Health Assurance

Ongoing developments in medical plastics are speeding innovations that could extend the reach, effectiveness, and safety of medical devices

Previous Article Next Article

By Pat Toensmeier

An insulin injection pen includes two parts molded from DuPont’s Delrin acetal homopolymer that regulate the dose and reduce injection pressure (photo courtesy of DuPont).

Many trends that shape the demand for medical devices are having a major effect on resin formulations and applications. The result is a steepening trajectory of innovation that’s revolutionizing the ways in which plastics are considered, designed, and used in this surging, vibrant market.

Looks are deceiving. These containers look the same, but only the three white bottles on the right contain an Ampacet SecurTrace taggant that confirms they’re genuine (photo courtesy of Ampacet).

The stakes are enormous in winning the materials competition that requirements for medical products mandate. The specification of resins in high-volume applications can generate a sizeable payback for all companies in a supply chain—resin producers, processors, and OEMs. This is because medical and related applications (packaging, diagnostic systems, and other components) continue to generate steady growth around the world and have the potential for broad penetration of developing regions. Trends fueling product use include:

- aging populations in North America, Western Europe, and Japan that require growing levels of healthcare, as well as access to the latest medical technologies;

- the increasing compatibility with Western standards of requirements for devices in China and India, which is opening vast new markets to OEMs and resin suppliers (both countries together account for 35% of world population, and India is projected to become the world’s most populous country by 2022); and

- ongoing efforts to upgrade medical care in underdeveloped countries.

Also important are reducing the cost of healthcare and, for people with chronic conditions such as diabetes, maintaining quality-of-life activities. The evolution of “smart” devices—in this case, plastics-rich products that record and transmit diagnostic and monitoring data, or release medicine into the body—is vital in meeting individual and societal needs in this regard.

The positive outlook for medical applications is confirmed by market studies. Consider these robust findings from one report compiled by Transparency Market Research of Pune, India, whose U.S. office is in Albany, New York:

- The global medical polymers market (including packaging, diagnostic systems, and components) is projected to reach $15.8 billion by 2020. This equates to a compound annual growth rate in demand of 8.3% from 2014 to 2020.

- The global sales revenue for the market will account for $505 billion by 2020.

- North America remains the top market for medical device sales, with, in 2013, a little more than 40% of global share, closely followed by Europe.

Other studies forecast somewhat lower global growth and sales revenue. Nevertheless, all of them confirm continuing gains in the market, along with the potential for sizable new business opportunities.

This is good news, but it also presents major challenges for the supply chain, one of the biggest of which is how best to guarantee the quality and integrity of materials and devices.

The GlowCap is a cap and container for meds that alerts people about missed dosages by illuminating the cap’s top and calling them on their phone (photo courtesy of Vitality).

Counterfeit Detection

Simply put, global sales—and the inevitable access to offshore supply and processing sources they generate—increase the risk of counterfeit products replacing ones that have been qualified for medical applications.

“It’s a global problem, though many counterfeit parts and resins originate in China and Russia,” remarked one materials supplier (off the record). Another source of counterfeit resins is India, which has a growing chemicals and pharmaceuticals industry and thus, for the unscrupulous, access to production of off-spec resins that can be offered as seemingly benign substitutes or even branded grades.

Using counterfeit resins, however inadvertently, can have huge repercussions for a company’s reputation and bottom line. One ongoing case, for example, involves a U.S.-based OEM that allegedly used a resin from China in a medical product. The material was not what had been specified, and resulting lawsuits over the underperforming product have led to multi-million-dollar judgments against the company.

An important way of guarding against counterfeiting is by inserting a taggant in a resin or compound. The taggant, which is usually inorganic and inert, can be one of a number of materials, including rare earth minerals, ceramic pieces, and either photochromic or ferromagnetic particles. They can be readily visible or concealed, depending on application needs.

The detection procedure is similar no matter what material is used. A minute concentration is added to a resin or compound, often in masterbatch form. The taggant’s presence is detected by various analytical methods, with each property tailored for a specific material—such as a wavelength of laser energy or ultraviolet light. In many cases a technician does not have to conduct a lab analysis or destructive tests to detect a taggant. A product or material can be interrogated directly with a handheld scanner to identify it as real.

Counterfeiters cannot easily game the process since specific taggants are identified only with certain types of detectors. Multiple taggants and detectors could conceivably be used as an additional safeguard.

The low levels of taggants that are used to prevent counterfeiting mean processing, properties, and part appearance are unaffected, says Morgan Gibbs, director of technical service and development at Ampacet Corp., which supplies taggants under the SecurTrace name. Examples of loadings range from parts per million to 1% of a finished product, adds Neil Ivey, CEO of BrandWatch Technologies, a strategic partner with Ampacet in taggant technology.

Depending on the application, anti-counterfeiting technology can range from sophisticated to less sophisticated, and prices follow the level of sophistication. There’s no easy way of calculating return on investment. What it comes down to, Ivey explains, is the cost a company is willing to absorb to protect its brand and good name.

Generally, though, the more advanced the taggant technology, the more foolproof it is. But regardless of complexity, counterfeiters will usually not bother trying to duplicate a covert security feature, whether it’s a taggant or something else. They can look for a covert signature and figure out easily that, for example, an infrared material is in use, but the chances of their duplicating this, much less a more advanced or complex signature, are low. “If you don’t know what to look for,” Ivey says, “it will be hard to find.”

Ampacet and BrandWatch, like many suppliers, are reluctant to disclose details of new products and technologies. Ivey says, however, that Ampacet has anti-counterfeiting tools with specific signatures that allow it to customize as well as distinguish its taggants no matter where in the product chain they are used.

