MOBILE IS DRIVING ONLINE

OUTDOOR SALES GROWTH

___________________________

By Stephanie Nickell

For the 25 online furniture retailers featured in this year’s Leading E-tailer report, total sales in 2013 nearly hit $80 billion. All 25 online furniture retailers featured in this year’s e-tailer report are selling outdoor furniture and accessories.

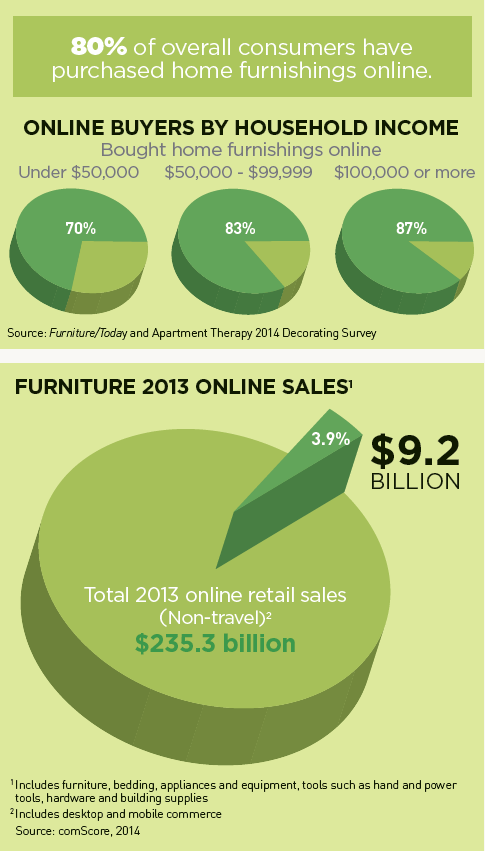

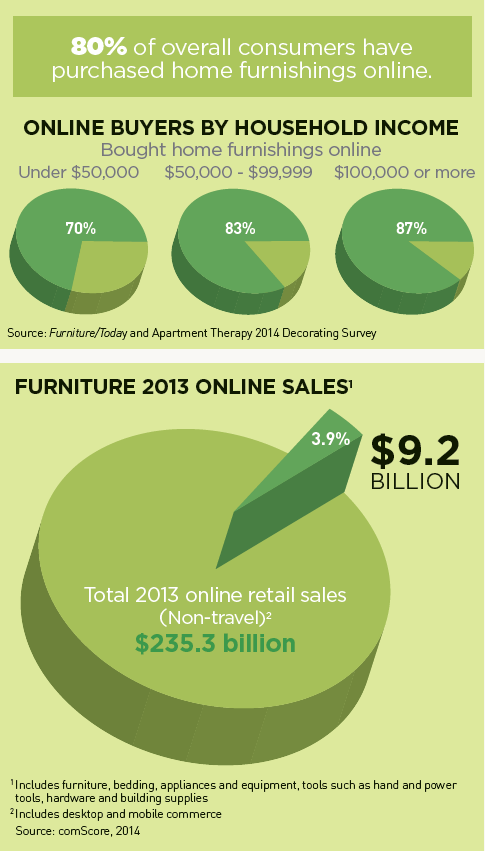

According to the latest data from comScore, online furniture sales for all categories, including outdoor, have continued to rise since 2010. Internet furniture sales totaled $9.2 billion last year and accounted for 3.9% of 2013 total online non-travel retail sales.

2013 proved to be a banner year for furniture with Salt Lake City-based Overstock.com. The e-tailer recorded 2013 outdoor furniture sales of $40 million. Stormy Simon, president of Overstock.com attributes its 2013 sales success with furniture to customer trust. She says, “To sell furniture online, the customer has to be able to trust you,” she said.

For home furnishings in 2014, Simon said, “Our goal is to continue to be the number one online retailer of furniture and home goods. Every year we evaluate the business and go after those areas we feel will make the biggest impact and give our customers the selection they deserve.”

Casual Living’s consumer data reveals that eight out of 10 consumers have purchased home furnishings online.

The increase in overall e-commerce sales over the last few years is largely due to the growth in mobile commerce sales. The share of mobile dollars as a piece of total e-commerce has doubled in the last three years.

