Vern Fonk Drives Sales Success with Conversica’s AI

The Seattle-based insurance firm converts more Internet leads with an automated email solution

Vern Fonk Drives Sales Success with Conversica’s AI

The Seattle-based insurance firm converts more Internet leads with an automated email solution

Vern Fonk Drives Sales Success with Conversica’s AI

The Seattle-based insurance firm converts more Internet leads with an automated email solution

“[The AI-generated emails] are written very well and designed to gain interest in the client to return to us.”

Based in the American Northwest, Vern Fonk is an independent brokerage firm providing nonstandard, high-risk insurance policies to automobile and home owners, as well as commercial bonds and liability insurance. It has 23 offices and 90 employees and has been expanding since it was bought by a holding company, Confie Seguros, in 2010.

Formed in the 1950s, the company takes pride in retaining its customers, says Craig Rexroat, Vern Fonk’s COO. “Retention, in our business, is where you realize the efforts of what you’ve done, where you make your money,” Rexroat says. “Most companies in the industry retain their clientele for about 11 months, which is pretty good, considering that people will sometimes improve their driving records and move on to a preferred market, or one of the bigger companies like State Farm or Safeco. We retain our customers for about 18 months.”

Hanging on to customers the old-fashioned way, though, required legwork and upkeep. In checking up on canceled policies, for instance, agents had to make phone calls manually in an effort to win back the business. Without a system that could set up streamlined correspondence, leads could be neglected and forgotten.

Vern Fonk realized its processes could be simplified and sped up. “It’s much easier to have something automated than to hire people, where you have to depend on them showing up to work and increase your overhead,” Rexroat says.

But engaging customers would also demand personalized communications. The company didn’t have to look far beyond Conversica, which offered the mix it was looking for, Rexroat says. That the vendor had roots in the automobile industry didn’t hurt. “Some of the car dealerships that were using it got some extremely good results off of it,” Rexroat says. “That’s a fairly closely related industry for us.”

Conversica’s artificial intelligence (AI) solution adopts a human-like persona and helps automate email conversations. The technology reads text and engagement cues within an email to determine a person’s intentions. Using that information, it alerts agents if a lead has any intention to buy and keeps them abreast of which leads are at risk and which are likely to embrace further contact.

Vern Fonk has been impressed with the level of writing generated by the AI, which Conversica calls “Ava” (ironically, the moniker dates from years before the sci-fi flick Ex Machina, which features an android character with that name). “[The emails] are written very well and designed to gain interest in the client to return to us,” Rexroat says. “We feel it’s been a big help in doing that.”

Thanks to Conversica, Vern Fonk could avoid hiring extra staff members and save hundreds of thousands of dollars a year, Rexroat estimates. The system has been particularly useful in maintaining after-hours communications to keep potential new clients engaged. If, for instance, a prospect contacts the company on a Sunday night, “Ava” will assess the customer’s needs based on Web site interaction and engage him with relevant messages until an agent can pick things up during working hours.

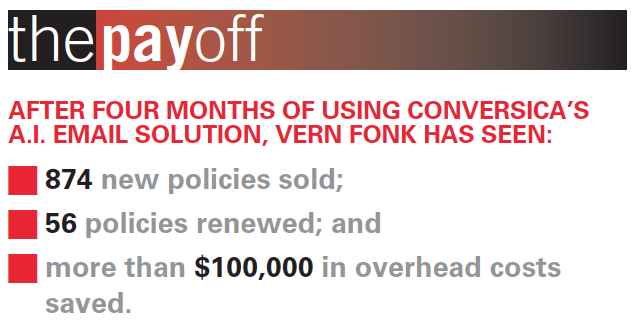

Upon implementing the technology, the number of leads the company could draw from began to increase. In the four months after the company started using Conversica, 11,780 leads were generated. Of those, agents were able to engage 2,306. Ultimately, the company tallied 874 policies.

“Our closing ratio increased,” Rexroat says. “Where we might have been down ten or eleven percent, we increased that to seventeen or eighteen percent over time.”

The process of re-engaging leads also became easier. During those four months, Vern Fonk reconnected with 226 past customers, giving agents another chance to nurture those relationships. The result was 56 renewed policies. —Oren Smilansky