Smart handheld medical devices such as this glucose meter record and transmit patient data with digital technology (photo courtesy of RTP Co.).

The Internet of Care

One major influence on the design and use of medical devices is digital technology. The accelerating growth of “smart” devices and their ability to record and transmit data—and in the process connect users to caregivers, doctors, and even drug companies—is spawning a new generation of products that increase the effectiveness of personal care without locking users into costly diagnostic routines such as doctor and hospital visits.

The idea is simple: A digital device records data ranging in complexity from when users take prescribed pills and other meds, to periodic sampling of blood glucose levels for diabetics, timed injections of various medicines, and monitoring of heartbeat, body temperature, and other physical conditions that can be used to assess an individual’s response to treatment.

One device that has gained wide use is GlowCap from Vitality Inc., an Internet-connected plastic cap and container programmed to transmit reminders to users if they do not take their medicines on time. The cap also lights up as an extra reminder. The reminders are sent over AT&T’s mobile broadband network to a user’s telephone (cell or landline) if a dosage is missed, and can be transmitted as well to family members, healthcare providers, and even prescription drug companies. A push-to-refill button on the bottom of the container automatically sends refill requests to a local pharmacy.

Compounds from RTP and others formulated for laser direct structuring allow integration of electronic circuitry in point-of-care diagnostic equipment (photo courtesy of RTP Co.).

The GlowCap and container are plastic, probably a commodity resin such as polypropylene. While its monitoring and data-transmission capabilities are a nifty application of digital circuitry, the benefit to users, especially the elderly, is immense. One study found that 98% of people who take meds from a GlowCap and other smart packages do so on time. The proportion of on-time dosages by people who have conventional meds containers, in contrast, was 71%.1

Dosing medicine on time also has a positive impact throughout the healthcare network. People who do so are generally healthier than those who do not, and are less susceptible to complications. This in turn means they’re less likely to make repeat visits to doctors or go to hospitals, which frees up time and space for other patients, and helps reduce healthcare expenditures.

“Smart” Patient Tracking

Patient tracking, in fact, is an important aspect of smart technologies for medical devices. Compounder RTP Co., for one, develops formulations that allow OEMs and others to print circuitry on heat-resistant plastics via laser direct structuring (LDS). This technique, in use for some time by the consumer electronics industry, permits the eventual selective metallization of circuits onto a molded polymer substrate. When energized with a snap-in battery, the circuits record and transmit data generated by a device. Devices can include catheters, drug-injection pens, and blood sugar monitors, says Josh Blackmore, medical marketing manager at RTP.

“We seek better patient outcomes and traceability to prove the effectiveness of a device to the FDA and for coverage by medical insurance,” says Blackmore. In formulating compounds for these products, RTP does a lot of work in the development of devices that inject drugs and monitor the results on patient health.

One advantage of using LDS and other integrated capabilities is that devices can be downsized and lightweighted. The design flexibility of LDS circuits especially is a boost for 3-D injection molding, which means devices can be more compact, ergonomic, and, if necessary, comfortable to wear.