Overall mobile purchasing accounted for 12% of e-commerce spending in the first quarter of 2014, compared with 6% the same quarter in 2011, according to comScore. Overstock.com reported its overall mobile sales make up 24%, which is a 36% year over year gain.

Credit card giants Visa, Mastercard and American Express are making it easier and more secure for consumers to make purchases using their mobile devices. In July, Visa announced it was rolling out a new Visa Checkout program.

Jim McCarthy, Visa’s global head of product said, “All the wonderful benefits that consumers get from using their mobile phone, when you’re out and about, kind of fall apart when you get to the payment part of the process.”

Under the new system every Visa customer gets an account that stores their credit card number and billing address, so that when shoppers are ready to buy on their mobile device they provide a username and password and all the pertinent information is provided to the merchant for checkout.

In addition to customer convenience, major credit card companies are also looking to enhance security features. Visa along with Mastercard and American Express have worked together on new technology called tokenization, where the 16-digit credit card number stays inside the credit card company’s server walls. The retailer would get a randomly generated 16-digit token that can’t be used at any other retailer.

As consumers find it more convenient and secure to purchase through their mobile devices, m-commerce sales will continue to rise. Seventy-eight percent of the online outdoor furniture retailers listed in this year’s Leading E-tailers report have mobile-optimized websites and are poised to capture increasing mobile sales.

Amazon.com

Seattle

amazon.com

Estimated 2013 total sales:

$74.5 billion

Publicly held, fiscal year ended Dec. 31. Began selling online in 1995 and is known as the world’s biggest online retailer. Sells directly to consumers and through third-party vendors online and through mobile apps. North American 2013 sales grew 27.9% to $44.5 billion and accounted for 60% of total. The electronics and other general merchandise mix category, including the furniture categories of upholstery, case goods, occasional, outdoor furniture and mattresses, comprised 67% of 2013 North American net sales. Outdoor furniture brands include Alfresco Home, California Umbrella and Telescope Casual. Total 2013 sales were $74.5 billion, up 21.9% from $61.1 billion in 2012.

Bellacor

Mendota Heights, Minn.

bellacor.com

Estimated 2013 total sales:

$30 million to $49.9 million

Privately held, established in 2000. Offers mid-priced to high-end lines. Furniture lines include bedroom, living room, dining, occasional and outdoor. Also sells decorative accessories, including lighting. Has 63 employees. Major vendors include A.R.T., Butler Specialty, Cooper Classics, Crosley, Currey & Company, Kichler, Crystorama, Schonbek, Emerald Home, Hillsdale, Hudson Valley, Klaussner, Modway, Safavieh, Steve Silver, Surya, Uttermost and Zuo. Has a social media presence through Facebook, Twitter, Pinterest, Google+, YouTube, LinkedIn and Instagram. Promotes free shipping for orders over $75, no sales tax collected in most states and a price-matching policy. Site also features a live-chat option for customers. Attends seven U.S. trade shows each year.

BestPricedFurniture.com

Torrance, Calif.

bestpricedfurniture.com

Estimated 2013 total sales:

Less than $5 million

Founded in 2003. Offers promotional to lower-middle priced lines. Has six employees. Case goods accounted for 50% of 2013 total sales; upholstery, 20%; bedding, 5%; outdoor furniture, 5%; decorative accessories, 15%; and textiles, 5%. Major suppliers include Lifestyle Solutions, Fashion Bed Group, Powell and Hillsdale for furniture and bedding; Zuo Modern for outdoor furniture; and Chandra and Anthony for decorative accessories. Has a mobile-optimized website and a social media presence through Facebook, Twitter, Pinterest, YouTube and LinkedIn. Attends six U.S. trade shows each year.

Beyond Stores

Davie, Fla.

beyondstores.com

Estimated 2013 total sales:

$5 million to $9.9 million

Established in 2011. Offers promotional to high-end lines. Has 15 employees. Has 25,000 visitors to its website each week. Case goods accounted for 60% of 2013 total sales; upholstery, 20%; outdoor furniture, 10%; and decorative accessories, 10%. Major suppliers include American Drew, Bellini Home and Gardens, Boca Rattan, Groovystuff, Hillsdale, Homelegance, Howard Elliott, Jofran, Powell, Patio Living Concepts, Uttermost and Zuo. Has a mobile-ready website. Has a social media presence through Facebook, Twitter, Pinterest, Google+, LinkedIn and Instagram. Attends two U.S. trade shows each year.

