“Shale Gas-Advantaged” Plastics

They’re expected to dramatically boost U.S. jobs & expo

Previous Article Next Article

By American Chemistry Council

“Shale Gas-Advantaged” Plastics

They’re expected to dramatically boost U.S. jobs & expo

Previous Article Next Article

By American Chemistry Council

“Shale Gas-Advantaged” Plastics

They’re expected to dramatically boost U.S. jobs & expo

Previous Article Next Article

By American Chemistry Council

These values refer to U.S. manufacturers of plastic materials (resins) in 2013.

These values refer to U.S. manufacturers of plastic materials (resins) in 2013.

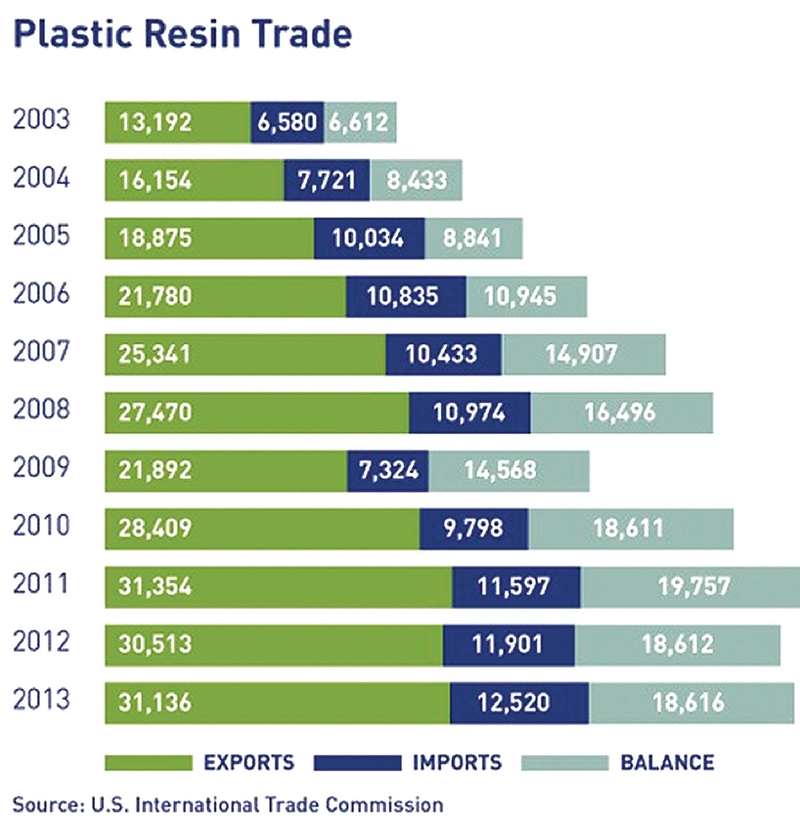

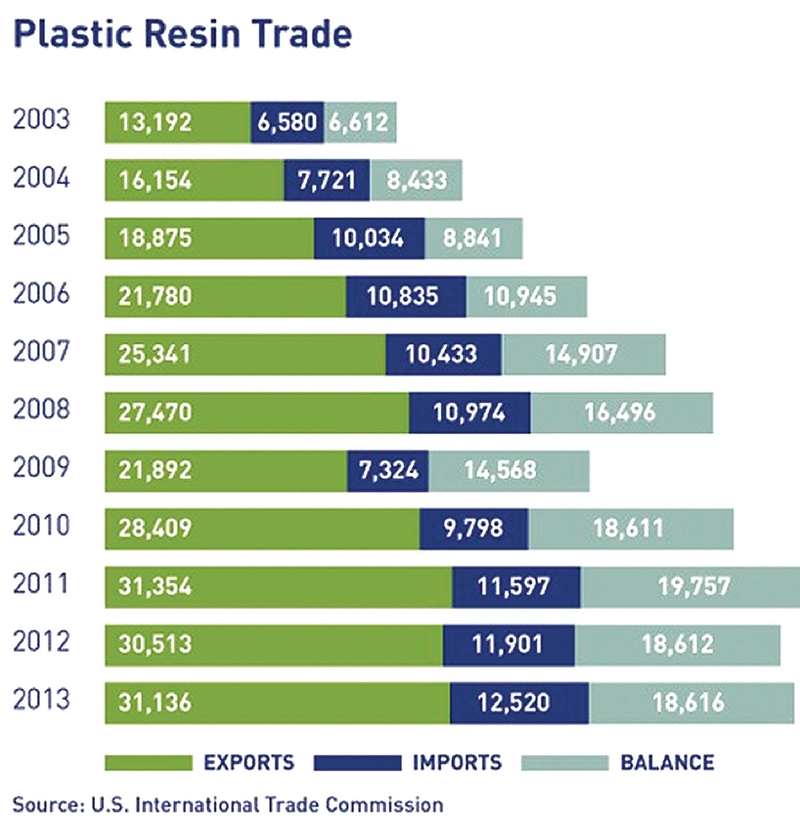

U.S plastic resin exports: a growing trade surplus.

U.S plastic resin exports: a growing trade surplus.

Note: This article continues the series of updates in Plastics Engineering from Plastics Make it Possible®, an initiative sponsored by America’s Plastics Makers™ through the ACC.

Plastics make possible all sorts of innovations that enhance the performance and sustainability of our packaging, auto parts, building materials, healthcare products, sports equipment, and more. They also make jobs possible—lots of them—and exports—lots of them, too.

And with the dramatic increase in production of natural gas from shale formations, those jobs and exports are predicted to grow dramatically in the coming decade.