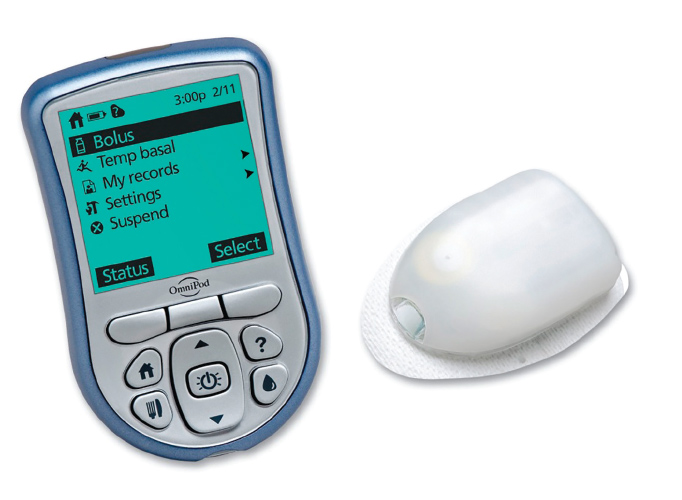

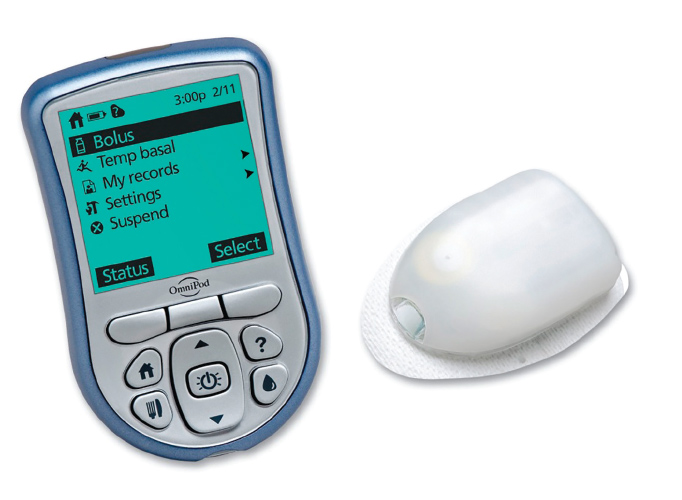

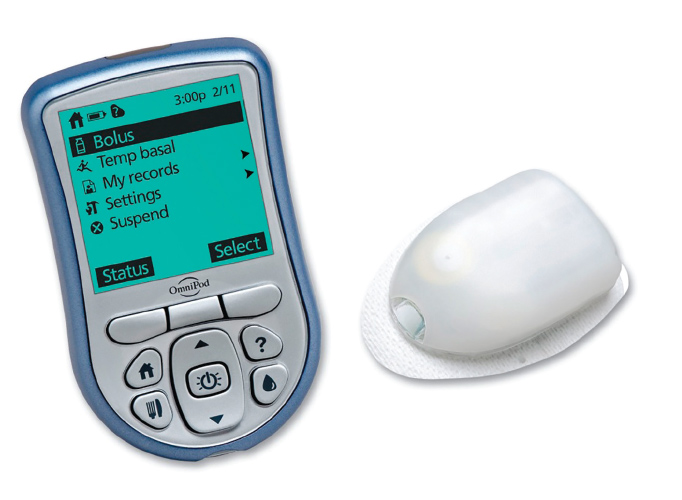

The miniaturization of devices is an important design trend especially as it pertains to products that meet lifestyle needs. “There is a growing number of people who prefer to discretely use drug-delivery devices for medicine like insulin, and they want small devices that deliver exact doses,” says William Hassink, technical services senior consultant at DuPont Performance Materials.

Like many resin producers, DuPont has a number of materials it supplies for medical applications. One is Delrin acetal, whose strength, stiffness, and impact resistance, he notes, are especially suitable for snap-fit assemblies and mechanical performance.

DuPont recently announced that an impact-resistant grade of Delrin homopolymer was specified for a new insulin pen from a major OEM. The resin is used to mold two threaded components that regulate dose accuracy, and are part of a snap-fit assembly. An added benefit of the material is low friction, which reduces the injection force applied by the patient.

These properties allow designers to develop products that are thin, small, and light enough to fit inside pockets and purses, Hassink says.

A three-way stopcock (developed by Elcam Medical and molded from Makrolon PC) has a luer-activated valve that acts as a barrier against bacteria (photo courtesy of Covestro).

Maintaining Color Balance

Among the challenges materials suppliers face is the growing strength of sanitizing chemicals in hospitals and the effects of radiation sterilization. Both affect the color stability of devices and instruments, which could lead to problems in the correct designation of color-coded items for surgery and other critical procedures.

The sanitizing chemicals are stronger, experts say, as facilities react to threats from potent germs, bacteria, and viruses. One equipment supplier, Elcam Medical, dealt with this concern by developing a three-way stopcock, molded from Makrolon polycarbonate from Covestro. It has a luer-activated valve that doubles as a barrier against bacteria, and a specially designed inner channel that promotes self-flushing and minimizes residue.

Meanwhile, to minimize discoloration, work is ongoing to maintain consistent color levels in devices and instruments.

Solvay, for example, promotes the IXEF line of polyarylamide resins for color-stabilized, high-performance applications such as surgical tools. The materials, which include highly filled grades, are formulated to resist harsh disinfectant chemicals, for one-time or repeated use (which means repeated sterilizations).

“There is a lot of color-coding in the identification of surgical instruments,” says Dane Waund, global market manager for healthcare at Solvay. Maintaining color stability is vital to ensuring that the proper instruments are selected for spinal, orthopedic, and other invasive procedures.

Solvay supplies seven colors in the IXEF line, along with black and natural. The colors are stabilized to 40 kGy (kilogray) of gamma and electron beam sterilization. “Twenty kilograys, sometimes delivered twice, is a typical dose for hospital sterilization,” Waund says. He doesn’t disclose exactly how Solvay maintains color, beyond saying the process involves pigment and resin stabilization technology and elevated heat resistance.

RTP is another supplier that develops color-stabilized materials. Since radiation typically causes a yellow shift in colors, Blackmore says the compounder has successfully added blue or purple tints to formulations that result in color shifts toward the center, or to the true color of a material.

The company also has additive technology that scavenges free radicals created by radiation sterilization. Free radicals affect the molecular weight of a polymer, building it up or down, and the additive regulates them.

As these and many other examples show, current and future developments in medical plastics will not only allow most patients to effectively treat the conditions they have, but do so in ways that are increasingly cost-effective, easy to use, and which offer little disruption to their lives. The ongoing coupling of advances in plastics performance and devices with developments in digital technology and novel ways of applying treatment could usher in an era of medical care that offers greater access, increasingly effective treatment, and better health for more people.

Reference

1.D. Rose, presentation comments, Dassault 3D EXPERIENCE Forum, Boston, Massachusetts, USA, Nov., 2015.

DNA Taggants: Fighting Crime

The technology behind taggants continues to advance. A few suppliers offer DNA taggants: BrandWatch is one, as is DNA Technologies, which specializes in applying its taggants to thin films.

Another supplier is Applied DNA Sciences, an industrial biotech firm that has been in business for ten years and is expanding its technology to a number of applications. The use of DNA as a taggant is a virtually foolproof way of certifying the authenticity of material, says CEO Jim Hayward. “DNA is considered the gold standard by courts globally. It is the most detectable analyte on the planet.”

With levels of use in the parts-per-trillion range, the material is “agnostic to form and function” in chemicals and finished products, he adds.

The company’s DNA is sourced from plant genomes, and can be supplied as a concentrate, solid or liquid, or as a fraction of a raw material. Applied DNA has a patented metering system that thoroughly mixes the taggant with materials, and is working with masterbatch suppliers to develop blending techniques for the microscopic quantities involved. Detecting a DNA taggant, Hayward says, is as simple as taking a surface swab of a material or product, a tape pull, or shaving off a small portion to test. The company supplies testing devices that require little training to use. The cost of DNA taggants, he adds, is “very affordable.”

