The

Transforming

Consumer Magazine Business Has

Not Been

Good

to the

Newsstand

Retail rapidly declines as publishers concentrate their focus elsewhere.

by Baird Davis

Getting Personal:

An Open Letter to the Newsstand Supply Chain

Dear Publishers, Wholesalers and National Distributors:

I’ve been tracking the newsstand for nearly 15 years as a consultant and correspondent, and before that, as a magazine circulator for 25 years. It’s been forty years of trying to come to grips with the newsstand conundrum. Needless to say, the multifaceted complexity of the subject still fascinates me. Yet, at a gut level, it continues to confound me that the industry has been unable to make the changes necessary to meet the obvious realities of the business.

In many of my articles on the subject, especially over the last five years, I tried to highlight the seriousness of the newsstand situation. Those warnings, and those of some of my colleagues, have apparently fallen on deaf ears. But I don’t give up easily. Therefore, in the accompanying article, I’ve tried to provide more in-depth substance to help clarify the reasons why the newsstand sales slide can’t be fully curtailed and, by inference, why the need for transforming the newsstand channel is so urgent.

The greater responsibility for initiating change lies with publishers. They have revenue and cost cutting survival options not available to other supply-chain partners. Wholesalers and national distributors are fully dependent on demand for the publishers’ products. When the demand equation changes, as it has, it leaves them vulnerable and their immediate survival prospects doubtful. Therefore, it’s going to require what publishers have been reluctant to do in the past: Take charge, act in concert and assume complete responsibility for driving the channel infrastructure changes which are so desperately needed.

Don’t miss the opportunity. The task is not impossible, but it may be your last chance.

Your faithful correspondent,

Baird Davis

Consumer magazine publishers are learning how to cope in an environment racked by massive shifts in technology that have altered how people consume media. However, neither publishers nor their key newsstand supply-chain partners have been fully realistic in evaluating the effect on newsstand sales.

The stultifying naiveté that surrounds these changes has never been more apparent than at the recent MPA-PBAA-sponsored conference, Retail MarketPlace 2013. The presentation by Mary Berner, president and CEO of the MPA, and a roundtable discussion with leading executives from the magazine industry—Steve Lacey (Meredith), David Carey (Hearst), Skip Zimbalist (Active Interest Media), Bob Sauerberg (Condé Nast)—centered around promotion and marketing solutions, how valuable magazines are to retailers and the newsstand’s relevance to publishers. The discussions, though well measured, were surreal, as if fixes merely involved tweaking a well-oiled machine. There was hardly a hint that the antiquated magazine newsstand channel was on the verge of collapse.

Ron Clark, president of Hudson News, made the only comment that hinted at the dark cloud hovering above the newsstand channel: “If something doesn’t change, we’ll be flat-out closed.”

A Hard Look at The Changes

Clark’s blunt comment is a siren for immediate action. It highlights the overwhelming need to change the infrastructure of the dysfunctional newsstand distribution channel.

Understanding the changes to the consumer magazine business is a critical first step in comprehending their permanence, and ultimately, to forging improvements. To that end, we’ll take a hard look at audited consumer magazines. We’ve confined the scope of this report to audited publications because the availability of that information allows for more succinct comparisons of data.

This, however, hasn’t limited the evaluation of the industry’s total newsstand sales because non-audited titles, despite the “successes” of bookazines and special interest publications, have not performed any better than audited titles the last five years. The newsstand sales of audited publications are a very good proxy for the entire consumer magazine business.

Changes to the consumer magazine business are not transitory and have an unalterable affect on newsstand sales.

Steep Decline of Newsstand Sales

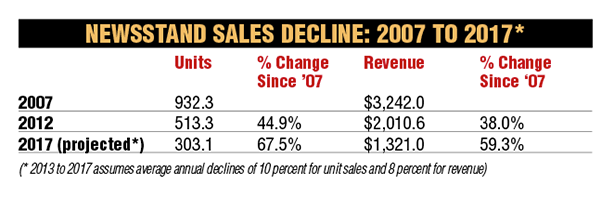

First, a review of newsstand sales of audited titles over the last five years (2007 to 2012) and projected sales of audited titles over the next five years (2013 to 2017).

