware, is relatively standard. Seating executives generally say that process changes in these areas are incremental.

Occasionally, a process advance emerges. Boshoku Automotive Europe, a Tier 1, has been able to improve the aesthetics of a new injection-molded seat backrest for the Audi A3. It uses a hot runner technology called SynFlow that was developed by Synventive Molding Solutions of Peabody, Massachusetts, USA.

Boshoku uses a cascade molding process to produce two textured backrests per cycle, which are installed without coatings. Cascade molding, as the name suggests, opens valve gate nozzles in a sequential process designed to eliminate weld lines.

The parts, each molded of 15% talc-reinforced PP and weighing 800 g, ran into appearance problems because the hot runner nozzles, whose openings were delayed during sequential mold flow, injected melt under full pressure. This created a burst of expanding melt in the cavities and a surge in flow-front velocity. Resulting surface problems included gloss differences caused by pressure alteration and gating marks.

SynFlow is a velocity- and position-dependent opening-stroke control system for hydraulic valve-gated hot runners. It lets operators set the initial opening velocity of the valve pins and the length of the opening stroke over which the velocity is controlled, by regulating the flow of hydraulic fluid to the opening port of the valve-gate piston.

With the system, Boshoku is able to control how quickly valve pins open, and eliminate the sudden burst of melt into the cavities. As a result, the appearance of the Audi A3 backrests has improved and rejects have been minimized.