The accuracy, moreover, is virtually guaranteed. Among the company’s applications are ATMs in the UK. When one of these cash machines detects an attack by thieves, it “decorates all of its cash with DNA,” Hayward says. If the police arrest suspects and recover the stolen money, they test it for the DNA taggant. Thus far, Hayward notes, suspects in 101 ATM thefts have gone to trial, and all 101 trials ended in convictions.

Health Assurance

Ongoing developments in medical plastics are speeding innovations that could extend the reach, effectiveness, and safety of medical devices

Previous Article Next Article

By Pat Toensmeier

An insulin injection pen includes two parts molded from DuPont’s Delrin acetal homopolymer that regulate the dose and reduce injection pressure (photo courtesy of DuPont).

Many trends that shape the demand for medical devices are having a major effect on resin formulations and applications. The result is a steepening trajectory of innovation that’s revolutionizing the ways in which plastics are considered, designed, and used in this surging, vibrant market.

Looks are deceiving. These containers look the same, but only the three white bottles on the right contain an Ampacet SecurTrace taggant that confirms they’re genuine (photo courtesy of Ampacet).

The stakes are enormous in winning the materials competition that requirements for medical products mandate. The specification of resins in high-volume applications can generate a sizeable payback for all companies in a supply chain—resin producers, processors, and OEMs. This is because medical and related applications (packaging, diagnostic systems, and other components) continue to generate steady growth around the world and have the potential for broad penetration of developing regions. Trends fueling product use include:

- aging populations in North America, Western Europe, and Japan that require growing levels of healthcare, as well as access to the latest medical technologies;

- the increasing compatibility with Western standards of requirements for devices in China and India, which is opening vast new markets to OEMs and resin suppliers (both countries together account for 35% of world population, and India is projected to become the world’s most populous country by 2022); and

- ongoing efforts to upgrade medical care in underdeveloped countries.

Also important are reducing the cost of healthcare and, for people with chronic conditions such as diabetes, maintaining quality-of-life activities. The evolution of “smart” devices—in this case, plastics-rich products that record and transmit diagnostic and monitoring data, or release medicine into the body—is vital in meeting individual and societal needs in this regard.

The positive outlook for medical applications is confirmed by market studies. Consider these robust findings from one report compiled by Transparency Market Research of Pune, India, whose U.S. office is in Albany, New York:

- The global medical polymers market (including packaging, diagnostic systems, and components) is projected to reach $15.8 billion by 2020. This equates to a compound annual growth rate in demand of 8.3% from 2014 to 2020.

- The global sales revenue for the market will account for $505 billion by 2020.

- North America remains the top market for medical device sales, with, in 2013, a little more than 40% of global share, closely followed by Europe.

Other studies forecast somewhat lower global growth and sales revenue. Nevertheless, all of them confirm continuing gains in the market, along with the potential for sizable new business opportunities.

This is good news, but it also presents major challenges for the supply chain, one of the biggest of which is how best to guarantee the quality and integrity of materials and devices.

The GlowCap is a cap and container for meds that alerts people about missed dosages by illuminating the cap’s top and calling them on their phone (photo courtesy of Vitality).

Counterfeit Detection

Simply put, global sales—and the inevitable access to offshore supply and processing sources they generate—increase the risk of counterfeit products replacing ones that have been qualified for medical applications.

“It’s a global problem, though many counterfeit parts and resins originate in China and Russia,” remarked one materials supplier (off the record). Another source of counterfeit resins is India, which has a growing chemicals and pharmaceuticals industry and thus, for the unscrupulous, access to production of off-spec resins that can be offered as seemingly benign substitutes or even branded grades.

Using counterfeit resins, however inadvertently, can have huge repercussions for a company’s reputation and bottom line. One ongoing case, for example, involves a U.S.-based OEM that allegedly used a resin from China in a medical product. The material was not what had been specified, and resulting lawsuits over the underperforming product have led to multi-million-dollar judgments against the company.

An important way of guarding against counterfeiting is by inserting a taggant in a resin or compound. The taggant, which is usually inorganic and inert, can be one of a number of materials, including rare earth minerals, ceramic pieces, and either photochromic or ferromagnetic particles. They can be readily visible or concealed, depending on application needs.

The detection procedure is similar no matter what material is used. A minute concentration is added to a resin or compound, often in masterbatch form. The taggant’s presence is detected by various analytical methods, with each property tailored for a specific material—such as a wavelength of laser energy or ultraviolet light. In many cases a technician does not have to conduct a lab analysis or destructive tests to detect a taggant. A product or material can be interrogated directly with a handheld scanner to identify it as real.

Counterfeiters cannot easily game the process since specific taggants are identified only with certain types of detectors. Multiple taggants and detectors could conceivably be used as an additional safeguard.

The low levels of taggants that are used to prevent counterfeiting mean processing, properties, and part appearance are unaffected, says Morgan Gibbs, director of technical service and development at Ampacet Corp., which supplies taggants under the SecurTrace name. Examples of loadings range from parts per million to 1% of a finished product, adds Neil Ivey, CEO of BrandWatch Technologies, a strategic partner with Ampacet in taggant technology.

Depending on the application, anti-counterfeiting technology can range from sophisticated to less sophisticated, and prices follow the level of sophistication. There’s no easy way of calculating return on investment. What it comes down to, Ivey explains, is the cost a company is willing to absorb to protect its brand and good name.

