Are Ad Sales Becoming Strictly a Numbers Game?

A recent study depicts media buyers as over-worked number crunchers who aren’t interested in relationship-driven sales. Here’s how some publishers are responding.

BY BILL MICKEY

With the media landscape in a perpetual state of transition and the growing influence of digital, the ad buying and selling ecosystem has shifted dramatically. As a result, the fundamentals of the sales process have changed. Publishers not only have a wider array of ad products to sell, but buyers are continually challenged to drive more efficiency into managing their expanding client portfolios.

Kantar Media, which operates the SRDS data service, partnered with ad rep firm James G. Elliott Co. in the fall of 2013 to conduct a research survey to measure how the media planning and buying process has changed. The survey was mailed to 4,000 media buyers at agencies, with 204 individuals responding.

The results are a wake-up call for publishers and reps who still rely on traditional “relationship” selling tactics. Instead, the study finds that the sales process, mostly due to increasing workload pressures on media buyers and a greater reliance on data, has become more transactional.

“The personal relationship with the buyer is not as important as the product or service you’re representing to that buyer,” says James Elliott, defining what he means by transactional. “It’s the recognition that you can’t even get to that relationship because buyers aren’t on the campaign that long. It’s a euphemism for the process becoming a numbers game.”

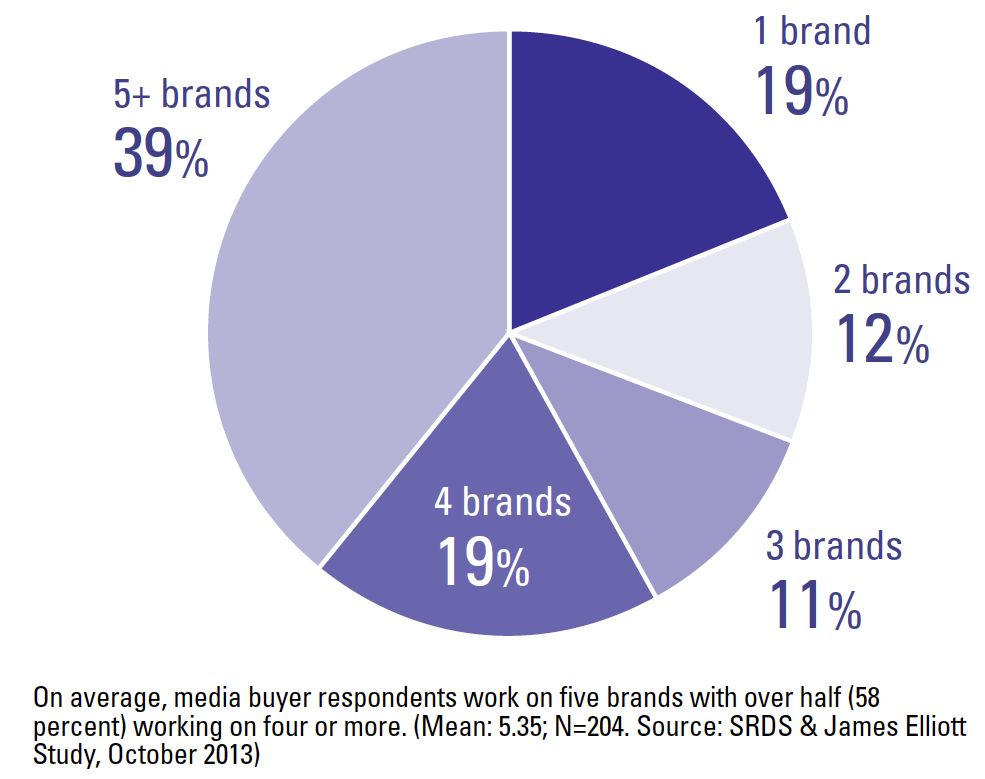

Indeed, according to the survey, respondents are responsible for an average of five brands, with more than half (58 percent) working on four or more. “That’s an enormous number of accounts,” says Elliott.

