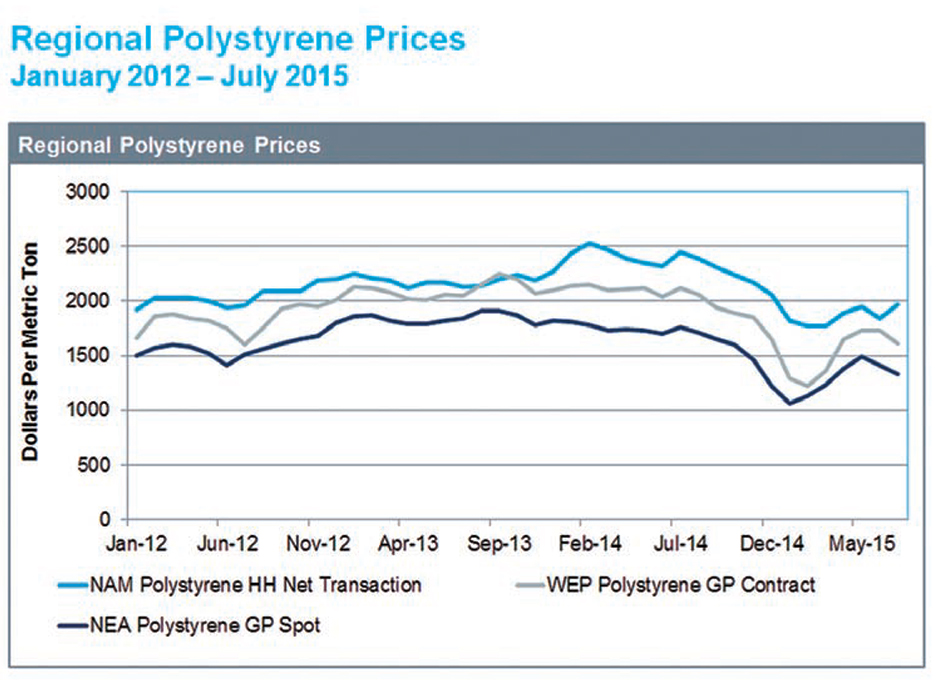

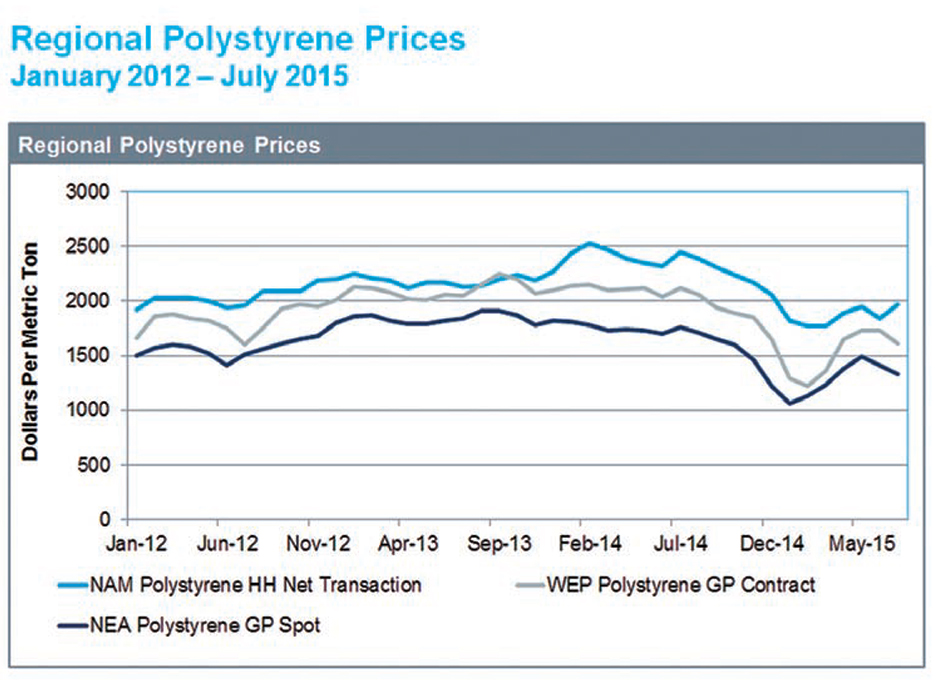

Over the last couple of years, the polystyrene market has been marked by slowing demand and high prices. Prior to the decline in energy prices in 2014, polystyrene prices were on a steady rise globally, driven by the rise in benzene prices. After the recession of 2008–2009, benzene prices steadily increased, reaching an all-time historical high of $5.28 per gallon in July 2014.

In North America, the switch to lighter feedstocks in refineries and an increased focus on shale gas production (which results in lower aromatics as a by-product) resulted in the region’s increased reliance on benzene imports. This increased the volatility of North American benzene prices, as the market is more vulnerable to supply delays or interruptions.

North American Producers Improve Margins

In addition to rising benzene prices, the North American polystyrene market saw a considerable change on the supply side. Consolidations and rationalization of capacity resulted in three major suppliers in the North American market holding nearly 85% of the market share. These suppliers shifted their focus from gaining market share to improving profitability. As feedstock prices rose, suppliers more than kept up with the increase in feedstock prices. The result: higher polystyrene prices and improved margins for polystyrene producers in the region.

Despite rising prices in North America and an increasing arbitrage opportunity for Asian suppliers, there was no significant increase in polystyrene imports. This can be attributed to two factors. First, both benzene and styrene are traded globally, which more or less keeps the raw material costs similar across the regions. As a result, there has been no consistent arbitrage opportunity historically. However, rising producer margins in North America did create some consistent arbitrage opportunity in 2014. Secondly, logistics and grade availability have kept imports from growing in the region, even with a consistent arbitrage opportunity.

On a regional basis, the polystyrene markets in Europe and Asia did not see the same margin improvement as was seen in North America. In Europe, the market—in addition to seeing excess capacity following consistent demand declines for the last several years—is also considerably influenced by Asian imports. In Asia, there have been significant capacity additions and several new players entering the market in a declining demand environment—these factors combined to leave no possibility of margin improvement.

Outlook for Pricing and Global Growth

With the drop in energy prices in 2014 and early 2015, polystyrene prices did see some decline. However, while feedstock costs declined around 43% from July 2014 to February 2015, polystyrene prices only declined around 23%. Despite being at lower level than in 2014, benzene prices continue to remain volatile, resulting in large swings in polystyrene prices as well. With no change forecasted on the benzene supply side in North America in the short term, polystyrene prices are expected to remain volatile.

Global polystyrene demand in the last five years has decreased 0.3%. The outlook is for several factors—including high prices, inter-polymer substitution, polystyrene food packaging bans in several major cities around the world, and a weaker Chinese economy—to continue to have a negative impact on global demand growth.

The author, Priya Ravindranath, is principal analyst, Polystyrene & Expandable Polystyrene, for IHS Chemicals, and can be reached at Priya.Ravindranath@ihs.com.

Resin Market Focus, by IHS Chemicals, provides ongoing insights into key industry topics and trends for major plastics and engineering resins, covering all major regions. IHS Chemicals provides extensive industry insight, analytics, and data for over 300 chemical markets worldwide, including the global plastics, polymers, and engineering resin markets. Learn more or inquire about IHS content at U.S. 888-293-8153 or AmericasTQ@ihs.com.![]()