Putting Up Barriers

From metallized and nano-scale coatings, to “greener” resins or multiple layers of materials, protective films get serious upgrades for the 21st century

Previous Article Next Article

By Geoff Giordano

Aclar® high moisture-barrier thermoformed blister film helps softgel manufacturers achieve shelf-life objectives (this image courtesy of Tekni-Plex).

Keeping bad things out and good things in is the essential function of barrier films. Doing so with less polymer, more layers, improved metallized coatings, nano-modifiers, or resins that facilitate recycling are some suppliers’ responses to the challenges put forth by 21st-century food and pharmaceutical brand owners.

A product example of Celplast’s metallized film in gold. (All Celplast product photos in this article are courtesy of the company.)

For flexible packaging, the key barrier properties are oxygen transmission, water vapor transmission, and light transmission, or opacity, says Michael Navarro, director of global product development for Now Plastics. “Each application—dry food, liquid, pouch, rigid containers, and thermoformables—[has] different requirements based on the products they contain.”

Now Plastics serves primarily flexible-packaging markets, selling thin films and aluminum foil. It works with converters to reach their goals for shelf life, package size, distribution channels, environmental impact, and consumer appeal. “We have been working with our manufacturing partners to introduce thinner films with similar or better barrier properties to reduce package weight,” Navarro notes.“

Down-gauging is an area all converters and film manufacturers are always interested in, and as equipment becomes more sophisticated, thinner films can be produced and converted—printed, laminated, etc.—and perform well on packaging lines.”

Global Needs

Dealing with packaging requirements around the globe continues to drive innovation, thanks to widely varying geographic and climatic hurdles. In Africa, for example, barrier films must be “far more robust because the distribution channels are more challenging; roads, weather conditions, and time from production to delivery are more demanding than they are in North America,” Navarro explains. And, “Humidity of the Indian/Asian subcontinent during the rainy season causes product spoilage faster than in the drier months.” Meanwhile, the extreme cold in northern climates requires manufacturers of biaxially oriented polypropylene (BOPP) film to have what they call “summer” and “winter” formulas for the films to perform properly.

But packaging demands aren’t necessarily uniform, even within a region, Navarro says. “At one time, BOPP film producers in the U.S created a film that would survive the elevation of the Rocky Mountains—termed an ‘over-the-mountain’ grade because seals on snack food bags were failing when the product shipped above a certain altitude.”

At Celplast Metallized Products, a provider of metallized barrier films, “We see continued growth opportunities in transparent barrier packaging and overall higher-barrier packaging requirements in food and medical [applications],” says marketing manager Naomi Panagapka. She notes growing opportunities with fruit and condiments and says annual expected growth in transparent barrier film is expected to be around 3.5% over the next five years.“

As consumers become more informed regarding healthy food choices, they also want to know what they are eating, as well as see the package contents,” adds Celplast business development engineer Veronica Ataya. “One specific area where we have seen this happen is in the granola and health bar market, where brands very often offer products with transparent packaging showcasing the food. Another major area of growth for clear packaging has been pet food, with owners wanting to see what they are feeding their pets.”

Metallized films by Celplast.

Metallic Barriers

Improving barrier film properties by locking in a metallized layer with a top coat is a specialty at Celplast—which is planning to expand its current technology with a customized machine that streamlines the process.“

Over the past few years, we have invested significant resources in our in-line coating and metallizing technology, called Metacoat, by which we lock in the metallized barrier and protect it from scratches in downstream processing with a protective top coat,” Ataya explains.

Typically, two steps are needed to produce a top-coated metallized film using roll-to-roll processes, she says. First, the material is metallized under vacuum, then it’s top-coated at atmospheric pressure. “This two-step process creates certain inherent disadvantages, such as high operating and capital costs. We also suspected that pin-holing and scratch defects were being introduced … and that we could improve upon it by creating a single-step, in-line process to top-coat directly in the metallizing chamber.”

For this new method, Celplast is commissioning a custom metallizer/coater. The company “will be able to produce our line of top-coated metallized films, capable of achieving barrier properties not currently attainable with standard technology.” Avoiding the two-step process reduces material usage and lessens the carbon footprint of packaged goods by replacing or eliminating barrier layers, Ataya says.

With a wide-ranging portfolio of high-barrier films already in place to meet contemporary water-vapor and oxygen requirements, she says, “we have some still-higher barrier items in the pipeline that will perform in markets that we haven’t participated in—where perhaps glass and foil are used presently.”

High Barriers for “On-the-Go” Pouches

Other major elements in Celplast’s portfolio are Foilmet and Ultramet. In smaller pouch formats for on-the-go products, high-barrier films like Foilmet “Plus” offer an alternative to foil laminations.“

Many existing products use a lamination with foil, where the package can look damaged and shopworn on the shelf, and as it travels through the supply chain,” says Ataya. Thus the films must offer excellent barrier properties, as well as puncture resistance and increased productivity. The company reports barrier values in the range of 0.31–0.46 g/m2/day for water vapor and 0.31–0.46 cm3>/m2/day for oxygen.1

Meanwhile, Ultramet, offered in several formulations, “was designed to provide improved metal adhesion to solve the problem of metal delamination in large-format pouches.” Ultramet WR has had the most recent impact in the industry, Ataya says:

“It is a game-changer in terms of outstanding metal adhesion and flex crack resistance and performs very well in high-moisture applications and environments—an area where formerly only foil would previously have been viable. We recently worked with a customer developing a metallized film with high metal adhesion and moisture resistance. This customer is making in-mold labels for tubes used in personal care, which are likely to be used and stored in high-moisture environments.”

Expanding Nylon Barrier Films

With demand for nylon-based barrier films continuing to grow in its core markets—and in some niches experiencing above-market growth—Charter Nex recently acquired Optimum Plastics “to be the leading specialty engineered film supplier in North America,” according to Bill Wright, vice president of technology.“

We were excited at the prospect of adding cast film to our portfolio, as well as growing our nylon and barrier films capability,” Wright says. “[W]hile both Charter NEX and Optimum are strong players in food, medical, and industrial applications, Optimum brought new consumer, aerospace, automotive, and home decor markets to the mix.” Charter Nex intends to expand facilities in Ohio and Wisconsin to offer more film solutions.

