Cool New Materials for Durables

Product design possibilities are being expanded by the unusual characteristics of three new series of materials

Previous Article Next Article

By Jan H. Schut

Automotive molder Faurecia reportedly spent over ten years developing NafiLean, an 80/20 percent PP/chopped hemp-fiber compound for lightweight car door panel inserts (inset). The next stage will be 80/20 PBS/hemp-fiber compounds, called BioMat, to be commercialized next year with 70% bio-based content, including the hemp.

One is hard, one is soft, and one is really hard. Respectively, the matrials are: (1) the first “all bio” polylactic acid (PLA) and polybutylene succinate (PBS) formulations for durable injection-molded parts, (2) a new syndiotactic elastomer for calendering, and (3) an amorphous metal that can be molded using injection molding machinery. The biopolymer formulations for durables and the syndiotactic polyolefin elastomers have been over ten years in development; the amorphous metal has been nearly 30 years in gestation. They’re now all limitedly commercial and remain specialties so far, yet they’re likely to shape, or rather reshape, your computers, cell phones, cars, and appliances for years to come.

The “First High-Bio-Content” Polymers for Durables

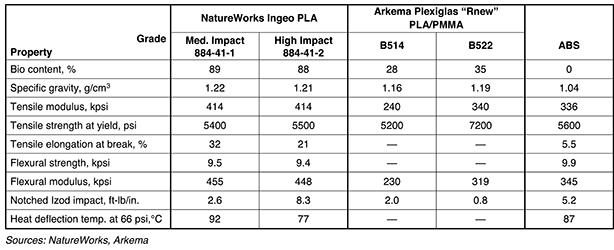

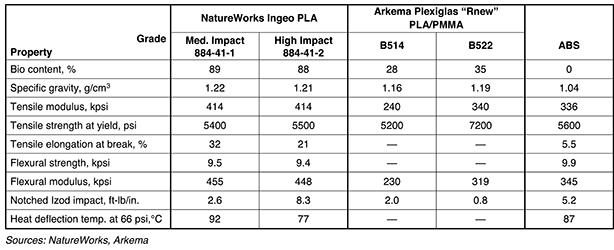

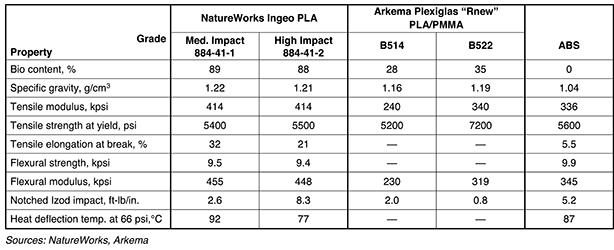

Partly bio-based engineering compounds aren’t new. Arkema Group (Colombes, France), for example, introduced two grades of its Plexiglas “Rnew” material in 2012. Here the company alloys its petro-based acrylic with 28% and 35% bio-based PLA from NatureWorks LLC (Minnetonka, Minnesota, USA), adding performance and bio-content. Now, however, several new biopolymer formulations are in the works for durables with very high bio-based content for the first time, competing head-on with ABS for electronics and appliances.

NatureWorks has developed two new injection molding grades of Ingeo PLA: one medium-impact grade and one high-impact grade, using nucleating agents to get rapid crystallization and a higher heat deflection temperature (HDT). The medium-impact R&D grade has 89% bio-content with 11% modifiers and nucleating agents and an HDT of 92°C. The high-impact R&D grade has 88% bio-content, 12% modifiers and nucleating agents, and an HDT of 77°C. Both are available in test quantities.

Meanwhile, Wacker Chemie AG (Munich, Germany) also recently published data on blends of 40% PBS and 30% PLA, with 20% of Wacker’s Vinnex compatibilizers to enhance properties. The material includes 10% filler (either talc or calcium carbonate), for a total of 70% bio-content. The Vinnex component is comprised of 14% Vinnex 2504, a vinyl acetate ethylene copolymer for higher elongation, and 6% Vinnex 2510, a vinyl acetate homopolymer for higher stiffness. The developmental PBS was supplied by Mitsubishi Chemical Corp. (Tokyo, Japan) from a pilot plant, and the Ingeo 4043D PLA was supplied by NatureWorks.

Wacker claims higher impact and melt strength for the PBS/PLA blend, more flexibility, and higher heat resistance for appliance applications—about 100°C, versus 60°C for typical PLA. Vinnex also allows PLA and PBS to be combined in any ratio. Without compatibilizing, the amount of PBS miscible with PLA would be limited to 10-20%. The company introduced Vinnex five years ago in the USA and six years ago in Europe, and offers nearly a dozen grades.

Other Bio-Combinations: Hemp & PBS

Automotive parts molder Faurecia SA (Nanterre, France) has developed what’s said to be the first hemp-fiber-filled PBS compound for injection molding. The 15-year development program, which started in 2006, has three stages. The first material, which took seven years to develop, is 80% polypropylene and 20% short chopped hemp fibers. Called NafiLean, it was commercialized for non-visible door-panel inserts and the central console on Peugeot 308 cars, starting with model year 2013. Chopped hemp fibers, supplied through a French agricultural cooperative, add strength and make the parts 20% to 25% lighter weight than PP alone, Faurecia says.