Cymax Stores USA

Reston, Va.

cymax.com

Estimated 2013 total sales:

$100 million or more

Founded in 2004. Offers promotional to high-end price points. Has 100 total employees. Has 450,000 site visitors each week. Website is mobile-optimized. Has a social media presence through Facebook, Twitter, Pinterest, Google+, YouTube, LinkedIn and Instagram. Major vendors include Coaster, Crosley, Hooker, Safavieh, Stanley, Tommy Bahama, Walker Edison and Zuo. Attends six U.S. trade shows each year.

Dynamic Home Décor

Braintree, Mass.

dynamichomedecor.com

Estimated 2013 total sales:

Less than $5 million

Family owned, in business since 1999. Offers promotional to high-end price points. Has four employees. Website is mobile-optimized. Case goods accounted for 50% of 2013 total sales; upholstery, 20%; bedding, 5%; outdoor, 10%; decorative accessories, 10%; and textiles, 5%. Major suppliers include Legends, Furnitech, BDI, Salamander Designs, Jofran, Nuevo, Zuo, Modway, Lexington and Sligh for furniture and bedding; Modway, Euro Style and Shine for outdoor furniture; and Howard Elliott, Elk and Nova for decorative accessories. Has a social media presence through Facebook, Twitter, Pinterest and Google+. Has 5,000 unique visitors to its site each week. Attends two U.S. trade shows each year.

Etsy.com

Brooklyn, N.Y.

etsy.com

Estimated 2013 total sales:

$1.4 billion

Online global marketplace, founded in 2005. Offers mid-priced to high-end lines. Has 615 employees worldwide. Has a mobile-optimized website. Sells through iPhone, iPad and Android apps. Furniture products include bedroom, living room, office furniture, accent tables and chairs, entertainment and outdoor furniture. Also sells decorative accessories. Other products carried include women’s and men’s apparel, jewelry, wedding products and gifts. Has over 40 million members. Has a social media presence through Facebook, Twitter, YouTube, Pinterest and Google+.

Everything Furniture

Riverside, Calif.

everythingfurniture.com

Estimated 2013 total sales:

$23.4 million

Family owned, established in 1996. Offers home furnishings for the bedroom, dining room, living room, office and outdoor. Has a mobile-optimized website. Has a social media presence through Facebook, Twitter, Pinterest and YouTube. Major suppliers include Abbyson Living, Catnapper, Coaster, Hillsdale, Homelegance, Jofran, Prepac, Pulaski, Sauder, Walker Edison and Zuo. Offers free shipping on orders of more than $999.

EZBuyFurniture

Golden, Colo.

ezbuyfurniture.com

Estimated 2013 total sales:

Less than $5 million

Family-owned, founded in 2003. Offers promotional to high-end lines. Five total employees. Has a social media presence through Facebook, Twitter and Google+. Major suppliers include Home Styles, Modloft, Walker Edison, Hillsdale, Bradley Brand Furniture, KidKraft, Holly & Martin, Butler and Zuo. Offerings include outdoor furniture and accessories, case goods, upholstery and decorative accessories. Attends one U.S. trade show per year.

Fab.com

New York

fab.com

Estimated 2013 total sales:

$140 million

Established in 2011. Offers promotional to mid-priced lines. Opened a U.S. warehouse in 2012. Recently announced it plans to layoff 80 to 90 employees in its New York office. Is shifting its focus to design. Unveiled in May a private label collection called Happy Modern, with more than 40 SKUs, including bedding, rugs, decorative pillows, storage and other home furnishings. In June acquired One Nordic Furniture, a Scandinavian seller of high-end designer furniture. Announced plans to launch Hem.com later this year, which will sell furnishings designed in-house. Has m-commerce capabilities through iPhone, iPad and Android devices. Has a social media presence through Facebook, Twitter, YouTube, Pinterest, Google+ and Instagram.