2007 to 2012

Units Sales: Down 44.9 percent to 513 million

Revenue: Down 38 percent to $2,010.6 million

Unit sales: Declining 11.2 percent annually

Revenue: Declining 9.1 percent annually

The devastating newsstand sales slide of the last five years, and the prospect of continuing declines of equal proportions, has exposed the fundamental weaknesses of the newsstand channel and has called into question its very survival.

An Industry Transformed

• Smartphones and Tablets: The revolutionary change in the consumer magazine business has been advanced by the ubiquitous use of mobile devices. It has transformed how people consume media and increasingly how advertisers deliver messages. It has enabled publishers—helped by offering impulse-driven, often free, access to their content—to expand their reach (confirmed by recent GfK/MRI results).

This has largely satisfied advertiser requirements, however, the capacity for instant access of information has clashed mightily with traditional print product circulation sales practices. The effect has been most apparent at the newsstand where unit sales continue to decline 10 percent annually. Sales have been unable to recover from the “great recession” induced slide of 2008 and 2009 primarily because of the explosion of smartphone use and the game-changing introduction of tablets in 2010.

• Managing a More Complex Business: Magazine publishing has become a business of managing many more revenue streams while trying to master a more involved set of content delivery options. One publisher has aptly called it “multiple ancillary enterprises.” In the last five years, it has become an infinitely more complex business operating in a much more competitive environment. Employees are expected to handle a more diverse group of tasks, which has had the effect of diverting attention from the magazine print product.

Nowhere is the multi-tasking effect more evident than in the editorial function. The editor is now responsible for not only the magazine’s content and design, but also for website content, preparing edit to support native advertising, creating books and videos, selling retail products and, for some, it involves TV appearances and even developing TV shows. These additional duties have forced time management tradeoffs that may compromise editorial quality. Managing the dictates of a multiplatform brand delivery system, often with reduced staffing, has also significantly altered the advertising and circulation disciplines.

A Shrinking Industry

The consumer magazine industry has not only been transformed, but it has shrunk substantially since 2008. See the benchmark audited publication data shown below:

Industry Paid Circulation Level: Declined from 278 million to 234 million—a drop of 16 percent, 3 percent annually.

Newsstand Circulation: Declined from 49 million to 27 million—down 45 percent, 11 percent annually.

Subscription Paid Circulation: Declined from 229 million to 209 million—down 8.6 percent, 1.5 percent annually (Note: subscription circulation is declining at a much slower rate than newsstand circulation).

Number of Audited Titles: Declined from 556 to 397, down 29 percent.

Advertising Revenue/Pages: Advertising pages have declined 32 percent.

Smaller Book Sizes/Less Editorial Pages: Book size and edit content have been reduced in direct proportion to the decline in ad pages creating a reduction in product value perception.

New Title Starts: Only nine currently audited titles launched in the last five years, just two with circulations over 150,000.

Newsstand Circulation as Percent of Total Circulation: Declined from 17.6 percent to 11.5 percent.

By any measure, the consumer print magazine business is significantly smaller than it was five years ago and it’s likely to shrink even further. Most importantly for this analysis it’s become an industry increasingly less reliant on newsstand circulation.

Source and Product Mix Changes Negate Significance of Newsstand Circ

The dramatic circulation source and product mix changes (primarily, Replica Product and Paragraph 6 Circulation) that have occurred in the last five years provide graphic examples of how publishers have made permanent adjustments to meet the demands of changing conditions, including compensating for reduced newsstand sales.

• Replica Product Circulation: Replica is not a circulation source, but it represents delivering the magazine product on a different platform, in a different format. Demand for replica product is growing dynamically.

Prior to the Alliance for Audited Media rule changes in 2009, replica product circulation was not shown on audit bureau statements. But that was yesterday. Through 2012, it has grown to 7.7 million—3.3 percent of total paid circulation—up 240 percent from a similar period a year previous.

