One of the many views from the Naples Grande Beach Resort in Naples, Florida.

One of the many views from the Naples Grande Beach Resort in Naples, Florida.

Photo courtesy of Speedo

Photo courtesy of Speedo

Image courtesy of Guill Tool

Image courtesy of Guill Tool

Graphic courtesy of Frigel

Building on a successful 2014 conference with nearly 400 attendees, over 100 presentations, and more than 75 exhibitors, the Society of Plastics Engineers (SPE) and the Association of Industrial Metallizers, Coaters and Laminators (AIMCAL) will again present a combined event in 2015, SPE’s FlexPackCon and AIMCAL’s Web Coating & Handling Conference.

Donna Davis, FlexPackCon conference chair says: “This three full-day multi-track event, which will take place October 25-28 at the Naples Grande Beach Resort, Naples, Florida, is the only flexible packaging conference set to examine leading-edge technologies that have current commercial applications. Issues facing consumer product companies, from food preservation to supply-chain security, are program considerations.”

The keynote speech, “The U.S. Flexible Packaging Industry,” will be given byMarla Donahue, executive director of the Flexible Packaging Association. She will address current business trends in this $30-billion U.S. industry, which is experiencing a continuing shift from rigid to flexible packaging, taking advantage of the adaptability of flexible packaging as well as opportunities for source reduction.

Conferences organizers also describe the following highlights of various session topics at the conference:

Sustainable Solutions:Sustainability is more than a trend; it’s a requirement in today’s business environment. Flexible packaging formats are positioned for growth, offering many advantages and increasing consumer acceptance over alternatives. This session will engage plastic users throughout the value chain with discussions focused on the conversion from rigid to flexible packaging formats. Advances in materials, manufacturing, converting, and end of life are highlighted, with a call to action and collaboration.

Food Safety and Preservation: Packaging plays a primary role for food safety. Consumer awareness and changing regulations are at the forefront for package users and designers. Learn how our industry is focused on improving

communication, collaboration, and management systems throughout the supply chain. Technology for traceability, modified atmosphere, and improved barriers are aimed at enhancing shelf life and improving consumer safety.

Our Evolving Industry: Merger and Acquisition: Technology advancements, innovation, and favorable market dynamics help drive growth in the flexible packaging industry. With positive outlooks, the industry attracts new investments and business structures. Learn how mergers and acquisitions play an important role in the makeup of our field. This session will highlight recent activities by private equity,

corporations, and entrepreneurs. Participate in a panel discussion that links financial markets to private equity to major industry players.

Processing Equipment and Materials: Advances in materials and equipment are the core building blocks for innovation and new flexible packaging structures. Material innovations help processors overcome challenges and allow for new synergies. New machinery helps packaging engineers scale innovations from the lab to production. Advances in production improve film quality and open capabilities. Data collection and analytics improve troubleshooting.

Package Performance and Sealing: Industry leaders from academia, material science, and process technology converge to improve package design and functionality. Seal integrity and surface interactions are critical elements in the development and converting process. State-of-the-art technology is discussed with practical applications. Attendees will learn new approaches to sealing and package performance.

Innovation Tools and Trends:Industry experts from across the value chain share best practices to manage the innovation process. Main topics covered include process development, open innovation, and networking. Commercial case studies from Sealed Air and Campbell’s Company highlight the innovation process at work. The audience is invited to participate in a panel discussion to expand on key learnings.

Moreover, the event will begin with the short course in “Film Fundamentals: Scratch and Fracture,” taught by Hung-Jue Sue, Polymer Technology Center, Texas A&M University. www.4spe.org/flexpackcon2015

To help create the strongest and lightest composite infrastructure materials, Dow Polyurethanes has introduced the Voraforce™ TP 1200 series to the North American market. The series of polyurethanes is said to enable fast, energy-efficient pultrusion composite fabrication with low volatile organic compound (VOC) emissions.