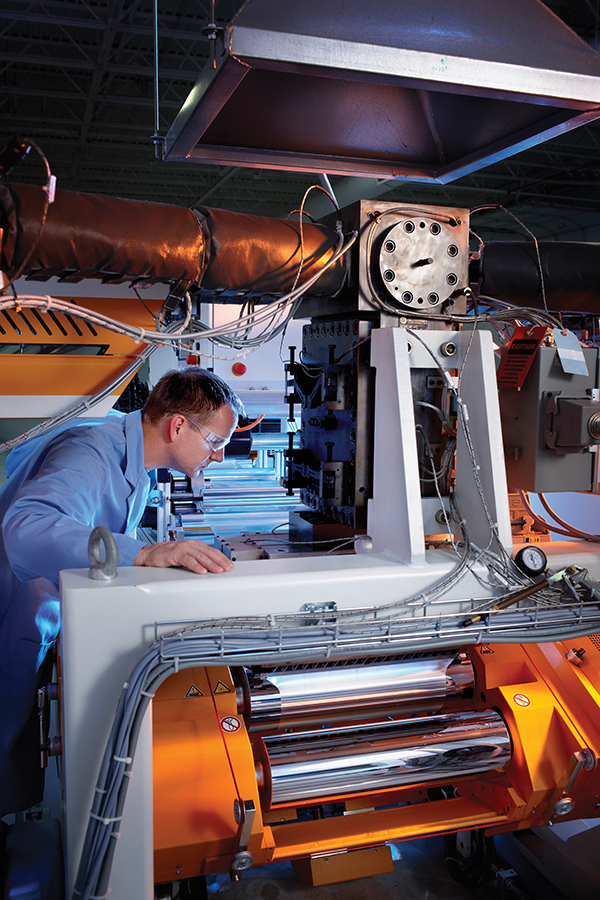

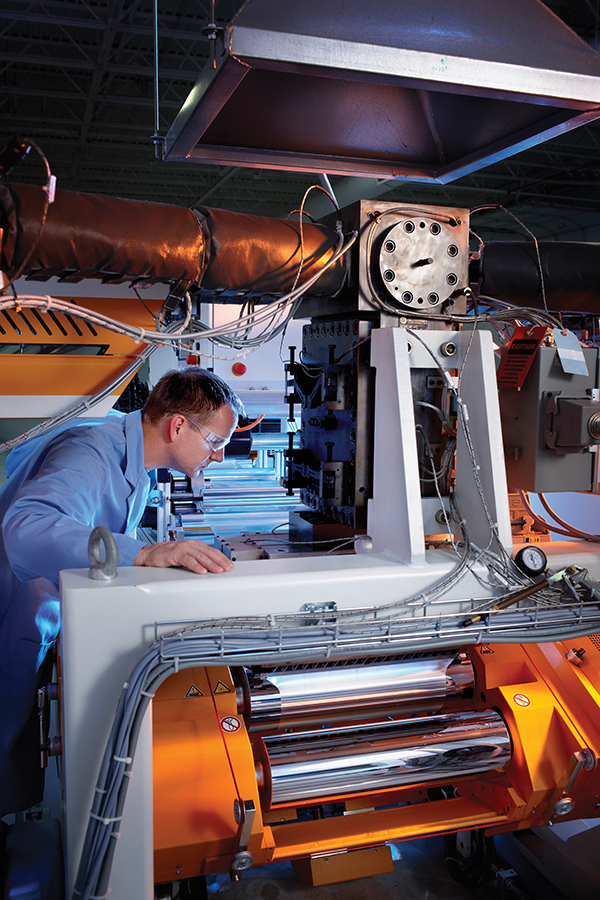

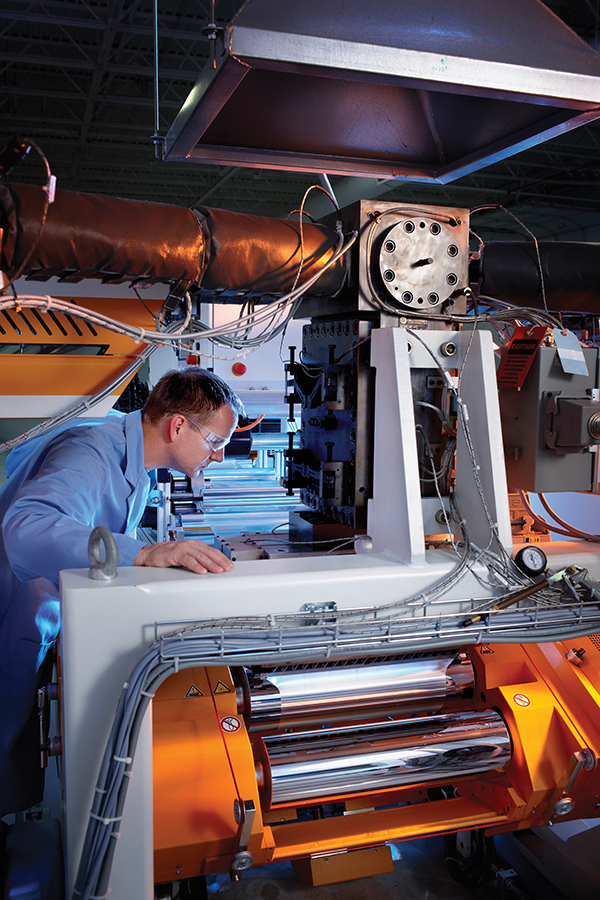

A multilayer co-extrusion film line at Tekni-Plex’s Global Technology Center in Ohio, adjacent to the company’s lamination line (image courtesy of Tekni-Plex).

“Our ability to develop films that dial-in on a precise barrier need—oxygen, moisture, or odor—positions us uniquely to serve this space,” Wright explains. “In food, growing demand for produce films in retail and institutional applications has our attention. In health care, myriad applications from sterilization bags to transdermal patches to wound care use barrier films and continue to see strong growth. Barrier applications in agriculture are focused on keeping nutrients, moisture, and fumigants in, while keeping pests, bacteria, and fungi out.” In particular, Wright says, Charter Nex customers are keenly interested in:

- increased heat resistance for sterilization, food safety, and kitchen “re-therm” convenience;

- improvements in seal integrity, such as hermetic fusion to protect the oxygen barrier value of EVOH and polyamide;

- tightened auto-profile standards, shifting to 3-sigma detection profiles; and

- enhanced package-abuse resistance, including polymer and structure strategies whereby film toughness sustains heavy content weights.

With growing consumer demand for on-the-go or heat-and-eat packaged foods, Charter Nex focuses on “allowing optimized taste quality and consumer safety while providing the convenience of in-package microwaving or boiling,” Wright notes. “In many instances, the key control parameter is oxygen, and performance ranges from high barrier to high transmission rate, depending on the food type.

“Package aesthetics—especially in the context of value-added graphics—are affected significantly by film surface gloss. Evolving polymer technology is providing continuing opportunities to increase gloss levels, and we are investing aggressively in multilayer processes to make economical use of aesthetically advanced resins.”

In the near future, Charter Nex has two market initiatives in progress. The first is advanced liquid packaging for burst and drop strengthening. “Our customers continue to ask us for more robust films to hold greater volumes of liquid used under increasingly rigorous conditions,” Wright says. The second innovation is in the area of thermal lamination films. “We are developing proprietary adhesive alloys that provide two and three times the bond properties of lamination films available today.”