The second material will be PBS and chopped hemp fibers, expected to be commercial in 2016. Faurecia calls the patent-applied-for natural-fiber/PBS composite BioMat. The compound includes PBS, flow enhancers, compatiblizers, impact modifiers, and 20-40% hemp fiber, depending on the application. Mitsubishi Chemicals will supply the PBS, which will at first be 60% bio-based, making the first BioMat compounds 65-70% bio-based, including the hemp.

PBS availability could be a sticking point. PBS won’t be readily available until the world’s first commercial PBS plant, PTTMCC Biochem Co. Ltd. (Rayong, Thailand), is running. The plant started up in August, but it’s limited to only 40 million pounds (18 million kg) per year, so there won’t be a lot of PBS available, even at full production. The plant will at first make partly bio-based PBS, sourcing bio-succinic acid from BioAmber Inc.’s new plant in Sarnia (Ontario, Canada), which also started up in August.

PTTMCC will make all-bio PBS when bio-based 1,4-butanediol monomer, which is 40% of PBS, is available in 2017. Then, in stage three, BioMat will be all bio-based.

PTTMCC is a joint venture between Mitsubishi Chemical and PTT PLC Ltd., in Bangkok, Thailand (a sister company is 50% owner of NatureWorks). NatureWorks previously offered two PLA/PBS blends with over 50% PBS (AW300D for injection molding and AW240D for thermoforming food service) in the AmberWorks joint venture with Montreal-based BioAmber. AmberWorks used technology BioAmber acquired in 2010, but the material grades aren’t actively sold, awaiting a “competitively priced, food-contact-registered supply of PBS,” BioAmber says.

“Thumbs” Up for a Mysterious Syndiotactic Elastomer

One of the most unusual polymer developments in recent years is a syndiotactic elastomer from Mitsui Chemicals Inc. (Tokyo, Japan). The material series was launched in April 2011 as Notio SN, with expected annual sales of over 1 billion yen ($8 million). The syndiotactic copolymer is now called simply Notio. (A syndiotactic polymer is a stereo-regular polymer made by a metallocene catalyst, which assembles “handed” monomers with pendant groups, or “thumbs,” on alternating sides of the polymer chain, giving distinctive strength and clarity. In contrast, conventional polypropylene is isotactic, meaning that its pendant methyl “thumbs” are all on one side of the polymer chain, like a comb.)

Properties of High-Bio-Content Polymers for Injection Molding vs. ABS

Mitsui says that Notio is a syndiotactic elastomer, but not a syndiotactic polypropylene elastomer, which indicates a relatively high comonomer amount. Propylene and butene are both handed alpha-olefin monomers; styrene is also handed, but it’s not an alpha olefin. So the logical comonomers for Notio are propylene and butene. Mitsui also holds patents on metallocene-made propylene and butene copolymers with high scratch resistance.

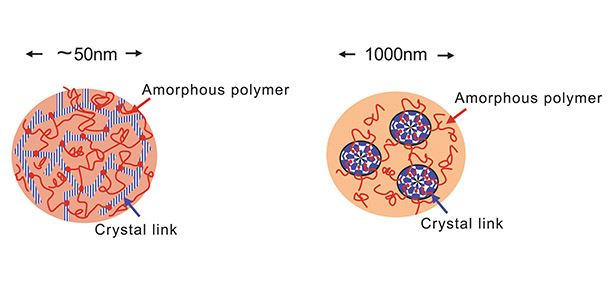

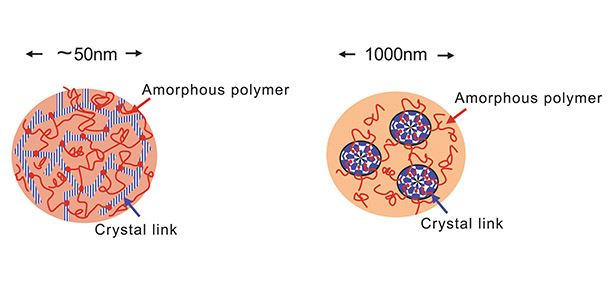

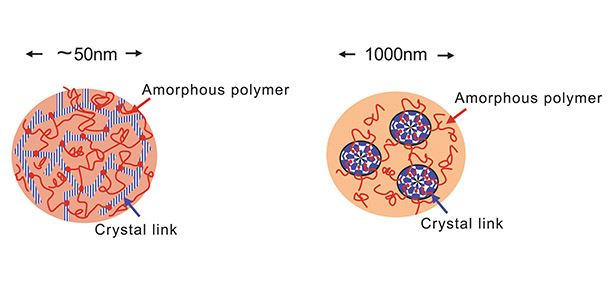

Syndiotactic PP homopolymer is normally lower in molecular weight than isotactic PP for the same melt flow, and much less crystalline: 20-30% crystalline for sPP vs. 50% for iPP. Mitsui describes Notio as 30% crystalline but with very high molecular weight. Notio copolymers are described as having a distinctive nano-crystal structure, which means they’re inherently elastomeric with a high level of molecular entanglements on the long polymer chain itself.

Notio elastomer is flexible, low density, and transparent with excellent heat resistance and no cross-linking, Mitsui says. Adding Notio to conventional isotactic PP improves impact and scratch resistance, transparency, flexibility, and elasticity—and eliminates stress whitening, Mitsui adds.