Dow says the material supports the fabrication of strong composites for a number of applications, including building profiles (such as pilings and panels), window manufacturing, electrical infrastructure (such as utility poles), and civil engineering. Voraforce also reportedly is versatile enough that it can be used to create heavy-duty polyurethane pallets for logistics and transportation applications, as well as ladder rails for consumer use.

“As an alternative to traditional materials like aluminum, polyester, or epoxy, we’ve created a more cost-effective solution to help fabricators deliver superior strength and durability to structural profiles,” says Avery Watkins, new business development manager for Dow Polyurethanes.

Voraforce materials reportedly have the same toughness as traditional composite materials but requires less resin to fabricate, thus making the technology a more cost-efficient solution than polyester or vinyl ester resins. In addition, the company says it offers a number of sustainability benefits, such as lower amounts of VOCs emitted during the pultrusion process and thinner lightweight composite profiles. www.dowpolyurethanes.com

Polyamide producer Aquafil has announced it has partnered with Speedo USA on a take-back program that will allow Speedo USA’s post-manufacturing swimwear scraps to be upcycled into Aquafil’s “100% regenerated” Econyl® nylon. The take-back program gives new life to leftover fabric scraps, which would otherwise end up in landfills, allowing them to be turned back into raw nylon fiber and eventually new swimsuits.

“We are challenging apparel manufacturers to be more sustainable and restructure their supply chain to divert waste from landfill,” says Giulio Bonazzi, chairman and CEO of Aquafil. “Our partnership with Speedo USA shows their commitment to the environment with the take-back program, but also their ingenuity in creating products from materials that can be recycled an infinite number of times. They are really helping us close the loop and create a more sustainable manufacturing process.”

In the swimwear industry, post-production fabric waste has not been suitable for traditional recycling due to its complex technical composition. However, Aquafil has developed a technology that can turn swimwear fabric and other blended waste materials into new raw nylon.

The Econyl Regeneration System takes manufacturing byproduct waste and nylon materials that have reached the end of their product life—such as abandoned fishing nets and old carpets—and re-engineers them into high-quality nylon 6 for the production of new carpets, sportswear, and swimwear. The regeneration process will be used to separate usable nylon from Speedo’s blended post-production fabric scraps, upcycling it into raw nylon fiber that can be made into new PowerFlex Eco swimwear.

Made from 100% upcycled nylon waste materials, the producer says Econyl is ideal for creating high-quality garments that are durable, lightweight, breathable, and environmentally friendly. It also offers the same quality and performance as traditionally manufactured nylon, the company claims. www.econyl.com

The organizing committee for the SPE Automotive Composites Conference & Exhibition (ACCE) has announced the Dr. Jackie Rehkopf Best Paper Awardwinners for the group’s fifteenth-annual event, September 9-11, 2015. Three lead authors who received the highest average ratings by conference peer reviewers, out of a field of 70 contenders, are being honored for excellence in technical writing:

- Christopher Pastore, professor of Transdisciplinary Studies in the Kanbar College of Design, Engineering and Commerce at Philadelphia University, took first place in this year’s competition;

- Amy Langhorst, research engineer in the plastics research group of Materials Research & Advanced Engineering at Ford Motor Co., took second place; and

- Jacob Anderson, senior research & development engineer at the PPG Fiber Glass Science and Technology Center, placed third in the paper competition.

The conference’s best paper awards honor long-time SPE ACCE committee member, session organizer, two-time technical program co-chair, and long-time automotive-composites industry researcher, Jackie Rehkopf.

Pastore was sole author on a paper titled “Lightweighting Composites through Selective Fiber Placement,” in the “Advances in Reinforcements” session at the conference. About his topic, the author says, “The underlying idea is to use more expensive carbon fiber reinforcement only where needed through the use of a gradient hybrid material that incorporates glass everywhere else.

“The goal is a process that allows automation while optimizing weight and cost for a given structural element. Through a combination of theoretical and experimental evaluations, a methodology for evaluating the weight/cost efficiency of chopped fiber composites has been developed and confirmed experimentally.”