New Facility, New Laminated Materials

Also growing its business is Tekni-Plex, which opened a new facility for its Tekni-Films division in Holland, Ohio, in July 2015. The facility, relocated from New Jersey, handles all the company’s North American laminated film volume with state-of-the art equipment, says Phil Bourgeois, senior vice president of global technology and regulatory affairs.

“This line has more sophisticated ovens to control the process with better tension controls, and a lot more electro-servo based controls, versus those that are more manually based,” he notes. Chief performers in the Tekni-Plex portfolio are:

- high-moisture-barrier, laminated Aclar® structures to support new drug growth areas, including branded formulations from major pharmaceutical makers as well as generics;

- PVDC-coated films supplied from recently acquired Gallazzi (Italy) manufacturing facilities; and

- PX copolyester monolayer and laminate films for blister and tray structures for pharma and medical device packaging in place of PVC and PVDC.

“Pharmaceutical companies can thermoform PX structures with existing PVC molds at temperatures that are 10 to 15 degrees Celsius lower,” notes Garret Hager, director of pharma films and medical packaging. “Conversely, if customers choose, they can keep the same temperature and run the PX material faster, providing higher output. Either approach has a positive impact on carbon footprint due to the reduction of energy consumption.”

Celplast’s barrier film recently won an AIMCAL packaging award in the “Healthcare, Cosmetics and Toiletries” category.2

Like Celplast and Filmquest, Tekni-Plex is keenly aware of providing alternatives to PVC, which faces strictures in Europe and Japan. In countries where companies must pay a fee in relation to the type of materials they put in the marketplace (regarding recycling scores), “we offer a full high-barrier system for oxygen and moisture, based on cyclic olefin copolymers [COCs],” Bourgeois says.

Thanks to various sustainability initiatives, significant investment has been made in materials and manufacturing platforms to ensure that co-extruded COC-based barrier films function on a par with traditional materials, he continues. “You’re relying on the barrier because of the construction of the film and how it’s put together by the supplier. But you can vary the barrier properties depending on the thickness of materials within a co-extruded structure.”

For instance, citing the example of a 12-mil (0.3-mm) Aclar product, he suggests, “I might be utilizing that COC at a particular thickness within that end-use structure. However, we will utilize other materials in that structure, typically polypropylenes, etc., as the product contact surface—maintaining the overall thickness of the traditional barrier film, but varying the thickness of that COC within that structure. We will dial in the barrier specifically required for that application. In many cases we’re still providing the same barrier.”

Creating a total-package solution for a new barrier film that’s completely compatible with brand owners’ manufacturing processes requires continued engineering, Bourgeois says. One example regards “the thermoforming process utilized to transfer [a new COC material] to a blister film, as well as the lid stock being used in the final primary package. Most lid stocks are foil-based, and the sealing material of that foil structure would need to change to be compatible with the new barrier material structure … depending on whether it’s a peelable structure, or a welded or push-through structure.”

A Post-Use “Green” Resin

With longer-serving barrier films becoming more vital to brand owners, the resulting scrap is of significant environmental concern for many. Dow’s just-introduced “Retain” polymer modifier is geared to significantly boosting the reusability of post-consumer materials.

Barrier films “are projected to grow faster than the general plastic market due to continued consumer demand for more transparent packaging with longer shelf life,” notes

Ritika Kalia, North America marketing manager for Dow Packaging and Specialty Plastics. “One of the challenges in this category of films that contain commonly used barrier materials such as polyamide and EVOH is that their scrap cannot readily be reused in common polyethylene recycle streams.”

Retain is “a new resin compatibilizer that gives millions of pounds of post-industrial barrier film scrap and post-consumer barrier packaging a second chance at life by allowing it to be recycled without compromising performance, aesthetics, or processing efficiency,” she explains. It finely disperses barrier-film particles into the general polyolefin matrix that typically makes up the majority of the structure, and can be incorporated either during repelletization or at the extruder when incorporating pelletized recycled material, she says.

Creating these modifiers “requires excellent control of catalysis and processing variables,” she continues. “Significant advances led to the development and commercial deployment of molecular catalysts. These catalysts also allow control over the polymer structure, altering the properties of the finished polymer.” The result is a solution “capable of post-industrial and post-consumer recycling with the current polyethylene recycle streams without processing or performance issues.”

With more consumers making sustainable and recyclable packaging a priority, Retain provides “an unprecedented opportunity,” Kalia concludes. “Compared to other control films, the technology in Retain helps converters develop high-quality packages with better clarity and mechanical properties and significantly reduces gels in films produced from barrier-film recycle.”

References

1. “5 Areas in Which Metallized Film Beats Foil.” Jan. 29, 2015. www.celplast.com/educational/5-ways-metallized-film-surpass-foil-performance accessed April 21, 2016.

2. “AIMCAL Awards | IML DECORATION IS A “10”.” March 23, 2016. www.aimcal.org/2016-awards.html accessed May 2, 2016.

Nano-Barriers Line Up to Provide a “Tortuous Path”

Vermiculite platelets are the key to Filmquest’s NanoShield high-barrier technology. Deionization is a critical component in creating the “tortuous path” that does the job, says company president John Felinski.

“Select Purified Vermiculite is a particular silicate clay with platelets having an especially high aspect ratio—very thin, 1 to 3 nanometers, but very broad in the other two dimensions—10,000 to 40,000 nanometers, which is 10 to 40 microns,” he explains.

“The proprietary formulation ‘singularizes’ the platelets, giving them the same charge. Like same-pole magnets, the platelets repel each other and are parallel in a very tight impervious layer, usually about 0.3-microns thick.”

What that means is gas molecules have a hard time getting through or around the 40 to 50 layers of platelets. “Other conventional clays also work, but are smaller platelets,” Felinski notes. So “[t]here are many more potential pathways for gas molecules to move through.”

NanoShield was developed as a clear barrier coating to replace less eco-friendly material, he notes. “It also has source-reduction and cost benefits for many EVOH [ethylene vinyl alcohol] applications.” Primary users are those seeking high barriers for oxygen, nitrogen, and flavor or aroma—ideal for snacks, especially nut-mix products, spices, seasoning mixes, and bakery mixes with egg or milk components.

Because the barrier coating is thin, he says, “the best barrier is achieved with films that have smooth surface topography. PET and nylon are excellent, and most BOPP and PLA work well.” Metallizing grades tend to be smoother and have good surface energy to coat especially well, he adds.

“NanoShield coating films are competitive to barrier materials in which the package needs to be clear, foils and metallization are not options, and the customer has an active environmental stewardship,” he explains. “Small-to-medium-sized customers using EVOH coextruded films may also achieve substantial cost benefit and source reduction, and the ability to dial in the desired OTR [oxygen transmission rate] on a wide range of films in ideal gauges does offer some benefit.”