Based on current trends, it’s not unrealistic to expect that within the next five years that replica product circulation will reach 10 percent of total audited paid circulation (20 million) and surpass newsstand circulation, which is currently 11.5 percent of total paid circulation, but is projected to decline to about 8 percent by 2017.

• Paragraph 6 Circulation: This is a designation for a group of circulation sources as shown on AAM publisher’s statements, primarily: Verified, partnership, sponsored, combination and award. Let’s be frank, they are not the circulation sources preferred by most publishers or advertisers. They are generally less profitable and are presumed to deliver a less qualified reader. These sources, authorized as paid circulation by the audit bureaus in 2006, have been helpful in enabling publishers to “economically” meet the demands of maintaining paid circulation at high levels despite the loss of newsstand circulation.

Based on current trends, five years from now Paragraph 6 subscription sources use will have grown to more than 20 percent of total paid circulation.

• Replica Product and Paragraph 6 Circulation Use

Advance the Subscription-Centric Nature of the Business:

The advance of Replica Product and Paragraph 6 circulation use is accentuating the subscription-centric nature of the consumer magazine business. Even newsstand sales leaders People and Cosmopolitan, whose newsstand circulation levels once represented more than half of their total paid circulation, have in recent years maintained constant paid circulation levels by liberally substituting subscription circulation (often Replica and Paragraph 6) for “lost” newsstand circulation.

• Cannibalizing Effect: Combined, it’s estimated that the use of Replica Product and Paragraph 6 circulation sources will account for over 30 percent of the industry’s audited paid circulation level within the next five years. Their growing influence is very significant, especially considering their cannibalizing effect on newsstand sales.

The Domino Effect of Eroding Weekly Performance

For at least the last 50 years, weekly publications have been the standard bearers for the newsstand industry. TV Guide led the newsstand channel in the 1970s, 80s and into the 90s. At their peak (1978) they sold over 12 million copies per week and accounted for a mind-warping 35 percent of all audited publications sold. In the process, they fostered the great magazine sales expansion in supermarkets and helped establish the primacy of magazine sales at checkout.

Additionally, it should not be forgotten that the sales of TV Guide made it economically feasible for a whole host of other titles (many with marginal sales) to be sold at the newsstand.

People followed TV Guide in the early 1990s as the newsstand leader, spawning in its wake five additional weekly celebrity magazines. The sales of these six weekly celebrity titles helped propel newsstand sales to their recent revenue peak of $3.2 billion in 2005 (this compares to $2.0 billion in 2012).

However, the compelling power of weekly publications has been seriously eroded in the last few years by instant electronic access to news and information. The effect of the abrupt sales decline of the newsweeklies (Time, Newsweek, U.S. News & World Report) now appears to be affecting the six weekly celebrity titles. Their combined unit sales have fallen 40 percent in the last five years, with the decline escalating in the last several years.

• Worrisome Implications: The sharp decline in weekly celebrity publication sales has extraordinarily worrisome implications. The sales increase of high-priced, irregular frequency bookazines, for instance, won’t nearly compensate for their sales decline. The leadership position of weekly celebrity publications is the underlying economic support for the newsstand channel, their frequency requirements dictate wholesaler operating procedures and they are the financial backbone for the checkout space, which is a lucrative component in maintaining retailer support for magazines.

New Product Investment

and Competitive Set Changes

The mature consumer magazine business is also being transformed by changes in product investment decision making and the industry’s rearranged competitive set.

• New Product and Service Investment: Publishers are confining their product investments, with very few exceptions, to expanding the reach of their existing brands by delivering content on multiple platforms.

Conversely, relatively few investment dollars are being directed toward the development of new regular frequency print products. This dearth of new print products will eventually have adverse long term ramifications for the industry. But on the newsstand, the lack of new products is already being acutely felt. Without a sufficient supply of new products to refresh the line, the industry has been unable to offset the increasing number of publications that are annually being discontinued and/or whose sales have seriously eroded. The consumer magazine product line is showing its age.