Langhorst was lead author along with Alper Kiziltas, Deborah Mielewski, and Ellen Lee, all from Ford, on a paper titled “Selective Dispersion and Comptabililizing Effect of Cellulose Filler in Recycled PA 6/PP Blends.” About her topic, Langhorst notes that “the environmental impact of automobiles can be reduced by using combinations of recycled polymers and natural fiber reinforcements to replace traditionally unfilled, glass-filled, and talc-filled polymeric components … The resulting properties [of these composites prepared for the study] were investigated on a microscopic (scanning-electron microscope) and macroscopic (mechanical and thermal properties) scale….”

Anderson was lead author, along with Ryan P. Emerson, on a paper titled “Effect of Processing Technique on the Mechanical Performance of Glass Fiber Reinforced Thermoplastics.” Describing his topic, Anderson explained “In the present work, thermoplastic bulk molding compound (BMC) was investigated to determine its mechanical performance relative to granulated long-fiber thermoplastic (GLFT) and continuous fiber-reinforced thermoplastic tape … Versus the GLFT specimen, the BMC material was shown to exhibit improvements in flexural and impact performance of 100% and 20%, respectively….” speautomotive.com/comp.htm

Guill Tool has introduced The Bullet™, a new extrusion head with fixed center design, multi-port spiral flow design, and gum space adjustment, plus the added feature of no fastening hardware, so cleaning and restart are easier and faster than any conventional head on the market currently, according to company sources.

The Bullet allows quick tooling changes, as the tips remove from the back, and the die removes from the front of the unit. “The absence of fastening hardware eliminates leaking, as does the taper body and deflector design pioneered by Guill,” the company adds.

High- and low-volume applications are suitable for this head and are accommodated with the changing of just one component. A family of crosshead designs is available, and users can specify the “caliber,” the maximum die I.D., Guill says.

A vacuum chamber and kit for assembly and disassembly are included with the unit. Optional keyed tooling offers machine designers and end users quick orientation, so the overall unit design allows faster disassembly and proper cleaning and restart, allowing the production line to become more profitable. www.guill.com

MHG’s CEO, Paul A. Pereira, recently announced the company has become the world’s largest producer of polyhydroxyalkanoate (PHA) with the startup of its first commercial-scale fermenter.

This new fermentation vessel places MHG in an ideal position to meet the product delivery needs of its manufacturing customers worldwide, the company says. It has been working over the last couple years to ramp up the Bainbridge, Georgia, USA, facility. In 2013, MHG brought in an engineering and construction group to design and buildout the plant. This expansion included the ordering and installation of custom equipment that will allow it to produce even greater quantities of PHA in the near future.

“Every single person, whether they are inland or on the coast, has been affected in some way by plastic debris,” says Pereira. “The plastic we have seen and touched will be there for several generations, adversely affecting our environment. At MHG, we believe PHA is the solution for a healthier planet, and operating this new fermentation vessel will allow us to increase production of this solution to combat the problem of plastic waste.”

MHG previously partnered with Tate & Lyle, a global provider of specialty ingredients, to test the scalability of Nodax™ brand PHA. The achieved production rates reportedly exceeded the metrics needed for commercial production viability, confirming that MHG’s PHA can be scaled for commercialization.

The PHA can be used to manufacture many items commonly made of petroleum plastics, including toys, cups, straws, utensils, “single use” plastic bags, and many other disposable items that are entering the waste stream worldwide. And because products manufactured from Nodax PHA biodegrade in three months to one year, they provide a solution to plastic pollution and accumulation when used instead of conventional plastic, the company adds. www.mhgbio.com