Blown-Film Equipment: Eleven Layers, and Beyond

Progressing beyond five-, seven-, and nine-layer films, longtime barrier-film equipment supplier Windmoeller & Hoelscher Corp. is seeing an increase in requests for 11-layer blown film from high-barrier producers, says Nick Nigro, sales manager for extrusion systems.

“While in the past it wasn’t unusual to see 11 layers on a limited basis, that has become commonplace—and requests for up to 15 layers is now the new direction,” he notes. “With the onset of a multitude of new resins and equipment capabilities, producers are pushing the limits and clearly tailoring the structures to specific needs.”

Launched in late 2013, the Varex II blown-film line is an example of the company’s technology. Varex II is “based on a modular concept that allows almost unlimited configurations,” according to the W&H website, “from 8-μm HDPE liner film, to 11-layer barrier film with only a 1-μm EVOH layer.”

With experience in serving not only food and pharmaceutical customers, but also laminators and high-end converters, W&H emphasizes control and consistency in its equipment. Customers are looking for higher outputs and yields—and the development of more layers that are thinner, Nigro explains.

W&H customers “participate in a plethora of markets and specialty segments that require specific post-extrusion converting. This can include, but is not limited to, complex laminations, die cutting, and MDO [machine direction orientation]. So it’s necessary for the equipment manufacturer to be knowledgeable of the film requirements for these subsequent processes in order to help insure successful operation.”

Windmoeller & Hoelscher’s advanced Varex II blown-film equipment (photo courtesy of W&H).

Putting Up Barriers

From metallized and nano-scale coatings, to “greener” resins or multiple layers of materials, protective films get serious upgrades for the 21st century

Previous Article Next Article

By Geoff Giordano

Aclar® high moisture-barrier thermoformed blister film helps softgel manufacturers achieve shelf-life objectives (this image courtesy of Tekni-Plex).

Keeping bad things out and good things in is the essential function of barrier films. Doing so with less polymer, more layers, improved metallized coatings, nano-modifiers, or resins that facilitate recycling are some suppliers’ responses to the challenges put forth by 21st-century food and pharmaceutical brand owners.

A product example of Celplast’s metallized film in gold. (All Celplast product photos in this article are courtesy of the company.)

For flexible packaging, the key barrier properties are oxygen transmission, water vapor transmission, and light transmission, or opacity, says Michael Navarro, director of global product development for Now Plastics. “Each application—dry food, liquid, pouch, rigid containers, and thermoformables—[has] different requirements based on the products they contain.”

Now Plastics serves primarily flexible-packaging markets, selling thin films and aluminum foil. It works with converters to reach their goals for shelf life, package size, distribution channels, environmental impact, and consumer appeal. “We have been working with our manufacturing partners to introduce thinner films with similar or better barrier properties to reduce package weight,” Navarro notes.“

Down-gauging is an area all converters and film manufacturers are always interested in, and as equipment becomes more sophisticated, thinner films can be produced and converted—printed, laminated, etc.—and perform well on packaging lines.”

Global Needs

Dealing with packaging requirements around the globe continues to drive innovation, thanks to widely varying geographic and climatic hurdles. In Africa, for example, barrier films must be “far more robust because the distribution channels are more challenging; roads, weather conditions, and time from production to delivery are more demanding than they are in North America,” Navarro explains. And, “Humidity of the Indian/Asian subcontinent during the rainy season causes product spoilage faster than in the drier months.” Meanwhile, the extreme cold in northern climates requires manufacturers of biaxially oriented polypropylene (BOPP) film to have what they call “summer” and “winter” formulas for the films to perform properly.

But packaging demands aren’t necessarily uniform, even within a region, Navarro says. “At one time, BOPP film producers in the U.S created a film that would survive the elevation of the Rocky Mountains—termed an ‘over-the-mountain’ grade because seals on snack food bags were failing when the product shipped above a certain altitude.”

At Celplast Metallized Products, a provider of metallized barrier films, “We see continued growth opportunities in transparent barrier packaging and overall higher-barrier packaging requirements in food and medical [applications],” says marketing manager Naomi Panagapka. She notes growing opportunities with fruit and condiments and says annual expected growth in transparent barrier film is expected to be around 3.5% over the next five years.“

As consumers become more informed regarding healthy food choices, they also want to know what they are eating, as well as see the package contents,” adds Celplast business development engineer Veronica Ataya. “One specific area where we have seen this happen is in the granola and health bar market, where brands very often offer products with transparent packaging showcasing the food. Another major area of growth for clear packaging has been pet food, with owners wanting to see what they are feeding their pets.”

Metallized films by Celplast.

Metallic Barriers

Improving barrier film properties by locking in a metallized layer with a top coat is a specialty at Celplast—which is planning to expand its current technology with a customized machine that streamlines the process.“

Over the past few years, we have invested significant resources in our in-line coating and metallizing technology, called Metacoat, by which we lock in the metallized barrier and protect it from scratches in downstream processing with a protective top coat,” Ataya explains.

Typically, two steps are needed to produce a top-coated metallized film using roll-to-roll processes, she says. First, the material is metallized under vacuum, then it’s top-coated at atmospheric pressure. “This two-step process creates certain inherent disadvantages, such as high operating and capital costs. We also suspected that pin-holing and scratch defects were being introduced … and that we could improve upon it by creating a single-step, in-line process to top-coat directly in the metallizing chamber.”

For this new method, Celplast is commissioning a custom metallizer/coater. The company “will be able to produce our line of top-coated metallized films, capable of achieving barrier properties not currently attainable with standard technology.” Avoiding the two-step process reduces material usage and lessens the carbon footprint of packaged goods by replacing or eliminating barrier layers, Ataya says.

With a wide-ranging portfolio of high-barrier films already in place to meet contemporary water-vapor and oxygen requirements, she says, “we have some still-higher barrier items in the pipeline that will perform in markets that we haven’t participated in—where perhaps glass and foil are used presently.”

High Barriers for “On-the-Go” Pouches

Other major elements in Celplast’s portfolio are Foilmet and Ultramet. In smaller pouch formats for on-the-go products, high-barrier films like Foilmet “Plus” offer an alternative to foil laminations.“

Many existing products use a lamination with foil, where the package can look damaged and shopworn on the shelf, and as it travels through the supply chain,” says Ataya. Thus the films must offer excellent barrier properties, as well as puncture resistance and increased productivity. The company reports barrier values in the range of 0.31–0.46 g/m2/day for water vapor and 0.31–0.46 cm3>/m2/day for oxygen.1

Meanwhile, Ultramet, offered in several formulations, “was designed to provide improved metal adhesion to solve the problem of metal delamination in large-format pouches.” Ultramet WR has had the most recent impact in the industry, Ataya says:

“It is a game-changer in terms of outstanding metal adhesion and flex crack resistance and performs very well in high-moisture applications and environments—an area where formerly only foil would previously have been viable. We recently worked with a customer developing a metallized film with high metal adhesion and moisture resistance. This customer is making in-mold labels for tubes used in personal care, which are likely to be used and stored in high-moisture environments.”

