As we begin 2016, a number of factors, including low crude prices, a strong U.S. dollar, and bearish market sentiment in China, are creating opportunities for buyers of engineering resins to find new leverage points. Nylon is certainly not immune to these global influences, but underlying demand is strong, particularly in the automotive segment, and leading producers continue to benefit from innovations that create value and increase demand.

Innovations Drive Market Demand

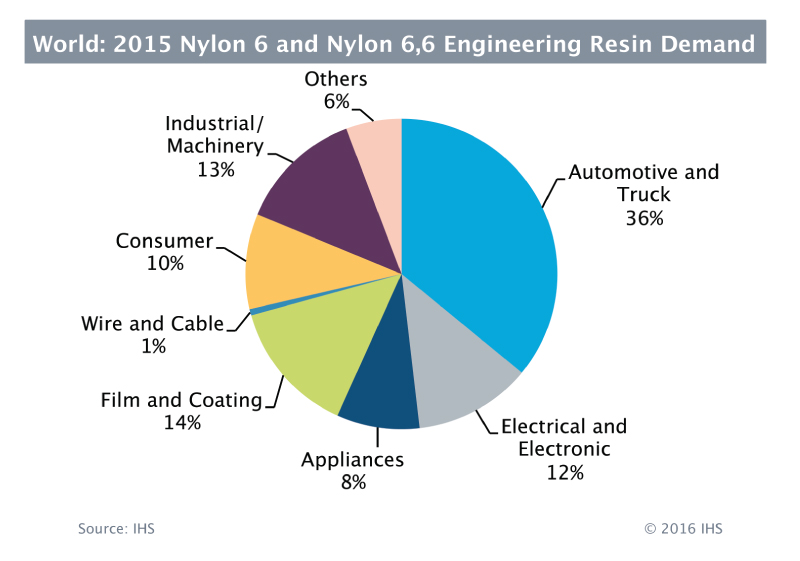

Global nylon consumption is growing almost 3% per year, as new applications—often improving upon conventional metal designs—are brought to market. This is especially evident in the automotive market, where nylon continues to provide solutions for improved fuel efficiency, safety performance, styling, and durability.

Nylon is most often the polymer of choice for automotive applications requiring heat endurance, fuel and oil resistance, and mechanical durability. Underhood and structural applications such as engine oil pans, transmission oil pans, engine mounts, and strut mounts—until recently in the realm of metal—are notable examples of parts now being made of nylon compounds.

The combined goals of weight and cost reduction, often coupled with performance advantages, drive material selection and prompt collaboration by leading nylon producers, Tier 1 suppliers, and OEMs—and this frequently yields parts consolidation and reduction of secondary operations, compared with conventional approaches.

Production Capacity Exceeds Demand Requirements

Global nylon 6 resin capacity will increase over 30% in 2016, paced by Northeast Asia, where several new lines are being constructed by several producers. In addition to a new nylon 6 capacity addition in Western Europe in 2014, new nylon 6 and nylon 66 capacity is being added in North America, aimed at markets for engineering compounds and film. As a result, global nylon 6 production operating rates are forecast to be suppressed for several years until demand absorbs that new capacity.

Global production capacity for nylon 66 is about one-third the size of nylon 6 capacity. While 40% of nylon 66 capacity currently resides in North America, the most significant increases are underway in Northeast Asia, where the capacity is forecast to rise 50% over the 2015/2016 time period. With the recent demand slowdown in China, this capacity increase is putting pressure on operating rates and ensuring at least a sufficient supply of nylon 66 during the midrange outlook.

Lower prospects for economic activity in China, combined with ample supply, could prompt Asian nylon producers to increase their efforts to sell more resin and compounds in Europe and North America. The key question facing the industry is how quickly the emerging supply will be absorbed through rising demand from innovative applications.

The author Brendan Dooley is director, Engineering Resins North America, for IHS Chemical and can be reached at brendan.dooley@IHS.com.

Resin Market Focus, by IHS Chemical, provides ongoing insights into key industry topics and trends for major plastics and engineering resins, covering all major regions. IHS Chemical provides extensive industry insight, analytics, and data for over 300 chemical markets worldwide, including global plastics, polymers, and engineering resins. Learn more or inquire about IHS Chemical content at 877-225-8188, or email us at AmericasTQ@ihs.com.