Gilt

New York

gilt.com

Estimated 2013 total sales:

$600 million

Privately held online shopping flash retailer. Launched in the U.S. in November 2007 and in Japan in March 2009. Originally founded as an invitation-only site; now offers all consumers the ability join as free members. Offers leading designer labels for women, men, home and kids as well as local experiences, all at up to 60% off retail prices. Mobile shopping accounts for more than 40% of Gilt’s daily revenue. Michelle Peluso joined as CEO in February 2013 after being on the board for three years. Has a social media presence through Facebook, Twitter and Instagram. Brands offered include Brown Jordan, Fox Hill, Novica, Poly-Wood, UMA and Zuo. 2013 total sales estimated at $600 million.

HauteLook

Los Angeles

hautelook.com

Estimated 2013 total sales:

$100 million or more

Founded in 2007. Had 16 million members at end of 2013. Is a stand-alone subsidiary of publicly held Nordstrom. HauteLook offers mid-priced to high-end lines. Has a social media presence through Facebook, Twitter, Pinterest, YouTube, Instagram and Tumblr. Six hundred and fifty total employees. Case goods accounted for 15% of 2013 total sales; upholstery, 10%; bedding, 40%; decorative accessories, 30%; and other, 5%. Attends 10 U.S. trade shows a year to source product. Has mobile apps for iPhone, iPad and Android devices. HauteLook’s 2013 sales increased by 27.3%.

Hayneedle

Omaha, Neb.

hayneedle.com

Estimated 2013 total sales:

$375 million

Founded in 2002, formerly operated as NetShops and rebranded to Hayneedle in 2009. One of the nation’s largest online retailers for home furnishings, Hayneedle.com offers more than 3,000 brands and millions of products for every room, style and budget. The company employs more than 500 people nationwide. Hayneedle.com, is the place to find everything home, from patio sets to platform beds, coffee tables to kitchen islands. Major outdoor furniture brands include Lloyd Flanders and Woodard. Hayneedle’s regional fulfillment operations provides for the capability to deliver products in two days or less to 90% of the country. 2013 total sales were $375 million, up an estimated 7% from $350 million in 2012.

Home Furniture Mart

Commerce, Calif.

homefurnituremart.com

Estimated 2013 total sales:

$5 million to $9.9 million

Family owned, in business since 2005. Offers promotional to high-end lines. Has 12 total employees. Major suppliers include Abbyson Living, AICO, AspenHome, Classic Flame, Coaster, Fairmont Designs, Homelegance, Jofran, Magnussen, Modway, Parker House, Primo, Standard, Sunny Design, Walker Edison and Wynnwood. Has a social media presence through Facebook and Twitter. Offers free shipping. Attends one U.S. trade show each year.

Homelement

East Brunswick, N.J.

homelement.com

Estimated 2013 total sales:

$5 million to $9.9 million

Family-owned, founded in 2003. Offers mid-priced to high-end priced lines. Has 10 employees. Website is mobile-ready. Has 120,000 site visitors each week. Major suppliers include Home Styles, Padma’s Plantation, Rustic Cedar and Zuo for outdoor furniture; Homelegance, Hillsdale, Coaster and Parker House for furniture and bedding; and Butler, Imax and Jaipur for decorative accessories. Has a social media presence through Facebook, Twitter, Pinterest, Google+ and YouTube. Attends two U.S. trade shows each year.

Inmod

Fairfield, N.J.

inmod.com

Estimated 2013 total sales:

$6.8 million

In business since 2003. Carries promotional to high-end product lines, featuring a full range of green/eco-friendly furniture. Has 15 employees. Has a social media presence through Facebook, Twitter, Pinterest, Google+ and YouTube. Major suppliers include Calligaris, Domitalia, Doimo, Euro Style, Nuevo and Soho Concept. Offerings include outdoor furniture, case goods, upholstery, contract seating, lighting and decorative accessories. Attends five U.S. trade shows each year.