Expanding Nylon Barrier Films

With demand for nylon-based barrier films continuing to grow in its core markets—and in some niches experiencing above-market growth—Charter Nex recently acquired Optimum Plastics “to be the leading specialty engineered film supplier in North America,” according to Bill Wright, vice president of technology.“

We were excited at the prospect of adding cast film to our portfolio, as well as growing our nylon and barrier films capability,” Wright says. “[W]hile both Charter NEX and Optimum are strong players in food, medical, and industrial applications, Optimum brought new consumer, aerospace, automotive, and home decor markets to the mix.” Charter Nex intends to expand facilities in Ohio and Wisconsin to offer more film solutions.

A multilayer co-extrusion film line at Tekni-Plex’s Global Technology Center in Ohio, adjacent to the company’s lamination line (image courtesy of Tekni-Plex).

“Our ability to develop films that dial-in on a precise barrier need—oxygen, moisture, or odor—positions us uniquely to serve this space,” Wright explains. “In food, growing demand for produce films in retail and institutional applications has our attention. In health care, myriad applications from sterilization bags to transdermal patches to wound care use barrier films and continue to see strong growth. Barrier applications in agriculture are focused on keeping nutrients, moisture, and fumigants in, while keeping pests, bacteria, and fungi out.” In particular, Wright says, Charter Nex customers are keenly interested in:

- increased heat resistance for sterilization, food safety, and kitchen “re-therm” convenience;

- improvements in seal integrity, such as hermetic fusion to protect the oxygen barrier value of EVOH and polyamide;

- tightened auto-profile standards, shifting to 3-sigma detection profiles; and

- enhanced package-abuse resistance, including polymer and structure strategies whereby film toughness sustains heavy content weights.

With growing consumer demand for on-the-go or heat-and-eat packaged foods, Charter Nex focuses on “allowing optimized taste quality and consumer safety while providing the convenience of in-package microwaving or boiling,” Wright notes. “In many instances, the key control parameter is oxygen, and performance ranges from high barrier to high transmission rate, depending on the food type.

“Package aesthetics—especially in the context of value-added graphics—are affected significantly by film surface gloss. Evolving polymer technology is providing continuing opportunities to increase gloss levels, and we are investing aggressively in multilayer processes to make economical use of aesthetically advanced resins.”

In the near future, Charter Nex has two market initiatives in progress. The first is advanced liquid packaging for burst and drop strengthening. “Our customers continue to ask us for more robust films to hold greater volumes of liquid used under increasingly rigorous conditions,” Wright says. The second innovation is in the area of thermal lamination films. “We are developing proprietary adhesive alloys that provide two and three times the bond properties of lamination films available today.”

New Facility, New Laminated Materials

Also growing its business is Tekni-Plex, which opened a new facility for its Tekni-Films division in Holland, Ohio, in July 2015. The facility, relocated from New Jersey, handles all the company’s North American laminated film volume with state-of-the art equipment, says Phil Bourgeois, senior vice president of global technology and regulatory affairs.

“This line has more sophisticated ovens to control the process with better tension controls, and a lot more electro-servo based controls, versus those that are more manually based,” he notes. Chief performers in the Tekni-Plex portfolio are:

- high-moisture-barrier, laminated Aclar® structures to support new drug growth areas, including branded formulations from major pharmaceutical makers as well as generics;

- PVDC-coated films supplied from recently acquired Gallazzi (Italy) manufacturing facilities; and

- PX copolyester monolayer and laminate films for blister and tray structures for pharma and medical device packaging in place of PVC and PVDC.

“Pharmaceutical companies can thermoform PX structures with existing PVC molds at temperatures that are 10 to 15 degrees Celsius lower,” notes Garret Hager, director of pharma films and medical packaging. “Conversely, if customers choose, they can keep the same temperature and run the PX material faster, providing higher output. Either approach has a positive impact on carbon footprint due to the reduction of energy consumption.”

Celplast’s barrier film recently won an AIMCAL packaging award in the “Healthcare, Cosmetics and Toiletries” category.2

Like Celplast and Filmquest, Tekni-Plex is keenly aware of providing alternatives to PVC, which faces strictures in Europe and Japan. In countries where companies must pay a fee in relation to the type of materials they put in the marketplace (regarding recycling scores), “we offer a full high-barrier system for oxygen and moisture, based on cyclic olefin copolymers [COCs],” Bourgeois says.

Thanks to various sustainability initiatives, significant investment has been made in materials and manufacturing platforms to ensure that co-extruded COC-based barrier films function on a par with traditional materials, he continues. “You’re relying on the barrier because of the construction of the film and how it’s put together by the supplier. But you can vary the barrier properties depending on the thickness of materials within a co-extruded structure.”

For instance, citing the example of a 12-mil (0.3-mm) Aclar product, he suggests, “I might be utilizing that COC at a particular thickness within that end-use structure. However, we will utilize other materials in that structure, typically polypropylenes, etc., as the product contact surface—maintaining the overall thickness of the traditional barrier film, but varying the thickness of that COC within that structure. We will dial in the barrier specifically required for that application. In many cases we’re still providing the same barrier.”

Creating a total-package solution for a new barrier film that’s completely compatible with brand owners’ manufacturing processes requires continued engineering, Bourgeois says. One example regards “the thermoforming process utilized to transfer [a new COC material] to a blister film, as well as the lid stock being used in the final primary package. Most lid stocks are foil-based, and the sealing material of that foil structure would need to change to be compatible with the new barrier material structure … depending on whether it’s a peelable structure, or a welded or push-through structure.”

A Post-Use “Green” Resin

With longer-serving barrier films becoming more vital to brand owners, the resulting scrap is of significant environmental concern for many. Dow’s just-introduced “Retain” polymer modifier is geared to significantly boosting the reusability of post-consumer materials.

Barrier films “are projected to grow faster than the general plastic market due to continued consumer demand for more transparent packaging with longer shelf life,” notes

Ritika Kalia, North America marketing manager for Dow Packaging and Specialty Plastics. “One of the challenges in this category of films that contain commonly used barrier materials such as polyamide and EVOH is that their scrap cannot readily be reused in common polyethylene recycle streams.”

Retain is “a new resin compatibilizer that gives millions of pounds of post-industrial barrier film scrap and post-consumer barrier packaging a second chance at life by allowing it to be recycled without compromising performance, aesthetics, or processing efficiency,” she explains. It finely disperses barrier-film particles into the general polyolefin matrix that typically makes up the majority of the structure, and can be incorporated either during repelletization or at the extruder when incorporating pelletized recycled material, she says.

Creating these modifiers “requires excellent control of catalysis and processing variables,” she continues. “Significant advances led to the development and commercial deployment of molecular catalysts. These catalysts also allow control over the polymer structure, altering the properties of the finished polymer.” The result is a solution “capable of post-industrial and post-consumer recycling with the current polyethylene recycle streams without processing or performance issues.”