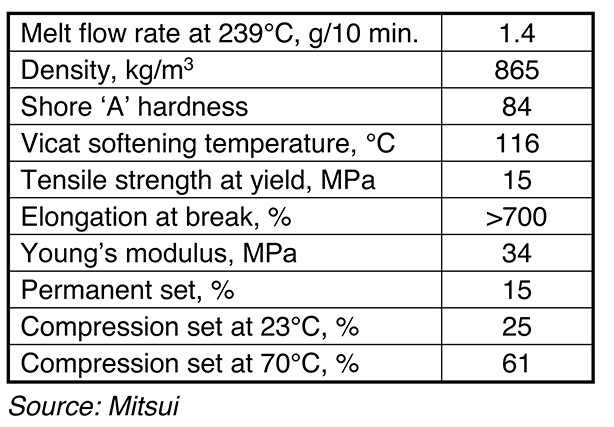

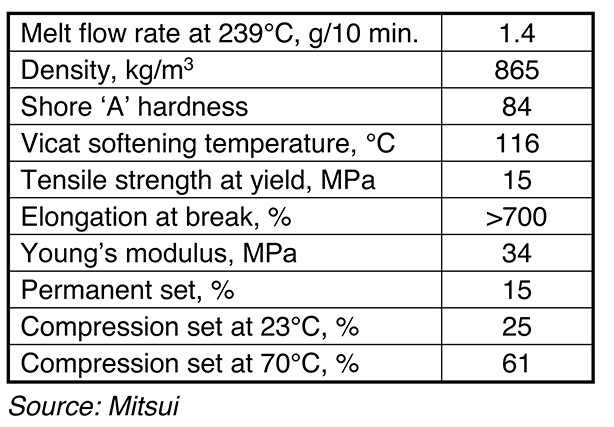

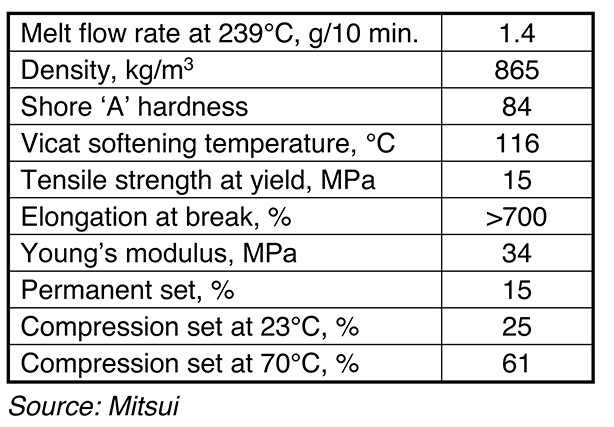

Properties of Mitsui Chemicals’ Notio Syndiotactic Copolymer, Grade SN-0285

Notio SN-0285, with a melt flow rate of 1.4 g/10 min., was commercialized for imitation leather for high-end handbags in March 2013. Other Notio compounds are blended with isotactic PP and TPO and have an MFR of 3 g/10 min.; they’re also for calendering and extrusion. Applications under development include auto interiors, footwear, and furniture.

Mitsui’s patent-applied-for catalyst technology for syndiotactic polyolefins describes a metallocene catalyst based on organoaluminum oxy-bridged to a hydrocarbon group and silicon-containing group to form a ring. The patent says the catalyst makes a stereo-regular copolymer from propylene monomer and “one other alpha olefin.” The patent also describes polymer chains that are 85-90% syndiotactic—i.e., with very regularly alternating “thumbs.”

“That indicates that there is either a small fraction of comonomer in Notio SN or that the comonomer can also be polymerized syndiotactically like butene-1,” says Kenneth Sinclair, a consultant at polymer research group EnerChemTek Inc. (Toronto, Ontario, Canada). The patent says the comonomer is either ethylene or an alpha olefin with 2-20 carbon atoms. Its scratch resistance also indicates that the co-monomer could be butene, which is used to prevent stretch whitening.

Mitsui only offers Notio for extrusion and calendering, but there are references to sPP in Mitsui patent literature which includes injection molding compounds. A 2008 Mitsui patent (U.S. Pat. #7,411,017), published three years before Mitsui announced syndiotactic Notio SN, describes reactive compounding with peroxide of a blend of isotactic and syndiotactic PP with rubber and softeners. The syndiotactic PP content is small—only 1.5 to 8.5% according to the patent, but the reacted blend could produce a more miscible rubber/PP elastomer for molding.

Mitsui Chemicals’ syndiotactic Notio elastomers have a nano-crystal structure with very high molecular weight and a high level of molecular entanglement. They’re also blended with isotactic PP and TPO for extrusion and calendering, targeting synthetic leather applications.

Amorphous Metal Alloys for Injection Molding

Liquidmetal Technologies Inc. (Rancho Santa Margarita, California, USA) markets amorphous zirconium technology developed over the last 30 years by scientists at the California Institute of Technology in Pasadena with the National Aeronautic and Space Administration and U.S. Department of Energy. The company, founded in 1987, developed several alloys, but primarily uses LM105, a mix of five elements: zirconium, titanium, aluminum, copper, and nickel.

The idea is that a blend of large and small metal molecules in the right ratio, cooled rapidly from the melt, will pack tightly without crystallizing, forming an amorphous metal which behaves like plastic—a metallic glass. Amorphous LM105 has a broad thermal softening range, starting around 400°C and melting at around 858°C. It reportedly has ten times the elasticity of steel and is twice as strong as titanium (yield strength of up to 1524 MPa, vs. 830 MPa for titanium) with low specific gravity and high corrosion resistance.