InteriorMark

Golden, Colo.

sofasandsectionals.com

Estimated 2013 total sales:

$30 million to $49.9 million

Privately held, in business since 2007. Offers promotional to high-end lines through its five websites: Theaterseatstore.com, Sofasandsectionals.com, Entertainmentcenterspot.com, Bedroomfurniturespot.com and Curiocabinetspot.com. Has 40 employees. Website is mobile-optimized. Major suppliers include Heritage Home, Palliser, Klaussner and Southern Motion for furniture and bedding; Zuo and Modway for outdoor furniture; and Stein World for decorative accessories. Has a social media presence through Facebook, Twitter, Pinterest, Google+ and YouTube. Has 100,000 site visitors each week. Attends two U.S. trade shows each year.

ivgStores

Pembroke Pines, Fla.

ivgstores.com

Estimated 2013 total sales:

$33.8 million

Family owned, established in 2003. Offers mid-priced to high-end lines through a network of more than 200 online specialty stores. Stores include Chairs1000.com, Bar-Stools-Barstools.com, PatioFurnitureStation.com, Tables21.com, BedroomSetShowroom.com, BenchesByTheBunches.com and Comcore21.com. Major vendors include American Heritage, Butler, Calligaris, Coaster, Crosley, Groovystuff, Hekman, Hillsdale, Holly & Martin, Hooker, Howard Elliott, Imax, Klaussner, Lloyd Flanders, Magnussen, Oakland Living, Safavieh, Spice Island Wicker, Steve Silver, Wynwood and Zuo. Has a social media presence through Facebook, Twitter, Pinterest and YouTube.

One Kings Lane

San Francisco

onekingslane.com

Estimated 2013 total sales:

$320 million

Privately held, flash-sale e-tailer, founded in 2008. Offers mid-priced to high-end lines. Has nearly 500 total employees. Features a mobile-ready site. Has a social media presence through Facebook, Twitter, Pinterest, Google+, YouTube, LinkedIn and Instagram. Raised $112 million in a Series E funding round in January, bringing the total amount One Kings Lane has raised to $229 million. Cut 15% of its workforce, 79 employees, in June. Case goods accounted for 26% of 2013 total sales; upholstery, 8%; outdoor furniture, 3%; home accents, including lamps, area rugs and wall decor, 37%; textiles, 11%; and other merchandise, including consumer electronics, major appliances, carpet and tile, 15%. 2013 estimated retail sales were $320 million.

Overstock.com

Salt Lake City

overstock.com

Estimated 2013 total sales:

$1.3 billion

Publicly held, fiscal year ended Dec. 31. Online-only closeout retailer offering discount brand name merchandise. Began selling online in 1999. Direct revenues, with orders fulfilled through its own warehouses, accounted for 12% of 2013 net revenues. The balance, $1.15 billion last year, is through fulfillment partners. Has 1,500 total employees. Enabled shoppers to pay with Bitcoin in January, making Overstock the first major e-tailer to accept the digital currency. Offers promotional to high-end price points. Has a social media presence through Facebook, Twitter, Pinterest, Google+, YouTube, LinkedIn and Instagram. Website is mobile ready. Offers an iPhone and Android app. Sales for outdoor furniture were an estimated $40 million in 2013. Patio brands include Amazonia, Angelo Home, Atlantic, Christopher Knight Home, International Caravan and Vifah. Total 2013 sales were $1.3 billion, up 18.6% from $1.1 billion in 2012.

Renegade Furniture Group

Cedarhurst, N.Y.

colemanfurniture.com

Estimated 2013 total sales:

$13.5 million

Family owned, established in 1999. Offers mid-priced lines. Has 31 employees. Case goods accounted for 35% of 2013 total sales; upholstery, 56%; bedding, 2%; outdoor furniture, 3%; decorative accessories and other merchandise, 4%. Major suppliers include TOV Furniture, Pulaski, Broyhill, Ashley, Coaster, Liberty and Legacy Classic for furniture and bedding; and Uttermost and Stein World for decorative accessories. Has 40,000 site visitors each week. Offers free in-home delivery and setup. Has a social media presence through Facebook, Pinterest and YouTube. Attends two U.S. trade shows each year.