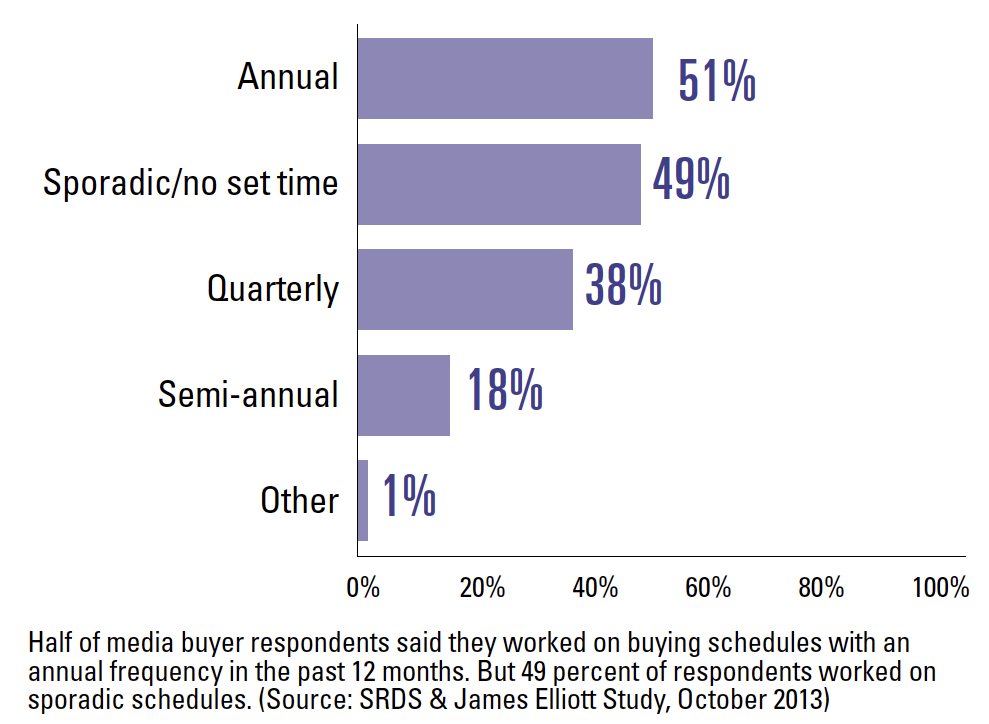

At the same time, buying schedules are becoming much more unpredictable. While half of respondents say they work on annual schedules, the other half say their schedules are sporadic and have no set time.

Todd Haskell, senior vice president and chief revenue officer at Hearst Magazines Digital Media, echoes the notion of a diminished priority on relationships. However, that dynamic has been changing for a while now.

“I’ve been in the business for 25 years and it’s been shifting year over year for as long as I’ve been here,” he says. “But the point is valid. We are seeing the agencies under enormous pressure to become more efficient. The buyers have more and more responsibilities on their plates and as a result they have less time to spend with sellers.”

Cost a Major Factor and Focus

Further supporting the notion of transactional sales is survey data showing an emphasis on cost and rate card discounts. Ninety-four percent of respondents say total cost/price is extremely or very important to the final buying decision. CPM delivery and rate card discount were selected by 91 percent and 82 percent, respectively. From then on, criteria such as positioning, circulation size and competitive separation come into play.

Nevertheless, Haskell advises that publishers need to tailor the conversation with the buyers in ways that hover above their more transactional, numbers-driven needs.

“It used to be all about us, meaning the publishing brand,” he says. “Now the conversation is much more about the client and the brand needs of the client and what we can do for them. That’s how smart sales people change the dynamic. If you don’t change, that’s how you get into that transactional dynamic.”

Bob Melk, president of IDG’s Consumer and SMB division agrees. “We’re refocusing our reps and re-engineering our services on what’s needed to get beyond the quantitative analysis. If it was as simple as a mathematical equation, it wouldn’t be marketing anymore.”

In other words, if the process was as numbers-driven as the buyers would like it to be, then campaigns could theoretically be duplicated simply based on data. But variances in audience behavior and brand positioning would never allow that to happen.

Sure, there are areas that require a data-based approach to buying such as programmatic and real-time bidding, but bigger programs still require the human touch.

“This is not something that will be automated,” adds Melk. “This is something that requires strategy, consultation and engagement.”

Automation Is Not a Strategy

Melk says the survey is supporting the trend towards a more automated buying model, but that will not produce successful marketing strategies by itself. “That just creates efficiencies. What media companies and agencies need to do is move to strategic value and compelling programs,” he says.

Furthermore, brands have jumped on the publishing bandwagon in a big way, creating their own content in an effort to drive earned and owned media. Those kinds of campaigns inherently require a more strategic approach.

“There is plenty of opportunity to buy impressions and data-based programmatic buying en masse,” says Melk, “but there’s also terrific opportunity to tap into the growing audience that seeks news and information via digital distribution.”

The RFP process is still high on the list, according to the study. More than three-quarters (82 percent) of respondents use RFPs always or often in the planning or buying process ad 78 percent of them rate their importance as extremely or very important.

RFPs Get Only One Chance

But don’t expect to get any second chances. If buyers can be convinced to look past the numbers at the strategic value of a campaign, they’re less likely to review an RFP a second time. “That is a function of the buyers having so much work they need to do and limited bandwidth,” says Haskell. “It used to be you could come in and appeal your case. That’s a luxury very few buyers have anymore.”

Along with the focus on price and performance, buyers may try to break apart bigger integrated campaigns and haggle on individual elements. Again, both Melk and Haskell advise that while buyers will want to look over the campaign elements, publishers need to keep the conversation focused on strategy.

“When you’re talking about innovation, you’re talking about an element of risk,” says Melk. “Innovation isn’t proven metrics. You need to be talking to clients who can see beyond CPMs and CPLs. When we’re presenting the more complex programs do we get pigeon-holed into conversations that try to break them down? Yes, but we’re training our reps to move beyond that conversation and encourage the agency folks to as well.” ![]()