Generally, though, the more advanced the taggant technology, the more foolproof it is. But regardless of complexity, counterfeiters will usually not bother trying to duplicate a covert security feature, whether it’s a taggant or something else. They can look for a covert signature and figure out easily that, for example, an infrared material is in use, but the chances of their duplicating this, much less a more advanced or complex signature, are low. “If you don’t know what to look for,” Ivey says, “it will be hard to find.”

Ampacet and BrandWatch, like many suppliers, are reluctant to disclose details of new products and technologies. Ivey says, however, that Ampacet has anti-counterfeiting tools with specific signatures that allow it to customize as well as distinguish its taggants no matter where in the product chain they are used.

Smart handheld medical devices such as this glucose meter record and transmit patient data with digital technology (photo courtesy of RTP Co.).

The Internet of Care

One major influence on the design and use of medical devices is digital technology. The accelerating growth of “smart” devices and their ability to record and transmit data—and in the process connect users to caregivers, doctors, and even drug companies—is spawning a new generation of products that increase the effectiveness of personal care without locking users into costly diagnostic routines such as doctor and hospital visits.

The idea is simple: A digital device records data ranging in complexity from when users take prescribed pills and other meds, to periodic sampling of blood glucose levels for diabetics, timed injections of various medicines, and monitoring of heartbeat, body temperature, and other physical conditions that can be used to assess an individual’s response to treatment.

One device that has gained wide use is GlowCap from Vitality Inc., an Internet-connected plastic cap and container programmed to transmit reminders to users if they do not take their medicines on time. The cap also lights up as an extra reminder. The reminders are sent over AT&T’s mobile broadband network to a user’s telephone (cell or landline) if a dosage is missed, and can be transmitted as well to family members, healthcare providers, and even prescription drug companies. A push-to-refill button on the bottom of the container automatically sends refill requests to a local pharmacy.

Compounds from RTP and others formulated for laser direct structuring allow integration of electronic circuitry in point-of-care diagnostic equipment (photo courtesy of RTP Co.).

The GlowCap and container are plastic, probably a commodity resin such as polypropylene. While its monitoring and data-transmission capabilities are a nifty application of digital circuitry, the benefit to users, especially the elderly, is immense. One study found that 98% of people who take meds from a GlowCap and other smart packages do so on time. The proportion of on-time dosages by people who have conventional meds containers, in contrast, was 71%.1

Dosing medicine on time also has a positive impact throughout the healthcare network. People who do so are generally healthier than those who do not, and are less susceptible to complications. This in turn means they’re less likely to make repeat visits to doctors or go to hospitals, which frees up time and space for other patients, and helps reduce healthcare expenditures.

“Smart” Patient Tracking

Patient tracking, in fact, is an important aspect of smart technologies for medical devices. Compounder RTP Co., for one, develops formulations that allow OEMs and others to print circuitry on heat-resistant plastics via laser direct structuring (LDS). This technique, in use for some time by the consumer electronics industry, permits the eventual selective metallization of circuits onto a molded polymer substrate. When energized with a snap-in battery, the circuits record and transmit data generated by a device. Devices can include catheters, drug-injection pens, and blood sugar monitors, says Josh Blackmore, medical marketing manager at RTP.

“We seek better patient outcomes and traceability to prove the effectiveness of a device to the FDA and for coverage by medical insurance,” says Blackmore. In formulating compounds for these products, RTP does a lot of work in the development of devices that inject drugs and monitor the results on patient health.

One advantage of using LDS and other integrated capabilities is that devices can be downsized and lightweighted. The design flexibility of LDS circuits especially is a boost for 3-D injection molding, which means devices can be more compact, ergonomic, and, if necessary, comfortable to wear.

The miniaturization of devices is an important design trend especially as it pertains to products that meet lifestyle needs. “There is a growing number of people who prefer to discretely use drug-delivery devices for medicine like insulin, and they want small devices that deliver exact doses,” says William Hassink, technical services senior consultant at DuPont Performance Materials.

Like many resin producers, DuPont has a number of materials it supplies for medical applications. One is Delrin acetal, whose strength, stiffness, and impact resistance, he notes, are especially suitable for snap-fit assemblies and mechanical performance.

DuPont recently announced that an impact-resistant grade of Delrin homopolymer was specified for a new insulin pen from a major OEM. The resin is used to mold two threaded components that regulate dose accuracy, and are part of a snap-fit assembly. An added benefit of the material is low friction, which reduces the injection force applied by the patient.

These properties allow designers to develop products that are thin, small, and light enough to fit inside pockets and purses, Hassink says.

A three-way stopcock (developed by Elcam Medical and molded from Makrolon PC) has a luer-activated valve that acts as a barrier against bacteria (photo courtesy of Covestro).

Maintaining Color Balance

Among the challenges materials suppliers face is the growing strength of sanitizing chemicals in hospitals and the effects of radiation sterilization. Both affect the color stability of devices and instruments, which could lead to problems in the correct designation of color-coded items for surgery and other critical procedures.

The sanitizing chemicals are stronger, experts say, as facilities react to threats from potent germs, bacteria, and viruses. One equipment supplier, Elcam Medical, dealt with this concern by developing a three-way stopcock, molded from Makrolon polycarbonate from Covestro. It has a luer-activated valve that doubles as a barrier against bacteria, and a specially designed inner channel that promotes self-flushing and minimizes residue.

Meanwhile, to minimize discoloration, work is ongoing to maintain consistent color levels in devices and instruments.

Solvay, for example, promotes the IXEF line of polyarylamide resins for color-stabilized, high-performance applications such as surgical tools. The materials, which include highly filled grades, are formulated to resist harsh disinfectant chemicals, for one-time or repeated use (which means repeated sterilizations).