Rue La La

Boston

ruelala.com

Estimated 2013 total sales:

$440 million

Member-only flash sales e-tailer, founded in 2008. Is owned by parent company Kynectic. Offers men’s, women’s and children’s apparel and accessories; home decor and accents; and exclusive destinations and experiences in select cities around the globe. Daily boutique sales go live at 11 a.m. and stay open for 48 hours. Debuted its first mobile site in 2009 and first mobile app in 2010. Expects more than half of 2014 revenue to come from mobile devices. Offerings include outdoor furniture, upholstery, case goods and decorative accessories. Launched DressingRoom, a series of online boutiques that combine home decor and fashion for one-stop shopping in May. Total 2013 sales estimated at $440 million.

Stratashops

Elkhart, Ind.

stratashops.com

Estimated 2013 total sales:

$5 million to $9.9 million

Privately held, in business since 2008. Offers upper-middle to high-end lines. Has 10 employees. Has a mobile-optimized website. Case goods accounted for 8% of 2013 total sales; upholstery, 2%; outdoor furniture, 85%; and decorative accessories, 5%. Major suppliers include Lexington, Tommy Bahama and Jackson Furniture for furniture and bedding; Lloyd Flanders, Woodard, Tommy Bahama, NorthCape International, Harmonia Living, Sunset West, Tortuga Outdoor and Source Outdoor for outdoor furniture; and Patio Living Concepts, Surya and Imax for decorative accessories. Has a social media presence through Facebook, Twitter, Pinterest, Google+, YouTube, LinkedIn and Instagram. Attends two U.S. trade shows each year.

Wayfair

Boston

wayfair.com

Estimated 2013 total sales:

$915 million

Privately held, founded in 2002. Sells through Wayfair.com, Birch Lane, DwellStudio, AllModern.com and its flash site, Joss & Main. Has 1,600 total employees. Features a mobile-ready site and an iPhone app. Has a social media presence through Facebook, Twitter, Pinterest, Google+, YouTube, LinkedIn and Instagram. Offers promotional to high-end lines. Outdoor furniture brands include Kingsley-Bate, Lloyd Flanders, Oxford Garden, OW Lee, Poly-Wood, Telescope Casual, Uwharrie Chair and Woodard. Partnered with HGTV this summer so consumers can shop for products via the HGTV shows “Brother vs. Brother” and “Flipping the Block.” Wayfair marries daily sales events with featured content on the shows. Total 2013 sales were $915 million, up a whopping 51.9% from $602.5 million in 2012. Industry analysts believe the e-tailer will go public within the year.

Wholesale Furniture Brokers

Kamloops, British Columbia, Canada

gowfb.ca

Estimated 2013 total sales:

$5 million to $9.9 million

Privately held, in business since 2002. Offers promotional to high-end lines. Has 20 employees. Case goods accounted for 33% of 2013 total sales; upholstery, 40%; bedding, 20%; outdoor, 5%; and decorative accessories and textiles, 2%. Major suppliers include Coaster, Poundex, Primo International, Trendwood and Prepac for furniture and bedding; Patio Republic, Boca Rattan and Zuo for outdoor furniture; and Coaster and Zuo for decorative accessories. Has a social media presence through Facebook, Twitter, Pinterest, Google+, YouTube and Instagram. Has 25,000 site visitors each week. Attends one U.S. trade show each year.

Source: Casual Livingmarket research

HOW THE LIST WAS COMPILED

Casual Living’s exclusive report lists 25 online home furnishings retailers and flash sales sites in alphabetical order.

This list is by no means comprehensive. Many more than the 25 Internet retailers listed here are strong players within the home furnishings industry and online channel. This report does not rank companies, nor does it feature outdoor furniture retailers who have both a brick-and-mortar and online presence, such as Target, Walmart and Home Depot.

Casual Living chooses not to include some companies due to lack of verification of revenue figures.

All sales figures and ranges are Casual Living market research estimates and are for total 2013 sales, which may include revenues from the sale of products other than furniture, bedding and decorative accessories. Where possible, the percentage of sales from outdoor furniture is given.

Casual Living compiled this report by surveying online furniture retailers, researching business newspaper archives and speaking with furniture industry insiders. Information was gathered, compiled and analyzed byCasual Living’s research department.