The alloy is made under license for Liquidmetal by Materion Corp. (Mayfield Heights, Ohio, USA) and comes in partially crystalline rods, which are cut into ingots. To become amorphous, the alloy must be melted, molded, and cooled rapidly from above its melting temperature; otherwise it reverts to a crystalline morphology.

Liquidmetal adapted an injection molding machine from Engel Austria GmbH (Schwertberg, Austria) to process ingots using induction heat and mold conditioning. In 2010 Liquidmetal partnered with Engel to develop a commercial molding machine for the alloy. Engel has since delivered roughly a half-dozen machines, all the same size, and all to Liquidmetal or its licensees for development.

Liquidmetal Technologies partnered with Engel to develop an unusual injection molding machine for an amorphous metal alloy, LM105, which behaves somewhat like plastic. Liquidmetal can mold parts (like those shown here), or the company can license and teach others the technology.

The machine melts one ingot at a time by induction heat in a high vacuum chamber, which keeps out contamination like oxygen and nitrogen to avoid crystallization (since oxides act as nucleating agents and create crystals). Once the metal is melted, it’s cooled by injection into a mold either at room temperature or heated to up to 200°C (500-700°C cooler than the molten metal) and forms the amorphous structure as it cools. Cycle time is typically less than 2.5 minutes, depending on part geometry. Maximum shot weight is 100 grams, or one ingot, for a maximum part size of 80 grams, with 20 grams of sprue. The sprue is removed robotically by waterjet cutter or shears, and recycled. The alloy reportedly has been molded in molds with up to 32 cavities.

Liquidmetal technology is different from metal injection molding (MIM), which conventionally molds a blend of metal and plastic powders, after which the part is sintered in a furnace to remove the plastic binder. MIM parts often have rough surface finishes, which take reworking, where Liquidmetal parts are very smooth. MIM parts also shrink by up to 20%, while LM105 parts shrink only about 0.4%, Liquidmetal says.

Because molding conditions for the LM105 alloy are critical to creating the amorphous properties, Liquidmetal authorized two U.S. moldmakers to build molds for the process, Matrix Tool Inc. (Fairview, Pennsylvania) and Mold Craft Inc. (Willernie, Minnesota). Liquidmetal doesn’t sell the alloy directly, but either does the molding itself or licenses the technology and teaches others how to do it.

Cool New Materials for Durables

Product design possibilities are being expanded by the unusual characteristics of three new series of materials

Previous Article Next Article

By Jan H. Schut

Automotive molder Faurecia reportedly spent over ten years developing NafiLean, an 80/20 percent PP/chopped hemp-fiber compound for lightweight car door panel inserts (inset). The next stage will be 80/20 PBS/hemp-fiber compounds, called BioMat, to be commercialized next year with 70% bio-based content, including the hemp.

One is hard, one is soft, and one is really hard. Respectively, the matrials are: (1) the first “all bio” polylactic acid (PLA) and polybutylene succinate (PBS) formulations for durable injection-molded parts, (2) a new syndiotactic elastomer for calendering, and (3) an amorphous metal that can be molded using injection molding machinery. The biopolymer formulations for durables and the syndiotactic polyolefin elastomers have been over ten years in development; the amorphous metal has been nearly 30 years in gestation. They’re now all limitedly commercial and remain specialties so far, yet they’re likely to shape, or rather reshape, your computers, cell phones, cars, and appliances for years to come.

The “First High-Bio-Content” Polymers for Durables

Partly bio-based engineering compounds aren’t new. Arkema Group (Colombes, France), for example, introduced two grades of its Plexiglas “Rnew” material in 2012. Here the company alloys its petro-based acrylic with 28% and 35% bio-based PLA from NatureWorks LLC (Minnetonka, Minnesota, USA), adding performance and bio-content. Now, however, several new biopolymer formulations are in the works for durables with very high bio-based content for the first time, competing head-on with ABS for electronics and appliances.

NatureWorks has developed two new injection molding grades of Ingeo PLA: one medium-impact grade and one high-impact grade, using nucleating agents to get rapid crystallization and a higher heat deflection temperature (HDT). The medium-impact R&D grade has 89% bio-content with 11% modifiers and nucleating agents and an HDT of 92°C. The high-impact R&D grade has 88% bio-content, 12% modifiers and nucleating agents, and an HDT of 77°C. Both are available in test quantities.

Meanwhile, Wacker Chemie AG (Munich, Germany) also recently published data on blends of 40% PBS and 30% PLA, with 20% of Wacker’s Vinnex compatibilizers to enhance properties. The material includes 10% filler (either talc or calcium carbonate), for a total of 70% bio-content. The Vinnex component is comprised of 14% Vinnex 2504, a vinyl acetate ethylene copolymer for higher elongation, and 6% Vinnex 2510, a vinyl acetate homopolymer for higher stiffness. The developmental PBS was supplied by Mitsubishi Chemical Corp. (Tokyo, Japan) from a pilot plant, and the Ingeo 4043D PLA was supplied by NatureWorks.

Wacker claims higher impact and melt strength for the PBS/PLA blend, more flexibility, and higher heat resistance for appliance applications—about 100°C, versus 60°C for typical PLA. Vinnex also allows PLA and PBS to be combined in any ratio. Without compatibilizing, the amount of PBS miscible with PLA would be limited to 10-20%. The company introduced Vinnex five years ago in the USA and six years ago in Europe, and offers nearly a dozen grades.