“There is a lot of color-coding in the identification of surgical instruments,” says Dane Waund, global market manager for healthcare at Solvay. Maintaining color stability is vital to ensuring that the proper instruments are selected for spinal, orthopedic, and other invasive procedures.

Solvay supplies seven colors in the IXEF line, along with black and natural. The colors are stabilized to 40 kGy (kilogray) of gamma and electron beam sterilization. “Twenty kilograys, sometimes delivered twice, is a typical dose for hospital sterilization,” Waund says. He doesn’t disclose exactly how Solvay maintains color, beyond saying the process involves pigment and resin stabilization technology and elevated heat resistance.

RTP is another supplier that develops color-stabilized materials. Since radiation typically causes a yellow shift in colors, Blackmore says the compounder has successfully added blue or purple tints to formulations that result in color shifts toward the center, or to the true color of a material.

The company also has additive technology that scavenges free radicals created by radiation sterilization. Free radicals affect the molecular weight of a polymer, building it up or down, and the additive regulates them.

As these and many other examples show, current and future developments in medical plastics will not only allow most patients to effectively treat the conditions they have, but do so in ways that are increasingly cost-effective, easy to use, and which offer little disruption to their lives. The ongoing coupling of advances in plastics performance and devices with developments in digital technology and novel ways of applying treatment could usher in an era of medical care that offers greater access, increasingly effective treatment, and better health for more people.

Reference

1.D. Rose, presentation comments, Dassault 3D EXPERIENCE Forum, Boston, Massachusetts, USA, Nov., 2015.

DNA Taggants: Fighting Crime

The technology behind taggants continues to advance. A few suppliers offer DNA taggants: BrandWatch is one, as is DNA Technologies, which specializes in applying its taggants to thin films.

Another supplier is Applied DNA Sciences, an industrial biotech firm that has been in business for ten years and is expanding its technology to a number of applications. The use of DNA as a taggant is a virtually foolproof way of certifying the authenticity of material, says CEO Jim Hayward. “DNA is considered the gold standard by courts globally. It is the most detectable analyte on the planet.”

With levels of use in the parts-per-trillion range, the material is “agnostic to form and function” in chemicals and finished products, he adds.

The company’s DNA is sourced from plant genomes, and can be supplied as a concentrate, solid or liquid, or as a fraction of a raw material. Applied DNA has a patented metering system that thoroughly mixes the taggant with materials, and is working with masterbatch suppliers to develop blending techniques for the microscopic quantities involved. Detecting a DNA taggant, Hayward says, is as simple as taking a surface swab of a material or product, a tape pull, or shaving off a small portion to test. The company supplies testing devices that require little training to use. The cost of DNA taggants, he adds, is “very affordable.”

The accuracy, moreover, is virtually guaranteed. Among the company’s applications are ATMs in the UK. When one of these cash machines detects an attack by thieves, it “decorates all of its cash with DNA,” Hayward says. If the police arrest suspects and recover the stolen money, they test it for the DNA taggant. Thus far, Hayward notes, suspects in 101 ATM thefts have gone to trial, and all 101 trials ended in convictions.

Health Assurance

Ongoing developments in medical plastics are speeding innovations that could extend the reach, effectiveness, and safety of medical devices

Previous Article Next Article

By Pat Toensmeier

An insulin injection pen includes two parts molded from DuPont’s Delrin acetal homopolymer that regulate the dose and reduce injection pressure (photo courtesy of DuPont).

Many trends that shape the demand for medical devices are having a major effect on resin formulations and applications. The result is a steepening trajectory of innovation that’s revolutionizing the ways in which plastics are considered, designed, and used in this surging, vibrant market.

Looks are deceiving. These containers look the same, but only the three white bottles on the right contain an Ampacet SecurTrace taggant that confirms they’re genuine (photo courtesy of Ampacet).

The stakes are enormous in winning the materials competition that requirements for medical products mandate. The specification of resins in high-volume applications can generate a sizeable payback for all companies in a supply chain—resin producers, processors, and OEMs. This is because medical and related applications (packaging, diagnostic systems, and other components) continue to generate steady growth around the world and have the potential for broad penetration of developing regions. Trends fueling product use include:

- aging populations in North America, Western Europe, and Japan that require growing levels of healthcare, as well as access to the latest medical technologies;

- the increasing compatibility with Western standards of requirements for devices in China and India, which is opening vast new markets to OEMs and resin suppliers (both countries together account for 35% of world population, and India is projected to become the world’s most populous country by 2022); and

- ongoing efforts to upgrade medical care in underdeveloped countries.

Also important are reducing the cost of healthcare and, for people with chronic conditions such as diabetes, maintaining quality-of-life activities. The evolution of “smart” devices—in this case, plastics-rich products that record and transmit diagnostic and monitoring data, or release medicine into the body—is vital in meeting individual and societal needs in this regard.

The positive outlook for medical applications is confirmed by market studies. Consider these robust findings from one report compiled by Transparency Market Research of Pune, India, whose U.S. office is in Albany, New York:

- The global medical polymers market (including packaging, diagnostic systems, and components) is projected to reach $15.8 billion by 2020. This equates to a compound annual growth rate in demand of 8.3% from 2014 to 2020.

- The global sales revenue for the market will account for $505 billion by 2020.

- North America remains the top market for medical device sales, with, in 2013, a little more than 40% of global share, closely followed by Europe.

Other studies forecast somewhat lower global growth and sales revenue. Nevertheless, all of them confirm continuing gains in the market, along with the potential for sizable new business opportunities.

This is good news, but it also presents major challenges for the supply chain, one of the biggest of which is how best to guarantee the quality and integrity of materials and devices.

