Polyvinyl chloride (PVC) continues to exhibit healthy global growth as the third-largest volume thermoplastic after polyethylene and polypropylene. IHS expects global PVC growth to continue to be above GDP growth, driven by its intrinsic value in a wide range of durable applications linked directly to the construction market.

Overall, PVC demand continues to be price-sensitive, since this resin competes with a range of other products such as HDPE, glass, wood, aluminum, steel, and concrete. After the first half of 2015, trending industry dynamics make planning a challenge, for both producers and buyers.

Impact of the Lower Crude Oil Environment

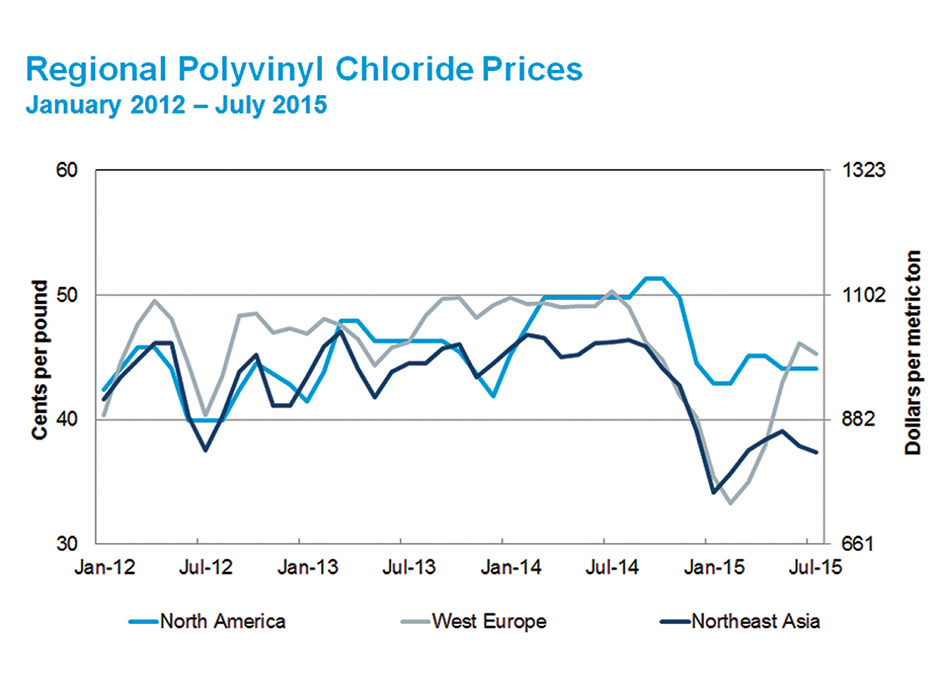

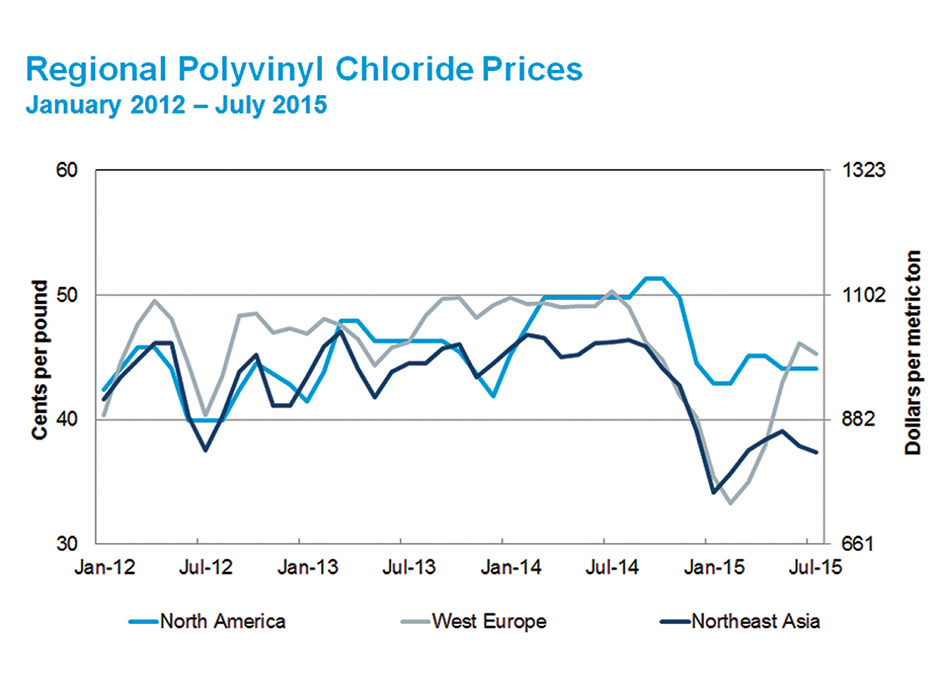

While the major drop in crude prices occurred in November 2014, Asian PVC prices actually began to decline after peaking in August 2014, falling 26% by early 2015. European PVC prices responded similarly, falling in excess of 33% from mid-2014’s peak. However, prices in these regions started to rebound in February and reached another peak during the second quarter of 2015. Overall global demand remained healthy, supported by lower energy prices, after prices had reached levels associated with Asian cash costs. In the end, major destocking took place in the first quarter of 2015.

Additionally, as crude oil prices stabilized, buyers returned to replenish stocks, while the industry experienced a number of unplanned outages and forces majeures, mainly in Europe, and long planned turnarounds in North America. These outages provided European and North American producers a chance to improve their margins, as effective operating rates increased.

China’s Expansion Wave Moderates

Globally, PVC supply is anticipated to stay long for another several years due to over-expansion that has occurred in the past. Today’s oversupply position is driven mainly by the massive Chinese investment in new vinyls capacity beyond its requirements. Part of the reason is attributed to the use of the acetylene route to produce PVC that does not rely on the availability of ethylene as a feedstock.

Over the past ten years, the Chinese vinyl sector ballooned from just over eight million metric tons to more than 31 million metric tons. In short, more than 90% of the global PVC expansion that has occurred from 2005 to 2015 happened inside China. Several years of poor return on investment within this sector has halted expansion plans until plant utilization rates can show considerable improvement.

North America: Ethylene Feedstock is Key

All of the North American PVC producers are integrated into chlor-alkali; however, the other key raw material for PVC is ethylene, which makes up about 50% of the resin molecule. Since 2008, the shale gas boom has ushered in a new era for chlor-alkali vinyls-integrated producers in the region.

The economic benefit of being back integrated into ethylene has now been recognized such that several major PVC producers are pursuing at this time, in one way or another, some kind of ethylene capacity project of their own (OxyVinyls, Mexichem, Shintech, and Axiall are some of the producers). Based on the advantaged cost position that this region has developed versus other parts of the world, the industry could perhaps see further vinyls investment taking place in the not-too-distant future.

The author, Ana Gamboa, is associate director, Chlor-Alkali/ Vinyls North America, for IHS Chemicals, and can be reached at ana.gamboatorres@ihs.com.

Resin Market Focus, by IHS Chemicals, provides ongoing insights into key industry topics and trends for major plastics and engineering resins, covering all major regions. IHS Chemicals provides extensive industry insight, analytics, and data for over 300 chemical markets worldwide, including the global plastics, polymers, and engineering resin markets. Learn more or inquire about IHS content at U.S. 877-825-8188 or AmericasTQ@ihs.com.