Shale Gas Advantages for Plastics

Since hydrocarbons found in natural gas and oil are the primary feedstocks used to make many types of plastics, the affordability and supply of natural gas, natural gas liquids, and oil are critical to the competitiveness of plastic resin makers in a global marketplace.

In the United States, producers of ethylene, a primary feedstock for many plastics, generally use natural gas-based feedstocks, while producers in Europe and Asia often use oil-based feedstocks. So lower natural gas and feedstock costs can give U.S. manufacturers a big edge over these foreign competitors.

Increased production of natural gas from shale formations has made domestic natural gas and natural gas liquids more abundant and affordable. As a result, between 2005 and 2012, the USA went from being among the highest-cost producers of ethylene to among the lowest. The global competitiveness of U.S. plastic resin manufacturing has reached its highest level in decades.

These lower-cost feedstocks from shale gas, plus rising wages in overseas factories and supply chain concerns outside the USA, have made manufacturing in the USA more competitive. As a result of these and other factors, some companies that moved manufacturing abroad are returning, and new manufacturing facilities are increasingly being built here—which can lead to more jobs.

Higher-Paying, Plentiful Jobs

Making plastics is a high-tech, capital-intensive business that employs large numbers of engineering and technical staff to ensure product quality, achieve performance specifications, and maintain safe and efficient manufacturing processes.

In 2013, plastic resin makers in the USA directly employed 55,200 people. These employees earned on average $84,900, which is 73% higher than the average wage for all industries.

Since the recession officially ended in June 2009, employment growth in both plastic resin manufacturing and plastic products manufacturing (commercial and consumer goods made with plastics) has outpaced overall manufacturing employment growth. At the end of the first quarter 2014, employment in plastic resin manufacturing was up 5.6%, and plastic product manufacturing employment rose 7%. This compares to a 3.1% gain in overall manufacturing employment over the same period.

The economic impact of plastic resin manufacturing, however, extends far beyond the facility gates. To produce plastic resins, companies purchase raw materials, supplies, energy, and services. The economic activity in these supply chain industries indirectly generates an additional 344,700 jobs. It’s estimated that household spending of wages earned by plastic resin manufacturing workers and employees along the supply chain support an additional payroll-induced 294,500 jobs.

In total, plastic resin manufacturing supports nearly 700,000 jobs. Put another way, each job in plastic resin manufacturing generates eleven additional jobs in other sectors of the economy through indirect and payroll-induced effects.

That’s quite impressive. But the dramatic increase in production of natural gas from shale formations is turning out to be a real game-changer.

To capitalize on U.S. feedstock price advantages due to shale gas, plastic resin makers have announced investments totaling more than $21 billion for new capacity, expected to come online over the next decade. For example, capacity to produce polyethylene, the most “shale gas-advantaged” resin, is expected to grow by more than 50% by 2020.

As new production comes online, plastics resin makers are projected to add nearly 12,000 jobs. In addition, over the next decade a total of nearly $13 billion in increased capacity to process plastic resin is expected to be built, which is anticipated to require an additional 76,000 workers. Plus, nearly $1.7 billion in new capacity and nearly 3,500 jobs are expected from increased sales of plastic additives (such as plasticizers, UV stabilizers, and colorants).

Once these resin, processor, and additives investments come online, plastic industry shipments are expected to create more than 92,000 direct new jobs.

And all of this new production will generate demand for products and services along the supply chain, which is projected to lead to more than 130,000 additional jobs (which includes jobs making plastics machinery and molds for plastics). The combined payroll of all these workers is in excess of $15 billion. These wages are spent largely in local communities, supporting other jobs in healthcare, education, retail, services, and more, resulting in more than 125,000 payroll-induced jobs.

So under current conditions, the manufacturing of shale gas-advantaged plastic resin and plastic products, plus related investments, will support a total of nearly 350,000 new jobs.

Increased Plastics Exports

America’s plastic resin manufacturing industry historically has been a net exporter and has maintained a large trade surplus. In 2013, the USA exported $31.1 billion worth of plastic resin and imported $12.5 billion worth, resulting in a trade surplus of $18.6 billion. U.S. resin manufacturing is highly competitive and maintains trade surpluses with most major regions and nations, including a $2.4 billion surplus with China and $6.3 billion surplus with Mexico.

Exports currently account for approximately 35% by value of U.S. resin shipments—typically higher-priced, value-added resins. Because of growing resin production capacity due in part to the cost advantages offered by U.S. shale gas, it’s expected that the share of exports compared to imports will increase.

Demand for plastic resin is increasing both in the USA and abroad. Important domestic end-use markets for plastics, such as vehicles and construction, are improving as automakers increase the use of lightweight plastic parts to improve fuel efficiency and builders expand the use of foam insulation to create more energy-efficient homes.

Rising demand abroad for competitively priced plastic resin from the USA is anticipated to dramatically boost exports in the years to come. How much? Due to growth in shale gas-advantaged plastics production, resin is expected to be an enormous driver of U.S. exports. In fact, the consulting firm Nexant, which recently conducted an economic study for the American Chemistry Council, projects that the trade surplus for plastic resins will triple by 2030.

For more information about roles plastics play in innovation & sustainability, visitwww.plasticsmakeitpossible.com. For more about plastics, jobs, and exports, visit www.americanchemistry.com.

References

- “Plastics: Contributions to Sustainability and the U.S. Economy,” October 2014, American Chemistry Council.

- “U.S. Chemical Export Projections,” February 2015, Nexant.