Other Bio-Combinations: Hemp & PBS

Automotive parts molder Faurecia SA (Nanterre, France) has developed what’s said to be the first hemp-fiber-filled PBS compound for injection molding. The 15-year development program, which started in 2006, has three stages. The first material, which took seven years to develop, is 80% polypropylene and 20% short chopped hemp fibers. Called NafiLean, it was commercialized for non-visible door-panel inserts and the central console on Peugeot 308 cars, starting with model year 2013. Chopped hemp fibers, supplied through a French agricultural cooperative, add strength and make the parts 20% to 25% lighter weight than PP alone, Faurecia says.

The second material will be PBS and chopped hemp fibers, expected to be commercial in 2016. Faurecia calls the patent-applied-for natural-fiber/PBS composite BioMat. The compound includes PBS, flow enhancers, compatiblizers, impact modifiers, and 20-40% hemp fiber, depending on the application. Mitsubishi Chemicals will supply the PBS, which will at first be 60% bio-based, making the first BioMat compounds 65-70% bio-based, including the hemp.

PBS availability could be a sticking point. PBS won’t be readily available until the world’s first commercial PBS plant, PTTMCC Biochem Co. Ltd. (Rayong, Thailand), is running. The plant started up in August, but it’s limited to only 40 million pounds (18 million kg) per year, so there won’t be a lot of PBS available, even at full production. The plant will at first make partly bio-based PBS, sourcing bio-succinic acid from BioAmber Inc.’s new plant in Sarnia (Ontario, Canada), which also started up in August.

PTTMCC will make all-bio PBS when bio-based 1,4-butanediol monomer, which is 40% of PBS, is available in 2017. Then, in stage three, BioMat will be all bio-based.

PTTMCC is a joint venture between Mitsubishi Chemical and PTT PLC Ltd., in Bangkok, Thailand (a sister company is 50% owner of NatureWorks). NatureWorks previously offered two PLA/PBS blends with over 50% PBS (AW300D for injection molding and AW240D for thermoforming food service) in the AmberWorks joint venture with Montreal-based BioAmber. AmberWorks used technology BioAmber acquired in 2010, but the material grades aren’t actively sold, awaiting a “competitively priced, food-contact-registered supply of PBS,” BioAmber says.

“Thumbs” Up for a Mysterious Syndiotactic Elastomer

One of the most unusual polymer developments in recent years is a syndiotactic elastomer from Mitsui Chemicals Inc. (Tokyo, Japan). The material series was launched in April 2011 as Notio SN, with expected annual sales of over 1 billion yen ($8 million). The syndiotactic copolymer is now called simply Notio. (A syndiotactic polymer is a stereo-regular polymer made by a metallocene catalyst, which assembles “handed” monomers with pendant groups, or “thumbs,” on alternating sides of the polymer chain, giving distinctive strength and clarity. In contrast, conventional polypropylene is isotactic, meaning that its pendant methyl “thumbs” are all on one side of the polymer chain, like a comb.)

Properties of High-Bio-Content Polymers for Injection Molding vs. ABS

Mitsui says that Notio is a syndiotactic elastomer, but not a syndiotactic polypropylene elastomer, which indicates a relatively high comonomer amount. Propylene and butene are both handed alpha-olefin monomers; styrene is also handed, but it’s not an alpha olefin. So the logical comonomers for Notio are propylene and butene. Mitsui also holds patents on metallocene-made propylene and butene copolymers with high scratch resistance.

Syndiotactic PP homopolymer is normally lower in molecular weight than isotactic PP for the same melt flow, and much less crystalline: 20-30% crystalline for sPP vs. 50% for iPP. Mitsui describes Notio as 30% crystalline but with very high molecular weight. Notio copolymers are described as having a distinctive nano-crystal structure, which means they’re inherently elastomeric with a high level of molecular entanglements on the long polymer chain itself.

Notio elastomer is flexible, low density, and transparent with excellent heat resistance and no cross-linking, Mitsui says. Adding Notio to conventional isotactic PP improves impact and scratch resistance, transparency, flexibility, and elasticity—and eliminates stress whitening, Mitsui adds.

Properties of Mitsui Chemicals’ Notio Syndiotactic Copolymer, Grade SN-0285

Notio SN-0285, with a melt flow rate of 1.4 g/10 min., was commercialized for imitation leather for high-end handbags in March 2013. Other Notio compounds are blended with isotactic PP and TPO and have an MFR of 3 g/10 min.; they’re also for calendering and extrusion. Applications under development include auto interiors, footwear, and furniture.

Mitsui’s patent-applied-for catalyst technology for syndiotactic polyolefins describes a metallocene catalyst based on organoaluminum oxy-bridged to a hydrocarbon group and silicon-containing group to form a ring. The patent says the catalyst makes a stereo-regular copolymer from propylene monomer and “one other alpha olefin.” The patent also describes polymer chains that are 85-90% syndiotactic—i.e., with very regularly alternating “thumbs.”

“That indicates that there is either a small fraction of comonomer in Notio SN or that the comonomer can also be polymerized syndiotactically like butene-1,” says Kenneth Sinclair, a consultant at polymer research group EnerChemTek Inc. (Toronto, Ontario, Canada). The patent says the comonomer is either ethylene or an alpha olefin with 2-20 carbon atoms. Its scratch resistance also indicates that the co-monomer could be butene, which is used to prevent stretch whitening.

