Ed. note: This is the first in a continuing series of market updates from IHS experts.

Crude oil prices collapsed from over $100/barrel to the mid-$40s, before stabilizing to about $60/barrel toward the end of February 2015. Further downward corrections are not excluded, with continued pressure from rising inventories—a key factor as of press time.

The overall decline in worldwide oil prices in the last nine months has caused petrochemical supply-chain destocking, but it’s also sowing the seeds for better economic prices and improved demand for petrochemicals and plastics—trends that should ultimately tighten market conditions.

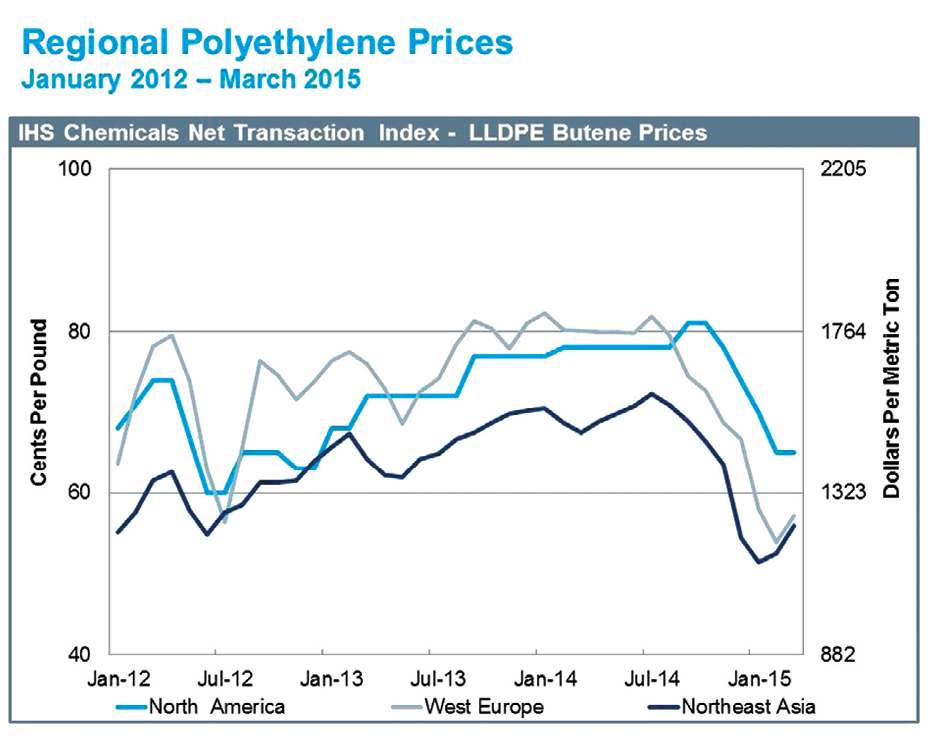

Global Polyethylene Prices Respond

As shown in the chart, global polyethylene prices declined in response to the lower crude prices. Price declines were more immediate in the spot Asian markets; from November to February, prices—using IHS Chemicals’ net transaction price estimate for LLDPE butene film resins—declined by $455 (U.S.) per metric ton, or 28%.

The initial declines in Asia quickly found their way to the Middle East, by far the world’s largest net exporter for polyethylene. Inventory de-stocking and higher China domestic operating rates from improved non-integrated margins also contributed to the prompt extension of price declines to the Middle East producers.

In like fashion, Western European producers looked to increase operating rates as price declines lagged declines in naphtha, with a weak Euro and higher import tariffs for Middle East imports further supporting domestic production.

Will Lower Crude Lead to Higher Demand?

Market participants may be surprised by the strength of global petrochemical demand growth spurred by the lower energy prices. A recent IHS Chemicals Research Note, “Oil Price Decline Impacts Petrochemicals Scenario,” provides a scenario analysis of how the recent decline in global oil prices is causing some petrochemical supply-chain destocking, but is also sowing the seeds for better economic conditions, lower petrochemical prices, and improving global petrochemical demand.

Capital Projects Expected to Proceed

Continued capacity expansions are needed for polyethylene to meet global demand, which is growing at some 4.4% per year. Prior to the recent crude decline, continued capacity growth expectations were centered in China and the Middle East, as well as resurgence in capacity growth for North America supported by ethane from shale drilling.

While lower crude prices have perhaps given pause to some of the more speculative projects envisioned for latter years, those projects that are already established are expected to proceed. China is expected to move forward with most of the near-term coal-to-olefins projects already underway, although future marginal projects may be canceled or delayed. Capacity growth in the Middle East continues, although the pace of expansions was already slowing prior to the recent decline in crude. In North America, IHS expects projects totaling some 7.4 MMT between now and 2019—an increase of more than 36% compared to 2014 capacity—to proceed as planned.

The author is Robin Waters, Director, Polyolefins North America, IHS; he can be reached via robin.waters@ihs.com.

Resin Market Focus, by IHS Chemicals, provides ongoing insights into key industry topics and trends for major plastics and engineering resins, covering all major regions. IHS Chemicals provides extensive industry insight, analytics, and data for over 300 chemical markets worldwide, including the global plastics, polymers, and engineering resin markets. Inquire about IHS content at U.S. 888-293-8153 or AmericasTQ@ihs.com. ![]()