one to watch

“SugarCRM has done a good job bringing an alternative to Salesforce.com for cloud-based solutions,” Wang says, and customers are excited about Sugar’s mobile interface and the sleeker Sugar UX. Still, he cautions that “more needs to be done on functionality to remain competitive in the market.” —S.S.

The Market

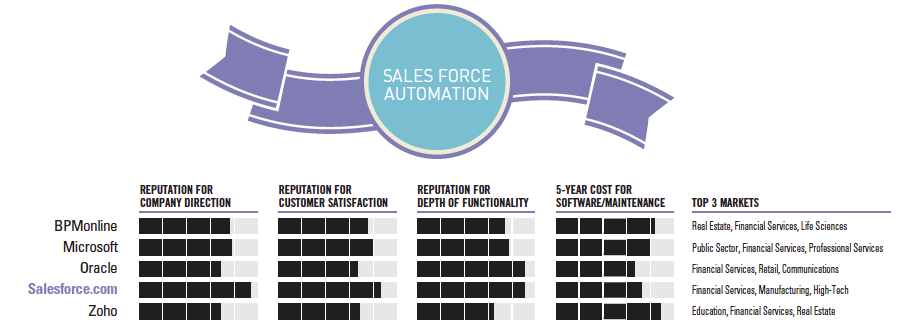

According to data collected by Nucleus Research, if salespeople are spending more than 8 percent of their time entering data into their CRM system, their performance is suboptimal. While many sales force automation (SFA) vendors have focused on adding feature after feature, these features take salespeople away from what they should be doing: selling.

Well-executed mobile versions of sales force automation may be one way to achieve that mix of usability and adoption. Two out of three firms with a sales force automation or CRM solution are giving salespeople access to corporate data via mobile devices, according to the Sales Performance Optimization Study conducted by CSO Insights. With mobile devices, sales reps can quickly look up information about a client, and jot down thoughts afterward instead of firing up a slow Internet connection in their hotel room and entering reams of data.

As managing partner of CSO Insights, Jim Dickie is also seeing companies integrate their sales processes into their sales force automation application. When the processes and the SFA system are combined, the system “can serve as virtual coaching, helping reps not only know what to do, but how to do it.”

The Leaders

For the first time, BPMonline appears on the leaderboard for sales force automation. The vendor is known for its strong focus on process and rules-based approach, which is excellent for sales teams trying to tie their sales processes to their software. “The newest version of their product is strong and cool and UI friendly,” Paul Greenberg, president of The 56 Group, says. Nucleus Research Vice President Rebecca Wettemann praises BPMonline for having “a very intuitive and easy to use application that requires limited configuration and training.” Analysts seem bullish on the outlook for the company, with Wettemann citing a success story for a telemarketing firm that had a huge ROI with BPMonline “after struggling with other competitors’ applications and adoption issues.”

Microsoft Dynamics CRM continues to gain market share with customers who seek better Outlook integration, XRM, deeper industry functionality that partners provide, and its on-premises option, says Ray Wang, founder and principal analyst at Constellation Research. Wettemann also sees Dynamics benefiting from being part of a larger ecosystem. “Microsoft has continued to extend its capabilities for SFA by taking advantage of the broader Microsoft portfolio with Office 365 integration and embedded analytics to make sales teams more productive,” she says.

Oracle’s Sales Cloud is having a “renaissance,” according to Wettemann, “with key value-adds like coaching, SPM [sales performance management], incentive compensation, territory management, and rich analytics within the core app.” Oracle’s Sales Cloud tightly integrates with Oracle’s Marketing Cloud, and has features around social collaboration as well as a sales prediction engine. Its 4.5 score in depth of functionality puts it on par with Salesforce.com.

Zoho is a bit of a workhorse for smaller businesses. Leslie Ament, senior vice president and principal analyst at Hypatia Research Group, praises Zoho for its “highly flexible, budget-friendly pricing combined with ease of configuration and robust software functionality.” Still, it has battled comments about its marketing. Ament says that its “go-to-market approach is a bit less sexy” than Salesforce.com’s; others find company direction lacking and its huge library of products confusing. One thing they do agree on is price. Zoho outscored all other companies in the cost category, earning a 4.4, making it especially attractive for companies trying to minimize costs.

The Winner

For the ninth year in a row, Salesforce.com leads the sales force automation category. Wang calls it the “industry standard” and hails Salesforce1 for “improving the mobile experience.” Its “recipe” of a partner ecosystem and the Force.com platform is one that “sales teams in the SMB and lower midmarket favor,” Ament observes. It also draws raves from analysts, who gave it a sky-high 4.7 score in company direction. “Salesforce.com continues to invest in key features, driving greater usability for SFA including mobile capabilities, Data.com, and integration,” Wettemann says. “Additional value is driven by the Salesforce.com ecosystem of applications that deliver more value for sales in areas like [configure, price, quote] and SPM.” —Sarah Sluis