Who is the

Tablet Reader?

Learning the Characteristics of the tablet audience and how to grow it. by John Parsons

Marketing TIPS

The most Important aspect of tablet readers

is

knowing how best to reach them—whether to attract

new readers or retain existing ones. Perry Solomon,

vice president, digital business development, at

Time Inc., and Vidya Gopal, director of digital

marketing at National Geographic, outlined several

strategic approaches that have worked well.

The most Important aspect of tablet readers

is

knowing how best to reach them—whether to attract

new readers or retain existing ones. Perry Solomon,

vice president, digital business development, at

Time Inc., and Vidya Gopal, director of digital

marketing at National Geographic, outlined several

strategic approaches that have worked well.

1. Include online promotions (“Download the Free App”) on each brand’s website supplemented by similar messaging in email and even direct print mail campaigns.

2. Cultivate good relationships with digital newsstands. Keeping newsstand administrators updated regularly on new and interesting articles often prompts them to include the tablet versions in the “latest news” sections of their storefronts. “Better reporting from these newsstands will help publishers improve marketing effectiveness and increase their marketing spend on digital editions,” Solomon says. “This is a message many publishers are delivering to their newsstand partners.”

3. Search optimization and social media are also being tried, but with less success (so far) than integrated media campaigns.

4. Try physical newsstands. Several publishers report success in reaching tablet users by simply promoting their app version on the wrapper, in a blow-in card, or in the book itself. Offering a free tablet copy with the printed newsstand version has potential to boost not only single-copy sales but also conversions. Many we spoke to offer a “best of” digital version as the incentive—which allows publishers to pick the most interactive content possible. However, the move seems to be toward the same tablet edition as the printed newsstand version—letting the reader experience the all-access model on a single copy basis.

Publishers suffering from declining circulation and ad revenues talk about tablets as they would a child prodigy—or perhaps even a Savior—despite the fact that Apple’s famous version appeared only 36 months ago. We often pay too much attention to the device, however, and not enough to the user. From a circulation perspective, we need to know how tablet users are different from other consumers—if they are. More importantly, we need to know how can we effectively attract and retain them.

Distinct characteristics

Tablet users are media-omnivorous. They engage in a variety of activities that may distract them from reading a digital magazine. In a recent BISG study —focused on ebooks, but still instructive to magazine publishers—many tablet activities vie for their users’ attention. Almost 55 percent of consumers use tablets as their primary e-reading device, claiming they used them “very often” to browse the Web. Other potential distractions include emails and texts (43 percent), playing games (41 percent), and watching videos (30 percent).

This does not mean that magazines will get lost in the media mix. Magazine content can be well-suited to today’s easily distracted reader. It does mean, however, that tablets give their users ample opportunity to do something else, if the digital magazine content fails to capture their attention.

From a strictly demographic perspective, tablet readers are younger and more affluent than typical print subscribers, according to Betsy Frank, chief research and insights officer at Time Inc. She also noted that such consumers, when given access to both print and digital, tend to be more engaged fans of Time Inc.’s various brands than are print-only subscribers. “They are proving more likely to take action in response to advertising, and more likely to renew,” she says.

Scott McDonald, senior vice president of market research at Condé Nast, agrees, adding “better educated” to the list of demographic differences. “This is a bit of a ‘best of both worlds’ story,” he says, “since usually the younger an audience is, the less affluent they are. But with tablets, they tend to be both younger and richer.” McDonald did caution, however, that the demographic information they have collected so far is from regular subscribers. With single-copy buyers, the data are less readily available, although he believes the pattern still holds true.

Robert Cohn, senior consumer marketing director at Bonnier Corporation cautions that we still don’t know very much about tablet readers, although Bonnier opt-in email surveys of current tablet readers are confirming the overall consensus of younger, better educated, and richer subscribers. He also notes that such readers typically spend more time—approximately 50 percent higher than print-only subscribers—reading each issue.