With more consumers making sustainable and recyclable packaging a priority, Retain provides “an unprecedented opportunity,” Kalia concludes. “Compared to other control films, the technology in Retain helps converters develop high-quality packages with better clarity and mechanical properties and significantly reduces gels in films produced from barrier-film recycle.”

References

1. “5 Areas in Which Metallized Film Beats Foil.” Jan. 29, 2015. www.celplast.com/educational/5-ways-metallized-film-surpass-foil-performance accessed April 21, 2016.

2. “AIMCAL Awards | IML DECORATION IS A “10”.” March 23, 2016. www.aimcal.org/2016-awards.html accessed May 2, 2016.

Nano-Barriers Line Up to Provide a “Tortuous Path”

Vermiculite platelets are the key to Filmquest’s NanoShield high-barrier technology. Deionization is a critical component in creating the “tortuous path” that does the job, says company president John Felinski.

“Select Purified Vermiculite is a particular silicate clay with platelets having an especially high aspect ratio—very thin, 1 to 3 nanometers, but very broad in the other two dimensions—10,000 to 40,000 nanometers, which is 10 to 40 microns,” he explains.

“The proprietary formulation ‘singularizes’ the platelets, giving them the same charge. Like same-pole magnets, the platelets repel each other and are parallel in a very tight impervious layer, usually about 0.3-microns thick.”

What that means is gas molecules have a hard time getting through or around the 40 to 50 layers of platelets. “Other conventional clays also work, but are smaller platelets,” Felinski notes. So “[t]here are many more potential pathways for gas molecules to move through.”

NanoShield was developed as a clear barrier coating to replace less eco-friendly material, he notes. “It also has source-reduction and cost benefits for many EVOH [ethylene vinyl alcohol] applications.” Primary users are those seeking high barriers for oxygen, nitrogen, and flavor or aroma—ideal for snacks, especially nut-mix products, spices, seasoning mixes, and bakery mixes with egg or milk components.

Because the barrier coating is thin, he says, “the best barrier is achieved with films that have smooth surface topography. PET and nylon are excellent, and most BOPP and PLA work well.” Metallizing grades tend to be smoother and have good surface energy to coat especially well, he adds.

“NanoShield coating films are competitive to barrier materials in which the package needs to be clear, foils and metallization are not options, and the customer has an active environmental stewardship,” he explains. “Small-to-medium-sized customers using EVOH coextruded films may also achieve substantial cost benefit and source reduction, and the ability to dial in the desired OTR [oxygen transmission rate] on a wide range of films in ideal gauges does offer some benefit.”

Blown-Film Equipment: Eleven Layers, and Beyond

Progressing beyond five-, seven-, and nine-layer films, longtime barrier-film equipment supplier Windmoeller & Hoelscher Corp. is seeing an increase in requests for 11-layer blown film from high-barrier producers, says Nick Nigro, sales manager for extrusion systems.

“While in the past it wasn’t unusual to see 11 layers on a limited basis, that has become commonplace—and requests for up to 15 layers is now the new direction,” he notes. “With the onset of a multitude of new resins and equipment capabilities, producers are pushing the limits and clearly tailoring the structures to specific needs.”

Launched in late 2013, the Varex II blown-film line is an example of the company’s technology. Varex II is “based on a modular concept that allows almost unlimited configurations,” according to the W&H website, “from 8-μm HDPE liner film, to 11-layer barrier film with only a 1-μm EVOH layer.”

With experience in serving not only food and pharmaceutical customers, but also laminators and high-end converters, W&H emphasizes control and consistency in its equipment. Customers are looking for higher outputs and yields—and the development of more layers that are thinner, Nigro explains.

W&H customers “participate in a plethora of markets and specialty segments that require specific post-extrusion converting. This can include, but is not limited to, complex laminations, die cutting, and MDO [machine direction orientation]. So it’s necessary for the equipment manufacturer to be knowledgeable of the film requirements for these subsequent processes in order to help insure successful operation.”

Windmoeller & Hoelscher’s advanced Varex II blown-film equipment (photo courtesy of W&H).

Putting Up Barriers

From metallized and nano-scale coatings, to “greener” resins or multiple layers of materials, protective films get serious upgrades for the 21st century

Previous Article Next Article

By Geoff Giordano

Aclar® high moisture-barrier thermoformed blister film helps softgel manufacturers achieve shelf-life objectives (this image courtesy of Tekni-Plex).

Keeping bad things out and good things in is the essential function of barrier films. Doing so with less polymer, more layers, improved metallized coatings, nano-modifiers, or resins that facilitate recycling are some suppliers’ responses to the challenges put forth by 21st-century food and pharmaceutical brand owners.

A product example of Celplast’s metallized film in gold. (All Celplast product photos in this article are courtesy of the company.)

For flexible packaging, the key barrier properties are oxygen transmission, water vapor transmission, and light transmission, or opacity, says Michael Navarro, director of global product development for Now Plastics. “Each application—dry food, liquid, pouch, rigid containers, and thermoformables—[has] different requirements based on the products they contain.”

Now Plastics serves primarily flexible-packaging markets, selling thin films and aluminum foil. It works with converters to reach their goals for shelf life, package size, distribution channels, environmental impact, and consumer appeal. “We have been working with our manufacturing partners to introduce thinner films with similar or better barrier properties to reduce package weight,” Navarro notes.“

Down-gauging is an area all converters and film manufacturers are always interested in, and as equipment becomes more sophisticated, thinner films can be produced and converted—printed, laminated, etc.—and perform well on packaging lines.”

Global Needs

Dealing with packaging requirements around the globe continues to drive innovation, thanks to widely varying geographic and climatic hurdles. In Africa, for example, barrier films must be “far more robust because the distribution channels are more challenging; roads, weather conditions, and time from production to delivery are more demanding than they are in North America,” Navarro explains. And, “Humidity of the Indian/Asian subcontinent during the rainy season causes product spoilage faster than in the drier months.” Meanwhile, the extreme cold in northern climates requires manufacturers of biaxially oriented polypropylene (BOPP) film to have what they call “summer” and “winter” formulas for the films to perform properly.

But packaging demands aren’t necessarily uniform, even within a region, Navarro says. “At one time, BOPP film producers in the U.S created a film that would survive the elevation of the Rocky Mountains—termed an ‘over-the-mountain’ grade because seals on snack food bags were failing when the product shipped above a certain altitude.”

At Celplast Metallized Products, a provider of metallized barrier films, “We see continued growth opportunities in transparent barrier packaging and overall higher-barrier packaging requirements in food and medical [applications],” says marketing manager Naomi Panagapka. She notes growing opportunities with fruit and condiments and says annual expected growth in transparent barrier film is expected to be around 3.5% over the next five years.“

As consumers become more informed regarding healthy food choices, they also want to know what they are eating, as well as see the package contents,” adds Celplast business development engineer Veronica Ataya. “One specific area where we have seen this happen is in the granola and health bar market, where brands very often offer products with transparent packaging showcasing the food. Another major area of growth for clear packaging has been pet food, with owners wanting to see what they are feeding their pets.”