The GlowCap is a cap and container for meds that alerts people about missed dosages by illuminating the cap’s top and calling them on their phone (photo courtesy of Vitality).

Counterfeit Detection

Simply put, global sales—and the inevitable access to offshore supply and processing sources they generate—increase the risk of counterfeit products replacing ones that have been qualified for medical applications.

“It’s a global problem, though many counterfeit parts and resins originate in China and Russia,” remarked one materials supplier (off the record). Another source of counterfeit resins is India, which has a growing chemicals and pharmaceuticals industry and thus, for the unscrupulous, access to production of off-spec resins that can be offered as seemingly benign substitutes or even branded grades.

Using counterfeit resins, however inadvertently, can have huge repercussions for a company’s reputation and bottom line. One ongoing case, for example, involves a U.S.-based OEM that allegedly used a resin from China in a medical product. The material was not what had been specified, and resulting lawsuits over the underperforming product have led to multi-million-dollar judgments against the company.

An important way of guarding against counterfeiting is by inserting a taggant in a resin or compound. The taggant, which is usually inorganic and inert, can be one of a number of materials, including rare earth minerals, ceramic pieces, and either photochromic or ferromagnetic particles. They can be readily visible or concealed, depending on application needs.

The detection procedure is similar no matter what material is used. A minute concentration is added to a resin or compound, often in masterbatch form. The taggant’s presence is detected by various analytical methods, with each property tailored for a specific material—such as a wavelength of laser energy or ultraviolet light. In many cases a technician does not have to conduct a lab analysis or destructive tests to detect a taggant. A product or material can be interrogated directly with a handheld scanner to identify it as real.

Counterfeiters cannot easily game the process since specific taggants are identified only with certain types of detectors. Multiple taggants and detectors could conceivably be used as an additional safeguard.

The low levels of taggants that are used to prevent counterfeiting mean processing, properties, and part appearance are unaffected, says Morgan Gibbs, director of technical service and development at Ampacet Corp., which supplies taggants under the SecurTrace name. Examples of loadings range from parts per million to 1% of a finished product, adds Neil Ivey, CEO of BrandWatch Technologies, a strategic partner with Ampacet in taggant technology.

Depending on the application, anti-counterfeiting technology can range from sophisticated to less sophisticated, and prices follow the level of sophistication. There’s no easy way of calculating return on investment. What it comes down to, Ivey explains, is the cost a company is willing to absorb to protect its brand and good name.

Generally, though, the more advanced the taggant technology, the more foolproof it is. But regardless of complexity, counterfeiters will usually not bother trying to duplicate a covert security feature, whether it’s a taggant or something else. They can look for a covert signature and figure out easily that, for example, an infrared material is in use, but the chances of their duplicating this, much less a more advanced or complex signature, are low. “If you don’t know what to look for,” Ivey says, “it will be hard to find.”

Ampacet and BrandWatch, like many suppliers, are reluctant to disclose details of new products and technologies. Ivey says, however, that Ampacet has anti-counterfeiting tools with specific signatures that allow it to customize as well as distinguish its taggants no matter where in the product chain they are used.

Smart handheld medical devices such as this glucose meter record and transmit patient data with digital technology (photo courtesy of RTP Co.).

The Internet of Care

One major influence on the design and use of medical devices is digital technology. The accelerating growth of “smart” devices and their ability to record and transmit data—and in the process connect users to caregivers, doctors, and even drug companies—is spawning a new generation of products that increase the effectiveness of personal care without locking users into costly diagnostic routines such as doctor and hospital visits.

The idea is simple: A digital device records data ranging in complexity from when users take prescribed pills and other meds, to periodic sampling of blood glucose levels for diabetics, timed injections of various medicines, and monitoring of heartbeat, body temperature, and other physical conditions that can be used to assess an individual’s response to treatment.

One device that has gained wide use is GlowCap from Vitality Inc., an Internet-connected plastic cap and container programmed to transmit reminders to users if they do not take their medicines on time. The cap also lights up as an extra reminder. The reminders are sent over AT&T’s mobile broadband network to a user’s telephone (cell or landline) if a dosage is missed, and can be transmitted as well to family members, healthcare providers, and even prescription drug companies. A push-to-refill button on the bottom of the container automatically sends refill requests to a local pharmacy.

Compounds from RTP and others formulated for laser direct structuring allow integration of electronic circuitry in point-of-care diagnostic equipment (photo courtesy of RTP Co.).

The GlowCap and container are plastic, probably a commodity resin such as polypropylene. While its monitoring and data-transmission capabilities are a nifty application of digital circuitry, the benefit to users, especially the elderly, is immense. One study found that 98% of people who take meds from a GlowCap and other smart packages do so on time. The proportion of on-time dosages by people who have conventional meds containers, in contrast, was 71%.1

Dosing medicine on time also has a positive impact throughout the healthcare network. People who do so are generally healthier than those who do not, and are less susceptible to complications. This in turn means they’re less likely to make repeat visits to doctors or go to hospitals, which frees up time and space for other patients, and helps reduce healthcare expenditures.

“Smart” Patient Tracking

Patient tracking, in fact, is an important aspect of smart technologies for medical devices. Compounder RTP Co., for one, develops formulations that allow OEMs and others to print circuitry on heat-resistant plastics via laser direct structuring (LDS). This technique, in use for some time by the consumer electronics industry, permits the eventual selective metallization of circuits onto a molded polymer substrate. When energized with a snap-in battery, the circuits record and transmit data generated by a device. Devices can include catheters, drug-injection pens, and blood sugar monitors, says Josh Blackmore, medical marketing manager at RTP.

