Building with Plastics—Now and Into the Future

An SPI report identifies factors shaping the utilization of plastics in building & construction

Previous Article Next Article

Building with Plastics—Now and Into the Future

An SPI report identifies factors shaping the utilization of plastics in building & construction

Previous Article Next Article

Building with Plastics—Now and Into the Future

An SPI report identifies factors shaping the utilization of plastics in building & construction

Previous Article Next Article

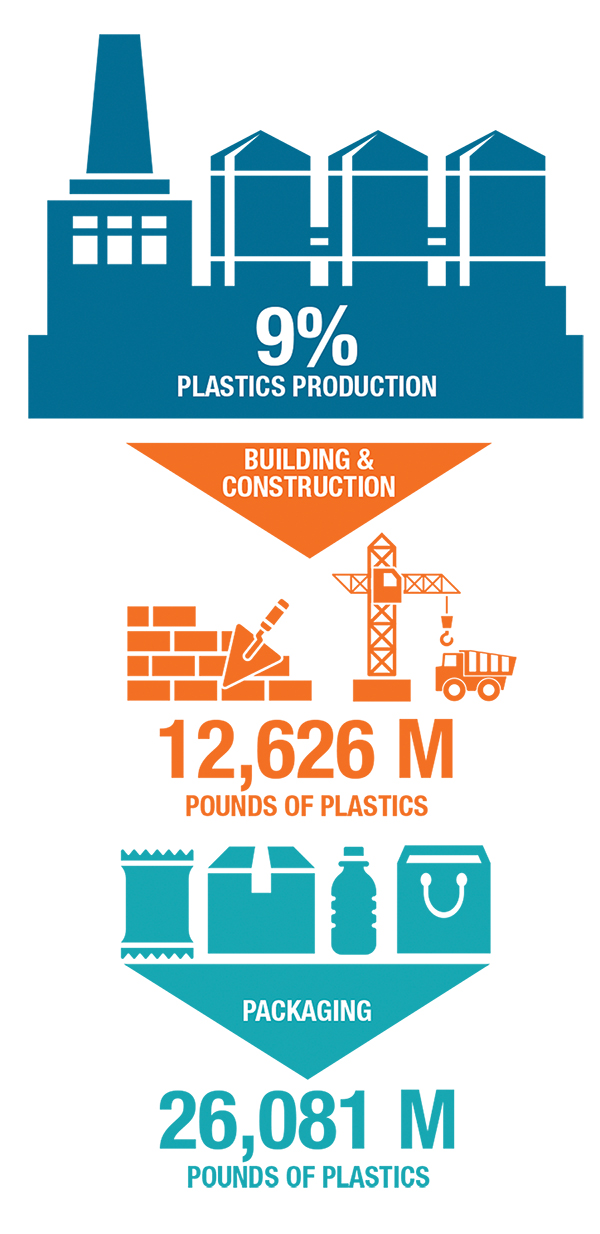

Building & construction is the second-largest plastics-consuming sector (graphic from SPI).

The bones of a new home are likely a wood-based product, and steel is going to be the fundamental support of a commercial high-rise. Masonry, stones, and glass will also likely be added during construction. But on projects around the world—big and small—plastics and plastic-derivative products are increasingly being used in construction and building.

According to “Plastics Market Watch: Building and Construction,” SPI’s fourth in a series of reports analyzing key factors impacting the plastics industry’s key end markets, plastics’ wide functionality offers a distinct advantage over other traditional building materials in terms of flexibility, lower costs, energy and weathering efficiency, and durability. As plastics are increasingly being used and adopted by architects and engineers for building and construction, SPI released the recent study at the 2016 International Builders’ Show in Las Vegas and met with conference participants and the media to tell plastics’ story to one of its best—and growing—customers.

“Plastics Market Watch: Building and Construction” dives into the key drivers for end markets to offer a forward-looking outlook on the building and construction sector’s utilization of plastics and plastics derivatives. A number of factors—like commodity prices of materials such as copper, “smart” home design and technology, and public policy prioritization on “green” construction and building—are shaping the adoption of plastics.

The innovation within the plastics industry to improve and diversify products is being matched by the building and construction sector’s pace to find, and use, new solutions to address fundamental issues like structural integrity, energy savings, recycling and cost savings.