Mitsui only offers Notio for extrusion and calendering, but there are references to sPP in Mitsui patent literature which includes injection molding compounds. A 2008 Mitsui patent (U.S. Pat. #7,411,017), published three years before Mitsui announced syndiotactic Notio SN, describes reactive compounding with peroxide of a blend of isotactic and syndiotactic PP with rubber and softeners. The syndiotactic PP content is small—only 1.5 to 8.5% according to the patent, but the reacted blend could produce a more miscible rubber/PP elastomer for molding.

Mitsui Chemicals’ syndiotactic Notio elastomers have a nano-crystal structure with very high molecular weight and a high level of molecular entanglement. They’re also blended with isotactic PP and TPO for extrusion and calendering, targeting synthetic leather applications.

Amorphous Metal Alloys for Injection Molding

Liquidmetal Technologies Inc. (Rancho Santa Margarita, California, USA) markets amorphous zirconium technology developed over the last 30 years by scientists at the California Institute of Technology in Pasadena with the National Aeronautic and Space Administration and U.S. Department of Energy. The company, founded in 1987, developed several alloys, but primarily uses LM105, a mix of five elements: zirconium, titanium, aluminum, copper, and nickel.

The idea is that a blend of large and small metal molecules in the right ratio, cooled rapidly from the melt, will pack tightly without crystallizing, forming an amorphous metal which behaves like plastic—a metallic glass. Amorphous LM105 has a broad thermal softening range, starting around 400°C and melting at around 858°C. It reportedly has ten times the elasticity of steel and is twice as strong as titanium (yield strength of up to 1524 MPa, vs. 830 MPa for titanium) with low specific gravity and high corrosion resistance.

The alloy is made under license for Liquidmetal by Materion Corp. (Mayfield Heights, Ohio, USA) and comes in partially crystalline rods, which are cut into ingots. To become amorphous, the alloy must be melted, molded, and cooled rapidly from above its melting temperature; otherwise it reverts to a crystalline morphology.

Liquidmetal adapted an injection molding machine from Engel Austria GmbH (Schwertberg, Austria) to process ingots using induction heat and mold conditioning. In 2010 Liquidmetal partnered with Engel to develop a commercial molding machine for the alloy. Engel has since delivered roughly a half-dozen machines, all the same size, and all to Liquidmetal or its licensees for development.

Liquidmetal Technologies partnered with Engel to develop an unusual injection molding machine for an amorphous metal alloy, LM105, which behaves somewhat like plastic. Liquidmetal can mold parts (like those shown here), or the company can license and teach others the technology.

The machine melts one ingot at a time by induction heat in a high vacuum chamber, which keeps out contamination like oxygen and nitrogen to avoid crystallization (since oxides act as nucleating agents and create crystals). Once the metal is melted, it’s cooled by injection into a mold either at room temperature or heated to up to 200°C (500-700°C cooler than the molten metal) and forms the amorphous structure as it cools. Cycle time is typically less than 2.5 minutes, depending on part geometry. Maximum shot weight is 100 grams, or one ingot, for a maximum part size of 80 grams, with 20 grams of sprue. The sprue is removed robotically by waterjet cutter or shears, and recycled. The alloy reportedly has been molded in molds with up to 32 cavities.

Liquidmetal technology is different from metal injection molding (MIM), which conventionally molds a blend of metal and plastic powders, after which the part is sintered in a furnace to remove the plastic binder. MIM parts often have rough surface finishes, which take reworking, where Liquidmetal parts are very smooth. MIM parts also shrink by up to 20%, while LM105 parts shrink only about 0.4%, Liquidmetal says.

Because molding conditions for the LM105 alloy are critical to creating the amorphous properties, Liquidmetal authorized two U.S. moldmakers to build molds for the process, Matrix Tool Inc. (Fairview, Pennsylvania) and Mold Craft Inc. (Willernie, Minnesota). Liquidmetal doesn’t sell the alloy directly, but either does the molding itself or licenses the technology and teaches others how to do it.

Cool New Materials for Durables

Product design possibilities are being expanded by the unusual characteristics of three new series of materials

Previous Article Next Article

By Jan H. Schut

Automotive molder Faurecia reportedly spent over ten years developing NafiLean, an 80/20 percent PP/chopped hemp-fiber compound for lightweight car door panel inserts (inset). The next stage will be 80/20 PBS/hemp-fiber compounds, called BioMat, to be commercialized next year with 70% bio-based content, including the hemp.

One is hard, one is soft, and one is really hard. Respectively, the matrials are: (1) the first “all bio” polylactic acid (PLA) and polybutylene succinate (PBS) formulations for durable injection-molded parts, (2) a new syndiotactic elastomer for calendering, and (3) an amorphous metal that can be molded using injection molding machinery. The biopolymer formulations for durables and the syndiotactic polyolefin elastomers have been over ten years in development; the amorphous metal has been nearly 30 years in gestation. They’re now all limitedly commercial and remain specialties so far, yet they’re likely to shape, or rather reshape, your computers, cell phones, cars, and appliances for years to come.

The “First High-Bio-Content” Polymers for Durables

Partly bio-based engineering compounds aren’t new. Arkema Group (Colombes, France), for example, introduced two grades of its Plexiglas “Rnew” material in 2012. Here the company alloys its petro-based acrylic with 28% and 35% bio-based PLA from NatureWorks LLC (Minnetonka, Minnesota, USA), adding performance and bio-content. Now, however, several new biopolymer formulations are in the works for durables with very high bio-based content for the first time, competing head-on with ABS for electronics and appliances.