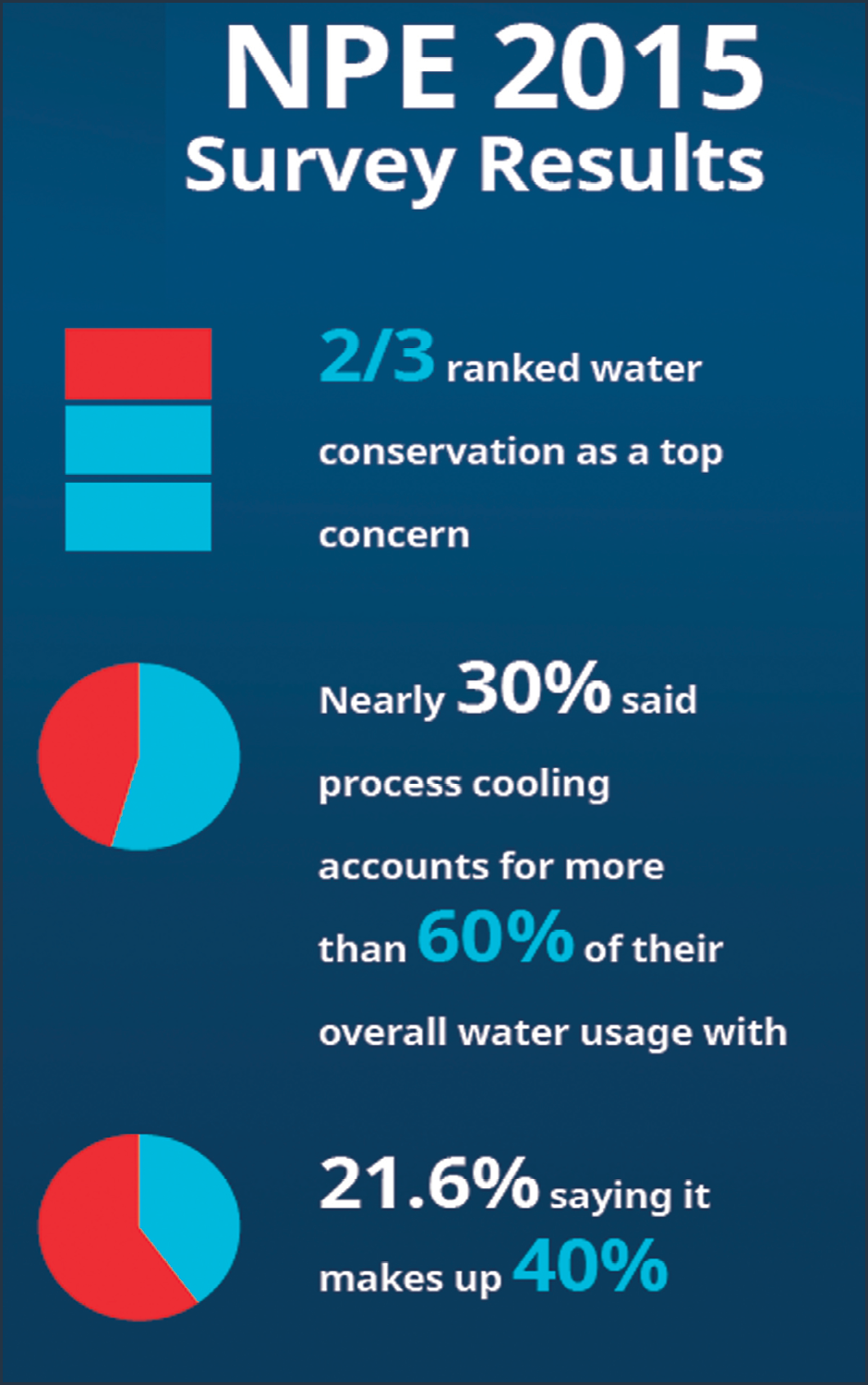

In a time of increasing global water scarcity, a survey of NPE2015 attendees conducted by Frigel shows that 64.7% of survey respondents rank water conservation as extremely or quite important at their plants. The survey also reveals that process cooling makes up a substantial portion of water usage at most plastic processing operations—driving the need for continued awareness about the positive impact that advanced systems have on both water savings and their ability to achieve operational efficiencies.

Frigel, a global provider of intelligent process cooling systems, conducted the survey to shed light on key issues that North American plastics processors have identified in the use of advanced process cooling technology. The survey was conducted via email before NPE2015 in March.

