one to watch

Cognizant, once a category leader but having fallen a bit off the pace in recent years, continues to impress the analysts nevertheless, particularly in the area of cost. Its score of 3.9 was just off the mark posted by this year’s category winner, Appirio (4.0). And although its score in company direction was lower than that of most its competitors, analysts will be keeping their eyes on Cognizant as it augments its deep development and software integration experience, with omnichannel and emerging digital customer experience features. —L.K.

The Market

Over the years, CRM systems have grown in their sophistication, to the point that most now require a high degree of expertise to modify and customize. As a result, CRM service providers continue to be in high demand, according to Gartner, with front-office and digital business transformations leading the way.

But CRM consultancies come in many forms. These companies vary widely in size, scope, and geographic reach, and they operate very differently from one another. In addition, they are more strategic with their offerings than technology vendors. They also cater to very different industries and types of companies. To differentiate themselves, many of them have started to expand their globally dispersed resources, deepen their technical skills, and offer suites of ancillary services, such as business process realignment or change management. And especially popular among small and midsized businesses are the growing number of CRM specialty firms—often called boutiques—that trade scale for more intimate customer relationships.

THE LEADERS

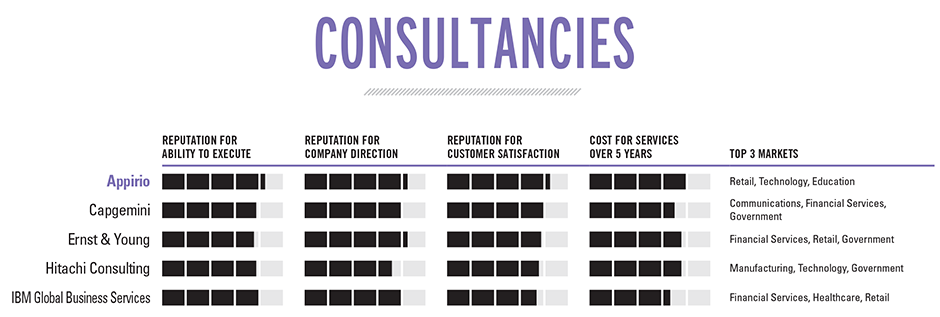

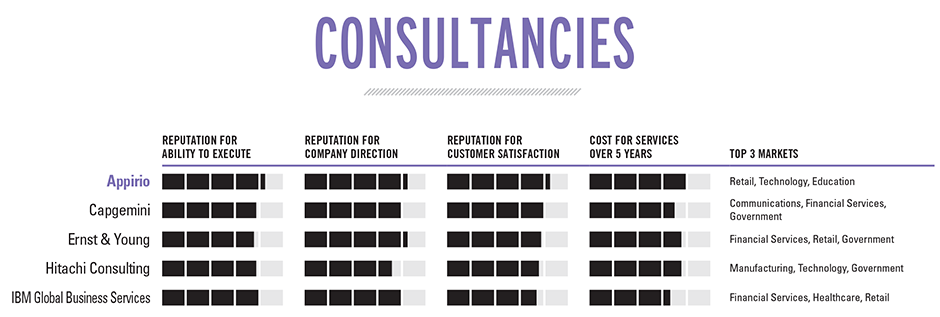

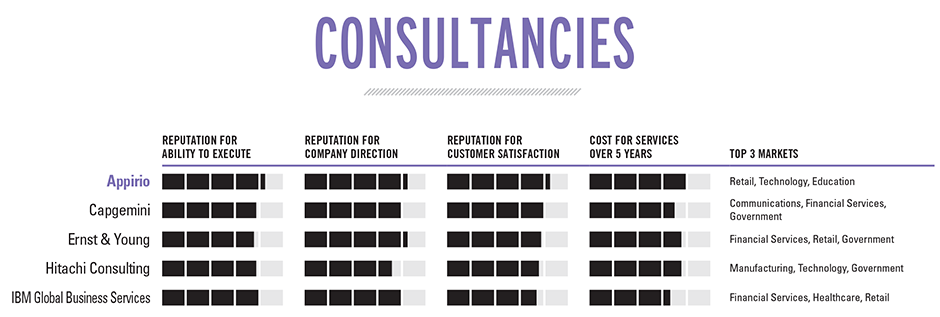

With scores of 4.0 in company direction and customer satisfaction, Capgemini this year finds itself back on the leaderboard after ranking as a One to Watch for the past two years. The French company also scored a 3.9 in ability to execute. And while some analysts believe that Capgemini is on the rebound primarily because of its digital-transformation thought leadership, Jim Dickie, managing director at CSO Insights, a division of MHI Global, says the company’s turnaround has more to do with a “particularly strong” focus on marketing value-chain management.

England-based Ernst & Young is a newcomer to the rankings, but it had strong showings across all categories, and its score in company direction (4.2) tied for tops in the industry. It is “forward-thinking about how companies can reinvent themselves to leverage digital,” Dickie says. Leslie Ament, senior vice president and principal analyst at Hypatia Research, maintains that Ernst & Young “has made significant investments as well as inroads in its customer advisory practice area, bringing it up to par” with more deeply rooted firms, and that its CRM practice “is highly complementary to its other advisory areas and is sure to benefit its customer base.”

Hitachi Consulting, last year’s consultancy winner, fell off a bit this year, but still earned a respectable 3.9 for its ability to execute. The firm, which is especially strong with Microsoft Dynamics CRM implementations, is a solid favorite among analysts and customers alike, as demonstrated by its 3.8 in customer satisfaction.

While IBM Global Business Services (GBS) suffered in the past owing to what analysts perceived as a portfolio lacking in CRM solutions, the company has changed gears and now offers what Dickie calls a “solid foundation in analytics and Big Data.” Ament has also observed a “cross-pollination between IBM’s ExperienceOne design-thinking approach and Global Business Services,” which she calls “a significant change to how GBS works with clients, and a highly positive one at that.” This design-thinking approach, others contend, will further help Big Blue secure high-end engagements and digital-related projects, which will likely further improve company direction and ability to execute, areas in which GBS received scores of 4.0 this year.

THE WINNER

Appirio this year was ahead of the pack in ability to execute, company direction, and customer satisfaction, with scores of 4.2 in each of those metrics. Appirio’s costs have also been a huge selling point, evidenced by its industry-leading score of 4.0. The company has a close partnership with Salesforce.com, but perhaps its most notable move in the past year was in the area of mobile application development, with its May launch of AppXpress, a self-service marketplace that companies can use to create enterprise-grade iOS apps. —Leonard Klie