Audited Consumer Magazine Circ Flat in First Half 2013

Digital subscriptions growing quickly while single-copy sales falter. By Caysey Welton And Arti Patel

The Alliance for Audited Media has released its semiannual Snapshot report showing a decline of 0.1 percent in circulation when combining print and digital. Rapidly declining single-copy newsstand sales are casting more shadows over magazine publishers however.

Digital circulation was a growth catalyst for many publications. That is, magazines with the most significant overall increases are also typically offering digital subscriptions. Still, for most titles, digital circulation sizes are typically between 1 to 10 percent the size of their print counterparts.

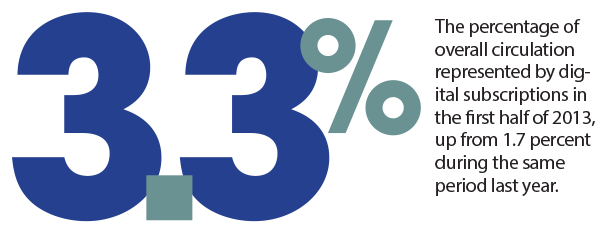

In fact, AAM reports 3.3 percent (10.2 million subscriptions) of total circulation comes from digital subscriptions, up from 1.7 percent (5.4 million) in 2012.

Breaking It Down By Category

Women and family lifestyle titles showed the most stable growth amongst the top 25 consumer titles. Specifically, Family Fun Magazine grew its total circulation by 7.3 percent.

Spanish-language titles continue to grow their readership in 2013 in both print and digital circulations. For instance, Vanidades expanded its total circulation by 57.2 percent, and its digital subscription base is nearly 15 percent of the size of its print circulation. A similar trend is noticeable in many of the smaller niche and enthusiast titles as well.

The top 25 consumer magazines by digital circulation size are a mixed bunch with Game Informer Magazine leading the way at just under 3 million subscriptions. But the disparity from 1 to 25 is vast, with 25th-ranked People only reaching 73,181 digital subscribers. Nevertheless, the majority of content categories are represented in the top 25 which suggests digital magazines have become appealing to a broad audience.

Trouble on the Newsstand

Troubling, however, are single-copy newsstand sales.

Newsstand sales continue to face hard times, but, according to MPA—The Association of Magazine Media, only account for around 10 percent of revenues. AAM indicates that portion could be even smaller. Regardless of the actual volume, the segment still accounts for revenue outputs in the billions.

Men’s magazines are seeing none of the growth women’s titles are, as sales continue to soften.

Maxim fell 23.8 percent in single-copy sales, as Playboy dropped further, down 42.5 percent over the last year. Both also saw their digital sales drop.

There was digital growth with Men’s Health, up 0.6 percent, and Men’s Journal, up 4.9 percent, but each title’s single-copy sales losses negated digital gains, falling 11.2 percent and 25.4 percent, respectively.

However, a bright spot in newsstand sales was saved for publishers targeting gun aficionados. American Rifleman saw its total print sales go up 14.2 percent to over 1.9 million readers, and Handguns magazine saw single-copy sales jump 34.3 percent.

It’s worth noting that tablet media sales spiked 84 percent during this same time period. The residual impact from those sales has the potential to move the needle in the second half of 2013 and beyond.