According to company global marketing manager Al Fosco, the survey results should interest companies worldwide where process cooling is vital to their operations, such as plastics, beverage, and metal processing, as well as pharmaceutical and medical device manufacturing.

“Frigel has been developing closed-loop process cooling technology since 1960 that is designed to help companies improve efficiencies and help achieve sustainability goals,” says Fosco. “This survey is another proof point that solutions we manufacture and market continue to address customers’ needs, yet only more-so today compared to decades ago.”

He says it’s clear, based on the survey, that many companies look to advanced closed-loop process cooling systems to deliver pragmatic business results. According to the survey, 58.6% of respondents said process cooling is extremely or quite important to plant efficiencies. It’s also clear, he adds, that companies appreciate how the technology contributes to sustainability initiatives.

“The survey supports what we’ve always known, which is that many

companies decide to adopt closed-loop process cooling technology for very practical business reasons. Survey respondents said they chose the technology to improve costs, increase machine uptime, and produce higher-quality products,” he says.

“Yet they also chose it to conserve water, which is in line with the growing concern over the importance of water use and the care needed to preserving it. Our goal is to continue to ensure that people understand that closed-loop process cooling systems can be part of the solution to smarter water use, in addition to plant efficiencies.”

In the survey, nearly 30% said process cooling makes up 60% of overall water consumption at their operations, and an additional 21.6% said it makes up 40%. The survey results come to light at a time when water resources are stressed globally.

“The United Nations Department of Economic and Social Affairs states that water scarcity affects every continent, and that about 1.2 billion people live in areas of physical scarcity,” cites Fosco. “Further, the United Nations’ World Water Development Report warns that the world could suffer a 40% shortfall in water supply by 2030—and that global water demand for the manufacturing industry is expected to increase by 400% from 2000 to 2050, leading all other sectors.”

With the recent drop in U.S. natural gas prices, U.S. polymer producers have restarted mothballed plants and are building new ones. However, the collapse of crude oil prices may force these companies to alter their plans, BCC Research reveals in its new report, “Polymeric Foams.”

The U.S. market for polymeric foam is predicted to reach nearly 9.3 billion pounds (4.2 billion kg) in 2020, reflecting a compound annual growth rate (CAGR) of 2.8%. The polyurethanes segment is expected to grow to nearly 5.1 billion pounds (2.4 billion kg) in 2020, with a CAGR of 3%. And the polystyrene market segment is expected to grow to 2.4 billion pounds (1.1 billion kg) in 2020, with a 2.4% CAGR.

In the roughly four years since BCC Research’s last study on the polymeric foams industry, the changes found in this major segment of the plastics production and processing industry were more evolutionary than revolutionary. Products and markets change as technology and society change, but aside from continuing work on finding newer and better foam blowing agents, the products and processes to make them are pretty much the same.

Polymer foams find their primary applications in consumer products, such as cushioning for furniture and automobiles, thermal insulation for construction and packaging, and similar end uses that are driven by the business cycle. As the business cycle has turned upwards again after the Great Recession of 2007-2009, these products are again getting attention and sales.

However, the anticipated growth in the USA of the polymers industry faces a number of potential roadblocks. The global nature of the economy and the high price of natural gas only a few years ago caused many U.S. chemical companies to stop building and even to shut down their U.S. plants and build and operate new ones in countries with cheaper labor, feedstock, or both. But the recent drop in U.S. natural gas prices has caused companies to reconsider restarting or building new capacity in the USA.

“Hydraulic fracturing [fracking] has lowered the price of U.S. natural gas to give U.S. petrochemicals and polymer producers a price advantage over those in Europe who depend on naphtha cracking for polymer feedstocks,” notes BCC analyst J. Charles Forman. “But the sudden drop in crude oil prices to about the $50 per barrel has suddenly made Europe more competitive again.

“Some analysts say that if crude drops below $50, other producers will reach price parity with those in the United States. The drop in crude oil prices has made drilling with fracking less profitable than it was.” www.bccresearch.com