• The “Big Four” and Competitive Set: Within the shrinking consumer magazine industry an intense market share survival battle is happening. This is most apparent in the actions of the “Big Four” (Time Inc., Hearst, Meredith, Condé Nast). There is no mistaking the commitment of these four publishers to maintaining their strong industry positions. They fully comprehend the significance of scale and category market share dominance.

Consequently, they have made few circulation level compromises. They now account for 47 percent of the paid circulation of audited consumer magazines—up from 40 percent five years ago.

Based on recent developments, that share could swell to 55 percent or 60 percent over the next several years. Their expanding market dominance increases the difficulty of competing with them, not only in the lucrative large circulation women’s field, but also on the newsstand.

Publisher Ambivalence to

National Distributor Services

Consumer magazine publishers rely on national distributors to provide valuable newsstand services—marketing, distribution, collections from wholesalers, cash advances on prospective sales, marketing reports and generally “policing” wholesaler activities. These services were deemed to be so valuable that many of the leading publishers were directly involved in owning and managing these service organizations: Time Inc. (TWRS), Hearst and Condé Nast (CMG), Hachette (Curtis) and American Media (DSI).

But recent developments, particularly the Hearst-Condé Nast sale of CMG to the Pattison Group (parent of The News Group) in partnership with Hudson Distributors, and Bauer’s recent decision to launch their new titles with CMG (rather than with Kable and DSI), have changed the newsstand landscape. These changes are starting to blur the distinction between wholesaler and national distributor services. To date, they don’t appear to have radically altered how business is conducted in the channel. However, it seems as if it’s only a matter of time until they do.

These changes reflect, to a certain extent, the growing ambivalence publishers have for the newsstand business. The Hearst-Condé Nast deal is looking more and more like an old-fashioned cost-cutting transaction.

The ambivalence of large publishers about national distributor services is yet another indication that the newsstand function has slipped down their priority scale.

The New Survival Criteria

The keys for survival in the consumer magazine business have always revolved around the quality of the print product—its attractiveness for both readers and advertisers. Success was measured by advertising and circulation revenue, market share, newsstand sales performance and ultimately, by profitability

Today, the criteria for survival remain similar, but there’s been a shift in emphasis. It’s in the search for additional revenue streams, particularly advertising, that things have gotten infinitely more complicated. Publishers chasing national advertising must be prepared to provide multiple delivery solutions for advertisers. This, in turn, has significantly increased the cost of playing the game and has altered several aspects of survival.

To meet the revenue demands of multiplatform product delivery, it’s now mandatory to own or have a strategic alliances with other media organizations. The “Big Four,” for example, are buttressed by agreements with a broad range of other companies (TV, video, social and digital agencies; book publishers, foreign distributors, etc.). It’s not by chance that the only two successful large audited circulation magazines launched in the last five years (Food Network Magazine and HGTV Magazine) were started by Hearst in partnership with the Scripps Network.

• Diminished Newsstand Significance: For years, newsstand sales served as an important circulation source, a major revenue stream and as advertisers’ benchmark for measuring product acceptance. It’s still important, but as the complexity of product delivery and the resulting need for alliances have steadily increased, the importance of newsstand performance for survival has diminished.

What DoEs it Mean On the Newsstand?

The consumer print magazine business is in the process of a radical transformation that’s made it significantly smaller, less profitable, more vulnerable, more complex, more narrowly competitive and, as we’ve shown, more subscription-centric. It’s a business now myopically focused on meeting the changing reader and advertiser requirements for the consumption and delivery of news and information. It’s clear that these changes are not transitory.

The transformation has given the consumer magazine business an opportunity to survive in a reconfigured media environment. Recent GfK/MRI numbers help support the industry’s contention that consumer magazines continue to remain relevant in reaching large numbers of actively involved readers.

The changes have been dramatic, yet the pace of change can only be expected to accelerate. This transformation, however, has proved to be almost universally detrimental to the newsstand business. The reality is that the consumer magazine newsstand will never be the same. This is not to say that the newsstand won’t continue to be important, but not nearly to the degree it was.