NatureWorks has developed two new injection molding grades of Ingeo PLA: one medium-impact grade and one high-impact grade, using nucleating agents to get rapid crystallization and a higher heat deflection temperature (HDT). The medium-impact R&D grade has 89% bio-content with 11% modifiers and nucleating agents and an HDT of 92°C. The high-impact R&D grade has 88% bio-content, 12% modifiers and nucleating agents, and an HDT of 77°C. Both are available in test quantities.

Meanwhile, Wacker Chemie AG (Munich, Germany) also recently published data on blends of 40% PBS and 30% PLA, with 20% of Wacker’s Vinnex compatibilizers to enhance properties. The material includes 10% filler (either talc or calcium carbonate), for a total of 70% bio-content. The Vinnex component is comprised of 14% Vinnex 2504, a vinyl acetate ethylene copolymer for higher elongation, and 6% Vinnex 2510, a vinyl acetate homopolymer for higher stiffness. The developmental PBS was supplied by Mitsubishi Chemical Corp. (Tokyo, Japan) from a pilot plant, and the Ingeo 4043D PLA was supplied by NatureWorks.

Wacker claims higher impact and melt strength for the PBS/PLA blend, more flexibility, and higher heat resistance for appliance applications—about 100°C, versus 60°C for typical PLA. Vinnex also allows PLA and PBS to be combined in any ratio. Without compatibilizing, the amount of PBS miscible with PLA would be limited to 10-20%. The company introduced Vinnex five years ago in the USA and six years ago in Europe, and offers nearly a dozen grades.

Other Bio-Combinations: Hemp & PBS

Automotive parts molder Faurecia SA (Nanterre, France) has developed what’s said to be the first hemp-fiber-filled PBS compound for injection molding. The 15-year development program, which started in 2006, has three stages. The first material, which took seven years to develop, is 80% polypropylene and 20% short chopped hemp fibers. Called NafiLean, it was commercialized for non-visible door-panel inserts and the central console on Peugeot 308 cars, starting with model year 2013. Chopped hemp fibers, supplied through a French agricultural cooperative, add strength and make the parts 20% to 25% lighter weight than PP alone, Faurecia says.

The second material will be PBS and chopped hemp fibers, expected to be commercial in 2016. Faurecia calls the patent-applied-for natural-fiber/PBS composite BioMat. The compound includes PBS, flow enhancers, compatiblizers, impact modifiers, and 20-40% hemp fiber, depending on the application. Mitsubishi Chemicals will supply the PBS, which will at first be 60% bio-based, making the first BioMat compounds 65-70% bio-based, including the hemp.

PBS availability could be a sticking point. PBS won’t be readily available until the world’s first commercial PBS plant, PTTMCC Biochem Co. Ltd. (Rayong, Thailand), is running. The plant started up in August, but it’s limited to only 40 million pounds (18 million kg) per year, so there won’t be a lot of PBS available, even at full production. The plant will at first make partly bio-based PBS, sourcing bio-succinic acid from BioAmber Inc.’s new plant in Sarnia (Ontario, Canada), which also started up in August.

PTTMCC will make all-bio PBS when bio-based 1,4-butanediol monomer, which is 40% of PBS, is available in 2017. Then, in stage three, BioMat will be all bio-based.

PTTMCC is a joint venture between Mitsubishi Chemical and PTT PLC Ltd., in Bangkok, Thailand (a sister company is 50% owner of NatureWorks). NatureWorks previously offered two PLA/PBS blends with over 50% PBS (AW300D for injection molding and AW240D for thermoforming food service) in the AmberWorks joint venture with Montreal-based BioAmber. AmberWorks used technology BioAmber acquired in 2010, but the material grades aren’t actively sold, awaiting a “competitively priced, food-contact-registered supply of PBS,” BioAmber says.

“Thumbs” Up for a Mysterious Syndiotactic Elastomer

One of the most unusual polymer developments in recent years is a syndiotactic elastomer from Mitsui Chemicals Inc. (Tokyo, Japan). The material series was launched in April 2011 as Notio SN, with expected annual sales of over 1 billion yen ($8 million). The syndiotactic copolymer is now called simply Notio. (A syndiotactic polymer is a stereo-regular polymer made by a metallocene catalyst, which assembles “handed” monomers with pendant groups, or “thumbs,” on alternating sides of the polymer chain, giving distinctive strength and clarity. In contrast, conventional polypropylene is isotactic, meaning that its pendant methyl “thumbs” are all on one side of the polymer chain, like a comb.)

Properties of High-Bio-Content Polymers for Injection Molding vs. ABS

Mitsui says that Notio is a syndiotactic elastomer, but not a syndiotactic polypropylene elastomer, which indicates a relatively high comonomer amount. Propylene and butene are both handed alpha-olefin monomers; styrene is also handed, but it’s not an alpha olefin. So the logical comonomers for Notio are propylene and butene. Mitsui also holds patents on metallocene-made propylene and butene copolymers with high scratch resistance.

Syndiotactic PP homopolymer is normally lower in molecular weight than isotactic PP for the same melt flow, and much less crystalline: 20-30% crystalline for sPP vs. 50% for iPP. Mitsui describes Notio as 30% crystalline but with very high molecular weight. Notio copolymers are described as having a distinctive nano-crystal structure, which means they’re inherently elastomeric with a high level of molecular entanglements on the long polymer chain itself.