Metallized films by Celplast.

Metallic Barriers

Improving barrier film properties by locking in a metallized layer with a top coat is a specialty at Celplast—which is planning to expand its current technology with a customized machine that streamlines the process.“

Over the past few years, we have invested significant resources in our in-line coating and metallizing technology, called Metacoat, by which we lock in the metallized barrier and protect it from scratches in downstream processing with a protective top coat,” Ataya explains.

Typically, two steps are needed to produce a top-coated metallized film using roll-to-roll processes, she says. First, the material is metallized under vacuum, then it’s top-coated at atmospheric pressure. “This two-step process creates certain inherent disadvantages, such as high operating and capital costs. We also suspected that pin-holing and scratch defects were being introduced … and that we could improve upon it by creating a single-step, in-line process to top-coat directly in the metallizing chamber.”

For this new method, Celplast is commissioning a custom metallizer/coater. The company “will be able to produce our line of top-coated metallized films, capable of achieving barrier properties not currently attainable with standard technology.” Avoiding the two-step process reduces material usage and lessens the carbon footprint of packaged goods by replacing or eliminating barrier layers, Ataya says.

With a wide-ranging portfolio of high-barrier films already in place to meet contemporary water-vapor and oxygen requirements, she says, “we have some still-higher barrier items in the pipeline that will perform in markets that we haven’t participated in—where perhaps glass and foil are used presently.”

High Barriers for “On-the-Go” Pouches

Other major elements in Celplast’s portfolio are Foilmet and Ultramet. In smaller pouch formats for on-the-go products, high-barrier films like Foilmet “Plus” offer an alternative to foil laminations.“

Many existing products use a lamination with foil, where the package can look damaged and shopworn on the shelf, and as it travels through the supply chain,” says Ataya. Thus the films must offer excellent barrier properties, as well as puncture resistance and increased productivity. The company reports barrier values in the range of 0.31–0.46 g/m2/day for water vapor and 0.31–0.46 cm3>/m2/day for oxygen.1

Meanwhile, Ultramet, offered in several formulations, “was designed to provide improved metal adhesion to solve the problem of metal delamination in large-format pouches.” Ultramet WR has had the most recent impact in the industry, Ataya says:

“It is a game-changer in terms of outstanding metal adhesion and flex crack resistance and performs very well in high-moisture applications and environments—an area where formerly only foil would previously have been viable. We recently worked with a customer developing a metallized film with high metal adhesion and moisture resistance. This customer is making in-mold labels for tubes used in personal care, which are likely to be used and stored in high-moisture environments.”

Expanding Nylon Barrier Films

With demand for nylon-based barrier films continuing to grow in its core markets—and in some niches experiencing above-market growth—Charter Nex recently acquired Optimum Plastics “to be the leading specialty engineered film supplier in North America,” according to Bill Wright, vice president of technology.“

We were excited at the prospect of adding cast film to our portfolio, as well as growing our nylon and barrier films capability,” Wright says. “[W]hile both Charter NEX and Optimum are strong players in food, medical, and industrial applications, Optimum brought new consumer, aerospace, automotive, and home decor markets to the mix.” Charter Nex intends to expand facilities in Ohio and Wisconsin to offer more film solutions.

A multilayer co-extrusion film line at Tekni-Plex’s Global Technology Center in Ohio, adjacent to the company’s lamination line (image courtesy of Tekni-Plex).

“Our ability to develop films that dial-in on a precise barrier need—oxygen, moisture, or odor—positions us uniquely to serve this space,” Wright explains. “In food, growing demand for produce films in retail and institutional applications has our attention. In health care, myriad applications from sterilization bags to transdermal patches to wound care use barrier films and continue to see strong growth. Barrier applications in agriculture are focused on keeping nutrients, moisture, and fumigants in, while keeping pests, bacteria, and fungi out.” In particular, Wright says, Charter Nex customers are keenly interested in:

- increased heat resistance for sterilization, food safety, and kitchen “re-therm” convenience;

- improvements in seal integrity, such as hermetic fusion to protect the oxygen barrier value of EVOH and polyamide;

- tightened auto-profile standards, shifting to 3-sigma detection profiles; and

- enhanced package-abuse resistance, including polymer and structure strategies whereby film toughness sustains heavy content weights.

With growing consumer demand for on-the-go or heat-and-eat packaged foods, Charter Nex focuses on “allowing optimized taste quality and consumer safety while providing the convenience of in-package microwaving or boiling,” Wright notes. “In many instances, the key control parameter is oxygen, and performance ranges from high barrier to high transmission rate, depending on the food type.

“Package aesthetics—especially in the context of value-added graphics—are affected significantly by film surface gloss. Evolving polymer technology is providing continuing opportunities to increase gloss levels, and we are investing aggressively in multilayer processes to make economical use of aesthetically advanced resins.”

In the near future, Charter Nex has two market initiatives in progress. The first is advanced liquid packaging for burst and drop strengthening. “Our customers continue to ask us for more robust films to hold greater volumes of liquid used under increasingly rigorous conditions,” Wright says. The second innovation is in the area of thermal lamination films. “We are developing proprietary adhesive alloys that provide two and three times the bond properties of lamination films available today.”

New Facility, New Laminated Materials

Also growing its business is Tekni-Plex, which opened a new facility for its Tekni-Films division in Holland, Ohio, in July 2015. The facility, relocated from New Jersey, handles all the company’s North American laminated film volume with state-of-the art equipment, says Phil Bourgeois, senior vice president of global technology and regulatory affairs.

“This line has more sophisticated ovens to control the process with better tension controls, and a lot more electro-servo based controls, versus those that are more manually based,” he notes. Chief performers in the Tekni-Plex portfolio are:

- high-moisture-barrier, laminated Aclar® structures to support new drug growth areas, including branded formulations from major pharmaceutical makers as well as generics;

- PVDC-coated films supplied from recently acquired Gallazzi (Italy) manufacturing facilities; and

- PX copolyester monolayer and laminate films for blister and tray structures for pharma and medical device packaging in place of PVC and PVDC.

“Pharmaceutical companies can thermoform PX structures with existing PVC molds at temperatures that are 10 to 15 degrees Celsius lower,” notes Garret Hager, director of pharma films and medical packaging. “Conversely, if customers choose, they can keep the same temperature and run the PX material faster, providing higher output. Either approach has a positive impact on carbon footprint due to the reduction of energy consumption.”