“We seek better patient outcomes and traceability to prove the effectiveness of a device to the FDA and for coverage by medical insurance,” says Blackmore. In formulating compounds for these products, RTP does a lot of work in the development of devices that inject drugs and monitor the results on patient health.

One advantage of using LDS and other integrated capabilities is that devices can be downsized and lightweighted. The design flexibility of LDS circuits especially is a boost for 3-D injection molding, which means devices can be more compact, ergonomic, and, if necessary, comfortable to wear.

The miniaturization of devices is an important design trend especially as it pertains to products that meet lifestyle needs. “There is a growing number of people who prefer to discretely use drug-delivery devices for medicine like insulin, and they want small devices that deliver exact doses,” says William Hassink, technical services senior consultant at DuPont Performance Materials.

Like many resin producers, DuPont has a number of materials it supplies for medical applications. One is Delrin acetal, whose strength, stiffness, and impact resistance, he notes, are especially suitable for snap-fit assemblies and mechanical performance.

DuPont recently announced that an impact-resistant grade of Delrin homopolymer was specified for a new insulin pen from a major OEM. The resin is used to mold two threaded components that regulate dose accuracy, and are part of a snap-fit assembly. An added benefit of the material is low friction, which reduces the injection force applied by the patient.

These properties allow designers to develop products that are thin, small, and light enough to fit inside pockets and purses, Hassink says.

A three-way stopcock (developed by Elcam Medical and molded from Makrolon PC) has a luer-activated valve that acts as a barrier against bacteria (photo courtesy of Covestro).

Maintaining Color Balance

Among the challenges materials suppliers face is the growing strength of sanitizing chemicals in hospitals and the effects of radiation sterilization. Both affect the color stability of devices and instruments, which could lead to problems in the correct designation of color-coded items for surgery and other critical procedures.

The sanitizing chemicals are stronger, experts say, as facilities react to threats from potent germs, bacteria, and viruses. One equipment supplier, Elcam Medical, dealt with this concern by developing a three-way stopcock, molded from Makrolon polycarbonate from Covestro. It has a luer-activated valve that doubles as a barrier against bacteria, and a specially designed inner channel that promotes self-flushing and minimizes residue.

Meanwhile, to minimize discoloration, work is ongoing to maintain consistent color levels in devices and instruments.

Solvay, for example, promotes the IXEF line of polyarylamide resins for color-stabilized, high-performance applications such as surgical tools. The materials, which include highly filled grades, are formulated to resist harsh disinfectant chemicals, for one-time or repeated use (which means repeated sterilizations).

“There is a lot of color-coding in the identification of surgical instruments,” says Dane Waund, global market manager for healthcare at Solvay. Maintaining color stability is vital to ensuring that the proper instruments are selected for spinal, orthopedic, and other invasive procedures.

Solvay supplies seven colors in the IXEF line, along with black and natural. The colors are stabilized to 40 kGy (kilogray) of gamma and electron beam sterilization. “Twenty kilograys, sometimes delivered twice, is a typical dose for hospital sterilization,” Waund says. He doesn’t disclose exactly how Solvay maintains color, beyond saying the process involves pigment and resin stabilization technology and elevated heat resistance.

RTP is another supplier that develops color-stabilized materials. Since radiation typically causes a yellow shift in colors, Blackmore says the compounder has successfully added blue or purple tints to formulations that result in color shifts toward the center, or to the true color of a material.

The company also has additive technology that scavenges free radicals created by radiation sterilization. Free radicals affect the molecular weight of a polymer, building it up or down, and the additive regulates them.

As these and many other examples show, current and future developments in medical plastics will not only allow most patients to effectively treat the conditions they have, but do so in ways that are increasingly cost-effective, easy to use, and which offer little disruption to their lives. The ongoing coupling of advances in plastics performance and devices with developments in digital technology and novel ways of applying treatment could usher in an era of medical care that offers greater access, increasingly effective treatment, and better health for more people.

Reference

1.D. Rose, presentation comments, Dassault 3D EXPERIENCE Forum, Boston, Massachusetts, USA, Nov., 2015.

DNA Taggants: Fighting Crime

The technology behind taggants continues to advance. A few suppliers offer DNA taggants: BrandWatch is one, as is DNA Technologies, which specializes in applying its taggants to thin films.

Another supplier is Applied DNA Sciences, an industrial biotech firm that has been in business for ten years and is expanding its technology to a number of applications. The use of DNA as a taggant is a virtually foolproof way of certifying the authenticity of material, says CEO Jim Hayward. “DNA is considered the gold standard by courts globally. It is the most detectable analyte on the planet.”

With levels of use in the parts-per-trillion range, the material is “agnostic to form and function” in chemicals and finished products, he adds.

The company’s DNA is sourced from plant genomes, and can be supplied as a concentrate, solid or liquid, or as a fraction of a raw material. Applied DNA has a patented metering system that thoroughly mixes the taggant with materials, and is working with masterbatch suppliers to develop blending techniques for the microscopic quantities involved. Detecting a DNA taggant, Hayward says, is as simple as taking a surface swab of a material or product, a tape pull, or shaving off a small portion to test. The company supplies testing devices that require little training to use. The cost of DNA taggants, he adds, is “very affordable.”

The accuracy, moreover, is virtually guaranteed. Among the company’s applications are ATMs in the UK. When one of these cash machines detects an attack by thieves, it “decorates all of its cash with DNA,” Hayward says. If the police arrest suspects and recover the stolen money, they test it for the DNA taggant. Thus far, Hayward notes, suspects in 101 ATM thefts have gone to trial, and all 101 trials ended in convictions.