From Floors to Roofs

A walk today around a new home construction site will reveal plastics are being used from floors to roofs, inside and outside of walls, in ways that increasingly offer advantages over other products. The leading uses of plastics for residential and commercial construction are roofing, insulation, wall coverings, windows, piping, flooring, structure wraps, and composite “lumber” planks and rails.

According to the SPI report, while the building and construction sector has not regained its pre-recession vigor, it is making steady progress with the promise of growth in the future. Globally, China, India, and the USA will be the primary drivers of construction activity, as India is on pace to overtake Japan as the third-largest construction market between 2017 and 2022.

Domestically, an estimated 1.3 million new housing units will be needed per year for the next decade to keep pace with population growth and existing housing unit characteristics, a dramatic increase of several hundred thousand more per year when compared to the Great Recession.

Generation Y and Millennials stayed on the housing market sidelines after the recession and have been reluctant to enter the market after the recession; the share of U.S. homes sold to first-time buyers in 2013 and 2014 declined 28%, its lowest level in three decades, according to the National Association of Realtors. But encouraging signals are coming from recent surveys showing U.S. consumers (young and old) are now more confident, reflecting lower unemployment rates and wages that are on a slight uptick. This pent-up demand and pool of new homeowners is a positive sign for building and construction in the USA.

China’s recent stumble represents a major impediment to the building and construction sector as the world’s most populous nation has served as the primary global growth engine for the past 20 years. The Chinese have recalibrated their projected economic growth down to 6.5%—but many analysts believe it will go lower. The nation’s economic cutback has spurred a drop in commodity prices around the world, including oil, iron ore, and copper.

The uncertain global economic conditions, the prospect of additional interest rate hikes, and geographic-specific labor shortages in the sector are the major clouds on an otherwise sunny horizon.

Smart Signals

An encouraging signal for plastics in the sector is coming from technology and public policy. The dramatic inroads made by plastics on building and construction sites, according to the SPI study, show the “propensity of the plastics industry to constantly develop new products to supersede traditional building materials in many phases of the building process.”

Advances in plastics have been embraced by architects, engineers, and designers, as reported for the Columbia University conference “Permanent Change: Plastics in Architecture and Engineering.” The Columbia conference, with more than 300 attendees, concluded: “Plastics have become one of the most ubiquitous and increasingly permanent materials in construction. The material capabilities of plastics, both as a generic material and as specific polymers, and the processes that underlie them, suggest a potential to reshape construction and the roles of architects and engineers in construction. While plastics are perhaps the most intensively engineered building materials today, we are still in the early stages of understanding them in terms of their potential applications and uses.”1

The Columbia participants encouraged product manufacturers to watch and monitor the fundamental shift going on in design and construction.

Meanwhile, the drive to find “smart” designs—with seamless technological capabilities and improved environmental and energy efficiencies—underscores the need to continue collaboration with engineers and architects on building materials, and find new innovations and advances.

Green Goals

Another positive development for more plastics usage is an increased awareness of sustainability in construction, and public policy support for green buildings and energy efficiency. The Leadership in Energy and Environmental Design (LEED) is the standard for commercial building and construction, while the National Green Building Standard (NGBS) ICC 700 Green Building Certification is the leading standard for homes, apartments, and land development.

The Obama Administration has promoted green building and increased energy efficiency as part of its Better Buildings initiative; the official goal of the effort is to “make commercial buildings 20% more energy efficient over the next decade by catalyzing private sector investment through a series of incentives to upgrade offices, stores, schools, municipal buildings, universities, hospitals, and other commercial buildings. Tax credits are an incentive policymakers have used to get homeowners and builders aligned with these green priorities.

The plastics industry has developed a strong and growing relationship with the building and construction sector to develop products and innovations that address specific needs and issues. The plastics industry has a strong story to tell building and construction: Plastic piping was first introduced in the 1970s; today plastics have grown to be a significant part of every construction project—inside and out, above and below ground, on the floor and on the roof. More uses and capabilities are in store around the world, as the building and construction sector continues to embrace and work with plastics.

Reference

1.www.arch.columbia.edu/flagship-projects/materials-project/conferences/permanent-change