Celplast’s barrier film recently won an AIMCAL packaging award in the “Healthcare, Cosmetics and Toiletries” category.2

Like Celplast and Filmquest, Tekni-Plex is keenly aware of providing alternatives to PVC, which faces strictures in Europe and Japan. In countries where companies must pay a fee in relation to the type of materials they put in the marketplace (regarding recycling scores), “we offer a full high-barrier system for oxygen and moisture, based on cyclic olefin copolymers [COCs],” Bourgeois says.

Thanks to various sustainability initiatives, significant investment has been made in materials and manufacturing platforms to ensure that co-extruded COC-based barrier films function on a par with traditional materials, he continues. “You’re relying on the barrier because of the construction of the film and how it’s put together by the supplier. But you can vary the barrier properties depending on the thickness of materials within a co-extruded structure.”

For instance, citing the example of a 12-mil (0.3-mm) Aclar product, he suggests, “I might be utilizing that COC at a particular thickness within that end-use structure. However, we will utilize other materials in that structure, typically polypropylenes, etc., as the product contact surface—maintaining the overall thickness of the traditional barrier film, but varying the thickness of that COC within that structure. We will dial in the barrier specifically required for that application. In many cases we’re still providing the same barrier.”

Creating a total-package solution for a new barrier film that’s completely compatible with brand owners’ manufacturing processes requires continued engineering, Bourgeois says. One example regards “the thermoforming process utilized to transfer [a new COC material] to a blister film, as well as the lid stock being used in the final primary package. Most lid stocks are foil-based, and the sealing material of that foil structure would need to change to be compatible with the new barrier material structure … depending on whether it’s a peelable structure, or a welded or push-through structure.”

A Post-Use “Green” Resin

With longer-serving barrier films becoming more vital to brand owners, the resulting scrap is of significant environmental concern for many. Dow’s just-introduced “Retain” polymer modifier is geared to significantly boosting the reusability of post-consumer materials.

Barrier films “are projected to grow faster than the general plastic market due to continued consumer demand for more transparent packaging with longer shelf life,” notes

Ritika Kalia, North America marketing manager for Dow Packaging and Specialty Plastics. “One of the challenges in this category of films that contain commonly used barrier materials such as polyamide and EVOH is that their scrap cannot readily be reused in common polyethylene recycle streams.”

Retain is “a new resin compatibilizer that gives millions of pounds of post-industrial barrier film scrap and post-consumer barrier packaging a second chance at life by allowing it to be recycled without compromising performance, aesthetics, or processing efficiency,” she explains. It finely disperses barrier-film particles into the general polyolefin matrix that typically makes up the majority of the structure, and can be incorporated either during repelletization or at the extruder when incorporating pelletized recycled material, she says.

Creating these modifiers “requires excellent control of catalysis and processing variables,” she continues. “Significant advances led to the development and commercial deployment of molecular catalysts. These catalysts also allow control over the polymer structure, altering the properties of the finished polymer.” The result is a solution “capable of post-industrial and post-consumer recycling with the current polyethylene recycle streams without processing or performance issues.”

With more consumers making sustainable and recyclable packaging a priority, Retain provides “an unprecedented opportunity,” Kalia concludes. “Compared to other control films, the technology in Retain helps converters develop high-quality packages with better clarity and mechanical properties and significantly reduces gels in films produced from barrier-film recycle.”

References

1. “5 Areas in Which Metallized Film Beats Foil.” Jan. 29, 2015. www.celplast.com/educational/5-ways-metallized-film-surpass-foil-performance accessed April 21, 2016.

2. “AIMCAL Awards | IML DECORATION IS A “10”.” March 23, 2016. www.aimcal.org/2016-awards.html accessed May 2, 2016.

Nano-Barriers Line Up to Provide a “Tortuous Path”

Vermiculite platelets are the key to Filmquest’s NanoShield high-barrier technology. Deionization is a critical component in creating the “tortuous path” that does the job, says company president John Felinski.

“Select Purified Vermiculite is a particular silicate clay with platelets having an especially high aspect ratio—very thin, 1 to 3 nanometers, but very broad in the other two dimensions—10,000 to 40,000 nanometers, which is 10 to 40 microns,” he explains.

“The proprietary formulation ‘singularizes’ the platelets, giving them the same charge. Like same-pole magnets, the platelets repel each other and are parallel in a very tight impervious layer, usually about 0.3-microns thick.”

What that means is gas molecules have a hard time getting through or around the 40 to 50 layers of platelets. “Other conventional clays also work, but are smaller platelets,” Felinski notes. So “[t]here are many more potential pathways for gas molecules to move through.”

NanoShield was developed as a clear barrier coating to replace less eco-friendly material, he notes. “It also has source-reduction and cost benefits for many EVOH [ethylene vinyl alcohol] applications.” Primary users are those seeking high barriers for oxygen, nitrogen, and flavor or aroma—ideal for snacks, especially nut-mix products, spices, seasoning mixes, and bakery mixes with egg or milk components.

Because the barrier coating is thin, he says, “the best barrier is achieved with films that have smooth surface topography. PET and nylon are excellent, and most BOPP and PLA work well.” Metallizing grades tend to be smoother and have good surface energy to coat especially well, he adds.

“NanoShield coating films are competitive to barrier materials in which the package needs to be clear, foils and metallization are not options, and the customer has an active environmental stewardship,” he explains. “Small-to-medium-sized customers using EVOH coextruded films may also achieve substantial cost benefit and source reduction, and the ability to dial in the desired OTR [oxygen transmission rate] on a wide range of films in ideal gauges does offer some benefit.”

Blown-Film Equipment: Eleven Layers, and Beyond

Progressing beyond five-, seven-, and nine-layer films, longtime barrier-film equipment supplier Windmoeller & Hoelscher Corp. is seeing an increase in requests for 11-layer blown film from high-barrier producers, says Nick Nigro, sales manager for extrusion systems.

“While in the past it wasn’t unusual to see 11 layers on a limited basis, that has become commonplace—and requests for up to 15 layers is now the new direction,” he notes. “With the onset of a multitude of new resins and equipment capabilities, producers are pushing the limits and clearly tailoring the structures to specific needs.”

Launched in late 2013, the Varex II blown-film line is an example of the company’s technology. Varex II is “based on a modular concept that allows almost unlimited configurations,” according to the W&H website, “from 8-μm HDPE liner film, to 11-layer barrier film with only a 1-μm EVOH layer.”

With experience in serving not only food and pharmaceutical customers, but also laminators and high-end converters, W&H emphasizes control and consistency in its equipment. Customers are looking for higher outputs and yields—and the development of more layers that are thinner, Nigro explains.

W&H customers “participate in a plethora of markets and specialty segments that require specific post-extrusion converting. This can include, but is not limited to, complex laminations, die cutting, and MDO [machine direction orientation]. So it’s necessary for the equipment manufacturer to be knowledgeable of the film requirements for these subsequent processes in order to help insure successful operation.”

Windmoeller & Hoelscher’s advanced Varex II blown-film equipment (photo courtesy of W&H).