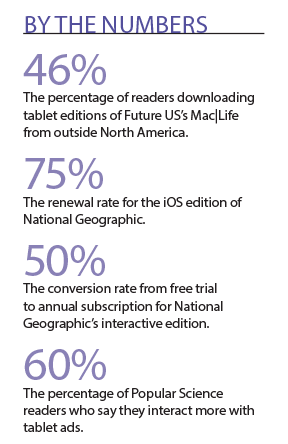

Future US publishes an assortment of lifestyle, gaming, and technology titles, including Mac|Life. Rachelle Considine, the company’s president, notes another key characteristic of tablet readers: Their country of residence. Because the fulfillment costs of tablet editions (like their replica digital edition predecessors) are fundamentally different from print, a tablet subscriber is far more likely to live outside the magazine’s home country. For Mac|Life, that means 46 percent of total downloads from Apple Newsstand are from those that live outside North America, compared with about 1 percent for print-only subscribers. She notes that reaching new, more international audiences presents challenges as well as opportunities.

These audience challenges are compounded by content expectations for different types of mobile devices—smartphones and tablets, for example. Not all publishers have found the basic demographics to be strikingly different, however. Vidya Gopal, director of digital marketing at National Geographic notes that while their tablet edition tends to have a slightly higher percentage of younger, male readership than print, the income and education levels are comparable for readers of either format. She also notes that the international component is about 20–25 percent for both print and tablet readership.

Renewals and advertising

Tablet subscribers—or all-access tablet and print subscribers—are renewing their subscriptions at a higher rate than print-only subscribers, although some we interviewed caution that the phenomenon is too new to show an absolute trend. Considine says that the tablet edition renewal rate for one Future US title was 71 percent, compared to 60 percent for print. Gopal reports similar results for National Geographic (75 percent for their iOS version). Conversion from free trial to annual subscriptions, where available, are about 50 percent for the interactive edition. “Once people sampled the interactive content, they subscribed,” she says. McDonald also describes the response of cross-platform Condé Nast subscribers as impressive: “Not only are they renewing at higher rates, but they also are paying higher prices for those renewal subscriptions.”

Perhaps the most attractive potential represented by tablet users is their impact on advertising. McDonald says that tablet titles are sold at full price through Apple’s and Amazon’s digital newsstands, and that for some titles—Wired and GQ—the new source of circulation has been robust enough to contribute to their rate base increases.

Cohn says that Bonnier is finding some useful advertising behavior information about tablet readers, primarily through surveys. This includes 50 percent of Popular Science readers who agree strongly with the statement “I pay more attention to advertising on tablets,” and 60 percent who claim they interact more with tablet ads.

Research methods

Most publishers we interviewed rely on a combination of reader surveys and analytics as the means of better understanding tablet readers as a group. Surveys tend to be more popular, however, as several seem to feel that analytics are still focused on traditional Web metrics, like impressions and click-throughs, rather than behavioral measurements of mobile device use.

Time Inc. began interviewing tablet subscribers within two months of the iPad’s introduction in 2010, and has amassed a large volume of data—most of it encouraging in the long term. Their behavioral research includes a unique biometric study, in-app surveys and an ongoing, 4,000-member panel of tablet edition subscribers.

According to Time Inc. research, digital readers are expressing higher satisfaction levels with tablet editions, returning to view the same issue close to five times, and spending about 40 minutes with each tablet edition, comparable to the average for print.

Analytics technology, including Omniture tagging, often supplement reader survey data. Cohn says that the data, while widely accepted among agencies, can be hard to interpret when studying subscribers and their behavior. He points out, for example, that user activity is not typically trackable when a reader has downloaded the magazine content for reading locally. He and others feel that behavioral analytics—distinctly different from traditional Web measurements—will help publishers create content for specific mobile devices, including smartphones as well as tablets.

No one we interviewed had a hard and fast formula for determining the relative value of a tablet subscriber. All agree that the value is high—both for circulation and advertising purposes. With continuing use of surveys and improvements in tablet-specific analytics, the economic potential of tablet users will become as knowable as that of print users—probably more.