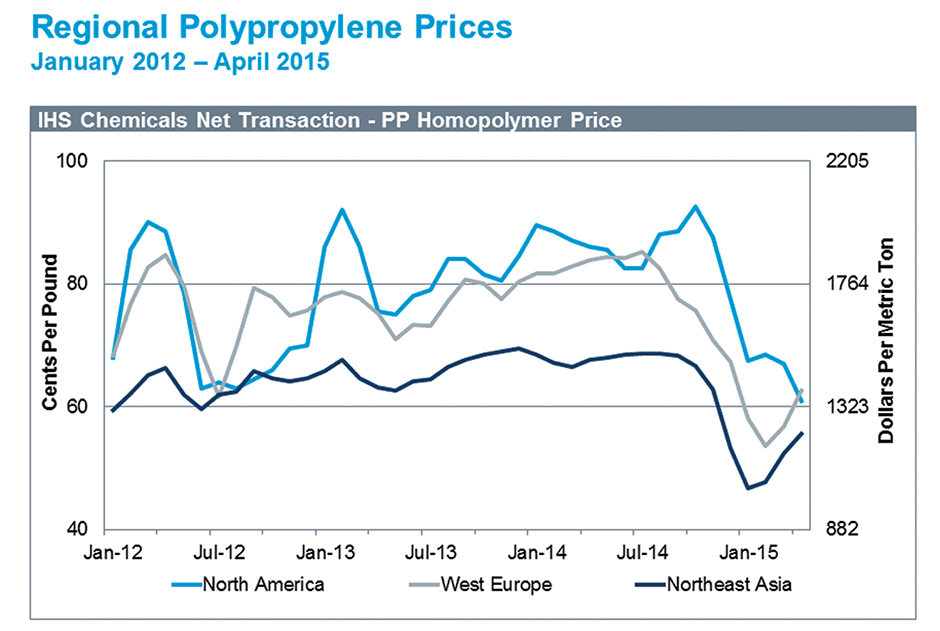

Polypropylene continues to exhibit strong global growth as the second-largest volume thermoplastic after polyethylene. IHS expects global polypropylene growth to continue to exceed GDP—driven by its enduring value in a wide range of durable and non-durable applications. However, as mid-year arrives, trending industry dynamics make planning a challenge for both producers and buyers.

Impact of Lower Crude

While the major drop in crude prices occurred last November, Asian polypropylene prices actually began to decline after peaking in September, falling by almost a third by the beginning of 2015. European prices responded similarly, declining some 25% from mid-2014’s peak. However, prices in these regions stabilized early in the first quarter.

Overall demand remained solid, supported by lower energy prices and boosted by increased prime resin demand, as prices declined to levels associated with recycled resin conversion costs. In the end, major destocking appeared to have run its course in the first quarter of 2015. Additionally, as crude prices stabilized, buyers returned to replenish stocks, while the industry experienced a number of unplanned outages, spread across the Middle East, Europe, and India. These outages came at a bad time for producers, as margins had improved and operating rates increased in all major markets.

China’s Unprecedented Expansions

Capacity growth continues to outpace global demand, with far-reaching implications. In the last four months of 2014, amidst the global decline in crude prices, 1.5 million tons of new polypropylene started up in China—only the beginning of what will be an unprecedented expansion over the next few years. This development is driven by a movement to become more self-sufficient in propylene and its derivatives, and it’s supported by China’s means and desire to monetize its abundance of coal assets. Simultaneously, Middle Eastern capacity continues to grow—with one million metric tons coming to the market in the next two years.

These regions’ additional capacity will impact supply and prices around the world. Europe, for example, will continue to see increased pressure from imports, despite the increased tariffs imposed on Middle Eastern products last year and a weak euro that continues to make imports challenging.

North America Remains Supply-Constrained

Despite a global oversupply of polypropylene, the current North American market is viewed as particularly constrained, with propylene supply reduced from both ethylene crackers and refineries. The shale boom, while an immediate positive for integrated producers in the ethylene chain, has had a short-term negative impact on the propylene supply picture. That being said, an abundance of propane is bringing new supplies of propylene to North America via on-purpose technologies, serving to replace and possibly exceed those lost from crackers and refineries in recent years.

The burning question for the industry today is whether this new volume of propylene will in turn drive increased domestic polypropylene supply. Recent years have seen North America’s tight supply conditions support increased prices and margins for producers. The extent that improved business conditions will result in additional polypropylene supply, and what this will mean for pricing, is a key indicator for the coming months and years.

The author is Robin Waters, Director, Polyolefins North America, IHS; he can be reached via robin.waters@ihs.com.

Resin Market Focus, by IHS Chemicals, provides ongoing insights into key industry topics and trends for major plastics and engineering resins, covering all major regions. IHS Chemicals provides extensive industry insight, analytics, and data for over 300 chemical markets worldwide, including the global plastics, polymers, and engineering resin markets. Learn more or inquire about IHS content at U.S. 888-293-8153 or AmericasTQ@ihs.com. ![]()