Notio elastomer is flexible, low density, and transparent with excellent heat resistance and no cross-linking, Mitsui says. Adding Notio to conventional isotactic PP improves impact and scratch resistance, transparency, flexibility, and elasticity—and eliminates stress whitening, Mitsui adds.

Properties of Mitsui Chemicals’ Notio Syndiotactic Copolymer, Grade SN-0285

Notio SN-0285, with a melt flow rate of 1.4 g/10 min., was commercialized for imitation leather for high-end handbags in March 2013. Other Notio compounds are blended with isotactic PP and TPO and have an MFR of 3 g/10 min.; they’re also for calendering and extrusion. Applications under development include auto interiors, footwear, and furniture.

Mitsui’s patent-applied-for catalyst technology for syndiotactic polyolefins describes a metallocene catalyst based on organoaluminum oxy-bridged to a hydrocarbon group and silicon-containing group to form a ring. The patent says the catalyst makes a stereo-regular copolymer from propylene monomer and “one other alpha olefin.” The patent also describes polymer chains that are 85-90% syndiotactic—i.e., with very regularly alternating “thumbs.”

“That indicates that there is either a small fraction of comonomer in Notio SN or that the comonomer can also be polymerized syndiotactically like butene-1,” says Kenneth Sinclair, a consultant at polymer research group EnerChemTek Inc. (Toronto, Ontario, Canada). The patent says the comonomer is either ethylene or an alpha olefin with 2-20 carbon atoms. Its scratch resistance also indicates that the co-monomer could be butene, which is used to prevent stretch whitening.

Mitsui only offers Notio for extrusion and calendering, but there are references to sPP in Mitsui patent literature which includes injection molding compounds. A 2008 Mitsui patent (U.S. Pat. #7,411,017), published three years before Mitsui announced syndiotactic Notio SN, describes reactive compounding with peroxide of a blend of isotactic and syndiotactic PP with rubber and softeners. The syndiotactic PP content is small—only 1.5 to 8.5% according to the patent, but the reacted blend could produce a more miscible rubber/PP elastomer for molding.

Mitsui Chemicals’ syndiotactic Notio elastomers have a nano-crystal structure with very high molecular weight and a high level of molecular entanglement. They’re also blended with isotactic PP and TPO for extrusion and calendering, targeting synthetic leather applications.

Amorphous Metal Alloys for Injection Molding

Liquidmetal Technologies Inc. (Rancho Santa Margarita, California, USA) markets amorphous zirconium technology developed over the last 30 years by scientists at the California Institute of Technology in Pasadena with the National Aeronautic and Space Administration and U.S. Department of Energy. The company, founded in 1987, developed several alloys, but primarily uses LM105, a mix of five elements: zirconium, titanium, aluminum, copper, and nickel.

The idea is that a blend of large and small metal molecules in the right ratio, cooled rapidly from the melt, will pack tightly without crystallizing, forming an amorphous metal which behaves like plastic—a metallic glass. Amorphous LM105 has a broad thermal softening range, starting around 400°C and melting at around 858°C. It reportedly has ten times the elasticity of steel and is twice as strong as titanium (yield strength of up to 1524 MPa, vs. 830 MPa for titanium) with low specific gravity and high corrosion resistance.

The alloy is made under license for Liquidmetal by Materion Corp. (Mayfield Heights, Ohio, USA) and comes in partially crystalline rods, which are cut into ingots. To become amorphous, the alloy must be melted, molded, and cooled rapidly from above its melting temperature; otherwise it reverts to a crystalline morphology.

Liquidmetal adapted an injection molding machine from Engel Austria GmbH (Schwertberg, Austria) to process ingots using induction heat and mold conditioning. In 2010 Liquidmetal partnered with Engel to develop a commercial molding machine for the alloy. Engel has since delivered roughly a half-dozen machines, all the same size, and all to Liquidmetal or its licensees for development.

Liquidmetal Technologies partnered with Engel to develop an unusual injection molding machine for an amorphous metal alloy, LM105, which behaves somewhat like plastic. Liquidmetal can mold parts (like those shown here), or the company can license and teach others the technology.

The machine melts one ingot at a time by induction heat in a high vacuum chamber, which keeps out contamination like oxygen and nitrogen to avoid crystallization (since oxides act as nucleating agents and create crystals). Once the metal is melted, it’s cooled by injection into a mold either at room temperature or heated to up to 200°C (500-700°C cooler than the molten metal) and forms the amorphous structure as it cools. Cycle time is typically less than 2.5 minutes, depending on part geometry. Maximum shot weight is 100 grams, or one ingot, for a maximum part size of 80 grams, with 20 grams of sprue. The sprue is removed robotically by waterjet cutter or shears, and recycled. The alloy reportedly has been molded in molds with up to 32 cavities.

Liquidmetal technology is different from metal injection molding (MIM), which conventionally molds a blend of metal and plastic powders, after which the part is sintered in a furnace to remove the plastic binder. MIM parts often have rough surface finishes, which take reworking, where Liquidmetal parts are very smooth. MIM parts also shrink by up to 20%, while LM105 parts shrink only about 0.4%, Liquidmetal says.

Because molding conditions for the LM105 alloy are critical to creating the amorphous properties, Liquidmetal authorized two U.S. moldmakers to build molds for the process, Matrix Tool Inc. (Fairview, Pennsylvania) and Mold Craft Inc. (Willernie, Minnesota). Liquidmetal doesn’t sell the alloy directly, but either does the molding itself or licenses the technology and teaches others how to do it.